PMS of Basant Maheshwari & Porinju Veliyath recoup losses

First, we have to turn to the important news as to the performance of the PMS portfolios of Basant Maheshwari and Porinju Veliyath.

I had reported earlier that in the wake of the unprecedented and savage Bear attack, the two stalwarts had lost huge chunks of their AUMs by way of losses (see PMS Portfolios Of Basant Maheshwari & Porinju Veliyath Suffer Losses & Under-perform Peers).

Now, the good news is that the duo has recouped a part of their losses.

This was revealed by Rahul Oberoi of ET, after consulting top-secret sources in SEBI.

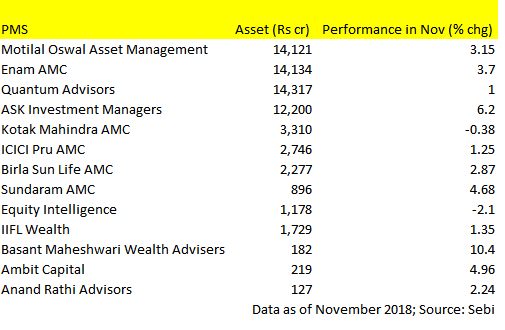

Basant’s PMS emerged as the top-performer with a hefty return of 10.41 per cent in November.

It outperformed arch rivals such as Bharat Shah’s ASK Investment Managers (6.2%), Ambit Capital (4.96%), Motilal Oswal (3.15%) etc.

Porinju’s PMS also put up a strong show though it could not give a positive return.

The loss was nominal at 2.10%.

No doubt, it is only a question of time before the duo ascends to the top of the charts again.

Market to surge to new highs: Rok sako toh rok lo!

Naturally, Basant’s top performance in the PMS rankings has put him in high spirits.

He pointed out that the appointment of Shaktikanta Das as the new RBI Governor means that interest rates will be slashed and huge liquidity will be infused into the economy.

This will send Banks and NBFC stocks surging upwards like rockets.

“Rok sako toh rok lo!” Basant roared, his eyes sparkling in defiance at the Bears.

With @DasShaktikanta as @RBI Gov expect interest rate cuts; liquidity & move from a headmaster type attitude + assembly elections show that though Modi didn’t get the seat share the vote share is intact for 2019 elections.Expect market highs led by financials.Rok sako toh rok lo!

— Basant Maheshwari (@BMTheEquityDesk) December 12, 2018

Rok sako toh rok lo! WOW….yes sir bought financials heavily y'day and today.

— sudipto (@catchsudipto) December 12, 2018

#OnCNBCTV18 | Basant Maheshwari, @BMTheEquityDesk says #market has bottomed out, getting ready for a bull run; Expect consumer stocks & financials to lead the bull run@_soniashenoy @Reematendulkar pic.twitter.com/XGFmF38gTg

— CNBC-TV18 News (@CNBCTV18News) December 14, 2018

Present 52-week highs will look like 52-week lows: Porinju Veliyath

Porinju is also in equally high spirits.

He pointed out that stocks will surge to such an incredible extent in 2019 that the present 52-week highs will look like 52-week lows.

He also reiterated his pet point that India is getting “cleaner, whiter, organized and patriotic” and that “Now is a great time for stock-picking”.

Look at the 52-week highs and today's price, unbelievable? Wait for next Dec and check the 52-week lows and prevailing prices, trust me it would be equally unbelievable.

Applies only to non-index, sound stocks?

— Porinju Veliyath (@porinju) December 13, 2018

2018 was a year of correction & pain for investors. Now is a great time for stock-picking if you are yet to invest. India is on track – getting cleaner, whiter, organized and patriotic. Long way to go. Explore the pockets of opportunities in #ChangingIndia

— Porinju Veliyath (@porinju) December 2, 2018

General elections in 2004, 2009 & 2014 all witnessed beginning of equity bull cycles. This time won't be different. The fear of event is already behind us. Elections, whoever wins, vindicates Democracy!

PS: I know who will win in 2019 ?

— Porinju Veliyath (@porinju) December 12, 2018

Put your money where your mouth is. Buy fear: Sanjiv Bhasin

Sanjiv Bhasin, the veteran investment expert, has also come out with all guns blazing in favour of an aggressive buy of large-cap and mid-cap stocks.

He lashed out at the novices who are waiting on the sidelines and napping.

“All that pessimism is over. For the Indian market, the lesson of 2018 is buy the fear and sell the greed. There is still a lot of fear around and people are waiting for corrections. They have been caught napping,” he said.

“The next 3-4 months can be pleasantly surprising because we think earnings are going to be a catalyst, along with flows because we have again seen foreigners turn to buy,” he added.

“Put your money where your mouth is. I still think midcaps can outperform in the next few months and that is what we are advocating to buy, select midcaps in most sectors where outperformance is on the cards,” he stated.

Which are the best stocks to buy now?

Basant has offered clear-cut advice that consumer stocks & financials will lead the Bull Run in 2019.

In his last interview, Basant also candidly revealed that he has been aggressively buying Bajaj Finance and PNB Housing Finance (see Basant Maheshwari Reveals Stock Picks + Multibagger Strategy For 2019).

Basant’s logic for recommending these two stocks appears flawless and so we can also consider tucking into them.

Porinju is very gung ho about hotel stocks. He described them as “safe bets” (see Porinju Veliyath Recommends Safe Multibagger Stocks For 2019).

Prima facie, there is merit in Porinju’s logic because the two stocks recommended by him, namely, Indian Hotels and Royal Orchid Hotels, are firing like rockets over the past one month.

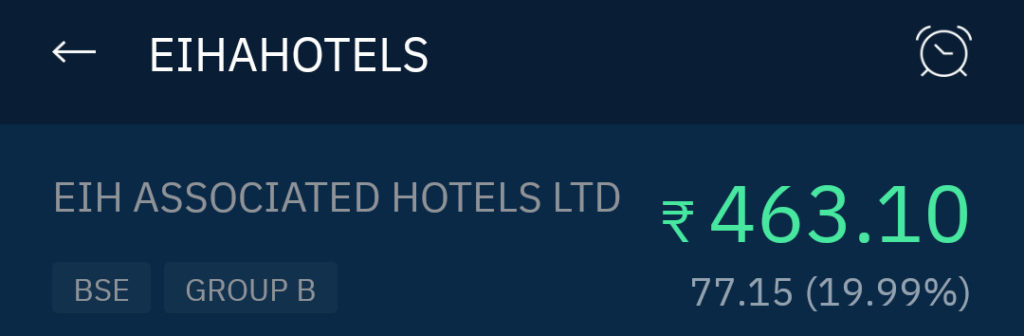

What about EIH Associated Hotels?

At this stage, we have to note that Nigel D’Souza has homed in on EIH Associated Hotels and provided a brilliant explanation of its merits.

Prima facie, EIH’s debt-free status coupled with small equity base and 75% promoter holding makes it an irresistible bet for discerning investors.

On #MidcapMania @Nigel__DSouza talks about EIH Associated Hotels, a zero debt company with a strong parentage https://t.co/FZKJ2aD0vq

— CNBC-TV18 (@CNBCTV18Live) December 3, 2018

The stock appears unstoppable. It effortlessly breached the upper circuit of 20% yesterday.

Sanjiv Bhasin has also done his duty and recommended several high-quality and fail-safe stocks for us to buy. He has described Ashok Leyland as a “dark horse” implying that it has potential to surprise and deliver multibagger gains!

All the stocks discussed, which include, Ashok Leyland, PNB Housing Finance, Bajaj Finance and few of the hotel stocks, are all good. Except that market should not take a sudden u-turn and spoil the current mood and rally.

Loss in 3 States, populist measures including farm loan waiver issue and profligacy in election years are a hang on the market mood.

abki baar 12 hazaar

Market funda: When analysts cum PF managers publicly proclaim euphoria, sell your stocks (and buy real estate – which has completed 5 years of downturn, its time for it to rise). These analysts will ask you to buy, will slowly sell just before the elections and then they will wait for their turn like vultures.

Porinju says he knows who wins. We know who he wants to win. So, maybe, his pet party has sent the EVMs to his home to doctor them!

Vote share maybe intact, but populist measures by the new incumbent govts till LS2019 (like the loan waiver which is already implemented) will reduce the central ruling party’s vote share further, especially in these 3 direct-fight election states, where the ruling party won more than 90% seats in last election. These analysts have also not seen the difficulty in which the ruling party retained Gujarat (very close fight), the high possibility of two strong regional parties working together in UP, the threat of ShivSena to fight alone in Maharashtra (where the ruling party is in minority), the failure of this party in Karnataka, the departure of its key ally in AP (TDP)… not one or two issues!

Economy does not like a coalition govt. And we are headed for one, without any doubt. Barring of course, EVM management.

Mark my words.

The original ET article says PV lost another 2% in Nov. It didn’t say he recouped Oct losses. Means his PMS continue to underperform big time. Seems some hands are trying to showcase that PMS comeback is on the cards which is not at all true.

Please stop publishing false information. My portfolio with purinju is down 40 percent Utd.i joined in Jan 2018.marketing gimmicks.

What more proof you require when somebody who himself is invested is telling his story of his burnt fingers – that too, all five – down by 40%.

This kind of coverage to these kinds of fund/PMS managers is actually unwarranted.

In my .view good multicap or aggressive hybrid funds are good investments.

Should we trust these two gentlemen at all after the fiascos in their PMS portfolios in last 1 1/2 years?

Absolutely “GEM23” of an observation and prediction. one hundred percent your views will come true and pray to god that “EVM management” does’t happen.

Don’t understand what is the “Mega Bull Run’ these PMS managers talking about. In subsequent years, we might see titles of “mega mega” or “galaxy” bull runs etc..

It is the election year and don’t know how crude prices will be in 2019. Already Govt is planning a huge welfare schemes which is going to deplete RBI reserves and foreign currency. Any foolish act can trigger USD=100 INR and SENSEX back to 15000 levels.

It would be stupid to buy just months before a election where there are high chances a big coalition might defeat BJP