When any stock is equated with the venerable Blue Dart, we have to sit up and take notice.

The reason for this is because Blue Dart, a mid-cap logistics company, has created humongous wealth for its shareholders.

In the past ten years, the stock has given an impressive return of 1156%. The return in the past five years is 355%. These massive gains have come with absolutely no risk to capital because the management enjoys an impeccable reputation for integrity and high values.

Not surprisingly, Radhakishan Damani, the legendary stock wizard, has cornered a huge chunk of Blue Dart’s equity. He, Gopikishan Damani and their investment vehicles, Bright Star Investments, Damani Estates and Derive Trading, collectively hold a treasure trove of 12,41,096 shares of Blue Dart worth an eye-popping Rs. 748 crore.

Radhakishan Damani has also commandeered a huge chunk of Transport Corporation of India stock. As of 31.03.2015, Radhakishan Damani held 342,656 shares while Ramesh Damani held 575,290 shares. The holding of the duo as of 31st March 2016 is not known.

It is an interesting fact that Radhakishan Damani bought TCI and Gati together on 5th January 2014. He was among the first to recognize that the economy was turning for the better and that the logistics stocks would be the first to benefit from that.

Porinju Veliyath has been constantly egging his followers to load up on TCI. He made his first recommendation on 22nd August 2015 at an investors’ camp on the logic that the company has a “clean balance sheet”, “hardly any debt” and its valuations at “one time revenue” are cheap.

Since then, some water has flowed under the bridge. TCI has announced that its “express distribution business” will be demerged into TCI Express Distribution. The latter company will be listed separately and each shareholder of TCI will receive one equity share of the demerged entity for every two shares held by him in TCI.

The demerger is on the verge of being sanctioned by the High Court of Telengana.

The claim of the experts that the demerger will result in “value unlocking” has catapulted the stock into higher orbit. On a YoY basis, the stock is up 43% which compares very favourably with the flat return given by its peers like Gati.

Porinju has now claimed that TCI’s value unlocking has the potential to transform it into the next Blue Dart.

Can TCI XPS go the Blue Dart way? Core holding in PMS; always liked TCI than VRL:-) Latest presentation on BSE:https://t.co/xzSPAb49rW

— Porinju Veliyath (@porinju) June 3, 2016

Interestingly, the equating of TCI with Blue Dart was also made by Vivek Pandey, a fund manager:

TCI's express biz has sales of 800 cr, market cap is 1900 cr

Express biz alone will have valuation of 2000 Cr

Blue Dart trades at 7x sales— Vivek Pandey (@IVivekPandey) October 9, 2015

Even if u give 3x sales to TCI's express biz, its valuation comes to 2000 Cr…

Blue Dart trades at 7x sales

So TCI is virtually free…— Vivek Pandey (@IVivekPandey) October 9, 2015

Porinju also drew attention to an investors’ presentation furnished by TCI which makes for interesting reading.

The investors’ presentation explains the rationale for the demerger in cogent terms.

“Rationale of Demerger

Focused leadership & management required

The XPS undertaking has tremendous growth and profitability potential, more specifically in E-commerce space where it requires focused leadership and management attention.

Investor’s attractiveness and unlocking shareholder’s value

The nature of the risk and competition with respect to the business of XPS Undertaking is distinct from the other businesses of the Remaining Undertaking and consequently, upon demerger, the XPS Undertaking would be capable of attracting a different set of investors and strategic partners.

Opportunity for Best Investment Strategies and diversification

The reorganization proposed by this Scheme will enable investors to separately hold investment in businesses with different investment characteristics, thereby enabling them to select investments which best suits to their investment strategies and risk profiles.

Greater Synergies in remaining businesses

The reorganization will enable the demerged company to focus its residual business and achieve greater synergies.”

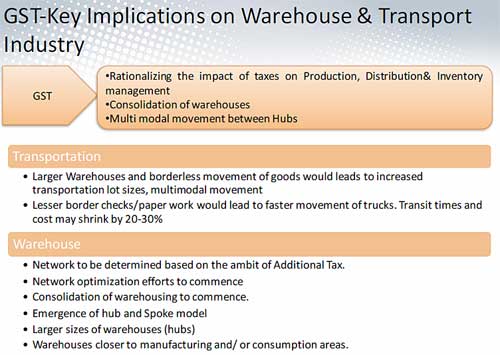

The presentation also sets out the benefits that will accrue to TCI if the GST is enacted as law:

So, prima facie, Porinju Veliyath and Vivek Pandey appear to be correct in their analysis that TCI will prosper as a result of the demerger. However, whether it will reach the exalted stature of Blue Dart and shower multi-bagger gains on its lucky shareholders requires to be carefully watched!

I am holding a TCI on RS 300 avg.. I feel the TCI xpress will list on above RS 500 with in 2 month.. Because fundamental is very very good and P/E will be more. All the best stock picker is having a chunk of holding…

it is bit watch the space tci xprs 500 means PE of around 50 Gati trades at some 38 pe or so even if it lists at 500 and remaining tci trades at 150 or so we have total rs 400 which is 33% gains in 3 months and at this price tci trades at around 22 multiples not sure market want to give 50 pe to xprs and 22 pe to tci i too hold but not very optimistic about grt value unlocking.. but good long term bet for sure

#Niveza #review ::

Transport Corporation of India is a good sustainable long term bet and can give consistent returns over the period of next few years. it is active in business of supply chain & logistics solution, cargo transportation etc. Since the overall economic activity and Industrial activity will pick up overall traffic of supply will increase and it will benefit the company. Since it is also government company, it should benefit from overall government related supply chain and logistics orders along with other outside orders. It is available at PE of 28 at the moment, M cap to Sales of around 0.9. ROE of about 15%. So on any declines towards 250-280 range it is a good value pick and can be hold for a long term

Stock Market Tips

Hi, if we purchase TCI shares now, will we still be eligible for getting TCI express shares or should the shares have been purchased before 31st March ’16, which was the record date for demerger?