Bulls back in the ring

Surabhi Upadhyay is known to be a master of data analysis.

She crunches vast amounts of raw data and converts them to small bits of actionable information which is easily understandable by novice investors.

The latest data collated by her is sending the clear signal that the Nifty is back to the top of the trading range and that the Bulls are back in the ring.

In fact, in the month of March 2019 itself, the Small-cap Index has surged a mammoth 7.6%.

The Mid-cap Index and Nifty Junior Index are up 4.4% and 3.9% respectively.

Individual stocks have obviously posted even higher gains of 20% to 40%.

IN 2019#Nifty : 1.9%

Nifty #Midcap: -2.3%

Nifty #smallcap : -1.1%THE MIDCAP PARTY

So Far In March

•Midcap Index up 4.4%

•Nifty Junior Up 3.9%

•Smallcap Index up 7.5%

•Nifty Up 2.6%#StockMarket #Bulls— Surabhi Upadhyay (@SurabhiUpadhyay) March 7, 2019

Example of some fast movers#midcaps #smallcaps #stockstowatch #StockMarket #Sugar

RALLYING FROM 1 YEAR LOWS

Dhampur: +227%

Balrampur: +135%

Praj: 124%

Dish TV: +107%

Dilip Buildcon: +86%

CG Power: +81%

BEML: +71%

PFC: +67%

OBC: +65%

Allahabad Bank: +64%— Surabhi Upadhyay (@SurabhiUpadhyay) March 7, 2019

Sugar & ethanol stocks give eye-popping gains of 227%

We have been totally oblivious of sugar and ethanol stocks.

These stocks are taboo to us owing to some past misconceptions.

However, the fact is that some sugar stocks like Dhampur and Balrampur have posted eye-popping gains of up to 227%.

Praj, which is said to be an ethanol stock, has posted a gain of 124%.

Varinder Bansal is an authority on the sugar and ethanol sector.

He has been bullish on the sector for the past several months and has pocketed massive gains.

Market finally recognizing the sector where we have very bullish since last 6-8 months 🙂 https://t.co/mCVGoxE7pq

— Varinder Bansal (@varinder_bansal) February 25, 2019

A lot of people laughed at us….mocked at us….but we just kept on reading & learning + doing ground research & finally feel v satisfied.. #ETHANOLtheme

— Varinder Bansal (@varinder_bansal) February 13, 2019

Varinder has explained the entire nuances of the sector in a programme named ‘Research Gurukul’ and advised on when and how to invest in these stocks.

Ashish Chugh, the authority on hidden gems, complimented Varinder Bansal’s stellar effort in educating novice investors.

Primer on Sugar Sector.

Dynamics of the industry succinctly explained by @varinder_bansal

In a language even a layman can understand – no jargons. Good show @AnilSinghviZEE

Good weekend watch https://t.co/Kd6BQCXjZ6— Ashish Chugh (@hiddengemsindia) March 2, 2019

Till today,I never invested in Sugar Cos for reasons as every retail investor does. But,this is the best analysis on Sugar till now. Neatly explained with a clear vision on how to invest in sugar cos,i feel I can start looking at this industry too.Thank You Both of U. Jai Hind !

— 2bFI (@Invest2bFI) March 2, 2019

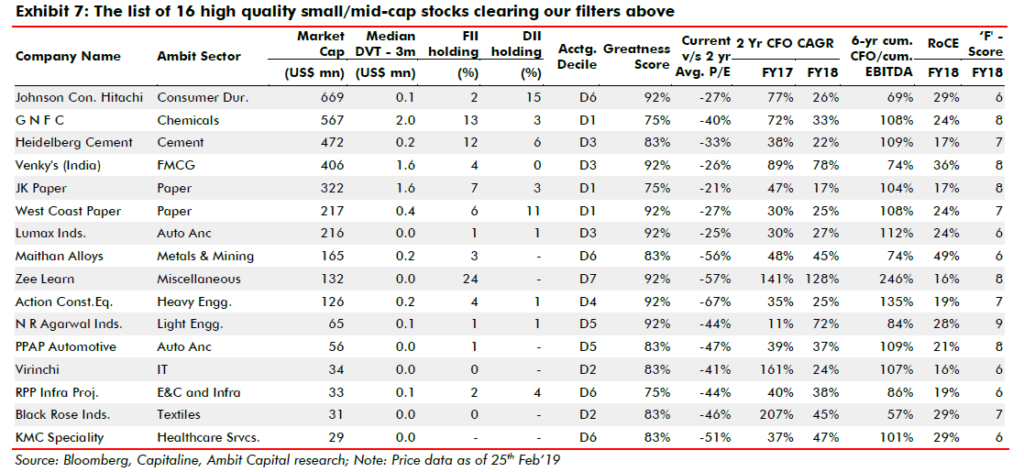

16 potential multibagger mid-cap stocks ripe for buy now

Ambit Capital is reputed for its stringent norms when recommending stocks.

Stocks are evaluated on numerous rigorous “top-down qualitative and quantitative parameters“.

There is a six step process used in the evaluation:

(1) Screen the listed universe for small and mid-cap stocks with a market capitalisation less than $3 billion;

(2) Scan for decent quality which is quantified using ‘HAWK’ scores – an in-house parameter;

(3) Shortlist companies that are trading at cheap valuations;

(4) Shortlist companies with a history of a healthy cash flow generation;

(5) Use Piotroski’s F-score to gauge improvement in the financial health of the company.

(6) Screen companies with pre-tax RoCE of at least 15 percent. RoCE is the return on capital employed. It is a metric that measures company’s profitability or efficiency with which its capital is employed.

It is obvious that companies that survive the evaluation process have a good chance at giving multibagger gains.

The stocks are also trading at attractive valuations to historical averages which makes the risk-reward attractive.

The 16 stocks are the following:

The list comprises of Johnson Controls Hitachi, GNFC, Heidelberg Cement, Venky’s, JK Paper, West Coast Paper, Lumax Industries, Maithan Alloys, Zee Learn, Action Construction Equipment (ACE), NR Agarwal, PPAP Automotive, Virinchi, RPP Infra, Black Rose Industries and KMC Specialty Hospitals.

Dolly Khanna’s portfolio boasts of these multibagger stocks

We don’t have to worry too much about some of these stocks because Dolly Khanna has already given them a clean chit and included them in her past and present portfolio.

Karunya Rao has conducted a brilliant analysis of the portfolio and explained their highlights.

And we’re back with #SmartPortfolio segment…here are the key changes made in #DollyKhanna top holdings during Q3 https://t.co/4oNrW6cstz

— Karunya Rao (@RaoKarunya) February 7, 2019

NR Agarwal and JK Paper, for instance, have won Dolly’s confidence owing to the tailwinds benefiting the paper sector.

NR Agarwal Ind. CMP 489.

Largest coated Duplex board & newsprint mfg co.

Promoters continuously buying

Dolly Khanna recently bought 1.18%

BNP Paribas recently bought 1.25%

Co to give good quarter result@SachinS38985066 @nishkumar1977 @Rupesh3399 @proxy_investor @mantrinama pic.twitter.com/6w9UvgMBpq— Nirav S. Karia (@caniravkaria) November 9, 2018

GNFC is one of Dolly’s old favourites owing to its monopoly in TDI, a speciality chemical.

The stock is presently under the weather owing to a surge in natural gas prices, slump in TDI prices and a change in top brass.

Hey Parag

There was a mgm change at GNFC but we are trying to get the new person at the helm to join us on the channel to help our viewers understand the co betterReason for the fall in stock price can b

-TDI price drop frm 335 in Feb2018 to 255 in July2018

-Change at the helm— Nigel D'Souza (@Nigel__DSouza) August 31, 2018

GNFC stock under pressure@drrajivguptaias has been transferred after leading the transformation in past few yrs

However the stock trades at 8.5x trailing EPS which can support the stck https://t.co/OLhwOL3x3E

— Nigel D'Souza (@Nigel__DSouza) July 13, 2018

However, this is the ideal opportunity to tuck into such powerhouses, according to the wisdom of Ambit Capital.

PPAP Automotive, yet another of Dolly Khanna’s former portfolio stocks, is also under the weather owing to the slowdown in the auto sector.

However, it boasts of heavy-weight clients like Maruti, Hero MotoCorp, Eicher, Bajaj Auto etc and it is only a question of time before it resumes its glorious multibagger journey.

#OnCNBCTV18 | Abhishek Jain,PPAP Automotive says entire auto sector is seeing a slowdown; 46% of co's rev comes fm @Maruti_Corp & B Vijayakumar,LG Balakrishnan says @HeroMotoCorp, Eicher,Bajaj are biggest customers; To maintain margin of around 13%@latha_venkatesh @Nigel__DSouza pic.twitter.com/MTOJWpwUo8

— CNBC-TV18 News (@CNBCTV18News) January 3, 2019

Hidden Gems?

There are two stocks in Ambit Capital’s list which are unknown to me.

These are Black Rose Industries and KMC Speciality Hospitals.

My rudimentary research shows that Black Rose Industries is some sort of a ‘speciality chemical’ stock with 75% equity held by a foreign promoter.

Interesting Exchange Note By Black Rose Industries –

To set up a Polyacrylamide plant with investment of 60 Cr;

Expected Revenue from this is 300 Cr.

Co's MCap at 220 Cr, FY17 Revenue at 171 Cr, PAT at 4.6 Cr

75% Held by Foreign Promoter— Mangalam Maloo (@blitzkreigm) December 11, 2017

Black Rose Industries – Niche Acrylamide Player! (#SpecialtyChemicals, Performance Chemicals). Serious bet? #Multibagger?https://t.co/q3mXF4JyDY#blackrose #bril #acrylamide #chemicals #Japan

— devulapalli C (@dc2727) September 26, 2018

KMC Speciality Hospitals is yet another mysterious stock with a market capitalisation of only Rs. 260 crore.

There is not much information available about the stock though the punters at MMB appear to be gung ho about it.

We will have to conduct in-depth research into both stocks and then take a call on whether we should tuck into them or avoid them.

Timely article to helpeople to book out profits from sugar sector.This is worst sector with consistent dependence on government to keep bailing out the mill owners. This is similar to the public sector bank. Look at the market cap of these company.

They have hardly created wealth over the years.These are just cyclical plays better avoided by retail investors.

How is that black rose ind recomended not even 3 percent net margin

black rose promoters are not foreign. Dont know why they are considered to be foreign. Tozai Enterprises is registered in mumbai who has Ambarish Daga as the director. Ambarish Daga is also the general manager of Black rose. Wedgewood is a company which is again registered at the same place which is Mittal towers Nariman point. The director of Wedgewood are again Shruti jatia who is again a partner in Tozai enterprises. These are for sure not foreign promoters. Triumph worldwide looks like a foeign promoter but it just brings some finance for emerging market players. No strategic benefits no chemical technology nothing comes from them. not much of a foreign promoter i would say.