Porinju Veliyath’s recommended stocks deliver mega gains

It is unbelievable that one tweet of Porinju Veliyath could deliver such mega gains.

On 28th August 2013, Porinju recommended to his army of followers that they buy five stocks. Porinju’s logic was that the stocks were quoting at the dirt-cheap valuations of “penny stocks” though they were in fact not “penny businesses”.

Balaji Telefilms@31, Orient Paper@5, Orient Cement@32, KRBL@23, Mirza Intl@20 – all looking penny stocks, but not penny business. BUY

— Porinju Veliyath (@porinju) August 29, 2013

The astonishing part is that each one of the five stocks has delivered humongous gains as of date.

| Stock | Reco price (Rs) | CMP (Rs) | Gains (%) |

| Balaji Telefilms | 31 | 89 | 176 |

| Orient Paper | 5 | 75 | 1186 |

| Orient Cement | 32 | 128 | 289 |

| KRBL | 23 | 350 | 1327 |

| Mirza Intl | 20 | 89 | 344 |

| Total | 3322 | ||

| Average | 664 | ||

What is even more amazing is that there are two 10-baggers in the list, namely, Orient Paper and KRBL.

The average return of the said five stocks is 664%, which is eye-popping in itself.

Did Porinju prematurely sell KRBL?

However, the tragedy is that Porinju may himself not have seen the ten-bagger gains that KRBL delivered. He revealed in April 2014 that he took the advice of Shyam Sekhar, the noted value investor, to sell the stock when it was still at the throwaway price of Rs. 60, after pocketing 200% gain.

KRBL@60 up 200% since I tweeted few months back. thanks my friend @shyamsek . am shifting to cash at a discount by acquiring Piramal.

— Porinju Veliyath (@porinju) April 16, 2014

After Porinju sold KRBL, it has surged 480%.

The only saving grace is that Piramal Enterprises is up 185% since that day!

Porinju’s followers home in on Chaman Lal Setia

It is notable that some of Porinju’s followers are also astute investors in their own right. They took the cue regarding KRBL and homed in on Chaman Lal Setia, which is KRBL’s arch rival in the basmati business.

@porinju SIR SEE CHAMANSEQ I THINK YOU LIKE IT THE STOCK

— pratik joshi (@pratikjosh84) November 4, 2015

@porinju morning sir. May be KRBL like story happens in chaman lal setia counter. Quality basmati rice sold through out the world.

— abduljaleel sk (@sidrabete) February 3, 2016

Chaman Lal Setia is also up an eye-popping 585% over the past 24 months. The stock is up 1969% since November 2013.

Porinju buys LT Foods for Equity Intelligence PMS

Porinju did not let the disappointment of premature disposal of KRBL affect him very much. He scooped up a chunk of 438,011 shares of LT Foods, the producers of ‘Dawaat’ brand of basmati rice, on 11th July 2016 at Rs. 295 per share, for Equity Intelligence, his PMS.

At the CMP of Rs. 379, Porinju is already sitting on gains of about 28% for an investment of about six months.

LT Foods has also been a multibagger with gains of about 219% over the past 24 months.

Shyam Sekhar explains why stocks like KRBL are a must-buy

Shyam Sekhar’s logic for buying stocks like KRBL etc is so simple that we have to wonder why we didn’t think of it.

The logic is that the companies buy rice from farmers at rock-bottom prices, convert it into basmati by the process of ‘ageing’, and sell it under the brand names ‘India Gate’, ‘Dawat’, ‘Maharani’ etc to retail consumers at exorbitant prices.

The ‘value addition’ of ‘ageing’ the rice and selling it under a brand name creates enormous profits for these companies, Shyam Sekhar explained.

KRBL is a compelling story of value migration: Manish Bhandari

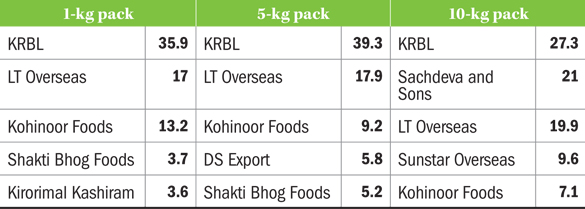

Manish Bhandari of Vallum Capital conducted a masterful analysis of the entire basmati business and of the key players therein. He explained, with reference to facts and figures, that India is the largest exporter of rice in the World and that this gives it competitive advantages over its arch rivals Pakistan, Vietnam, Thailand etc. He also pointed out that the consumption of basmati is growing at 25% CAGR over the past five years and that KRBL is the leader in the business.

After providing more details relating to KRBL and the business of basmati, Manish Bhandari recommended a buy of KRBL on the basis that the Company is “a compelling story of value migration towards branded business”.

The recommendation was spot on because KRBL has posted hefty gains of 100% since then.

(Image Credit: Outlook Business)

Ekansh Mittal of Katalyst Wealth recommends a buy of Chaman Lal Setia

The indication that it is not too late for us to tuck into basmati stocks comes from the fact that Ekansh Mittal, the founder of Katalyst Wealth, a stock advisory service, has recommended it as his “Best pick for 2017”.

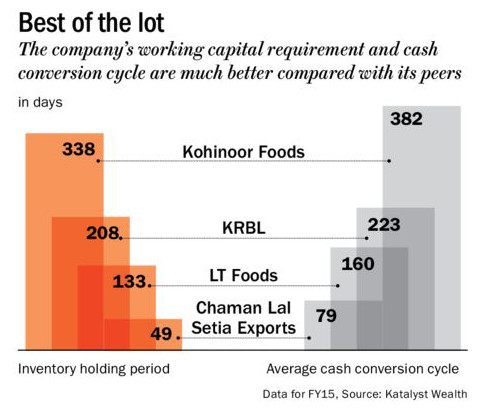

Ekansh has conducted a systematic analysis of Chaman Lal Setia vis-à-vis its peers, Kohinoor Foods, LT Foods and KRBL and has opined that Chaman Lal Setia is the “Best of the lot” on the basis that its “working capital requirement and cash conversion cycle are much better compared with its peers in days”.

(Image Credit: Outlook Business)

The buy recommendation is given by Ekansh Mittal on simple and clear logic:

“The company’s market cap is Rs. 450 crore and its enterprise value is Rs. 320 crore with a cash of around Rs. 40 crore (as of September 2016). For the trailing twelve months, the stock recorded a PAT of Rs. 37 crore and Pan of Rs. 55 crore. Based on which, the stock is trading at 9.73 times trailing 12-month earnings and an EV/EBIT multiple of 5.82 times. We, hence, believe that the valuations are reasonable both on an absolute and relative basis compared with 18 times TTM PAT for KRBL. Given that Chaman Lal is an efficiently managed business, it is best placed among its peers to make the most of the growth in the coming years.”

Time is ripe to buy all three basmati stocks: HDFC Securities

Now, to our good fortune, Atul Karwa of HDFC Securities has conducted a thorough study of all the three stocks in the basmati sector, namely, KRBL, LT Foods and Chaman Lal Setia.

He has explained that the basmati business in India has developed in such a manner that there is a “moat” in the form of “Huge entry barriers for new entrants”.

This is because:

“The Basmati players in India have built a robust profile which is difficult to replicate by any new entrant in the short term. Most players in the organized sector have an integrated business model and have forged strong relationships with farmers including contract farming which takes care of raw material requirements. They have built expertise in paddy procurement and state of the art manufacturing facilities. A wide number of brands have been launched with a wide distribution network. Expenses on advertisement and brand promotion have ensured huge brand recall resulting in huge base of loyal customers. The high level of working capital requirement dissuades new entrants.”

(Image Credit: HDFC Securities)

Thereafter, Atul Karwa has provided a meticulous explanation with regard to the respective merits and demerits of each of the three players.

The investment rationale is summed up as follows:

– Huge entry barriers for new entrants

– Strong demand in the Middle East

– Iran may resume purchases of Basmati rice

– Opening up of Chinese markets for basmati

– Rising disposable income leading to shift towards premiumisation

The concerns/ risk factors are also meticulously set out. A price target for each stock is also provided.

Conclusion

We have missed the bus once and foregone huge multibagger gains that would otherwise have effortlessly gushed into our portfolios. We must ensure that we don’t miss the bus again. We need to research all the basmati stocks meticulously and tuck into our favourite ones without further ado!

Isn’t Chaman Lal Setia a commodity type business where they have negative cash flows at particular intervals?

Don’t know to believe HDFC report? as these are all already ran-up so much …!

amazing

Daljeet Singh Kohli must be congratulated for his recommendation on ORIENTAL CARBON, FORCE MOTORS