Raamdeo Agrawal’s net worth surges to Rs. 1300 crore & impresses Mohnish Pabrai

Mohnish Pabrai, a visionary investor in his own right, paid rich tribute to Raamdeo Agrawal over the fact that he has amassed a mammoth fortune of Rs. 1,300 crore through brilliant stock picking.

Mohnish was in particular impressed by the fact that Raamdeo has invested his entire net worth in the mutual funds of Motilal Oswal.

“Raamdeo Agrawal himself is worth like Rs 1300 crore or something. Every penny of that is in one of his mutual funds that anyone else can invest in,” Mohnish said, the admiration clearly evident from his tone.

The creditable aspect is that Raamdeo Agrawal has laid bare all the secrets of how he amassed this mammoth fortune.

It is obvious that we have to listen to his revelations with rapt attention and walk in his illustrious footsteps.

Compounding wealth at 30% with QGLP has led to the staggering fortune

Raamdeo explained that “QGLP”, his top-secret formula, helps him effortlessly snare multibaggers.

“QGLP” is an acronym for “Quality, Growth, Longevity and favorable Price”.

Any stock which ticks all the boxes in the QGLP formula is destined for greatness, Raamdeo said with a big smile on his lips.

His also pointed out that his investing philosophy of ‘Buy Right, Sit Tight’ enables the gains to compound slowly and steadily.

“Time is a friend of good companies and an equal enemy of bad companies,” he added, quoting the immortal wisdom of Warren Buffett.

Have made 30% Annual returns starting for 2003 – 04 – @Raamdeo Agrawal#BQLive #AskRaamdeo LIVE @BloombergQuint

— Motilal Oswal Group (@MotilalOswalLtd) October 17, 2017

Raamdeo Agrawal reveals more secrets in response to queries from novices

Bloomberg did the sensible thing of getting Raamdeo to answer queries from novice investors.

Needless to say, his answers to the queries are very educative:

Q 1: Based on ‘Margin of Safety’ how do you decide when to exit a stock, partially or completely?

Ans: There are 2-3 hardcore principles of selling. One of them is if you are fundamentally wrong. For instance, after doing all the research, you bought the stock. Later, you figure out that it is completely wrong. You have to correct your portfolio. You have to sell.

The second is if the company is wrong. For instance, if they get into a diversified business, which one would have never thought they would do, and they put about 200 percent of networth into the new venture. Then one will have to run away.

Third, for instance, if I make my portfolio goal of 25 percent, later I notice that the stock has run to such a level that it is almost impossible to make 25 percent, then I will have second thoughts about continuing with that stock or not.

Q 2: What is the next value migration according to you and how could one benefit from that?

Ans: Value migration is a very powerful theme.

First, you must equip yourself with the theory. People who are masters since early times create a lot of value. The very purpose that the migration is happening is to get better margins.

Q 3: What are the 5 must screening criteria for selecting investment stocks?

Ans: First, you must see the key financial ratios. This tells if the company has any advantage.

Further, do refer to analyst research. Start building knowledge about the company such as what is the company doing right. Find out what is going to happen to the company’s business in the next 15-20 years. Check how its competitors are performing and project how its competitors will do. Dig out the company’s performance and project it for a set period of time.

Q 4: I want to ask your advise on general portfolio allocation strategy (for a small retail investor) one should follow.

(a) How many stocks one should have in his portfolio (Maximum & Minimum numbers)?

(b) What kind of general allocation should be assigned towards each bet in one’s portfolio?

(c) What should be one’s maximum allocation (percentage wise) towards a stock in his portfolio?

(d) Do you believe /follow /recommend in any systematic portfolio bet allocation methods like Kelly’s formula?

Ans: Apart from passion and information, what you need is a framework. One needs to build a skill in making a good portfolio. Unless you can buy enough to make it at least 10 percent of your portfolio, don’t buy that stock.

Buy a stock only if you ready to make it 10% of your portfolio, says @Raamdeo Agrawal.https://t.co/II93VUyCno pic.twitter.com/qSumXIkzPp

— BloombergQuint (@BloombergQuint) October 18, 2017

Q 5: How to hold on to your stocks for long time – when every other new idea sounds just as promising as the stocks one hold?

Ans: First thing you need to set a portfolio goal. For example, setting portfolio goal of 25 percent in three years. If your portfolio remains promising quarter after quarter and a terrific idea comes in between, you must find some money within portfolio to buy that particular thing.

Keep balance between a concentrated and diversified portfolio

Some novices get carried away and buy every single stock that comes their way with the result that they have a highly diversified portfolio.

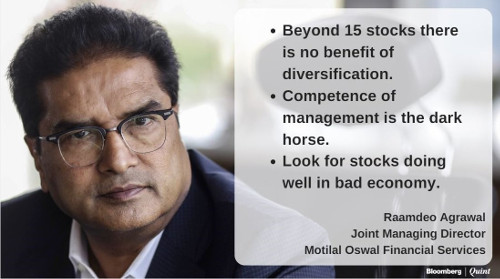

Raamdeo explained that this practice is counter-productive because it dilutes the returns that one can get from the portfolio.

The ideal number of stocks in the portfolio is about 15, he opined.

He also advised that investors should not over-concentrate their funds in a single stock. An allocation not exceeding 10 percent of the net worth is ideal, he said.

(Raamdeo Agrawal in the company of Tanvir Gill and other luminaries of ET Now)

Five “QGLP” stocks to buy for compounding gains

Raamdeo knows well from his days as a struggler on Dalal Street that novice investors have a low threshold for theoretical dissertations. Instead, they crave for tangible stock ideas.

So, he and his ace team at Motilal Oswal have homed in on five top-quality stocks which fulfill the criteria of the “QGLP” formula and have the potential to shower hefty gains upon us.

These stocks are the following:

| Stock Name | CMP* | Target | Upside (%) |

| Granules India Ltd | 136 | 200 | 47 |

| Manpasand Beverages Ltd. | 445 | 534 | 20 |

| RBL Bank | 518 | 651 | 25 |

| HDFC Ltd | 1763 | 2020 | 15 |

| Birla Corporation Ltd | 1005 | 1150 | 14 |

*Prices as on Friday (13th October 2017) closing

Granules India is very familiar to us because it has already been certified as a potential 100-bagger in Motilal Oswal’s famous 19th wealth creation study.

Granules India is also strongly recommended by Edelweiss, HDFC Securities and other brokerages on the basis that it is on the “cusp of new growth”.

In the present report, Motilal Oswal has explained that over the last six years, Granules has reported 39% earnings CAGR on improved profitability, higher operating leverage and superior business mix. It has also expanded its finished dosages business at a CAGR of 24% over FY12-17, leading to higher profitability and improved utilization of the existing capacity of 18b tablets.

The profitability of the PFI business has also improved substantially, with the implementation of 6MT order capacity.

The result is that Granules has expanded its EBITDA margins from 11.8% in FY11 to ~21% in FY17.

It is also pointed out that Granules India’s strong growth will be driven primarily by ramp-up of the base business (led by capacity expansion), shift in product mix, Omnichem JV, and OTC business expansion also plans to file ~25 ANDAs in the US by FY19E.

The stock presently trades at 12.5x FY19E EPS.

There is likely to be P/E re-rating given (a) strong PAT growth outlook >35% CAGR over FY17-20E, backed by 27% revenue CAGR and (b) expansion in high-margin CRAMs and US generic business.

MOSL bets big on Granules India, fair value INR200 (64% upside) – augmented capacity to fuel growth, focus on formulations to boost margins pic.twitter.com/j2gfeJFdgl

— Geetu Moza (@Geetu_Moza) October 9, 2017

Manpasand Beverages is also familiar to us because Sanjoy Bhattacharyya, the doyen amongst value investors, has written a treatise over it and explained why it is investment worthy. He has described it as a “genuine long-term investment opportunity stock“.

In the present report, the wizards of Motilal Oswal have explained that Manpasand Beverages has the unique distinction of being the sole listed company in the beverages sector. Mango Sip is the company’s flagship product, contributing 80% to revenues in FY16 (97%in FY14). Mango Sip is strategically focused on semi-urban and rural markets; it derives ~55% of revenues from rural areas, 20-22% through railways and the remaining from urban areas.

The company will benefit from its expanding distribution network. The present valuations of 29.5x FY19E P/E are reasonable for a high-quality FMCG stock.

It is worth noting that Varun Beverages is also a stock in the bottling/ beverages sector. Hiren Ved of Alchemy Capital has recommended Varun Beverages on the basis that it is a proxy for Pepsi, the global beverages behemoth, and has “multiple levers for growth”.

The other three stocks in the list recommended by Raamdeo Agrawal and Motilal Oswal, namely, RBL Bank, HDFC Ltd and Birla Corporation, are too well known to require elucidation. These are all blue-chip and fail-safe stocks that one can buy and forget!

Palash Securities … Porinju Veliyath’s new entry this quarter

Ramdeo has recommended something after a long time.. After his 10x bets not doing well he has been silent on recommendation and was only giving QGLP theory.. We have to see how QGLP works for these stocks

I value Mr Agarwal and his company MOSL quite high (and better than any other equity analyst in the country). I am not referring to his 5 stock recommendations, but the way they analyse and explain. They have a theory and they know how to explain that theory. Mr Agarwal is down to earth and talks to small investors in the way they understand. He may at times be wrong, but then, every equity analyst worth his salt has been wrong and will be wrong. including those highly paid MF pig-analysts.

I never invest in MFs, I believe in myself. Even if the best, MOSL, makes a recommendation, I study the stock before investing.And I keep a shortlist of 25 stocks, but in each PF, keep not more than 10.

In this report, Mr Agarwal has revealed the secret of selling. Its Valuable. Something new I learnt. Will follow from now on.

So @gem23, would you share your share your current shortlisted stocks

Just wondering, as article mentioned that all his wealth of 1200+ crore is in his mutual fund where common people can invest into as well. Anyone knows which one or what’s the name of that MF he has invested in?

Motilal Oswal MOSt Focused Multicap 35 Fund

RBL Bank looks good.

sree leathers will hit 280 by may next year 🙂

Granules India and RBL Bank look promising. Granules is on my buy list from long time, just waiting for price which can offer low risk, planning to add position on resistance break.

Mr.Ramesh damani should be happy with millions he earned and not complete with others.others have lost thier health in bargain which he hasn’t. Everybody cannot compare himself with Warren buffet.

Crest Ventures which owns 50% of Phoenix mall in Chennai is a Dark Horse considering it’s 99% occupancy in commercial property . It can go for REITS to unlock the value .Also once it repays the debt in 5 years the cash flow improves substantially. Present DSCR is more than 3