How come ace investors turned a blind eye to dangers which novice investors could spot?

One aspect that is perplexing is why the so-called savvy investors stayed invested in Noida Toll Bridge despite the several alarm bells that were clanging for a long time.

In fact, even an ultra-novice investor like me could sense that there is danger all around and investors should bail out and salvage what they can.

In my piece of July 2015 titled “Ace Value Investors Face Flak For Backing Noida Toll Bridge Inspite Of Strong Anti-Toll Sentiment In Country”, I pointed out that there is a strong “Anti-toll” sentiment amongst citizens and political parties and that the business model is not sustainable.

In fact, over the past several years, Noida Toll Bridge has itself been a victim of several anti-toll protests by leading political parties like “Jan Morcha”, “Bajrang Dal” and others.

Protestors forced the toll bridge employees out of their posts and let the vehicles through without paying. #Delhi #Noida

— Delhi News (@Delhi_News) August 29, 2016

No toll collection @ DND flyover today courtesy Jan hit morcha.Noida toll bridge company worried,some citing the lawlessness,some ecstatic

— Rashmi Mann (@RashmiMann) August 28, 2016

Some knowledgeable commentators even claimed that the DND flyover is a “scam” designed to unfairly profit the operator at the cost of the hapless public.

The NOIDA toll bridge scam which continues to fleece commuters. @nitin_gadkari https://t.co/dtgECHAyEH

— हम भारत के लोग (@India_Policy) August 11, 2016

Litigation threatened business model

It was also known that a Public Interest Litigation (PIL) had been filed in 2012 by the Federation of NOIDA Residents Welfare Association in the Allahabad High Court claiming that as the Noida Toll Bridge Company had already recovered by way of toll many times the value of its costs in building the road, further recovery of toll is illegal.

Surely, discretion is better than valour?

Common sense demands that when one is faced with a risky situation, it is better to avoid it rather than to face it. After all, there is no dearth of stocks in India which offer top-quality and value at reasonable prices.

One is supposed to conduct a “risk-reward” analysis of every stock. If the risks outweigh the potential reward, one should avoid an investment and seek other pastures to graze on.

That's how a value trap looks like!

Analysis: Noida Toll Bridge Company Limited (DND Flyway) | Vijay Malik – https://t.co/Rm6uRBPy7B

— Dr Vijay Malik (@drvijaymalik) July 18, 2016

Yet PPFAS Mutual Fund increased its holding in Noida Toll Bridge

The baffling aspect is that PPFAS Mutual Fund not only turned a blind eye to the imminent dangers of Noida Toll Bridge but increased its holding in the Company.

As of September 2013, PPFAS MF held 81,43,185 shares of Noida Toll Bridge comprising a massive 4.37% of the equity. This holding was increased to 86,54,434 shares (4.65%) by September 2014. By September 2015, the holding swelled to 87,48,218 shares (4.70%). It stands at that figure as of September 2016.

The stock has always been a favourite of Parag Parikh, the late founder of PPFAS Mutual Fund. In an old interview, he called Noida Toll Bridge his “Number one investment idea“. Of course, when he made the recommendation, the dangers were not as clearly spelt out as they were later.

In just the last year, the Noida Toll Bridge stock has lost 40.6% of its value which means that PPFAS has lost nearly Rs. 10 crore of its AUM in the stock in the last year.

High Court bans toll collection by Noida Toll Bridge

On Wednesday, 26th October, the worst fears came true when the Allahabad High Court delivered a detailed judgement holding that the Company is not entitled to collect toll as it has already recovered much more than the cost incurred by it.

The Court pointed out that Noida Toll Bridge has recovered Rs. 810.18 crore from toll income since the commencement of the expressway till 31 March 2014. Approximately Rs. 300 crore more was realized through user fee or toll between 1 April 2014 and 30 September 2016, it added.

“Keeping in mind the public interest, as per the settled position of law that no private person or company can be allowed to earn profit from the public property at the cost of public at large for indefinite period and the Concept of Toll in India, the levy of User fee by the Concessionaire cannot be justified” the Court ruled.

“We direct that, henceforth, Noida Toll Bridge Company, the concessionaire shall not impose or recover any user fee or toll from commuters for using the DND,” the Court added in a grim tone.

Delhi-Noida Toll Bridge- Loot In The Name Of Public-Private Partnershipshttps://t.co/1WexCXG7Iu

— Prasanna Viswanathan (@prasannavishy) October 27, 2016

Noida Authority signed a Gold Plated contract with the Noida Toll Bridge company, assuring exorbitant profits till perpetuity.

— हम भारत के लोग (@India_Policy) October 26, 2016

Investors face brunt of poor stock selection by PPFAS

PPFAS announced yesterday that though the stock had triggered only one lower circuit of 20%, it was marking the price of the stock “down by two more market circuits i.e. 20% & 10%” from the closing price.

Being conservative, we have marked down the value of Noida Toll Bridge Company Ltd. in today's NAV. https://t.co/GiCIMIJ0NV

— PPFAS Mutual Fund (@PPFAS) October 27, 2016

Rajiv Thakkar, the fund manager, clarified that the additional write-down was because “Circuit down price is not the true price” implying that more downside to the stock price is expected.

@JalajBaweja @PPFAS What is unethical? Valued the shares as per current available information. Circuit down price not the true price.

— Rajeev Thakkar (@RajeevThakkar) October 27, 2016

But accolades flow in from investors …

The baffling aspect is that investors in PPFAS Mutual Fund and other knowledgeable investors, instead of being upset at the fact that the Fund continued to stay invested in Noida Toll Bridge despite the imminent dangers, applauded the fund manager for the write-down.

Best fund ever. Concern for unit holders. Proud as an investor. @PPFAS @RajeevThakkar @oraunak pic.twitter.com/bL4hjNsjFc

— jimitzaveri (@lucky_jimit) October 27, 2016

First in MF industry

PPFAS MF values NOIDA Toll Bridge 30% < market price

2.82% of portfolioValuation rationalehttps://t.co/37zL2GOjQl

— Manoj Nagpal (@NagpalManoj) October 28, 2016

@RajeevThakkar @PPFAS @JalajBaweja Rajeev, we have full faith in your team. These things happen in life. We must do needful and move on.

— ravi negi (@rnegi62) October 28, 2016

@PPFAS I agree. Unfortunate development beyond any fund manager's Control. Better to mark down now and hope SC reverses HC Judgement

— Hitesh Gajaria (@gajaria) October 27, 2016

Peculiar psychological trait of investors

This is a peculiar psychological behavior by investors that deserves to be probed. One can understand the sentiment that the fiasco is an “Unfortunate development beyond any fund manager’s control” if the dangers were not known or were unpredictable. Can one be so charitable even when the danger was clearly spelt out and the fund manager preferred to ignore it?

“Being conservative ….”

In the first tweet, PPFAS played on the words “Being conservative” we have marked down the value of Noida Toll Bridge Company”.

However, whether staying invested in Noida Toll Bridge despite the imminent dangers is a part of the “being conservative” culture requires to be considered.

Supreme Court dashes hopes by refusing stay

Till today afternoon, there was a ray of hope that the Supreme Court would bail out Noida Toll Bridge and stay the judgement of the Allahabad High Court.

However, these hopes were dashed as the Supreme Court has refused to interfere.

SC refuses to resume collection of toll on DND Flyway; Noida Toll tanks 19%#Sensex #Nifty Live: https://t.co/4cBya47Yvn pic.twitter.com/w0p5siIhVp

— ETMarkets (@ETMarkets) October 28, 2016

Noida Toll Bridge Company Limited should change name as Noida Free Bridge Limited.. ???

— Anand Mohan (@AnandMohan1977) October 28, 2016

SC's Diwali gift to Delhi-Noida commuters: SC refuses to stay Allahabad HC order making DND flyway toll-free

— Mihir Mishra (@mihirmishraET) October 28, 2016

Winding-up will result in value unlocking?

Fortunately, all may not be lost yet for the beleaguered investors in Noida Toll Bridge.

Some knowledgeable observers opined that if the Company is liquidated and its cash distributed amongst investors, hefty gains can be reaped by investors.

No toll for Noida Toll – Stock down at 16.30.

Net cash/ reserves distributed to each shareholder = Rs 28 (No guarantee if this will happen)— Rajat Sharma (@SanaSecurities) October 28, 2016

However, the time frame within which this will be achieved, if at all, is anybody’s guess.

Inexplicable fascination of PPFAS Mutual Fund with foreign stocks despite pathetic returns

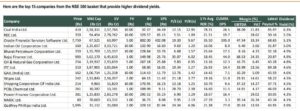

Another intriguing aspect is the fascination that PPFAS Mutual Fund has with foreign stocks. It has invested as much as 27.90% of the AUM in foreign stocks as of 30th September 2016.

| Stock | % of AUM | YoY Gain (%) |

| Alphabet (Google) | 11.52 | 13.63 |

| 3M Co | 3.07 | 6.4 |

| International Business Machines Corp | 3.26 | 5.99 |

| Anheuser Busch Inbev SA ADR | 1.07 | 2.3 |

| United Parcel Services | 4.23 | 1.2% |

| Apple Inc | 1.39 | (3.86) |

| Nestle SA ADR | 2.90 | (4.5) |

| Standard Chartered PLC | 0.46 | (25.04) |

As one can see, the gains from the foreign stocks are pathetic to say the least. The maximum gains are from Alphabet which has given a princely YoY return of 13.63%. Of the balance seven stocks, four are barely making ends meet while three are in the red.

It is notable that the investment in Apple was made despite the fund manager publicly expressing reservations as to the viability of Apple being able to charge a premium for its phones in the wake of rampant and aggressive competition from Android phones.

Even an index fund would have given better returns than the foreign stocks

One has to contrast the sorry selection of foreign stocks with the stocks picked by eminent stock wizards like Dolly Khanna, Vijay Kedia, Ashish Kacholia etc which have become mega multibaggers in the same time.

In fact, even an investment in an Index Fund would have given a superior return than the exalted foreign stocks referred to above. Even if one had even invested in average and run-of-the-mill Indian stocks, he would have more gains on the table than what the foreign stocks have to show.

Conclusion

There are two important lessons that one can learn from the fiasco. The first is that one should always err on the side of caution. It is foolhardy to play with fire if one wants to save oneself from burnt fingers. The second is that the fancy for foreign stocks is ill-founded. When enlightened foreign investors like Prem Watsa, Mark Mobius and others are making a beeline for India and pumping in billions of dollars into Indian stocks, it is foolish to be a contrarian and look for bargains overseas!

They have sold 50 lakh shares today in suicide attempt

Noida toll was a bad investment in my mind , but none of foriegn bets seems bad , one should not conclude the same about foriegn stocks. Indian small caps are seeing sharp runs , however in long term thieir high growth will mean revert

I think its a big confusion to think this way

Well , it is obvious that they believe that here contract will be respected(right or wrong is different matter)But even courts play to gallery many times.

Very good piece, accolades to you on writing it …. puts a lot of things in perpective

About PPFAS, I admire two qualities.

1. Very less number of stocks in the portofio. (Unike most of the other funds which have 50+ stocks)

2. The fund house has only 1 fund.

But this is a highly overhyped fund. A lot of duds in their portfolio. I dont want to name them.

Note: I dont invest in any mutual fund

Arjun,

Kudos to your guts. You hit the nain on the head.

Excellent writing, in fairness each line you mentioned in this article is absolutely true. Can’t agree more with you.

I am along time fan and investor of PPFAS, and a I like Rajeev Thakkar a lot; but I always had these doubts on back of my mind, when emerging markets are rocking why is he wasting time in the west.

Thanks for bringing such a nice article in such a short time.

Well done sir.

Those are commenting on their recent performance, must have the understanding that “in the short term market is a voting machine”, so stop complaining, wait ofr at leat 5 years to see the result and also remeber that they are also human being so they can fail. And always remeber if a fund can return 20%+ return over the long term then it is considered as a good return, and if anyone is not satisfitied with this retrun then should buy the share from the durect market.

These days unthinkables are happening. BREXIT is one such event. It is unforunate for Noida Toll investors. Get everyone ready for Trump as well.

I can offer advice to investors of PPFAS and other investors who are invested in Noida Toll Bridge. This will be made on a very nominal fee (at 50% discount) as I have always tried to help retail investors. The management of PPFAS may also contact me but they will have to pay full fee. I will be declaring this income in my income tax returns for AY 17-18.

A dividend yield stock story is now ended.

Nothing happened as unexpected.