The problem with novice investors like you and me is that we have our priorities all screwed up. While we are eager to aggressively buy stocks which are surging to 52-week highs, we are loath to buy stocks which are languishing at 52-week lows. For some reason, we equate the quality of the stock with its stock price and assume that a stock quoting at high valuations is safe and sound while another quoting at low valuations is dangerous.

We can see this play out in Meghmani Organics. When Daljeet Kohli and Amar Mourya ascended the stage to announce that Meghmani Organics should be bought because it was exhibiting signs of being a “classic turnaround story”, we stared back at the duo with a blank expression on our faces.

The reason for our disinterest in Meghmani Organics was because it was then languishing at 52-week lows and was available at a throwaway valuation of Rs. 15. In our naivety, we assumed that the low price of the stock meant that it belonged to the junkyard category.

Dolly Khanna backed Daljeet Kohli

Thankfully, Dolly Khanna, one of our favourite stock wizards, does not suffer from such amateurish prejudices. She read and re-read Daljeet’s research report and decided that there is merit in the latter’s theory (See Dolly Khanna Backs Daljeet Kohli In Quest For Mega Bucks From Micro-Cap Turnaround Stock).

In my latest piece on Dolly Khanna’s portfolio of specialty chemical stocks, I pointed out that Dolly has increased her holding in Meghmani Organics from 4,54,475 shares as of 1st April 2015 to 6,58,492 shares as of 31st March 2016.

Indianivesh Capitals Limited, Daljeet Kohli’s company, holds 6,86,000 shares of Meghmani Organics as of 31st March 2016.

250% Gain in just 24 months

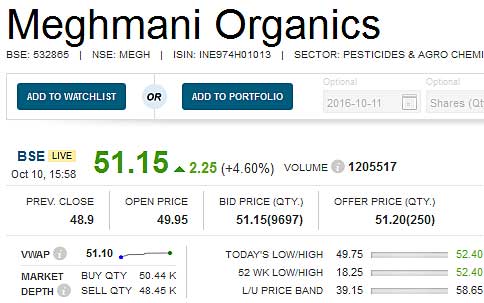

Today, barely 24 months since Daljeet’s recommendation, Meghmani has surged from Rs. 15 to Rs. 51, resulting in fabulous gain of 250%.

It is notable that the gains have not come in a linear manner. Instead, there were several occasions when the stock plunged after a spectacular rise. The quarterly results were also erratic. However, Daljeet was not disillusioned. He stayed steadfast and on each occasion, when the stock plunged, he implored his followers to buy more of the stock to take advantage of the crash in the price. (See You Have Another Chance For 100% Gains From Meghmani Organics: Daljeet Kohli)

More multibagger stocks are waiting to be picked up

Fortunately, there is no reason to feel dismayed if we missed Meghmani Organics because there are a number of other fish in the pond which we can scoop up.

Delta Corp:

Delta Corp is another textbook example of a stock which tests the patience of investors but ultimately delivers huge rewards. I recounted earlier the inspiring story of how Kalpraj Dharamshi, the veteran stock picker, held on to the stock through all its trials and tribulations and was handsomely rewarded for his conviction.

The stock appears to be on a strong trajectory of growth and has the potential to shower more gains on shareholders if one goes by the latest developments.

Jain Irrigation:

Ambareesh Baliga and Sandip Sabharwal, both noted stock market experts, have recommended a buy of Jain Irrigation on the basis that investors’ “disbelief” in the stock has caused its stock price to languish even though the operating metrics are showing great signs of improvement.

Ventura has recommended a buy with an aggressive price target of Rs. 250 which translates into whopping potential gains of 250%.

MCX:

Though the stock boasts of having won the confidence of legendary investors like Rakesh Jhunjhunwala, Radhakishan Damani and has also witnessed a change in management with Kotak taking over etc, it is still languishing.

Porinju Veliyath recommended a buy on the simple logic that an Exchange with an 83% market share cannot go a-begging for long.

S. P. Tulsian also recommended a buy of MCX as part of his 2016 recommendation (see Check Out 16 Top-Quality Multibagger Stocks For 2016 From Four Ace Stock Pickers).

Needless to say, the stock has posted hefty gains after the recommendation of the stalwarts though it still has the potential to give hefty gains in the foreseeable future.

Conclusion

Novice investors like you and me need to shed our prejudices and be inspired by the visionary approach of luminaries like Dolly Khanna. We need to be bold and step off the beaten path if we want to adorn our portfolios with dazzling multibagger stocks. Of course, it goes without saying that the path is treacherous and requires enormous patience and nerves of steel to be traversed!

Still a multibagger or to wait for a correction in the market?

Jain Irrigation System bought for 89 few days before ventura recommended. Surprisingly I have an account with them.