Political pundits have opined that voters in rural areas have given thumbs down to...

MPS

Porinju Veliyath and Ashish Chugh have made a fortune for themselves because their razor-sharp...

Mohnish Pabrai has sent a timely warning against blind cloning even as he and...

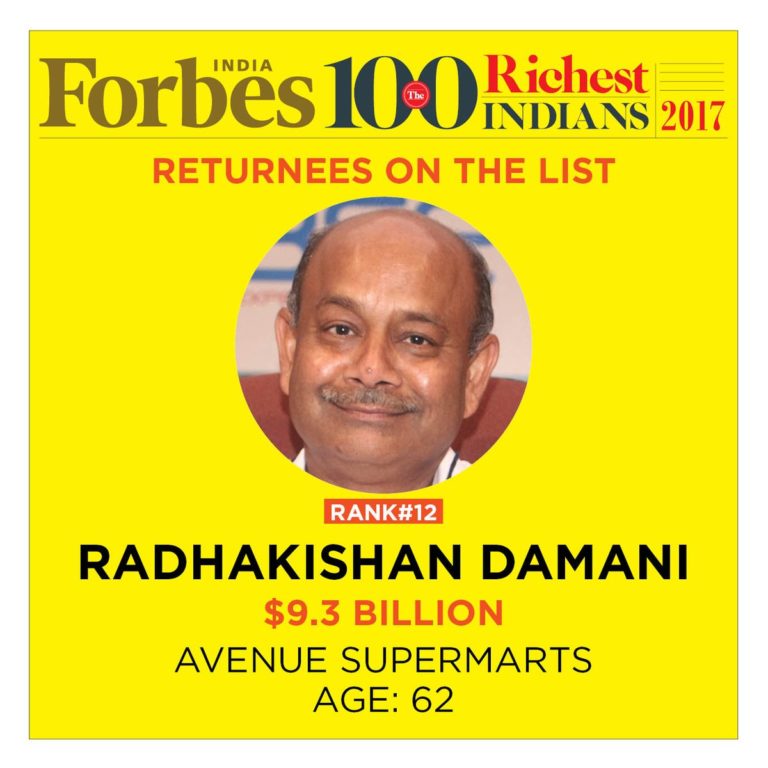

Radhakishan Damani, who faced the ignominy of being ousted from the Forbes Billionaires Club...

Shyam Sekhar’s technique of homing in on contrarian stock picks has yielded rich dividends...

Dolly Khanna & Anil Kumar Goel have added one more high-quality specialty chemical stock...

In a laudable move towards transparency, Sandip Sabharwal has revealed details of the performance...

Ajay Srivastava of Dimensions Consulting has opined that the newly listed Aditya Birla Capital...

Shankar Sharma has mastered the technique of homing in on stocks that look like...

Kenneth Andrade’s Old Bridge Capital PMS and Sunil Singhania’s Reliance Mutual Fund have both...