There is Hanky-Panky In Infosys’ Accounts: Whistle Blower

Normally, complaints by anonymous whistle blowers are ignored by the mandarins of Dalal Street.

This is because any random person and mischief-monger can level these complaints, with no accountability.

However, the complaint in the case of Infosys spread like wildfire.

The complaint alleges that there is serious hanky-panky in the accounts of Infosys and that the revenue has been overstated while the expenditure has been understated.

Infosys whistleblowers accuse CEO & CFO of fudging accounts and unethical practices. Complain to US authorities too https://t.co/doa5R2X0un via @PGurus1

— Subramanian Swamy (@Swamy39) October 22, 2019

Brokerages swung into action and predicted dire consequences for the stock.

Morgan Stanley warned that the Whistle blower complaint would put the stock under pressure.

Jefferies opined that there would be “P/E De-rating” due to lack of confidence in corporate governance practices.

Investors were reminded of previous fiascos such as the Vishal Sikka vs. Narayana Murthy controversy and the Panaya acquisition controversy when the stock had been de-rated from 20x PE to 13x PE.

Credit Suisse claimed that there would be a “lot of potential uncertainty“.

Here's what Morgan Stanley had to say about whistleblower allegations at Infosys.

Read: https://t.co/csM5RGkfqh pic.twitter.com/zdqe9qilze

— BloombergQuint (@BloombergQuint) October 21, 2019

Brokerages on INFY

MS- EW, TP Rs 805

Whistleblower News Could Put Stk Under PressureJefferies

Whistleblower Allegations hangover in near term

P/E De-rating Could Be Bigger RiskCS

Allegations Can Lead To A Lot Of Potential Uncertainty@Reematendulkar @CNBCTV18News— Nimesh Shah (@nimeshscnbc) October 22, 2019

Nandan Nilekani, the distinguished and Billionaire Chairman of Infosys, tried to do some damage control and douse the fires.

He assured that the allegations would be probed to the fullest extent and that both the CEO and the CFO have been recused to ensure independence.

Infosys Chairman Nandan Nilekani issues statement on whistleblower allegations, says will ensure allegations are probed to the fullest extent. both CEO & CFO have been recused from this matter to ensure independence pic.twitter.com/whwe5MHDZR

— CNBC-TV18 (@CNBCTV18Live) October 22, 2019

However, before anyone could make sense of what was happening, the stock sunk like a stone.

By the EOD, the stock had lost 16% and the monetary loss was a colossal fortune of Rs. 50,000 crore.

Infosys ends 16% lower today

*Drags Nifty today by more than 100 pts

*Ex #Infy Nifty would have ended +30pts

*Loses more than 50000cr in terms of Mcap todayCostly blow of the whistle!!#Infosys #WhistleblowerComplaint #nifty50 #stockmarkets pic.twitter.com/oIvi65TPEw

— Nigel D'Souza (@Nigel__DSouza) October 22, 2019

Was the disclosure of complaint delayed to enable insiders to load up on Puts?

One aspect which is intriguing is as to why Infosys delayed releasing the letter to the stock exchanges.

Though the letter is dated 20th September and was received by the Company on 30th September, it was informed to the stock exchanges yesterday, 21st October.

#Infy Whistleblower Letter received on 30th Sep & quarterly results were allowed to go thru on 11th Oct despite the allegations of an attempt to manipulate results.

Strange!

— Mahesh ?? (@invest_mutual) October 22, 2019

Dear @SEBI_India Waiting for you to pull up @Infosys for not submitting the Whistleblower letter in time. Strange that Infy decided to wait, and only brought it in public domain because a complaint was filed with US office of the Whistleblower Protection Programme. #FAIL #Infosys

— Market Watcher (@MarketChowkidar) October 22, 2019

The white blower letter not diclosed by Infy for a month!!!!

This is corporate governance in India.

Why indicator would have shown this? That too for Infy? The chairman must be immediately jailed first and then questioned.

— Cheated Indian (@Sunil967) October 22, 2019

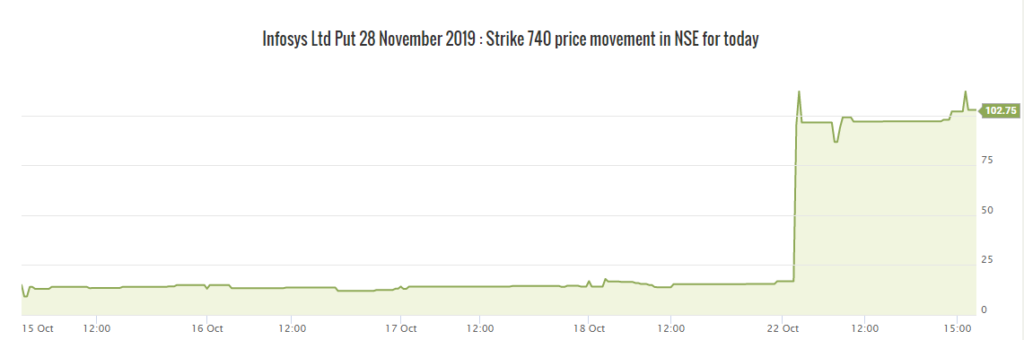

According to some knowledgeable observers, this delay gave some unscrupulous insiders enough time to load up on Puts.

Infosys November 740 Put has Open Interest of 18.56 lakh shares. More than double of any strike of October. If this is a coincidence, it's a very very strange one. Else, someone knew and created a large bearish position. pic.twitter.com/J7gqThnc7j

— Anuj Singhal अनुज सिंघल (@_anujsinghal) October 21, 2019

The Infy whistle blower letter is dt 20th September

There was a big selloff in Infy on 20th and 23rd September, with good volumes;

Someone knew!!

and the spike on 11th Oct before results was a big trap pic.twitter.com/9Xdh0pEgbr

— AP (@ap_pune) October 21, 2019

#Infosys #infy

check the date

20sep letter

25sep put…….740 NOV strike

insider trading!!!!!!!!!! pic.twitter.com/O4H6smd8IN— Տυℳî✞ (@ImSumit029) October 21, 2019

#Infosys

740 Put Strike

*November 2019 contract

*Open Interest +17.95lkh shares (doubles today)

*Premium +470% at 97If this position was created just to play this #Whistleblower news then think there should have been some unwinding today?#NIFTY#NIFTYFUTURE #stockstowatch https://t.co/bcKtowajzV

— Nigel D'Souza (@Nigel__DSouza) October 22, 2019

Put Buyers make 500% gain (in 5 days)

The unscrupulous Bears who loaded up on the Puts took home a massive gain of 500% for just 5 days of work.

Here comes the payoff, from 16 to 96. A cool 500% return in 5 days . If this is not trading on insider info, I don't know what is. Regulators sleeping as usual, traders requested not to disturb their sleep

"bhokoman nidra gechhen, golojog soite paren na" pic.twitter.com/uvqnzpU7tr— Subhadip Nandy (@SubhadipNandy) October 22, 2019

Not the first time that Infy has tanked

Anyway, the consoling aspect is that this is not the first time that Infy has tanked.

In just the last 10 years, it has tanked 10 times.

On 12th April 2013, it lost a massive 21.3% of its valuation.

Infosys – 10 biggest declines in last 10 years pic.twitter.com/tsHUY6o9KL

— Jayesh Khilnani (@jayeshkhilnani) October 22, 2019

However, the stock has always come back from the ashes and delivered massive gains to investors.

Hopefully, this time will be no different and the beleaguered investors will be able to get their money back in one piece sooner or later!

Its a dog eat dog world. Genuine and long term investors are suffering and where as some fraudsters are making money with insider info.