Dolly Khanna’s latest portfolio

First, we have to pay our ritual obeisance to Dolly Khanna’s latest portfolio of multibagger stocks.

This ritual is necessary because Dolly’s portfolio has the magical ability to energize and inspire us and put us on the right path.

| Stock | Nos of shares | Net Worth (Rs cr) | YoY Gain (%) |

| Manappuram Finance | 102.09 | 95 | 56 |

| Nilkamal | 2.43 | 48 | 70 |

| Trident | 53.17 | 42 | 61 |

| NOCIL | 33.54 | 39 | 123 |

| IFB Industries | 4.27 | 28 | 97 |

| Srikalahasthi Pipes | 6.36 | 22 | 34 |

| LT Foods | 29.57 | 20 | 189 |

| Tata Metaliks | 2.67 | 19 | 108 |

| RSWM | 4.52 | 19 | 6 |

| Dhampur Sugar Mills | 7.86 | 15 | 103 |

| Thirumalai Chemicals | 1.81 | 15 | 204 |

| Asian Granito India | 3.18 | 13 | 113 |

| Sterling Tools | 5.63 | 13 | 153 |

| Dwarikesh Sugar Industries | 2.74 | 12 | 102 |

| Nandan Denim | 6.18 | 8 | (6) |

| Nitin Spinners | 6.21 | 8 | 55 |

| Ruchira Papers | 3.95 | 6 | 130 |

| PPAP Automotive | 1.53 | 6 | 161 |

| IFB Agro Industries | 1.46 | 6 | 2 |

| ADF Foods Industries | 2.22 | 6 | 206 |

| Nahar Industrial Enterprises | 4.16 | 5 | 24 |

| Dai-Ichi Karkaria | 0.91 | 4 | 13 |

| Total | 449 | 2004 | |

| Simple average return | 91 |

As one can see, the portfolio is perfectly balanced. There are representatives of the NBFC, plastic furniture, textiles, specialty chemicals, white goods, sugar, auto, building materials, ready made foods, pipes, etc in the portfolio.

Dolly has consciously avoided investing in Pharma and Info tech stocks. We can see the wisdom of this move by Dolly because both sectors are now in the doldrums and have become touch-me-nots owing to domestic and global headwinds.

It is notable that there are two stocks with 200%+ return and nine stocks with 100%+ return.

The simple average YoY return from the 22 stocks in the portfolio amounts to 91% which is awesome by any standards.

This implies that we are making a mistake by foraging in the bushes, looking for stocks to buy, instead of mindlessly cloning Dolly’s picks.

Which of Dolly’s stock picks are good for a buy now?

Fortunately, novice investors are not required to blindly clone Dolly’s picks. Instead, eminent experts do the hard work for us and advice which stocks have the most potential for maximum gains.

Four stocks have received the green signal. These are Mannapuram Finance, Tata Metaliks, Trident Ltd and Nandan Denim.

Manappuram Finance – gold lending is secure & safe

Mannapuram Finance is somewhat lukewarm presently probably because of concerns relating to loan waiver and the micro-finance segment.

However, given its credentials as a powerhouse, it is only a question of time before the stock resumes its upward trajectory and brings cheer to investors.

Edelweiss has foreseen a target price of Rs. 120 on the following rationale:

“We see growth levers: a) stabilising gold prices; b) gap in AUM/gram (INR1,821 versus incremental lending at INR1,900-2,000); and c) stabilising auctions to aid growth. However, following lower AUM base set in FY17 and uncertainty following new rule of cash disbursements being restricted to INR20k, along with higher opex, we prune our FY18/FY19 earnings estimates by 6%/10%. Further push will come from scale up of other businesses, which will drive re-rating. The stock is trading at 1.7x FY19E P/BV (consolidated). We maintain ‘BUY/SO’ with TP of INR120.”

Sridhar Sivaram of Enam Holdings has also given a clean chit to all gold loan companies on the basis that they are secured lending with 4.5 percent return on assets (RoA) and 23 percent return on equity (RoE).

AK Prabhakar of IDBI Capital has opined that the market is not giving the right valuation to the business. He emphasized that Manappuram Finance is one of the two gold finance companies with a panIndia presence and is trading at 2.5 times book value, which is attractive. He opined that the stock can give 20-25% return in one year.

Buy Tata Metaliks: Ayush Mittal of Valuepickr forum

Tata Metaliks, the blue-chip small-cap stock, has already received approval from mighty investment experts such as Mudar Patherya and DD Sharma.

Now, according to reliable sources, Ayush Mittal, the co-founder of the Valuepickr forum, has recommended a buy of Tata Metaliks.

Ayush Mittal (@ayushmitt ) is bullish on the DI Pipes sector and Tata Metaliks is his top pick #IIC2017

— alphaideas (@alphaideas) June 17, 2017

The rationale for the investment advice cannot be disclosed because it is top secret and not meant for free loaders.

However, a close study of the discussion in the valuepickr forum lays bare the entire rationale of Ayush Mittal as well as the other experts of the forum.

The essence is that the spiraling construction activity across the Country in the wake of housing-for-all will spark humongous demand for pipes (both Ductile Iron and plastic) and that Tata Metaliks will benefit therefrom.

In fact, this theme is an extension of the “trillion dollar opportunity in housing and infra” referred to by Porinju Veliyath whilst recommending Everest Industries and Ramco Industries to us.

The only debate amongst the experts is whether one should buy DI pipes or plastic pipes manufacturers.

According to Hemang Jani of Sharekhan, plastic pipe manufacturers like Supreme Industries and Astral are better placed because of lesser competition in that sector.

Obviously, Ayush Mittal has taken the contrary view whilst recommending Tata Metaliks though he is also known to be bullish about Astral.

Some knowledgeable investors have also referred to Srikalahasthi Pipes as being a beneficiary of the bonanza.

Shrikalahasti pipes in the same business and trading at lower valuation. Dolly Khanna is in both tata metaliks and sripipes.

— Naresh kumar mamnani (@9529227172) June 18, 2017

Trident Ltd – multiple triggers

I have already conducted a detailed analysis of Trident Ltd in which I have drawn attention to all the research reports on the subject.

Cheap valuations, several triggers: Outlook Business

Jash Kriplani of Outlook Business has conducted a masterful analysis of the Company after speaking to leading experts.

The essence of his report is that Trident Ltd’s accelerated push in the home-textiles business will sustain its next leg of growth.

It is also emphasized that the valuations at 10x is cheap compared to the valuations of arch rivals like Welspun, Indo Count and Himatsingka Seide.

Trident Ltd is moving up the value chain: Edelweiss

Kshitij Kazi of Edelweiss has conducted a detailed analysis in which he has opined that Trident Ltd has an upside of 40%.

The rationale is succinct and convincing:

“Trident is one of the largest integrated home textile manufacturers in the world. Commencing operations as a yarn player, the company has shifted to the higher margin home textile segment. We estimate the company’s operating margin to improve to over 22.0% in FY19 from 19.5% in FY16 due to shift up the value chain with home textile accounting for 71% of revenue in FY19E versus 46% in FY16. Also, with utilisation of terry towel and bed linen improving from the current 49% and 32%, respectively, operating leverage should boost margin further. Additionally, we expect Trident to utilise the free cash flow of INR600cr generated every year over FY17-19E, as its expansion plans have been completed, to pay off debt, resulting in a debt to equity of mere 0.8x in FY19E. We initiate coverage with ‘BUY’ and TP of INR118.”

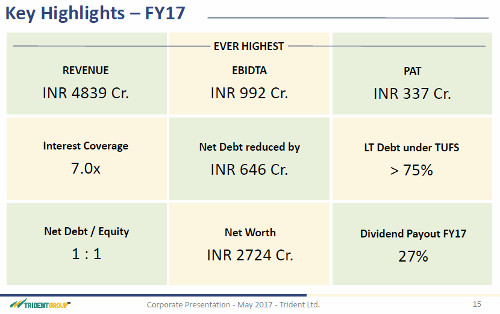

Trident Ltd- investors’ presentation

Trident Ltd has also issued a detailed investors’ presentation in which full facts and figures relating to future plans are given.

Nandan Denim – Re-rating is due

Nandan Denim is a disappointment in Dolly Khanna’s portfolio because unlike the other multibaggers, it has suffered the ignominy of having lost money on a YoY basis.

However, there is no reason to despair because Ventura has assured that the stock will be re-rated and deliver 32.6% gain.

The logic is as follows:

“Nandan Denim Ltd (NDL) is likely to report higher profits till FY19 due to increased denim manufacturing capacity and backward integration in spinning. Central and state government incentives will improve profitability further. Denim fabric accounted for 93% of revenues in FY17.

We are optimistic about NDL’s prospects given that:

– NDL is the largest denim fabric manufacturer with 110MMPA (Million Meters Per Annum) capacity in India and is 4th largest in the world. It would be serving the increasing demand of Indian and international denim market. Exports would likely account for 30% of sales in next two-three years.

– Better market response, efficient capacity utilization and cost savings on backward integration in yarn manufacturing would result in EBITDA margin improvement from 15.6% in FY17 to 18.8% in FY19.

– NDL will be eligible for interest subsidy of 5% as an integrated Spinning facility (2% for standalone facility) from Central Government. Gujarat’s reimbursement of state taxes on cotton helps improve profitability and lower finance cost.

– NDL has finished major capex programme in FY17 and benefits from these assets begins from FY18. This will increase ROCE to 20.1% in FY19 from 13.8% in FY17.

We launch coverage with a BUY rating and a price target of Rs. 175, arrived at by applying 7X multiple to its EPS Rs. 24.6 for FY19. We believe that the phase of flat PAT for FY16-17 is now over and expect to see 64% growth in FY18 followed by 27% in FY19. This will lead to a re-rating to 7X from the current 5X. Our target price suggests a return of 32.6% from the current market price of Rs 132 over the next 12 months.”

Conclusion

We have to be grateful to Dolly Khanna and the eminent experts for the hand-holding support that they are giving us. This provides us with much needed comfort that we are deploying our scarce funds in the right stocks and that we can hope to eke out a living!

where is cosmo films?

Does she hold GNFC?

Buying small caps at present inflated level may be risky .

There are few more companies, she has invested which is not finding a place in their write up, such as Cosmo film,nahar Ind which are at present underperforming the market. In addition she holds Meghmony organics, Sutlej textiles also.

Manappuram, NOCIL and Trident look very attractive even now.

Is nandan denim a good company to buy for next 4 years?

I’m looking at investing 25lakhs over the next one year period in sundaram finance,epc industrie and piramal phytocare. Looking to multiply it to 2.5 cr over next 3-5 years. Any advice??

Someone said “if u dream, dream big”. But there is a limit to that too. All the best.

Please go through this excellent detailed analysis of Nandan Denims…a lot of suppliers I know are complaining about non payment. I request the admin to please research a little bit before “blindly” quoting experts and recommending buys! I made the mistake of buying Quickheal tech after it was recommended here without researching in detail and now the stock is in the doldrums.

http://www.drvijaymalik.com/2017/06/analysis-nandan-denim-limited-equity-research-report.html

Great companies….