Who or what is Mishra Dhatu Nigam Ltd alias Midhani?

“Mishra Dhatu Nigam Ltd mein 100% gain ho gaya,” Mukeshbhai said with the air of one who is privy to top secrets of the stock market.

Jigneshbhai nodded his head sagely.

“Mishra Dhatu Nigam kya hai?” I asked with wide eyed innocence, thoroughly exposing my naivety, even as Mukeshbhai and Jigneshbhai glared with a contemptuous look.

It is the law in Dalal Street that one must never admit to not knowing anything. One must always pretend to know everything.

That is why even novices strut around here looking like experts.

However, I cannot be blamed for my ignorance because leading experts had condemned Mishra Dhatu Nigam’s IPO as not being investment worthy.

Anil Singhvi, the charismatic editor of Zee Business, has an army of devoted followers.

His cheerful personality coupled with a down-to-earth attitude appeals to novices and they throng his shows in large numbers.

In fact, many of his followers claimed to have stopped watching CNBC Awaaz after he left it.

Anil sir Apke bina CNBC dekhneka man hi nahi karta hai

— Arkate Sameer Yunus (@Arkatesameer) March 22, 2018

Thanks Anilji. Aap jab se gaye cnbc dekhna hi band kar diya. Please bataye aapko kab dekhne ka mauka milega

— suhail (@suhail_ansari99) March 22, 2018

Sir kaha chale gaye ho ? Tv par vo pardeep aur harshada sawant dekh ke maza nahi aa raha hai .. aao thoda masti machao ? sonam mehta ko bhi samjhao hindi theek se bolna

— Deep.ak (@Deepak251280) March 22, 2018

When we Will hear you , missing your valuable opinion

— Dharma (@Dharmen76803932) March 22, 2018

Sir You are Genius & Great !!!!

— Sk Nadir Ali (@nasknadirali) March 22, 2018

No doubt, it is rare for a TV anchor to have such fan following and adulation from viewers.

“Rs. 3 discount to retail n allotment at 87/- which is lower Band of IPO is NOT ENOUGH,” Anil Singhvi said in a stern tone.

He also cautioned that recent PSU IPOs had performed badly on listing and that MIDHANI will meet the same fate due to lack of interest from funds and investors.

Listing Preview – MIDHANI (Mishra Dhatu Nigam)

Rs. 3 discount to retail n allotment at 87/- which is lower Band of IPO is NOT ENOUGH

Recent PSU IPOs performed badly on listing, now same with MIDHANI

Expect a SUST LISTING with no interest from funds or investors@ZeeBusiness

— Anil Singhvi Zee Business (@AnilSinghviZEE) April 4, 2018

IPO review – MIDHANI (Mishra Dhatu Nigam)

AVOID for listing gain despite Rs 3 discount to retail, expensive valuations n volatile markets

Recent PSU IPOs BDL, HAL got poor response, same story now with MIDHANI

APPLY ONLY IF you are a long term or high risk investor@CNBC_Awaaz

— Anil Singhvi Zee Business (@AnilSinghviZEE) March 22, 2018

A similar opinion was expressed by Hem Securities, a brokerage which has deep knowledge about IPOs.

“Co is bringing the issue at p/e multiple of almost 29 on post issue H1FY18 annualized eps at price band of Rs 87-90/share. Although co has most advanced and unique facilities & capability to manufacture wide range of advanced product but weak order book size of Rs 517 Cr against strong topline in FY16 & FY17 doesn’t infuse optimisim in company. Hence, we recommend “Avoid” on issue,” Hem Securities said.

Such was the apathy against the IPO that the other brokerages did not even bother to review and issue recommendations.

Prediction comes true because Midhani sinks on debut …

Anil Singhvi and HEM Securities were perfectly justified in their advice because Midhani sank like a stone immediately upon listing.

As against the offer price of Rs. 90, the stock opened at Rs. 88.65 with barely any takers for it.

ICICI Sec Shares List at Rs 435 On NSE vs Issue Price Of Rs 520

Mishra Dhatu Nigam Lists at Rs 88.65 vs Issue Price Of Rs 90 On BSE. pic.twitter.com/qSSAriKyf6

— BTVI Live (@BTVI) April 4, 2018

… Big investors dump stock like hot potato …

One can well imagine the contempt of investors towards Midhani from the fact that two PSU Banks, who had probably been forced to subscribe to the IPO at gun point, dumped it like a hot potato on the next day of listing.

Mishra Dhatu Nigam Ltd – fund action

CANARA BANK SELLS 9.69 lk shares @ Rs 89/-

UNION BANK OF INDIA sells 10 lk shares @ Rs 90.03/-— SONAM MEHTA (@sonamcnbcawaaz) April 5, 2018

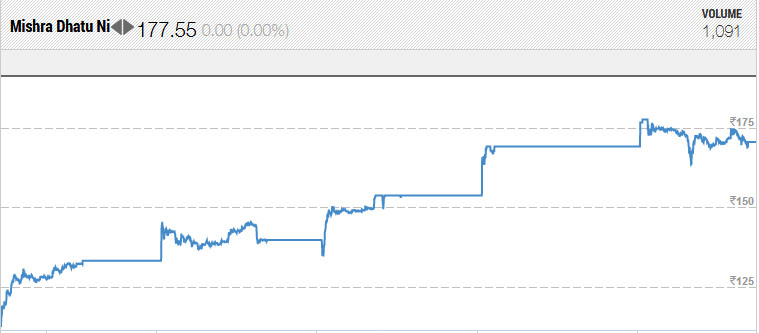

… then stock surges like a rocket and posts 100% gain

Thereafter, in a sudden turn of events, Midhani roared like a lion and surged like a super-sonic rocket.

The stock was locked in back-to-back upper circuits.

In just 2 weeks, the stock surged from the listing price of Rs. 88.65 to a high of Rs. 177.55, posting mind-boggling gains of nearly 100%.

(Midhani, stock on steroids)

Sir bade bade share dekhe par Midhani jaisa sher ni dekha Top – bottom-fir top and then move to Uppar circuit… @AnilSinghviZEE

— Nitesh kaushik (@royalknight1101) April 20, 2018

MIDHANI, unable to resist tweeting !! fast & furious 2x in 2weeks !only manufacturer of titanium alloys in India.niche product's cater to defence, space & power.Indian Govt Wants to spend Rs 1.7 trillion in military goods & services by 2025.#Beneficiary https://t.co/8vuueExtB7

— Tekumani Naveen (@NaveenTekumani) April 20, 2018

I shouldn't complain, given that I got full allotment during the IPO but anyone know why Mishra Dhatu Nigam (Midhani) is booming right now?

— Kushan Mitra (@kushanmitra) April 16, 2018

Mega defense deals in offing?

According to Deepali Rane, the charming journalist with CNBC Awaaz, Midhani has signed a couple of MOUs.

The MOUs are top-secret and details are not known. However, they are probably big-ticket deals and may catapult Midhani into the big league, judging by the response of the market.

In Focus-Mishra Dhatu

BRIEF-Mishra Dhatu Nigam Says Co Entered Into 2 Confidential Non-Binding MoUs https://t.co/iE1TWvlBzx

— Deepali Rana (@deepaliranaa) April 19, 2018

Dence and space-related expenditure in India are expected to rise sharply. Midhani (Mishra Dhatu Nigam) is engaged in mfg of special steels, super alloys, and titanium alloys. It is a zero debt company.

— Kush Katakia (@kushkatakia) April 4, 2018

Midhani @ 153. Mini Navratna from the governments stable. Only Titanium manufacturer in the country. Supplier to the defence and aviation sector. Debt free. Low public float. The ipo gave muted response but prima facie it ticks many boxes. Keep an ?

— Goldie (@GoldieTuteja) April 18, 2018

More bucks are due from Midhani?

Mubina Kapasi of ET Now has provided a masterful explanation of what Midhani does and what its prospects are likely to be.

She has explained that Midhani is not a plain vanilla metals producer but is instead a producer of rare metals called “super alloy” and “titanium alloy”.

She has opined that Midhani has great prospects owing to the increasing demand for rare metals from the defense sector.

#TrendingToday | Here's a stock that has rallied about 60% in 8 trading session. @MubinaKapasi tells us what's the story behind #MIDHANI pic.twitter.com/ViH06iaeTt

— ET NOW (@ETNOWlive) April 18, 2018

Mubina Kapasi’s analysis is corroborated by a write-up in moneycontrol.com by Jitendra Kumar Gupta.

He has pointed out that Midhani should not be dismissed as a commodities stock because it makes differentiated value added products that are hard to replicate and enjoy huge competitive advantage.

The super specialty or critical steel is used in niche applications like aerospace, defence, space, high end engineering or precision engineering like in oil & gas and automobiles, it is stated.

He has further opined that Midhani’s return on equity of almost 26%, 24% operating margins, debt free status, free cash flows and Mini-Ratna pedigree make it an irresistible bet for investors.

What about other defense stocks?

There are two other PSU defense IPO stocks which appear to be ripe for the picking.

These are Bharat Dynamics Ltd and Hindustan Aeronautics Ltd.

Bharat Dynamics Ltd manufactures Surface to Air missiles (SAMs), Anti-Tank Guided Missiles (ATGMs), underwater weapons, launchers, counter measures and test equipments.

It is the sole manufacturer for SAMs, torpedoes, ATGMs in India. It also undertakes refurbishment and life extension of missiles.

It has three manufacturing facilities located in Hyderabad, Bhanur and Vishakhapatnam.

Its customers are the MoD (Ministry of Defence), other defence PSUs, government bodies under MoD and other countries.

Post its listing, government-owned Bharat Dynamics has corrected and is currently trading at Rs 403 share, much below its issue price of Rs 428 a share. The valuations, at 14 times its FY17 earnings, are attractive and the company has strong earnings visi…https://t.co/MNZhCRHALR

— Sabyasachi Paul (@sabythetortoise) April 18, 2018

India's Bharat Dynamics Limited (BDL) has signed a licensing agreement with the MoD for the serial production of the indigenously developed Astra Mk I beyond-visual range air-to-air missile (BVRAAM)https://t.co/2kfunPgWgm#DoD

— SDI_DefenceNews (@DefenceNews_SDI) April 17, 2018

Hindustan Aeronautics Ltd is also a powerhouse engaged in the manufacture of Light Combat Aircraft.

It is tying up with Boeing Co, the global aviation behemoth, to manufacture F/A-18 Super Hornet fighter jets in India.

To play the defense theme, we can also consider established warriors like Bharat Electronics and BEML, which have a proven track record for operational excellence.

PHILIP CAPITAL ON DEFENCE SECTOR

Sector initiation

Here come the champions

reiterate our BUY rating on Bharat Electronics (BEL) and initiate coverage on Hindustan Aeronautics (HAL), Cochin Shipyard (CSL) with BUY ratings and on Bharat Dynamics (BDL) with a Neutral pic.twitter.com/d53dpFsgN2— SONAM MEHTA (@sonamcnbcawaaz) March 28, 2018

Conclusion

We have been deprived of mega gains which otherwise would have effortlessly flowed into our pockets. However, there is no point in crying over spilt milk. Instead, we will have to keep a close eye on Midhani and its peers and wait for an opportunity to tuck into them!

Frankly speaking, it all depends upon valuation. MIDHANI came with a reasonable valuation and therefore, it is now commanding good price/valuation.

In case of HAL and Bharat Dynamics also, it will depend upon valuation and not the ‘defense play’ as talked about.

Valuation should always be judged keeping in view the future prospects of the business.

The fact is that still there is no fundamental reason but only rumours of possible defense orders, which if not materialised the same rocket will come back at the same speed. What has happened is nothing but insider trade.

I hold an opposite view on Defense Sector. In my view Defense is a sunrise sector under Modi’s” Make in India” agenda. I am immensely bullish on this sector with very long runway.All the listed main players of this sector will make good amount of money for the investors.

Modi govt itself might sunset next year. Better to stay out of Modi pet project themes till 2019

If future defense related orders are coming, then one should buy BEL which daily falling? It will be biggest gainer from Akash missile orders.

One should think twice before taking a plunge on PSU as these Government Behemoths are highly influenced by vested interests of ruling party and often their working is twisted to serve those vested interests at the cost of minority shareholders like you and me !!! Also, most of them are run by Govt. appointed bureaucrats rather than professionals with killer’s instincts !! Even professionals in PSUs are lame-ducks as they are not given free hands and end up serving their political masters rather than the organization itself.

Checkout IVP Ltd latest shareholding shows the name of Shyam seems interesting

Dear All,

I was listening to Alpha Moguls program on BloombergQuint and they interviewed Nikhil Vora. He is one the best investors and excellent in predicting trends. Nikhil has invested in the liquor space. Does anyone know the name of the company in which he has invested? Thanks, Venkatesh.