Multibaggers galore from Mudar Patherya’s past recommendations

First, we have to express our gratitude to Mudar Patherya for tirelessly foraging in the bushes and identifying potential multibagger stocks for us to invest in.

Adani Transmission, the stock owned by Billionaire Gautam Adani, is a stellar example of this.

Mudar laboriously explained how the stock has “multiple triggers” which make it fail-safe and a potential multibagger.

The stock is up nearly 200% since then.

Experts have now opined that NAMO’s Saubhagya scheme will now open the flood gates of prosperity for stocks like Adani Transmission and send them rocketing into the upward trajectory.

Yet another example is that of Caplin Point Labs which Mudar boldly described as the “next Ajanta Pharma”.

This has also turned out to be a heavy-duty multibagger.

Other recommendations that come readily to mind include APL Apollo, Philips Carbon, Mercator, SPML Infra, GMDC, Yuken etc, all of which have generated incalculable wealth for investors.

Christmas Gift of five stocks

Now, let us turn to the pleasurable activity of opening the gift box and see what stocks Mudar has recommended for us to invest in.

Automotive Axles – swimming in cash amidst take-off of ancillary sector

Dolly Khanna was the first to recognize that the entire automotive ancillary sector is in take-off mode.

As far back as in mid-2016, she packed two high-quality ancillary stocks, being Sterling Tools and PPAP Automotive, into her portfolio.

Both stocks have surged like rockets since then.

While Sterling Tools is up 300% (YoY of 125%), PPAP is up 234% (YoY of 196%) since Dolly’s investment.

This clearly proves that Dolly Khanna has a prescient mind which enables her to foresee the future.

Automotive Axles is no slouch when it comes to giving multibagger returns. The stock is up 112% on a YoY basis.

The stock was first recommended by DD Sharma, the veteran stock picker, in June 2016 on the basis that it has a “high class, top class management”. He called it a “Behetareen” (excellent) company.

Mudar’s logic for recommending Automotive Axles is the fact that it reported blockbuster results with the EBITDA surging from ~30 crore to ~41 crore across successive quarters. Its’ interest outflow is down to a few lakhs which implies that it is on the verge of being debt-free.

“The company is virtually swimming in cash,” Mudar has exclaimed in an excited tone.

The other aspect worth noting is that the venerable Kalyani group (of Bharat Forge fame) are the promoters.

This means that the Company enjoys the stature of a small-cap blue-chip.

Also, the promoters have a strangle hold over 71% of the equity. The balance is controlled by various assorted institutional shareholders such as Reliance Mutual Fund, UTI Mutual Fund, Bajaj Allianz etc.

The result is that the stock enjoys a dearth-of-floating-stock premium.

Jindal Saw – re-rating triggers can send stock surging

Jindal Saw also has the privilege of being recommended by DD Sharma.

The veteran explained that the surging demand for Ductile Iron Pipes augers well for Jindal Saw.

Mudar has taken over from where DD Sharma left it. He explains that Jindal Saw is likely to report an Ebitda in excess of ~1,000 crore for FY 2017-18 against prevailing the present market capitalisation of only ~4,000 crore.

This implies that the stock is quite cheap.

He has also pointed out that there are two triggers that could re-rate Jindal Saw and send it into orbit. These are Revenue increase and decline in interest outflow.

It is worth recalling that Dolly Khanna is also sitting pretty with two Ductile Iron pipe companies in her portfolio, namely, Srikalahasthi Pipes and Tata Metaliks.

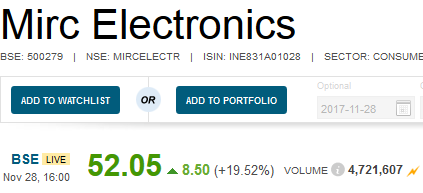

MIRC Electronics – “compelling story brewing” + Vijay Kedia’s fav stock

MIRC Electronics’ claim to fame (so far as we are concerned) is that it is Vijay Kedia’s favourite stock.

Varinder Bansal, the ace investigative journalist with CNBC TV18, revealed Vijay Kedia’s interest in the stock.

Vijay Kishanlal Kedia bought 23.2 lakh shares of Mirc Electronics in Sep quarter

— Varinder Bansal (@varinder_bansal) October 17, 2016

However, Vijay Kedia cautioned investors that the stock has a notorious reputation of being a brand destroyer and requires to be handed with utmost care.

Mirc is a destroyer of once a known brand.Mgmt trying to revive.But not easy.Mine is old,small, risky invstmnt.Will sell if doesn't perform.

— Vijay Kedia (@VijayKedia1) October 17, 2016

Thankfully, the management’s efforts appear to be bearing fruit if one goes by the spectacular surge of 20% seen in the stock today.

Mudar has opined that MIRC Electronics can be a “compelling story brewing” owing to the perseverance of the management in trying to make a name for the Company in the hyper-competitive electronics market.

The record EBITDA performance of ~16.84 crore in the September quarter versus ~15.93 crore in the March quarter shows that the efforts are bearing fruit, Mudar says.

Vijay Mansukhani, the MD of MIRC Electronics, hinted that there could be a strategic sale to the Chinese and Korean behemoths which are looking for a toehold into India.

He also revealed that the Company is targeting 25% to 30% revenue growth over the long-term.

#Reports MIRC ELECTRONICS

Open to selling the business and plants if it gets a good price

Company keen on taking the place vacated by Videocon as a dominant Indian brand@CNBC_Awaaz— Ashish Verma (@AshVerma111) November 21, 2017

Dixon Technologies – case studies will be written about the operating model

Dixon Technologies is a mysterious company that I had never heard of.

However, it appears to be a powerhouse if one goes by the results.

The revenue has surged from ~430 crore in the first quarter of FY17 to ~685 crore in the first quarter of FY18 to ~877 crore in the second quarter. Also, the interest outflow was around ~3.5 crore against an Ebitda of ~37 crore in the second quarter.

IIFL has recommended a buy of the stock on the basis that the Company is in a “sweet spot”.

IIFL on Dixon Technologies : Initiate with BUY and TP of Rs3491, at 20x Sep19ii EV/Ebitda. pic.twitter.com/siYeBxglWj

— Bharat Bagrecha (@bharat_bagrecha) November 27, 2017

The Company has also entered into an agreement with Flipkart to design and manufacture products like televisions, washing machines and other electrical appliances for the e-commerce major’s ‘MarQ’ brand.

It is stated that the company is also an Original Design Manufacturer (ODM) of lighting products, LED TVs and semi-automatic washing machines in India. Its key customers include Panasonic, Philips, Haier, Gionee, Surya Roshni, Reliance Retail, Intex Technologies, Mitashi and DishTV.

It is also stated that Dixon has a low working capital cycle, stable operating cash flows and high returns. The revenue and reported net profit have grown at a CAGR of 34% and 78% respectively (FY13-17).

All of this has enthused Mudar to observe that Dixon’s “operating model could well be the stuff they write case studies about”.

Godawari Power & Ispat – old war horse riding a sectoral rebound

Mudar has called Godawari’s results as “dramatic” owing to the surge in revenue and profits.

He points out that the consolidated EBDT (earnings before depreciation and tax) has strengthened dramatically in the past four quarters —from ~8.01 crore to ~8.55 crore to ~72 crore to ~87 crore. Interest outflow has been relatively steady, around ~66 crore, across the quarters.

He also states that the market cap is modest at ~590 crore implying that the stock can surge like a rocket at any time.

Holding mirc since 15₹ before Kedia entered , future multibagger

buy reliance home finance

Anil ambani companies in trouble

Ashish kacholia entering mirc through warrants and prefential shares, good boost to the current investors

I think Jindal saw is available for good valuations and risk is also less.