Shyam Sekhar’s rigorous investment process

Shyam Sekhar, the noted value investor, follows a rigorous process for screening stocks which are investment worthy.

He fits the stock idea into a theme, does a “360 degree” study of risks and checks whether the valuation is reasonable. The stock is bought only if the price is “safe”.

When I ideate an investment, I fit it to a theme, do a 360 degree study of risks, see the merit in its valuation & find a safe price to buy.

— Shyam Sekhar (@shyamsek) July 11, 2017

This rigorous process eliminates/ reduces the risks of investment whilst ensuring that multibagger gains gush in.

We saw a live example of this stock screening process in the case of Sintex Industries, Shyam Sekhar’s debut recommendation.

The stock was/ is available at such “rock bottom valuations” that Shyam referred to it as an “ugly duckling”.

Of course, it did not take long for the market to realize that Sintex Industries has numerous virtues that deserve a better valuation. The stock shot up like a rocket soon after Shyam Sekhar’s recommendation.

I usually never recommend. This was an exception as valuations were at rock bottom. I felt nobody would lose money due to my bad judgement.

— Shyam Sekhar (@shyamsek) July 13, 2017

Sintex Plastics is definitely worth a good look: Shyam Sekhar

Sintex Plastics Technology, the offspring of Sintex Industries, is the new stock on the radar.

Shyam Sekhar has made the disclosure that he owns the stock and that it is “definitely is worth a good look”. He has also revealed that his investment is for the long-term and that he has no intention to sell it in the foreseeable future.

it definitely is worth a good look. Study it well and decide.

Discl: i own.

— Shyam Sekhar (@shyamsek) August 14, 2017

Ek din achanak, it will list. Hardly matters when. None of us are itching to sell anyway.

— Shyam Sekhar (@shyamsek) July 23, 2017

Salient features of Sintex Plastics

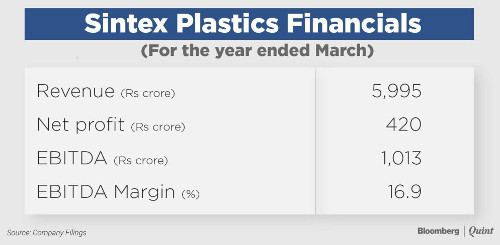

Darshan Mehta of Bloomberg has conducted a systematic analysis of the salient features of Sintex Plastics. These are as follows:

• Sintex Plastic makes prefabricated structures, custom moulding and storage tanks.

• It will mirror the shareholding pattern of Sintex Industries, 30.63 percent owned by promoters as of June 30, according to data available on the BSE.

• Sintex Plastic contributed 88 percent of revenues and 84 percent of earnings before interest, tax, depreciation and amortisation before the demerger.

• The company will have two wholly owned subsidiaries –Sintex BAPL Ltd. and Sintex Infra Projects Ltd.

• Sintex BAPL will house domestic and overseas custom moulding and the storage water tanks and allied plastic products businesses.

• Sintex Infra Projects would hold the prefabricated structures, monolithic construction, and other infrastructure businesses.

• Consolidated debt would be equally split between the two entities, according to the management comments, Antique Stock Broking said in a note to clients.

• $110-million foreign currency convertible bonds would come on the books of Sintex Plastics Technology.

Sintex Plastics has target price of Rs. 196: Ventura Securities (85% upside)

Ventura Securities enjoys a good reputation with regard to its stock recommendations. Its previous recommendations like Edelweiss, Ion Exchange, Heritage Foods etc, have yielded enormous gains within a short period.

Ventura’s logic for recommending a buy of Sintex Plastics is as follows:

“We are optimistic about the company’s prospects, given that:

• Revenues are expected to grow at 10% CAGR to Rs 7,770.3 crores by FY20 from Rs 5,810.6 crores in FY17, due to stable growth in the industrial custom moulding business, a turnaround in the pre-fab business, which had seen a negative growth rate in FY17 and a high growth rate in the retail custom moulding business.

• FCCBs worth $67mn are expected to be fully converted into equity as we believe that post listing of Sintex plastics Technology Ltd, the combined value of both demerged entities (Sintex Industries and Sintex Plastics) would be way above the conversion rate of Rs 92.16 and hence, we believe that the bond-holders will try to capitalize on such large gains.

• The return ratios of Sintex Plastics were way below that of its peers in FY17. However, we believe that the return ratios have bottomed out and expect ROE and ROCE to increase by ~120 bps and ~280 bps by FY20 to touch 14.7% and 14.2%, respectively.

• We expect the company to bring down its total debt by Rs 558.1 crore from Rs 4061.6 crore in FY17 to Rs 3,503.5 crore in FY20 due to conversion of FCCBs and generation of positive operating cash flows in the coming years.”

The target price of Rs. 196 projected by Ventura implies that gains of upto 85% will be up for grabs.

Fair market capitalisation for Sintex Plastic is Rs. 9,100 crore: Antique Stock Broking (54% upside)

According to Aasim Bharde of Antique Stock Broking, the plastics division will get more valuation post demerger as earlier that vertical was funding the capital-heavy textiles business.

He values the plastic division at 7.6 times its enterprise valuation to EBITDA ratio for 2018-19. The fair market capitalisation for Sintex Plastic for the period is close to Rs 9,100 crore.

The revenue and EBITDA have been estimated to grow at a compounded annual growth of 9.2 percent and 10.5 percent, respectively, over the three years to March 2019 with a stable margin of about 17.2 percent.

The present market capitalisation of Sintex Plastic is Rs. 5,900 crore. If the fair value is Rs. 9,100 crore, it means that hefty gains of 54% will be on the table for us to feast on.

Strong cash generation and return on capital will lead to PE of 12-15x: Philip Capital

Philip Capital is also bullish about Sintex Plastics. It expects earnings per share (EPS) of Rs 8.3 for the year ending March 2018 compared to Rs 7.7 in the previous year. The stock is expected to trade at 12-15 times its earnings after the demerger, given its strong cash generation and return on capital employed of 12-15 percent.

Investors’ presentation explains game plan for the future

The latest investors’ presentation provides important data relating to the present business operations, financials, future growth strategy, risk mitigation strategy, focus on debt reduction and efficient utilization of assets etc.

The business operations can be categorized into two segments:

▹ Custom Molding Solutions:

Sintex is among Top 20 globally in custom moulding products and solutions for plastics and composite materials. The company manufactures a large range of custom moulding products for the automotive, defence, aerospace, electrical sectors among others and also offers customised solutions for OEMs.

▹ Prefab/Infrastructure: A pioneer in India for prefabricated and monolithic structures for rural and urban social infrastructure. A pan India player with a wide range of products across building materials for various utility structures.

The Company has a global geographical presence. Its operations pans across 9 countries and 4 continents. There are 16 manufacturing locations in Europe, two in USA, two in Africa and 16 manufacturing locations across India.

Will Sintex Plastics benefit from Porinju Veliyath’s “trillion dollar opportunity” theme?

Porinju Veliyath has formulated the theory that there will be a “trillion dollar opportunity” in housing and infra coming up. He has advised us to “grab” the beneficiaries and assured that we can pocket 5x/ 10x multibagger gains from them.

10x in 3 yrs! Many more KNRs in making

Trillion Dollar opportunity in Housing & Infra coming up, Grab it! https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) May 9, 2017

Over a dozen Infra cos at inflection point – stronger balance sheet, better visibility & exciting operating environment; potential 5x & 10x

— Porinju Veliyath (@porinju) July 26, 2017

At least 5 Infra companies with mktCap <10,000 Cr currently, heading for >30,000 Cr mktCap in 5 years in a favorable operating environment.

— Porinju Veliyath (@porinju) August 13, 2017

We know from past experience that Porinju’s utterances are not meant to be taken lightly.

Prima facie, it appears that Sintex Plastics’ business model of “Custom Molding Solutions” and “Prefab/Infrastructure” qualifies it to benefit from the housing and infra boom.

Dolly Khanna and Anil Kumar Goel are also bullish on the infra theme

The action of Dolly Khanna and Anil Kumar Goel of loading up on Visaka Industries is a clear giveaway of the fact that they are also bullish about the housing and infra boom referred to by Porinju.

Visaka Industries is also engaged in the similar activity of providing prefabricated structures etc.

Is the dreaded T2T curse a blessing a disguise?

For some reason, the mandarins of BSE have condemned Sintex Plastics to the dreaded T2T segment.

#SintexPlastics

Will be part of the special pre-open session

Will be in T2T segment for 10 Trading Days@CNBC_Awaaz https://t.co/ABmr1OSA9l— Ashish Verma (@AshVerma111) August 4, 2017

The T2T segment paralyzes the stock and drains it of all speculative activity. All transactions have to be mandatorily settled by taking or giving delivery and there is no scope for carry forward. The failure to do so attracts severe penalty by way of auction of the stock.

It is obvious that punters looking to make a quick buck are discouraged from buying such stocks.

However, this is a blessing in disguise because it leaves the field wide open for genuine investors to buy the stock free of speculative pressures.

According to some watchers, when the stock is freed of the T2T restrictions, it will bounce back into glory.

Sintex Plastic will be out of T2T on 23rd August…keep in watch for bounce back

— n pal (@npal20) August 17, 2017

Why did MV SCIF Mauritius dump the stock?

MV SCIF Mauritius, a FII, dumped a massive chunk of 39,30,753 shares of Sintex Plastics on 14th August 2017 and sent the stock plunging to the lower circuit of Rs. 101.93.

According to MMB punters, the move was ill-advised because no sensible investor will dump a large holding when a stock is in the T2T segment, no matter how compelling the circumstances.

Prima facie, it appears that MV SCIF has acted in haste and committed a blunder. They had earlier sold off a massive stake in DHFL at Rs. 284. The CMP is Rs. 450.

Conclusion

Shyam Sekhar’s clean chit to Sintex Plastics coupled with Porinju Veliyath’s theory that select infra stocks will give 5x and 10x multibagger gains means that we have to keep a close eye on the stock and give it pride of place in our portfolios at the appropriate stage!

I love this idea. Sintex plastic can be multibagger

It’s a company with a worst diworsification record and poor corporate governance..stay away

Intelligent invester.

any particular instance?

Pls throw light on Shyam Sekhar’s considerable investment interest in Manugraph India engaged in manufacture of unique products.

Timely post with valuable insight!

Thanks

SS Gupt

Please provide your analysis/comments about two stocks: Electrosteel Castings (Shyam Sekhar has more than 2%) and Motor & General Finance Limited (Atyant Capital: 2.66%). Both of them are savvy investors. Kharab and other investors, please provide your comments. Thanks, Venkat.

I thank full very much for sintexplastic & tatagloble

Personally I don’t prefer to invest in new businesses, for better picture you need at least 4 years of balance sheet, income statement and performance report on execution of business related plans.

It is good idea to not invest in a business whose track record is not available.

Now its available at 76 Rs CMP. So now what to do.

now available at RS. 23 lol ye sab expert hain upar