Can Fin Homes goes from “super, super bullish” to “deserves no mercy”

There are two USPs about Basant Maheshwari.

The first is his ability to change his mind almost instantly. He can be bullish about a stock in one moment and become bearish in another moment.

The second is his ability to be “ahead of the curve”. He likes to predict what the situation is likely to be and tries to get there ahead of everyone else.

In the past, we have seen Basant exhibit both qualities in stocks like Hawkins Cookers, Page Industries, Gruh Finance, Repco Home Finance, Granules India etc.

In fact, Hawkins Cookers created a mega controversy amongst his fans and followers because some believed that he had sold his personal holding in the stock while not giving the same advice to the subscribers of the Basant Top 10 service.

Since then, Basant has taken a vow to never offer stock recommendations to the public because it always creates unseemly controversies due to disgruntled investors.

Have done that before and also seen the consequences of it.

— Basant Maheshwari (@BMTheEquityDesk) May 31, 2016

Focus on earnings & growth, not the P/E

“We were super bullish on HFCs all these years but now there is one more super to the super bullishness. Now we are super, super bullish,” Basant said with a big smile on his face.

In the case of Can Fin Homes, Basant gave cogent reasons as to why he is “super, super bullish” about the stock.

He explained that though the stock is expensive, it is a good buy because it is/was growing at a scorching pace of 40-50%.

“.. within the HFC space, the two stocks that we own are going to grow at 40-45%. We have to focus on growth. Growth in a bull market is like steam in a sauna. If there is no steam, there is no sauna. As long as there is no growth, there is no bull market. So money is going to chase growth,” he said.

“We should focus on earnings, we should focus on growth. Without earnings and without growth, a stock is like an orphan on a street nobody bothers to look at it,” he added.

“We like to chase earnings. If it is expensive, we buy it,” he exclaimed with a flourish.

Retweeted CNBC-TV18 News (@CNBCTV18News):

“Very bullish on Can Fin Homes & PNB Hsg Fin”, says Basant Maheshwari…. https://t.co/0bjRxsYZWm

— Basant Maheshwari (@BMTheEquityDesk) April 5, 2017

Get out of the musical chair before the music stops

Basant sent the clear warning that if one is investing in a stock on the premise that it has high earnings and growth, the sell button has to be hit at the first sign of a slowdown.

“Once you buy a stock, you cannot sell it. So the moment growth stops, it is like the music stopping with you not having a chair to sit on. Either you push someone and sit on a chair or you say you have lost the game,” he said.

“We normally get out of the room the moment the music stops but that is a very hard thing to do because when you want to sell a stock on earnings disappointment, you will be selling it 10-20-30% from the all-time high. That is okay as long as you have a big vision and you keep moving ahead in life,” he added.

Can Fin Homes has flopped on the earnings front and also on the corporate action front

Basant shocked his army of followers by making the sudden announcement that he has exited Can Fin Homes.

Excerpts from a newsletter sent to our PMS clients:

When you bet on corporate action and price you have to be nimble footed and ahead of the curve – which we were. However, when you bet on business, earnings and secular growth you ought to be lazy and lethargic which we also do. pic.twitter.com/Mxtad7GZiI

— Basant Maheshwari (@BMTheEquityDesk) April 7, 2018

Though Basant did not name the stock, it is obvious that the reference is to Can Fin Homes.

Can Fin Homes was soaring high on the back of reports that deep pocketed investors like HDFC and Barings and interested in buying a stake from Canara Bank.

However, the hint that all is not well came when HDFC denied a press report that it has made an upward revision to buy the stake.

#CNBCTV18Exclusive | HDFC revises offer upwards for buying Canara Bank’s stake in Can Fin Homes, sources tell @PoddarNisha . @canarabanktweet may assess bids for Can Fin stake & decide on winner today pic.twitter.com/d3aN2lGHVd

— CNBC-TV18 (@CNBCTV18Live) March 26, 2018

HDFC clarifies on Can Fin Homes report, says 'We deny offering any fresh proposal on Can Fin Homes'

— CNBC-TV18 (@CNBCTV18Live) March 26, 2018

This was compounded by the fact that Can Fin Home’s board also did not discuss the bids.

Here comes the twist, Can Fin Home says, board did not meet yesterday to discuss bids received for Canara Bank's stake in Can Fin Home

— Nimesh Shah (@nimeshscnbc) March 27, 2018

I fail to understand how #CANFINHomes can decide on who will win the bid, while #CanaraBank is the owner & seller of stake! Also fail 2 understand how an old news of 6 March (Tuesday) became 26 March (Monday) news?

Is der more to it than wt meets the eye or I'm reading too much? pic.twitter.com/I5pN724mBx— Abhishek Kothari (@kothariabhishek) March 28, 2018

Prima facie, Basant appears to have got jittery that Can Fin Homes is playing hard to get and that the stake sale will fail.

He appears to have sold the stock in anticipation of the failure.

@kothariabhishek : Whats happening with Can fin homes sir ? Even in strong markets it is underperforming . No info on deal ?

— Madhav Trader (@TraderMadhav) March 27, 2018

“When you bet on corporate action and price you have to be nimble footed and ahead of the curve – which we were,” Basant said.

“when a certain stock keeps you awake at night it’s probably a good idea to chicken out,” he added.

“Time was ticking and like members of the bomb disposal squad we didn’t want to be holding the time bomb till the very last second,” he said implying that in such circumstances it is best to dump the stock without waiting to see what the ultimate result will be.

#Can Fin Homes – Looks like Can Fin mgmt has messed things up! 😛 It is already at 6x book around 500. Trying to get that extra buck might cost them…

— MRIDUL SOMANI (@Mridulsomani2) March 30, 2018

Canara Bank calls off Deal with Can Fin Homes.

— Mangalam Maloo (@blitzkreigm) March 31, 2018

Companies that miss guidance deserve no mercy

Basant was also irked by the fact that Can Fin Homes was playing hard-to-get despite missing earnings guidance.

“And a company that misses its guidance twice a year is like a student who fails an open book test. He gets no mercy,” he fumed.

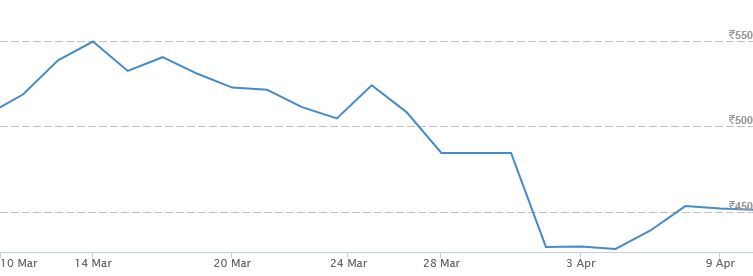

(Fall from grace)

End of the road for Can Fin Homes?

Basant hinted that the best days of Can Fin Homes are behind it and that the management committed an error of judgement in rejecting the attractive offers from HDFC and Barings.

“Last time we wrote that ‘if a girl is beautiful she will find a boy’. But the girl’s parents just couldn’t realise that beauty depletes with time. Some proposals in life don’t come all the time and this might well be one of them.”

The ominous statement “some proposals in life don’t come all the time and this might well be one of them” implies that Can Fin Homes is now condemned.

Should we also dump Can Fin Homes?

Basant advised that even investors who are “behind the curve” and are left holding the can should try to salvage what they can from the ruins.

“In the market it is better to take what’s left rather than wait to recover what’s gone. And it’s not too late to act even if someone is behind the curve,” he advised.

It has all the chances to hit 404 now #canfinhomes

Management is fooling public by adopting delay tactics. Seems the valuation given by 2 big names are less than 340 per share— Pulika Nath (@nalandacapital) March 29, 2018

Seems Can Fin Homes will hit 300 in April soon. Results are 1 month away. Many people build Long positions are stuck and it will lead to panic selling.

— Pulika Nath (@nalandacapital) April 2, 2018

Auto pilot long range growth missiles stocks bought

Anyway, the important aspect is Basant’s disclosure that he has bought “auto pilot long range growth missiles” stocks.

Unfortunately, he has not given any hint of what these stocks are.

In the past, Basant has revealed that he holds D-Mart (Avenue Supermarts), AU Small Finance Bank and diagnostic stocks (Dr Lal Path Labs and/or Thyrocare).

QUALITY helps you in bad times even as KACHRA sucks. The D-Mart stock is much like the D-Mart store. People who are in don't want to come out and the ones who are out can't get in. You can keep protesting but the stock is up 116% over listing price.

Disclaimer: We OWN it.

— Basant Maheshwari (@BMTheEquityDesk) February 23, 2018

It is possible that Basant has now tucked into Bandhan Bank.

We can come to this conclusion because Basant has a penchant for private bank stocks and also for “first day first show” IPO stocks.

He revealed that he bought D-Mart, AU Bank, Ujjivan/Equitas etc on the day of listing.

Conclusion

We have to mull over whether we should continue holding Can Fin Homes after the stake sale fiasco. HFC stocks are now a dime a dozen. A stock quoting at a PBV of 5.5x needs scorching growth of 40%+ to keep going. If the growth momentum slumps, the stock price may plunge. Perhaps, the situation will become clear after the Q4FY18 results are announced and we can thereafter take a firm decision!

He might have bought “Bharat Dynamics limited” because it produces auto pilot long range missiles….simple 🙂

I agree.

???

I think companies like Canfin Homes have risen exorbitantly beyond the justification for valuation and therefore needs to be punished. Even it doesn’t boast of a very great management either.

Experts call for long term investing but can not digest two bad quarter themselves. They can do whatever they want with their own money or whoever is trusting them with their own money , but why they have to come in public and share their wisdom as ” free public service” .. simply to manipulate the market and influence gullible investor. Only Rakesh J is true long term ethical investor you can trust.

SEBI should ban all PMS operator to appear in public media to distribute their “paid ” free gran !! Let them stay in the own cocoon and deliver return.

Completely agree!

Dolly khanna bought associated alcohols & breweries