Market is overheated does not mean that value picks cannot be found

Vijay Kedia has sent the chilling warning that the stock markets are “overheated” and that a correction is imminent.

Mere khyal se general market overheated hai. Reaction aa sakta hai. https://t.co/Exoc91fW6r

— Vijay Kedia (@VijayKedia1) April 15, 2017

However, this does not mean that we should stop looking for value picks.

Vijay Kedia demonstrated this by increasing his stake in Karanataka Bank, a stock that has been described as a “sitting duck multibagger” by leading experts.

Vijay Kedia and the experts have provided a masterful explanation as to why Karnataka Bank, which is presently quoting at a throwaway valuation of less than 1x book value, stands a chance to be “the next RBL Bank” and shower mega gains on the lucky shareholders.

Vaibhav Global – Vijay Kedia’s latest stock pick

Vijay Kedia has given yet another example of his stock picking mastery by buying a chunk of 345,000 shares of Vaibhav Global.

The investment is worth Rs. 15.35 crore at the CMP of Rs. 445.

Vijay Kedia’s latest portfolio

This is an opportune moment to cast a glance at Vijay Kedia’s latest portfolio of glittering multibagger stocks.

| Vijay Kishanlal Kedia’s portfolio and holdings as of 31st March 2017 | |||

| Stock | CMP (Rs) | Nos of shares held | Networth (Rs Cr) |

| Sudarshan Chemical Industries Limited | 367.40 | 2,555,317 | 93.88 |

| The Karnataka Bank Limited | 154.95 | 5,660,703 | 87.71 |

| Repro India Limited | 413.15 | 753,928 | 31.15 |

| Lykis Limited | 52.50 | 3,234,383 | 16.98 |

| Vaibhav Global Limited | 450.00 | 345,000 | 15.52 |

| ABC BEARINGS LTD. | 182.00 | 549,000 | 9.99 |

| Aries Agro Limited | 164.85 | 598,091 | 9.86 |

| Apcotex Industries Limited | 372.60 | 231,814 | 8.64 |

| TCPL PACK | 645.00 | 119,961 | 7.74 |

| CHEVIOT CO.LTD. | 1080.00 | 58,221 | 6.29 |

| PANASONIC ENERGY INDIA COMPANY LTD. | 283.00 | 93,004 | 2.63 |

| STEWARTS & LLOYDS OF INDIA LTD. | 23.60 | 142,014 | 0.33 |

| Vijay Kedia’s Net Worth as of 31st March 2017 | 290.72 | ||

Why is Vaibhav Global a good buy?

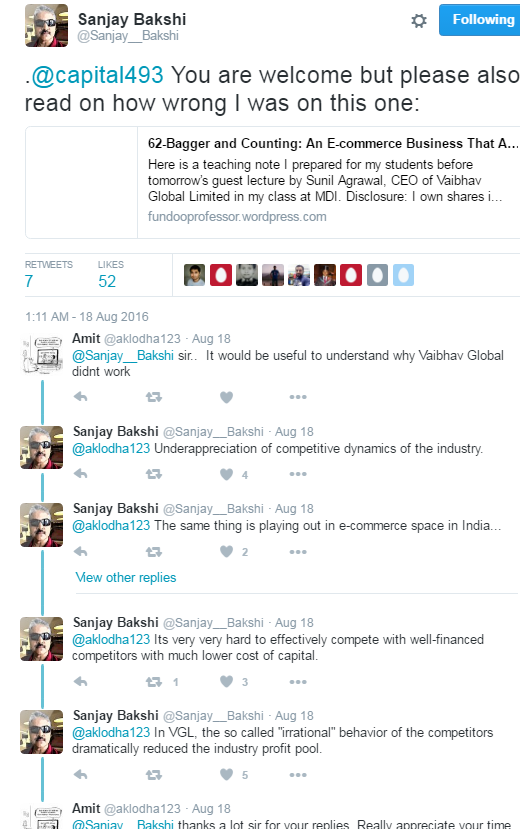

The best way to understand the nuances of Vaibhav Global’s business model is to read the detailed teaching note penned by Prof Sanjay Bakshi, the authority on value investing, titled “62 Bagger And Counting: An E-commerce Business That Actually Makes MONEY But Almost Didn’t”.

After a detailed examination of the prospects of Vaibhav Global from a “psychology lens” and a “finance lens”, Prof Sanjay Bakshi has concluded that the Company’s business model does have “beautiful applications of some of the most powerful principles of psychology” and illustrates Warren Buffett’s example of a “Low Cost Moat”.

“VGL’s moat comes from its low cost advantage which is very hard to replicate,” the Prof concluded.

Why did Vaibhav Global fail?

Prof Sanjay Bakshi noted that the stock had not performed as well as he expected and proceeded to explain the reasons thereof:

(Image Credit: forum.valuepickr.com)

He pointed out that the “irrational” behaviour of the competitors had wrecked havoc with the dynamics of the Industry.

This aspect is further explained by the experts at valuepickr forum in the following manner:

“Now there are many reasons why profits hv fallen and why they shud look up

1. The competitor started offering EMI as well as returns on delivery as convenience to lure customers away from Vaibhav. Initially Vaibhav dismissed these as gimmicks but soon realised that it will need to match these offers which it did but that led to increased working capital therefore increasing costs at the time of slowing sales thereby squeezing margins/profits

2. The competitor offered better web interface offering ease of use to customers. To match this Vaibhav had to invest in new technology and this took more time than planned leading to project cost overruns and lower sales again squeezing profits

3. The company had planned investments in new SEZ at Jaipur which it went ahead with and even though it was completed ahead of schedule it led to some addl expenses as well as higher depreciation, again hurting PAT

4. The company also invested more in its senior management team as it needed more web sales savvy and experienced people and also as some senior people left (which might hv been viewed negatively by mkt) so this meant increased variable expenses again squeezing margins

5. It also invested more in buying additional coverage for this tv channels in US giving it additional viewership but this also led to more addl expenses which are fixed in nature”.

After providing a masterful explanation of the reasons for Vaibhav Global’s downfall, the expert rightly observed that “at this price or at around 260-270 it looks like a good bet ie you won’t lose much but can gain big”.

This prediction has turned out to be prophetic because the stock has surged like a rocket to the CMP of Rs. 445, putting solid gains on the table.

Vaibhav Global 20% circuit today …

Bumper results..

We bought in portfolios around 275— Vivek Pandey (@IVivekPandey) February 8, 2017

(LIVE stream of the Liquidation Channel (Vaibhav Global’s channel)

Vaibhav Global is at an inflection point: Nirmal Bang

Runjhun Jain and Sunil Jain of Nirmal Bang are strong believers in the prospects of Vaibhav Global. They were early identifiers of the multibagger potential of the stock and have been regularly recommending a buy of the stock.

In their latest report, the duo has opined that Vaibhav Global is showing “early signs of recovery” and that it is at an “inflection point”. The duo has recommended a hold on the following rationale:

“Vaibhav Global Ltd (VGL) shows early signs of recovery in Q2FY17 which got further reiterated in Q3FY17 results wherein the company showed volume growth in both TV as well as Web sales. As we have keep highlighting that the company’s business model involves high fixed cost (cost of channel, employees, inventory etc) hence the leverage of higher growth directly translates to EBITDA level which is evident from the improvement seen in margins during current quarter. EBITDA margins for Q3FY17 improved to 8.6% vs 4.6%/6.5% in Q2FY17/Q3FY16, despite steady gross margins. Net sales grew by 14.7% to Rs 406 cr from Rs 354 cr in Q3FY16. The company has undertaken various steps like including introduction of Budget pay (EMI), allowed return of goods, launch of mobile app, to streamline its business and to become a level field player with the competition. We believe the company has now completed its transition phase and poised for healthy volume growth and strong margins. Management has maintained its low double digit volume growth for Q4FY17 as well which we believe will directly translate to profitability.

…..

Valuations and Recommendations

We continue to like the asset light business model of VGL and we believe that company has reached an inflection point. We expect the company to report muted volumes in FY17 however show improvement from FY18. Due to fixed cost heavy business model, we expect EBITDA margins to increase higher. Our first target of Rs 353 (given in 26 Dec 16 company update) has been achieved. VGL is trading at a PE of 12.8x on our FY19E earnings which we believe gives an attractive opportunity. We recommend HOLD on the stock with a target price of Rs 553 (15x FY19E).”

Conclusion

It appears that Vijay Kedia may have brought good luck to Vaibhav Global and that the original thesis formulated by Prof Sanjay Bakshi that the stock will give mega multibagger gains may now come true!

Vijay Kedia has many hits but also misses .Just before last Diwali he told in TV channel that he has bought Mahindra Holiday and is very bullish ,I also ends up buying that.After few days it was clear that he was heavily buying Karntaka Bank.What happened to his pick Mahendra holiday,did he dumped it to stock Karntaka bank .I had to book loss on his recommendation. So you will find noise of hits and misses will be forgotten without any trace

Kharb ji, do not worry for Mahindra Holidays. Its a long term story with play on expansion in memberships. This will take time of years and please do not loose patience till next 3-5 yrs.

You cannot dump a company in a few months. And don’t invest in something that you aren’t convinced about. Im super bullish on Repro india because I understand the space since I’ve been involved in the print industry and know the space. I found out about Repro India’s books on demand model via an analyst report that I had read. I never bought the stock post Kedia’s comments. But when i decided to get in his mark of approval made a massive impact on my conviction levels. Kedia had recommended the stock in 2016 i think. I bought a small portion only last week!

Exactly. Also, in Karnataka Bank, the gross NPA is much higher than being reported in some blogs. Please do not trust articles blindly.

These big shot investors act as glamour models to advertise on current investments and then discard stocks without any information later.

Exactly I have same doubt,markets are very efficient .If any stock remains underpriced compare to its peer,we should also think does market knows some thing more.In most of the cases market are efficient although exceptions are always there.

In my view in older small Pvt banking DCB and Federal Bank are the best ,and if we look into low ticket Pvt banking then add IDFC bank new generation bank to this list.So these three are best makes the best mid cap bank list.This list will beat Karnataka bank in long teem

where is the vijay kedias best pick astec life sience?? huh???