Elementary investing theories lead to fabulous gains

In hindsight, Porinju Veliyath’s theory that there will arise a “trillion dollar opportunity in housing and infra” and that companies like Everest Industries will benefit therefrom was extremely elementary and we should have figured it out for ourselves.

First, the Tamil Nadu Government announced that it will construct two lakh homes under the Pradhan Mantri Awas Yojana (PMAY) at a cost of Rs 7,800 crore.

Then, Chandrababu Naidu, the Chief Minister of Andhra Pradesh, launched the Urban Housing Scheme in Vijayawada pursuant to which 1,20,000 houses in 38 towns will be constructed. In addition, another 38,000 houses will be built over the next two years.

To top it up, M Venkaiah Naidu, the Union Urban Development Minister, announced that over 20 lakh affordable houses for urban poor will be constructed in 4,720 cities and towns under the Pradhan Mantri Awas Yojna.

Now, it obvious that such large scale of housing projects throughout the Country means that companies which supply building products will see their fortunes transform in a dramatic manner.

Everest Industries proved the veracity of this theory by surging a massive 20% today.

The total gains, since Porinju’s recommendation to us to buy the stock, is a fabulous 52%.

This has happened in just about five weeks, which proves that Porinju is a master of timing.

Fortunately, the other housing related stocks (including Ramco Industries, which is also recommended by Porinju) haven’t surged to the same extent, which means that there is still a chance for us to make amends.

Porinju’s latest stock pick will also be a multibagger?

Porinju’s visits to Dalal Street always create excitement amongst novice investors.

One could see this a few days ago (14th June) when Porinju suddenly landed up unannounced, his pockets bulging with cash.

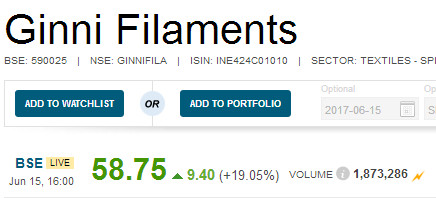

As novice investors watched him goggle-eyed, Porinju strode purposefully to the counter of Ginni Filaments, a micro-cap (Rs. 401 crore) engaged in the textiles business.

Without much ado or haggling, he bought all the stocks that were on offer (368,917) and paid a grand sum of Rs. 1.82 crore (Rs. 49.20 for each) for his purchase.

The stocks were bought in the name of Equity Intelligence, his PMS Fund.

When Porinju left, novice investors laid siege on the counter, each determined to grab the stock.

The resultant melee sent the stock price spiraling up to Rs. 58.75 and triggered the upper circuit breakers.

Ginni Filaments in focus today. Here’s why. @Navin_Shetty1 pic.twitter.com/XqHgLTHCSY

— CNBC-TV18 News (@CNBCTV18News) June 15, 2017

DD Sharma explains why Ginni Filaments is investment worthy

For some reason, DD Sharma, the veteran stock picker, does not figure prominently in our radar despite the fact that he has several multibagger stocks to his credit.

One reason for this could be the fact that he appears only on the Hindi channel CNBC Awaaz and not on the English channels.

Anyway, there is no doubting the quality of his analysis.

In February 2017, when Ginni Filaments was languishing at Rs. 31, DD Sharma recommended a buy on the basis that the Company is a “niche player” in textiles.

He explained that in the traditional textiles business, Ginni exports its products to elite global consumers such as Disney and Benneton.

In the non-woven segments, the Company supplies products like ‘wet wipes’, ‘water filters’ etc to other elite consumers such as Johnson & Johnson etc.

He explained that the non-woven segment is a business with huge potential for growth with hefty margins and that it would transform the fortunes of the Company for the better.

DD Sharma also reeled out impressive facts and figures relating to the Company’s financial performance to prove his point.

Towards the end, he projected a target price of Rs. 70 for the stock, which was a 100% gain from the then prevailing price.

The best part is that DD Sharma reiterated his bullishness for Ginni Filaments in May 2017 when the stock had surged to Rs. 45.

He again reiterated a buy with the promise that the Company will effortlessly breach the target price of Rs. 70 set by him.

Corporate videos of Ginni Filaments

More information with regard to the affairs of Ginni Filaments is available in its corporate videos.

| GINNI FILAMENTS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 401 | |

| EPS – TTM | (Rs) | [*S] | 2.54 |

| P/E RATIO | (X) | [*S] | 22.34 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | – | |

| LATEST DIVIDEND DATE | – | ||

| DIVIDEND YIELD | (%) | 0.00 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 22.55 |

| P/B RATIO | (Rs) | [*S] | 2.52 |

[*C] Consolidated [*S] Standalone

| GINNI FILAMENTS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | MAR 2017 | MAR 2016 | % CHG |

| NET SALES | 202.58 | 197.92 | 2.35 |

| OTHER INCOME | 4.83 | 1.46 | 230.82 |

| TOTAL INCOME | 207.41 | 199.38 | 4.03 |

| TOTAL EXPENSES | 185.12 | 184.11 | 0.55 |

| OPERATING PROFIT | 22.29 | 15.27 | 45.97 |

| NET PROFIT | 5.68 | 2.21 | 157.01 |

| EQUITY CAPITAL | 70.65 | 70.65 | – |

Conclusion

Prima facie, it does appear that Porinju has once again snared a magnificent multibagger for his portfolio. Whether Ginni Filaments will match the performance of its peers in Porinju’s portfolio requires to be seen!

Sir cover Inditrade capital/Cimmco/Shalimar also Porinju recent pick

I am great admirer / follower of D D Sharma. Many multibaggers were invented quite early by him.

Yes ,I . agree .I started investment thirty years Back at Jodhpur and has seen his investment style right from that time.

Porinju’s recent suggestion Rammco industires will ride the housing wave like Everest industries. Also a recent pick inditrade is managed by industry veteran Sudip Bandopadhay. Though it has moved up after recommendation it has a long way to go considering current marketcap is just 150cr. I am holding both stocks..

It will might go to 70 but trick is to sell it before it Reaches there.. Otherwise it will be like biocon.. Retail investor will be stuck with it. I think we should stop promoting what the big guys buy and do our own research. We can sell these stocks to biggies and they should be stuck with it. Why do biggies come and say I have bought this. But this is not a recommendation.. Why don’t they just keep their mouth shut.

disclosure of your your interest in recommended script is mandated by sebi . If it is recommended and not disclosed, they can be banned from trading for many years…

Cloning successful investor is not bad of it is supported by your own conviction. I have been benefited immensely by shamelessly cloning some of the picks of Porinju and Dolly khanna when supported by my own conviction

Porinju is badshah of the mere mortals.His picks are awesome . There are many big boyz in the market but they only inspire awe. But rare are the ones who are loved by the masses !

May God bless him !

This one is surely a trap for retail investors, to make a flash after it has risen. For a company to be a multibagger, it needs to have a good growth rate (among other factors) of both top line and bottom line. If you see the financials, the top line has hardly grown, though NP has risen, but is very low considering high capital base. Another indicator to consider is NP/Mkt Cap (typical return to enterprise value ratio) which is just around 1.2% (should have been at least 5%, if not more). Not worth at all. Much better textile companies exist in the markets.

You were right Gem23.

inditrade is not mentioned……..