Crude Oil prices are now in Bear territory

It is amazing how quickly things change in Dalal Street.

Just a few days ago, we saw the grim news that crude oil prices are on the boil and that India is facing an economic crises.

India facing ‘economic crisis’ due to huge oil imports: Nitin Gadkari – Livemint https://t.co/KpeZ5aUNqJ

— Subramanian Swamy (@Swamy39) October 4, 2018

Consequent to that crisis, the Government directed the OMCs like HPCL, BPCL and IOC to bear the burden of the subsidy.

This move sent the stock market crashing.

The OMC stocks lost Rs. 64,500 crore while the entire market lost Rs. 9 lakh crore.

Apart from profitability, this move could have possibly hit investor confidence.

~38,600cr MCap lost yesterday

~25,900cr MCap lost today till now(For all 3 OMCs) https://t.co/CjblK9wg11

— Sonal Bhutra (@sonalbhutra) October 5, 2018

Nifty

– Largest One Day fall since Aug 2015

– Ended in the Green on Mon, Shut on Tue

– Lost 692 Points in 3 Days. Biggest 3 Day fall since Jan 2018

– Lost 614 Points This Week (Biggest Ever Fall in Absolute Terms)Sensex in last 3 Days

– Lost 2149 Pts; Lost 9 Lk Cr in MCap— Mangalam Maloo (@blitzkreigm) October 5, 2018

Today, the situation has totally reversed.

It is now official that crude oil prices have plunged to such an extent that they are in “Bear” territory.

This implies that crude oil prices will remain subdued in the foreseeable future.

Obviously, this will dramatically improve the position of CAD (current account deficit), soften inflation etc because India imports nearly 85% of its requirements of crude oil from foreign countries.

It's official! Crude #oil is now in a bear market and it took just over one month to get there. pic.twitter.com/cR37lJTcUP

— jeroen blokland (@jsblokland) November 8, 2018

US crude oil slips deeper into bear market territory, down for a 12th day in a row, its longest losing streak on record. Dips below $59/barrel, now lost 23% in just over a month. pic.twitter.com/Aj65lnLiAl

— Jamie McGeever (@ReutersJamie) November 13, 2018

Crude oil suffers its longest losing streak since 1984 https://t.co/R50L6STfy7 pic.twitter.com/mkEpWUbKfR

— CNN Business (@CNNBusiness) November 10, 2018

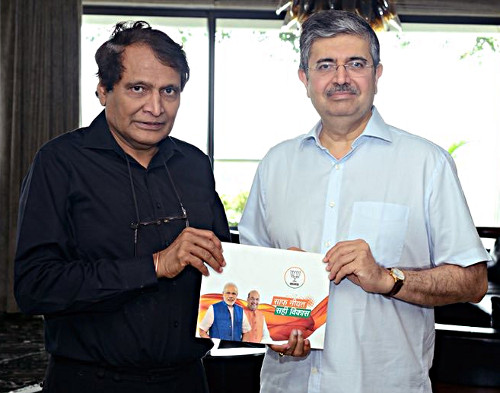

Heavens are smiling on India: Uday Kotak

Uday Kotak’s brilliant and visionary mind was quick to connect the steep fall in crude oil prices with India’s prosperity.

“Heavens seem to be smiling on India. Brent at 65$ gives policy makers headroom to move ahead. At this crucial juncture for economics and politics, oil below 70$ if it sustains, is Advantage India,” he exclaimed in an excited tone.

Heavens seem to be smiling on India. Brent at 65$ gives policy makers headroom to move ahead. At this crucial juncture for economics and politics, oil below 70$ if it sustains, is Advantage India.

— Uday Kotak (@udaykotak) November 14, 2018

The Billionaire also provided a masterful explanation of the state of the economy in the video embedded below.

He explained that the economy will comfortably grow at 7% and that even 9% growth will not be surprising.

He advised us to take advantage of the sell-off and add high-quality stocks into our portfolios.

Here's a Diwali message from one of the top Indian banking czars. @udaykotak bets on the system's fundamentals, says the Govt & policy-makers are at work to curb the contagion effect from IL&FS fallout & advises long term investors to stay put in mkt even in times of volatility pic.twitter.com/uoKK3cqygC

— ET NOW (@ETNOWlive) November 9, 2018

(Uday Kotak with Suresh Prabhu)

Are NBFC stocks a good buy now?

Prima facie, NBFC stocks have been beaten down to such an extent that they qualify as no-brainer investments for intrepid investors.

This was confirmed by Keki Mistry, the boss man of HDFC, the blue-chip behemoth, when he was grilled by Sonia Shenoy and Sumaira Abidi, the charming ladies of CNBC TV18.

Very imp takeaways from interview with Keki Mistry ,HDFC

– Confidence returned to the NBFC industry

– Commercial papers have been rolled over or redeemed

– no need for liquidity window by RBI since crisis has been resolved

– IL&FS was a stray case, dont expect a repeat— Sonia Shenoy (@_soniashenoy) November 16, 2018

No question of another #ILFS moment says Keki Mistry of HDFC!! Need for special RBI dispensation no longer exists! wow.. what a confidence booster to start the day!! #NBFCs #mutualfunds #debtfunds #markets

— Sumaira Abidi (@SumairaAbidi) November 16, 2018

“In a couple of months, it will be business as usual for majority of NBFCs,” Keki Mistry roared, implying that the present crisis situation will be soon forgotten and NBFC stocks will surge back to their old glory.

“I am confident that going forward over the next three or four weeks, as these commercial paper keeps maturing and keep either getting rolled over or start getting repaid on maturity the full confidence will come back into the system. And if the confidence comes back into the system, it should be business as usual in two to four months time,” he added.

Keki Mistry also reminded everyone that the NBFC sector is here to stay.

“NBFCs to have an important role to play in the financial system. They are niche players. They have a niche role to provide and a big role to play in the times to come,” he said.

Billionaires Ajay Piramal & Nirmal Jain support Keki Mistry’s theory

Ajay Piramal & Nirmal Jain, the two illustrious Billionaires who know the entire NBFC sector like the back of their hands, have come out strongly in support of NBFC stocks.

I think NBFC sector fears are exaggerated. Sector has robust regulatory framework, is growing well helping financial inclusion-nation’s growth by delivering credit to underserved!Excessive panic can cause heart attack in a healthy body. Equity sentiment alwys moves in a pendulum

— Nirmal Jain (@JainNirmal) September 26, 2018

No NBFC, other than IL&FS has actually defaulted or shown any sign of distress or liquidity issue till now. Yet so much of rumour mongering and panic. In fact mutual fund, CP squeeze Sept rollover have been acid test for the sector. We must listen at data, facts and not hearsay

— Nirmal Jain (@JainNirmal) October 9, 2018

#EXCLUSIVE | Things have started to settle down in the NBFC space w/ capital flowing much easier than few days back. Ajay Piramal of @PiramalGroup says NBFCs are critical for the growth of the country as they lend to MSMEs which are the backbone of the country. @Ajaya_buddy pic.twitter.com/YvPwR6r7ne

— ET NOW (@ETNOWlive) October 9, 2018

Four reasons why HFC stocks are a must buy

Keki Mistry gave four convincing reasons why HFC stocks make for great investment.

(i) The housing market in India offers enormous opportunity for growth. Also the fact that housing today is a lot more affordable compared to what it used to be even 10 years ago.

(ii) Secondly, the penetration level of mortgages in India is extremely low. The mortgage to GDP ratio in India stands at 10% compared to something like 63% in the US or 68% in the UK or 22% in China.

(iii) Thirdly, we have a young population in India. Two-thirds of India’s population is below 35 years of age and unlike the west, in India people go to buy house only when they are in their late 30s. So, it means that two-thirds of the population has not even thought of buying a house so far but over the next one, three, five, seven, ten, fifteen or twenty years, all these younger people will get to an age where they will necessarily have to buy a house.

(iv) There will be a structural growth or structural increase in demand for housing loans in India and last but not the least, the focus that the government has put on the sector by giving fiscal benefits and by having the subsidy scheme which is now in full play now.

All these factors taken together will ensure that the growth for housing loans will remain strong for a very long time, he said.

HFC stocks are no-brainers: Mohnish Pabrai

The logic given by Keki Mistry in support of HFC stocks is also echoed by Mohnish Pabrai.

Mohnish has described the entire sector as a “no-brainer” owing to the huge scope of opportunity (see Housing Finance Stocks Are “No Brainers” Says Mohnish Pabrai & Approves “Lakh Crore Ki Kahani” Theory).

Based on this theory, Mohnish and his assorted funds have bought a chunk of 32,31,728 shares of Repco Home Finance comprising 5.16% of the equity capital.

Mohnish praised Repco for having “no competition” and “lending discipline”.

#ChaiWithPabrai | Repco Home has no competition in the demographic they're serving; Expect Repco's lending discipline to continue in the future, says @MohnishPabrai in an #Exclusive chat with @nikunjdalmia @tanvirgill2 pic.twitter.com/4Jr8w0HhpL

— ET NOW (@ETNOWlive) June 1, 2018

53% upside from NBFC Stock. Core investment co with 3 businesses of general insurance, Housing Finance & Asset Management. Strong earnings & continuous improvement trajectory. PAT to grow at 17% CAGR in FY18-20E. RoE to move to double digit by FY19E https://t.co/EA22ToCs61 pic.twitter.com/DbNSzYVyUD

— RJ Stocks (@RakJhun) April 30, 2018

Focus on quality, liquidity, long-term business and customer value: Rashesh Shah

Rashesh Shah, the self-made Billionaire founder of Edelweiss, advised us to stop being obsessed about the stock “price” but to instead to focus on the stock “value”.

“Focus on quality, liquidity, long-term business and customer value instead of stock price,” he said, echoing the timeless wisdom of Warren Buffett (see Buffettology: The Previously Unexplained Techniques that have made Warren Buffett the Worlds most Famous Investor).

.@rasheshshah, Chairman & CEO – Edelweiss Group, shares his views on the current NBFC liquidity situation and suggests a new Mantra – Focus on quality, liquidity, long-term business and customer value instead of stock price. Read more: https://t.co/PYywhcwJsi pic.twitter.com/itHI6FeFBW

— Edelweiss Group (@EdelweissFin) October 16, 2018

No doubt, Rashesh Shah’s advice is sound and we should obediently follow it.

Which other stocks are good for buy now?

Thankfully, there is no dearth of high-quality multibagger stock recommendations for us to choose from.

A few days ago, on the auspicious occasion of Diwali, Porinju Veliyath recommended stocks to with the confident assurance that they are “safe” and compounders.

We have also received recommendations of the best stocks to buy for 2019 from Edelweiss, Sharekhan, Stewart & Mackertich and IIFL.

We have to cherry-pick the best stocks from this lot and load our portfolios with them.

In housing finance ,I shall never go below HDFC ,no doubt that India is growing economy and good companies will continue to grow.But I shall continue to make my portfolio with in top 100 companies ( minus PSU , telecom, utility and metals ) and no stock higher than 9% of portfolio and keep around 30 stocks . .For small and mid cap go for mutual funds as they are very risky and is game for for full time experts .In India markets are hollow , you never know when Next DHFL will happen with stock down 40 to 50 % in a day..

Sir,

i am a little bit cautious about housing/Real estate sector simply as its over hyped. The ability of youngsters to repay loans of 50L+ going forward is very challenging. With Trump admin clamping down immigration procedures, going to USA and earning money in USD is not possible anymore. Since housing sector’s biggest patron are the IT professionals, RE market across the country has a lot of surplus unsold units.

Better to stick to cement or paint stocks.

Regards

Anand

real estate are in a down turn india so how come HFC a buy??..less people buying home so whom these HFC distributing the money…???

I have holding in DHFL and PNB Finance. Both stocks are down heavily. I hope some recovery is there soon.

Awesome! Let’s close our eyes and start buying the stocks recommended by the great Shri porinju ji!

this banker old boys club is getting more and more boring to listen to -all of them were aware of IL & FS – all of them were aware of the skewed borrowings of HFC- still not of them said anything save 1 or 2 -the one cautious note to consider –

if there is no real increase in wages and no employment for normal young people in coming years -are the houses going to be subsidised or worse -free?if so who is going to foot the bill – this government has lost maximum money in Note bandhi and hasty GST(no wonder it is fighting/pleading with RBI for funds ) – most of the infra (power ,water and major roads)companies are in the RED -all are saddled with humongous loans and cancelled projects-So -looks like back to square one -of 2013.

Absolutely right.

And the picture posted by RJ mailer with a rogue (ex) MD of a bank makes you wonder which part of heaven is smiling!? That picture needed another two bankers to be featured in – Shikha Sharma and the YesBank buddy.

And imagine the issue about oil prices – these bankers always lag behind – keep quiet when prices shoot up (and along with the rupee too, with burden on the public and OMCs) and now talk about heaven smiling.

I haven’t seen commensurate reduction in petrol/diesel when crude prices came down 23%?! So, what the bankers say about it?

And which part of heaven (or hell) will be smiling when the Govt mishandles RBI (another autonomous body after all others grabbed by the collar)?

Explain please, Mr Kotak?