Difference between large-cap and small-cap valuations is at 20-year high

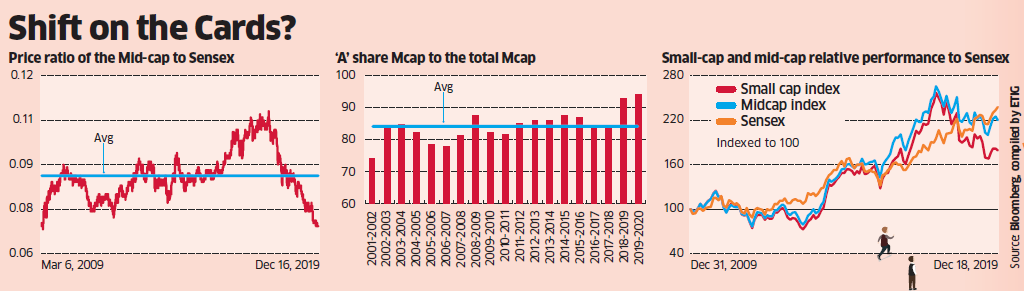

It is unbelievable but true that the difference in the market capitalisation between large cap stocks and their smaller counterparts has widened to a two-decade high.

This sensational information has been revealed in a study conducted by Ashutosh Shyam and Sanam Mirchandani of ET Bureau.

After a meticulous study of data collated from the BSE, the duo has pointed out that investors’ preference for large-cap stocks has caused a chasm, the widest in two decades, between market capitalisations of these scrips and small and mid-cap stocks.

It is stated that while the market cap proportion of ‘A’ group shares has surged to 94 per cent, the highest since 2000, small and mid-cap shares have dropped 30 per cent and 17 per cent respectively.

The effect of this is that the price-ratio between the midcaps and the Sensex has dropped to 0.069, the lowest in a decade.

Porinju Veliyath confirmed the veracity of the data and the underlying theory.

“I have never seen such a disparity before … I am not just talking about midcap or smallcap indices, but the broader market, where most non-institutional investors are concentrated. The value gap between largecaps and smaller stocks is unprecedented,” he stated.

Mean reversion will happen inevitably

The concept of “mean reversion” in the stock market was first coined by Benjamin Graham, the doyen amongst value investors.

In his timeless treatise titled “Security Analysis“, Graham eloquently described the concept as “Many shall be restored that now are fallen and many shall fall that now are in honor“.

This obviously implies that stocks that are in the dumps today will surge tomorrow, if their fundamentals are intact.

Porinju exuded confidence that mean reversion is round the corner and is likely to surface any day now.

“Many stocks may surprise people at some point, as investors have turned hopeless on smallcaps even when they trade at just 3-5 PE multiples, but are growing at 15-20 per cent and offering 3-6 per cent dividend yields. Many of these stocks would spring a surprise,” he stated with a sparkle in his eyes.

Valuation disparity between Large, Mid And Small Cap stocks creates investment opportunity

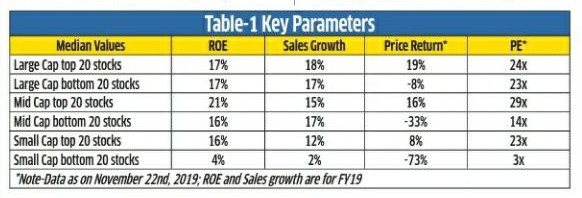

Profs. Ruzbeh and Shernaz Bodhanwala of Flame University have written an article in the Dalal Street Journal in which they have argued that the unnatural disparity between the various classes of stocks has created a great investment opportunity.

(Image Credit: Dalal Street Journal)

The duo has pointed out that the top 20 midcap stocks are trading at a median P/E multiple of 29 times whereas the bottom 20 stocks are trading at 14 times.

This disparity is odd because the sales growth and ROE performance of the bottom 20 stocks is close to the top 20 stocks.

This means that the bottom 20 stocks are undervalued as compared to the top 20 stocks even though financial performance are not substantially different, the Profs have opined.

The same is the situation with regard to the small-cap stocks.

“There may be some fundamental rerating of these stocks on the cards … mid cap space provide select good buying opportunity for retail investors,” the duo has concluded.

A similar view has been expressed by Navneet Munot, the CIO of SBI Mutual Fund.

“It’s time to go cherry picking in mid, smallcaps,” he has stated, after analysing reams of irrefutable data.

NAMO and Nirmala Sitharaman will change sentiments with dynamic policies in Budget

It is no secret that Porinju is a devoted follower of NAMO and Nirmala Sitharaman.

In fact, he had once famously stated that NAMO Is The Best Choice & Only “Ignorants & Anti-Nationals” Will Vote For Congress.

His confidence is well placed because the dynamic duo have shown that they have the wherewithal to introduce radical reforms and put the Country on the path to prosperity.

It is notable that the present super-surge in the markets is because of the dramatic slash in corporate tax rates and abolition of surcharge on FPIs (Foreign Portfolio Investors).

Sensex and Nifty posts biggest single day gains in the last 10 years. #NewIndiaInMaking pic.twitter.com/0WXmgqE3GT

— BJP (@BJP4India) September 24, 2019

Also, NAMO is working hard on making India into a $5 Trillion economy.

Together, we will realise the dream of a $5 Trillion economy. pic.twitter.com/4Vvo934ICk

— Narendra Modi (@narendramodi) December 20, 2019

Porinju expressed hope that Nirmala Sitharaman will live up to expectations and remove the twin evils of long-term capital gains tax (LTCG) and dividend distribution tax (DDT).

He also pointed out that income-tax rates in India at 42.7 per cent (the highest tax slab) is at a three-decade high and deserved to be slashed.

Such steps will revive interest in small and mid-cap stocks and provide the catalyst for them to catch up with their large-cap counterparts, he opined.

Be careful. Don’t rush in where angels fear to tread

Porinju is well aware of the tendency of novices of rushing in where angels fear to tread and buying all sorts of dubious stocks.

He candidly admitted that he has himself been a victim of over-exuberance and got carried away.

“But today is a different day,” he added, implying that we do not have to be prisoners of the past but have to look forward and make new beginnings.

“Despite the recent round of selloff and value erosion, there are still potentially 300-400 midcap and smallcap non-investable stocks that could get de-rated permanently and fall to near zero in value,” he warned in a blood-chilling tone.

Is the Nifty Junior Bees the best bet?

Porinju understandably did not name any small-cap and mid-cap stocks as being worthy of a buy, given the fiascos of the recent past.

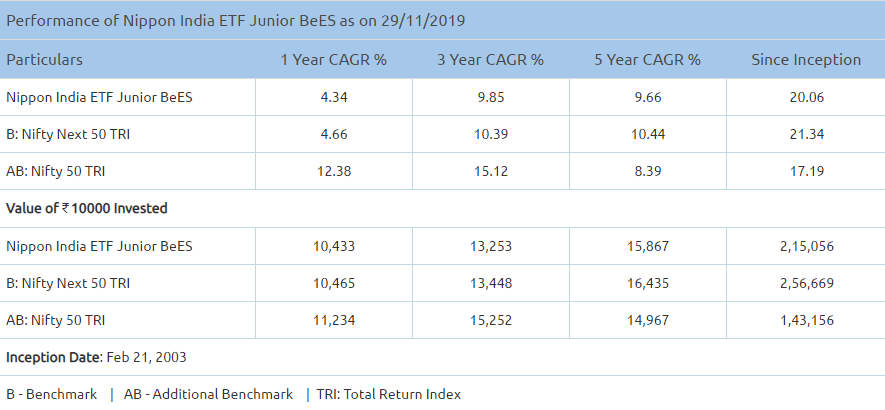

However, we can resolve the impasse by considering investing in the famous Nippon India ETF Junior BeES.

The ETF has the choicest of mid-cap stocks, diversified across sectors.

| Top 10 holdings of Nippon India ETF Junior BeES | |

| Stock | Sector |

| SBI Life Insurance Company | Financial |

| HDFC Life Insurance | Financial |

| Godrej Consumer Products | FMCG |

| Dabur India | FMCG |

| Shree Cement | Construction |

| Bandhan Bank | Financial |

| Divi’s Laboratories | Healthcare |

| ICICI Lombard General Insurance | Financial |

| HPCL | Energy |

| Petronet LNG | Energy |

| Pidilite Industries | Chemicals |

The performance is quite subdued at present for the reasons already stated above.

However, given the expected imminent revival of mid-cap stocks, we should not be surprised to see the Junior BEES outperforming its larger counterpart, as prophesied by Porinju and the other experts!

Very good human being . He is accepting his mistakes. Merry Christmas Porinju!

May Santa give you good returns!

only santa can give him good returns

Nice adivcd for value investing.

Thanks poorju do our country has any organized stock exchange even if it so do the official of sebi NSE BSE nsdl and cdsl are honest and upright in character for an act of fraud forgery and unathorised trading is arbitration law of India that to in cash segment without cheque payment and the I have given my request for removing me from margin funding and also my POA no action

It is very surprising about PV mentioning small and mid caps and valuations catching up with large cap. PV got in to many penny stocks and for his style of investing, a small cap is like large cap. Penny stock valuations will never catch up with large cap and no need to fool the public that when valuations bridge, returns from his PMS will be back to normal.

Don’t understand still what kind of customers go for PMS. Some hard selling with lot of fake info and glitz might be happening to lure them.