Not owning NBFC stocks is one of the great misses of my team in this bull market: Ramesh Damani

Ramesh Damani’s endearing trait is his honesty and candour especially when addressing novice investors. Unlike some of his peers, he does not hesitate to admit his mistakes.

“What is your thought on NBFCs because it is a sector that has had a phenomenal run. A bunch of NBFC managements we spoke to, even housing finance companies, believe 20-25% return or growth for the next two, three, four, five years still seems to be a certainty. Is it still a good space to be in?” Ayesha Faridi asked with a charming smile.

“To be perfectly candid, I have limited exposure to that sector and so I am not the best analyst to speak about them. I think there are some extraordinary companies in there .. like Bajaj which I do not own regretfully. I think it has been one of the great misses of my team in this bull market,” Ramesh Damani replied with a rueful grin.

“I missed out on all the great private sector banks,” Ramesh Damani had candidly admitted on an earlier occasion.

Never a bad time to buy a great business

“It is never a bad time to buy a great business if you get a good valuation,” Damani said, implying that we should never stop looking for stocks.

He also advised that if we find good businesses in the midcap space, we should “hold on to them for life”.

“You never know which of these midcap companies may become largecap companies,” he added.

He also emphasized that we should not even think of selling these stocks merely because they have gone up 2x, 3x etc.

He cited the stellar example of Bajaj Finance, which despite being alleged by pundits to be overvalued has given 40x multibagger gain during the present the bull market.

We should hold onto the stock “as long as they delivering, as long as they are compounding, as long as they are doing good corporate governance,” Ramesh said, making it clear that our focus has always to be on the underlying business and not on the price or the valuations of the stock.

SRG Housing Finance, Latest stock pick of Ramesh Damani

Ramesh Damani’s repeated references to Bajaj Finance in his interviews sends a clear signal that NBFC stocks are playing in his mind and that he is looking for a high-quality NBFC stock to tuck into.

He has finally found what he was looking for in the form of a little known micro-cap company named SRG Housing Finance.

He holds 111,000 shares of SRG Housing Finance which were allotted to him pursuant to a preferential offer in February 2017.

What is so special about SRG Housing Finance?

The merits of SRG Housing Finance have been cogently explained by Nigel D’Souza of Midcap Mania fame.

SRG Housing Finance is the stock on @Nigel__DSouza's radar today #MidcapMania https://t.co/bcPXZPmLhl

— CNBC-TV18 (@CNBCTV18Live) January 22, 2018

SRG Housing Finance

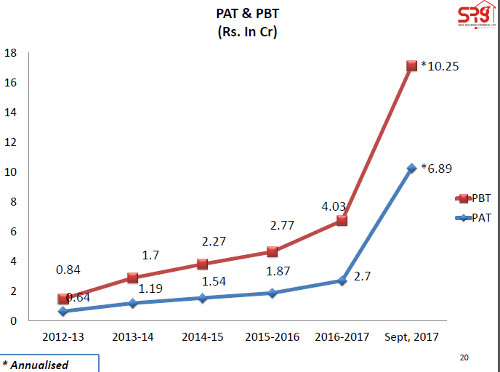

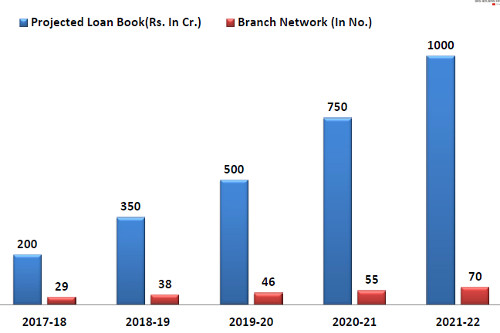

Loan book at 125 cr as of Sep 2017

Has set out ambitious targets

*FY2020e 500cr

*FY2022e 1000cr

Promoter increased stake to 61.57% as of Dec 2017

Ramesh S Damani HUF holds a mere 0.85% #midcapmania https://t.co/j4CFwKIZZh— Nigel D'Souza (@Nigel__DSouza) January 22, 2018

Nigel has pointed out that SRG is growing at a rapid pace and is well settled to capitalize on the great affordable housing boom.

However, the eye-catching aspect about SRG is the ambitious 2022 plans that it has formulated according to which the business will increase 5x.

It is obvious that if this comes to fruition, we are talking about a mega multibagger on our hands.

| SRG HOUSING FINANCE LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 305 | |

| EPS – TTM | (Rs) | [*S] | 3.68 |

| P/E RATIO | (X) | [*S] | 63.78 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 2.50 | |

| LATEST DIVIDEND DATE | 19 MAR 2015 | ||

| DIVIDEND YIELD | (%) | 0.00 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 28.41 |

| P/B RATIO | (Rs) | [*S] | 8.26 |

[*C] Consolidated [*S] Standalone

| SRG HOUSING FINANCE LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2017 | SEP 2016 | % CHG |

| NET SALES | 7.42 | 3.22 | 130.43 |

| OTHER INCOME | 0.02 | – | |

| TOTAL INCOME | 7.42 | 3.23 | 129.72 |

| TOTAL EXPENSES | 2.14 | 0.83 | 157.83 |

| OPERATING PROFIT | 5.28 | 2.4 | 120 |

| NET PROFIT | 1.9 | 0.69 | 175.36 |

| EQUITY CAPITAL | 13 | 11.31 | – |

(Source: Business Standard)

Vision 2022 plan

The business strategies with respect to the period from the present to 2022 are set out in the investors’ presentation. This reads as follows:

(i) The company is looking forward to increase its Brand Value and shareholder’s wealth with its expansion plan. The management has proposed the strategy for its expansion plan including:

1. Increasing the scale of operations: Company wish to expand its Branch Network in North West Region of the Country. Focus areas of the company will be Tier II & Tier III Cities of Rajasthan, Maharashtra, Gujarat and Madhya Pradesh.

2. Expanding Resource Base: The Company has received refinance from National Housing Bank under its Refinance Scheme. Further the Company has already been sanctioned loans from many banks. Company is also planning to raise funds by way of various capital market instruments.

(ii) Key strenghts

(a) High Capital adequacy

(b) Ratio Diversified Products & Customer Profile

(c) Strong Asset Quality

(d) Adequate Internal Control System

(e) Strong MIS

(f) Experienced Promoters

(g) Brand Name of SRG in Rural Sector

(h) NHB Funding

(i) Understanding of Core Geographies

(j) Employee Productivity

(iii) Risk Mitigation:

•Credit polices are framed in line with the business strategy

•Portfolio performance is closely monitored. Portfolio monitoring is done through early warning signals and performance of policy caps

Credit Risk

•Asset liability Management Policy covers liquidity and interest risk related aspects

Market Risk

•Fraud is prevented through a fraud risk management policy within the organization

•Approved operational risk management frame work is in place and operational risks are monitored on an ongoing basis

(iv) Key Drivers of Our Business Model

(a) Growing demand of affordable housing

(b) Limited availability of housing finance for low-income customers

(c) Tax incentives for individuals

(d) Urbanization,

(e) growth of nuclear families, rising incomes etc.

(f) The government’s ‘Housing for All by 2022’ and the Pradhan Mantri Awas Yojna (PMAY) initiatives, the grant of infrastructure status to affordable housing, allowing additional investment limits to debt mutual funds to invest in housing finance companies (HFCs), and lower risk weights for smaller-ticket housing loans.

The housing finance sector is a “lakh crore ki kahani”: Ajay Piramal, Raamdeo Agrawal, Vijay Kedia & Basant Maheshwari

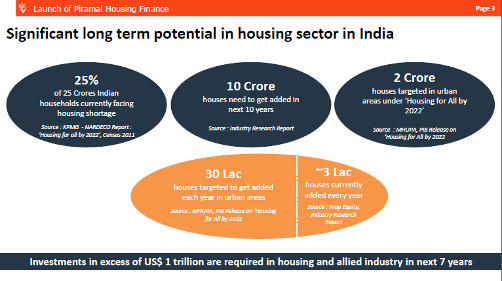

In an earlier piece, I pointed out that Billionaire Ajay Piramal, who is revered as “India’s Warren Buffett”, has confirmed that there is massive untapped potential in the housing finance sector.

“10 Crore houses need to get added in next 10 years,” the Billionaire said with a big smile on his face.

He also presented a detailed presentation which answers all doubts of sceptics.

A similar theory has earlier been formulated by Basant Maheshwari, Raamdeo Agrawal and Vijay Kedia.

Vijay Kedia has confidently asserted that “‘Housing Finance’ sector could be the next market leader”.

In my view, 'Housing Finance' sector could be the next market leader.

— Vijay Kedia (@VijayKedia1) January 30, 2017

Basant has confirmed that he is “super, super bullish” about HFC stocks and that one of them will quote in five figures in the times to come.

Raamdeo Agrawal coined the famous phrase “Lakh crore ki kahani” to emphasize that incalculable wealth can be made from the HFC sector.

This proposition is also confirmed by CLSA, the Global research house.

“The housing sector is at a tipping point and will be the economy’s next big growth driver,” CLSA has opined.

Housing Fin broad based rally yesterday got me digging. Found this brilliant note from CLSA: pic.twitter.com/CI2IrFwLQx

— Ajaya Sharma (@Ajaya_buddy) May 3, 2017

Der Aaye Durust Aaye (Better late than never)

Prima facie, Ramesh Damani has done the sensible thing by shedding his aversion for the NBFC stocks and tucking into a HFC.

He is late to the party though it is good that he is finally here. However, whether his choice of stock is also impeccable will have to be seen in due course of time!