SEBI compels Multi-cap schemes of Mutual Funds to invest in small and mid-cap stocks

It appears that mutual funds were hitherto misleading investors by classifying their schemes as “multi-cap” so as to attract them though they were de-facto investing a bulk of the funds into large-cap stocks.

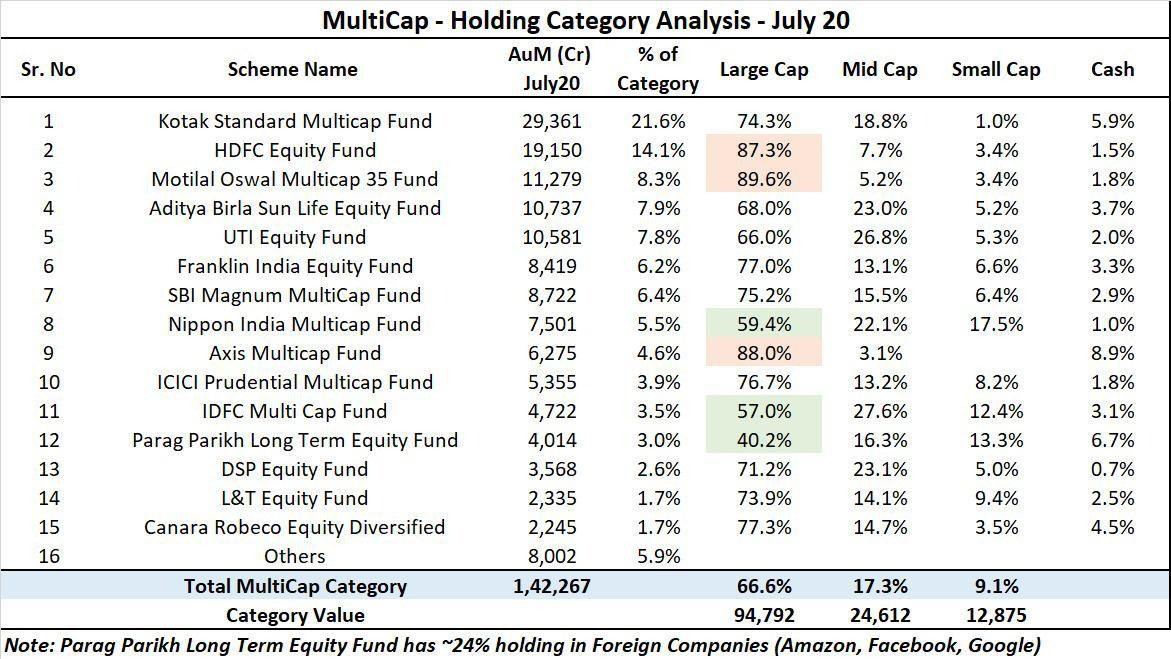

In fact, the so-called “Kotak Standard Multicap Fund” (which is the largest fund in the category) has only a measly 1% of its AUM invested in small-cap stocks.

The allocation to mid-cap stocks is 18.8% while 74.3% is invested in large-cap stocks.

The other funds are also allegedly guilty of the same practice, with upto 89% of the AUM in some cases being invested in large-cap stocks.

According to the latest directive from SEBI, such schemes have to invest 75% of their AUM in equity. Out of the 75%, 50% has to be invested in small-cap and mid-cap stocks and only 25% can be invested in large-cap stocks.

The deadline for compliance is January 2021.

Existing multicap funds to comply to above by January, 2021 @SEBI_India pic.twitter.com/axTdNdwH7Z

— ET NOW (@ETNOWlive) September 11, 2020

SEBI announces changes to constitution of multi cap #mutualfunds

-min 25% each in large, mod & small cap stocks

-currently multi cap funds could invest in stocks across mkt cap without any restrictions

-Multi cap funds manage Rs 1.46 lk cr as of Aug end; 2nd largest eq category https://t.co/gz0PvWM6Vp— Sumaira Abidi (@SumairaAbidi) September 11, 2020

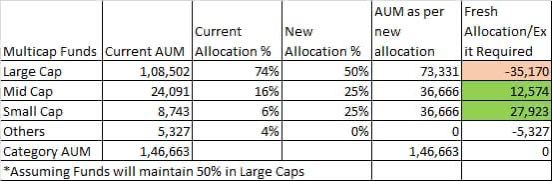

Rs 28,000 Crore will gush into small-cap stocks, Rs. 12,000 crore into mid-cap stocks

Presently, the total AUM of multi-cap funds is a mammoth Rs. 1.46 lakh crore. These schemes will have to shift nearly Rs. 35,000 crore from large-cap stocks into small and mid-cap stocks in order to comply with SEBI’s directive.

Experts divided over wisdom of SEBI’s move

It is obvious that if a mammoth sum of Rs. 35,000 crore is to be pumped into small and mid-cap stocks, and that too within a few months, they will surge like supersonic rockets.

Madhu Kela, an authority on the subject, described SEBI’s decision as “FANTASTIC” and said it is a “truly defining moment for the Multi Cap category funds”. He also said that it will immensely help broad base the current MF holdings and give due recognition to lot of deserving small/mid cap companies.

This is a FANTASTIC move from SEBI and a truly defining moment for the Multi Cap category funds. It will immensely help broad base the current MF holdings and give due recognition to lot of deserving small/mid cap companies@sebi_india @_anujsinghal @nikunjdalmia pic.twitter.com/WloKjhWoDZ

— Madhusudan Kela (@MadhusudanKela) September 11, 2020

Porinju Veliyath also, as expected, warmly welcomed the move.

Huge positive for investment worthy small & mid-caps! Fund managers were just throwing them to dustbin since Jan 2018. Valuations of many relevant, futuristic and well managed but ridiculed companies to regain sanity. pic.twitter.com/aGiJOOigw7

— Porinju Veliyath (@porinju) September 11, 2020

Sunil Singhania was also appreciative of SEBI’s decision. He described it as a “great” and “progressive” move.

What does SEBI circular for multicap fund asset allocation mean for the markets? @sunilsinghania analyses only on ET NOW. WATCH LIVE. @nikunjdalmia @SEBI_India #LIVE @NayantaraRai @29_ruchibhatia https://t.co/KV5pHh7b0o

— ET NOW (@ETNOWlive) September 11, 2020

However, some experts expressed concern that the bottom could fall out of the market if and when the mutual funds have to forcibly sell stocks to meet redemption pressures.

Precisely what I was wondering. All redemptions from these funds during a market wide crash must be met with selling relatively low liquidity. Bad for both the funds and the investors. Lose-lose scenario IMO.

— Dinesh Sairam (@Dinesh_Sairam) September 11, 2020

If this is not rolled back, watch for re categorisation by fund houses.

These changes micro managing the fund industry will cause chaos.

— Mahesh ?? (@invest_mutual) September 11, 2020

Some also objected to the alleged micro-management by SEBI.

And then they will directly give the names of the stocks to buy as well ?

— Anisha Jain (@_anishaj) September 11, 2020

Which stocks will the Mutual Funds buy?

It is elementary that mutual funds will add more of the stocks that are already held by the funds.

This is because the fund managers have already researched these stocks and have confidence in them.

So, we have to conduct the simple exercise of determining the small and mid-cap stocks which are the favourites of mutual funds and load onto them.

According to data collated by experts, mutual funds have been repeatedly loading onto fail-safe and blue-chip small-cap stocks like Tube Investments, Deepak Nitrite, Navin Fluorine, Finolex etc.

We can confidently assume that the fund managers will aggressively buy more of these stocks to comply with the directive of SEBI.

Almost a month back I shared list of Smallcap scrips which were ranked per their MF repeatativeness.

Time to look very closely to that one again.

Biggest buying and flow will happen in those first. https://t.co/qHPL85ekL2

— Krishna Agrawal (@krishnblue) September 11, 2020

How about just cloning Saurabh Mukherjea’s portfolio of Little Champs?

Another reliable way in which we can achieve the objective of loading our portfolios with the best small-cap and mid-cap stocks is to simply clone Saurabh Mukherjea’s “Little Champs” portfolio of small and mid-cap stocks.

Saurabh and his ace team have already done all the hard work and subjected the stocks to rigorous forensic screening before entrusting them with money.

We can confidently ride piggy-back on their broad shoulders.

The latest portfolio of “Little Champs” is as follows:

| Little Champs portfolio composition and brief description | |

| Garware Technical Fibres | Starting out as a supplier of cordage products to domestic fishing and shipping industries, the Company successfully diversified into sports, aquaculture and other sectors across global markets backed by strong product innovations and customer connects. Value added products now account for >60% of total revenues. |

| GMM Pfaudler | Dominant supplier of glass lined equipments (GLE) to the domestic pharma and chemical industries backed by technology from parent Pfaudler (a global leader). Successful diversification into adjacent products helped by strong customer relationships in core GLE portfolio. Profitability and RoCE metrics significantly ahead of peers as the latter have been devoid of scale in India. |

| Alkyl Amines Chemicals | Leader in supply of aliphatic amines to pharma & agro-chemical industries. The company has been successful in expanding its product baskets in higher value-added products on the back of strong R&D strength and focus on the niche amines space. |

| Galaxy Surfactants | Leading olechemical based surfactants supplier to Home/personal care players in India (-60% mkt share) with strong global presence (2/3rd revenues outside India). Enjoys strong patronage of leading customers like Unilever, P&G etc backed by quality, consistency and innovation capabilities. |

| Ultramarine & Pigments | A global top-3 supplier of Ultramarine Blue pigment with strong inroads into export markets in recent years. The company is also a leading supplier of surfactant particularly to South India based FMCG players. |

| Amrutanjan Health Care | Second largest player in the head painbalm category (-65% of revenue). The Company commands high market share in certain states like Tamil Nadu (traditional market with >5096 market share), Kerala, Orissa and West Bengal. In the recent years, the company has also diversified into newer segments such as body pain balm, sanitary napkins (Comfy brand) and beverages (Fruitnik brand). |

| Mold-Tek Packaging Engineering | Leading supplier of injection moulded rigid plastic containers to paint and lubricants industries with a strong presence across all leading players like Asian Pain., Berger, Castro!, Shell etc. Competitive advantages surround innovation and backward integration (in-house moulds, label development) which places company in a strong position to capture market share particularly as In-Mold labelling shift takes place in Food & FMCG packaging. |

| Suprajit Engineering | A leading supplier of mechanical cables to domestic 2Ws, the Company has been able to make inroads into domestic and export PVs in recent years helped by its immense cost advantages over MNCs in both domestic & global markets. |

| PPAP Automotive | Leading supplier of weather strips to the domestic PV industry helped by a strong Japanese technical partner and backward integration (in-house tools etc). Looking to increase content per vehicle through diversification into automotive plastic parts. |

| Sterling Tools | Second large. Indian automotive fasteners supplier (largest in North India), company is now looking at penetrating the southern based OEMs through a new plant commissioned in Karnataka. The Company is also looking at enhancing product and process capabilities through tie-up with Meidoh, a leading fasteners player in Japan. |

| Lumax Industries | Largest automotive lighting supplier in India backed by strong technology partners (Stanley, a co-promoter in company and S L Corporation) and a diversified presence across vehicle categories & OEMs. |

| V-Mart Retail | A leading retailer of low-ticket apparels in North India particularly in Tier 2/3 locations. Strong financial performance (amongst the best RoCE generating retail company in India) backed by superb inventory management, calculated .ore expansions and investments into technology. |

| La Opala | A Leading supplier of opalware with >5096 market share. The company has been primarily responsible for creating/growing the category through investments into manufacturing automation and passing on the ensuing cost benefits to bring down the price gap vs large incumbent tableware categories like steel and plastic. |

| Music Broadcast | Second largest Radio FM player in India. Growing focus on tier 2/3 cities helped by strong parentage (owned by Jagran Prakashan, a leading newspaper publisher in Hindi Heartland) and conservative capital allocation has led to significant outperformance over peers. |

| DCB Bank | A SME/ MSME focused lender with strong asset quality track-record. Over 95% of the loan book is secured with high degree of granularity. Improved productivity of branches set up in recent years to aid earnings growth and RoE improvement. |

| MAS Financial | Gujarat headquartered NBFC lending to SME/MSME via two models – direct lending and lending to NBFCs which in turn lend to SME/MSMEs. Unique business model of lending to NBFCs on the asset side and building liability side by way of assignments, thereby enabling it to make large NIMs with NPAs of under 1%. |