Festive atmosphere in Dalal Street

Over the past few days, there has been a festive atmosphere in Dalal Street.

This is for two reasons.

The first is that the stock markets are surging like rockets and breaching All-Time-Highs (ATHs).

The Sensex effortlessly surged to a record high of 37,273 while the Nifty stood tall at 11,233.

#MarketAtRecordHigh | All-time high for #Sensex & #Nifty pic.twitter.com/XRT3VsRtzx

— CNBC-TV18 (@CNBCTV18Live) July 27, 2018

In fact, the Sensex has outperformed its arch rivals in other emerging markets according to Syed Akbaruddin, India’s Ambassador & Permanent Representative to the United Nations.

India’s Sensex is stellar performer amongst Emerging Markets in 2018.

Chart courtesy @FT pic.twitter.com/Ok7fuoTlsk— Syed Akbaruddin (@AkbaruddinIndia) July 22, 2018

Naturally, novices, who till yesterday were bemoaning their fate, have got their swagger back.

Their pockets are now bulging with hefty gains and they are strutting around like Millionaires.

The second reason for the festivity was that Rakesh Jhunjhunwala, the Badshah of Dalal Street, agreed to provide much-needed pep talk to investors.

The Badshah’s words of wisdom deserve to be listened to with rapt attention by all investors because he has single-handed amassed a fortune of $2 Billion (Rs. 13,000 crore) from the stock market.

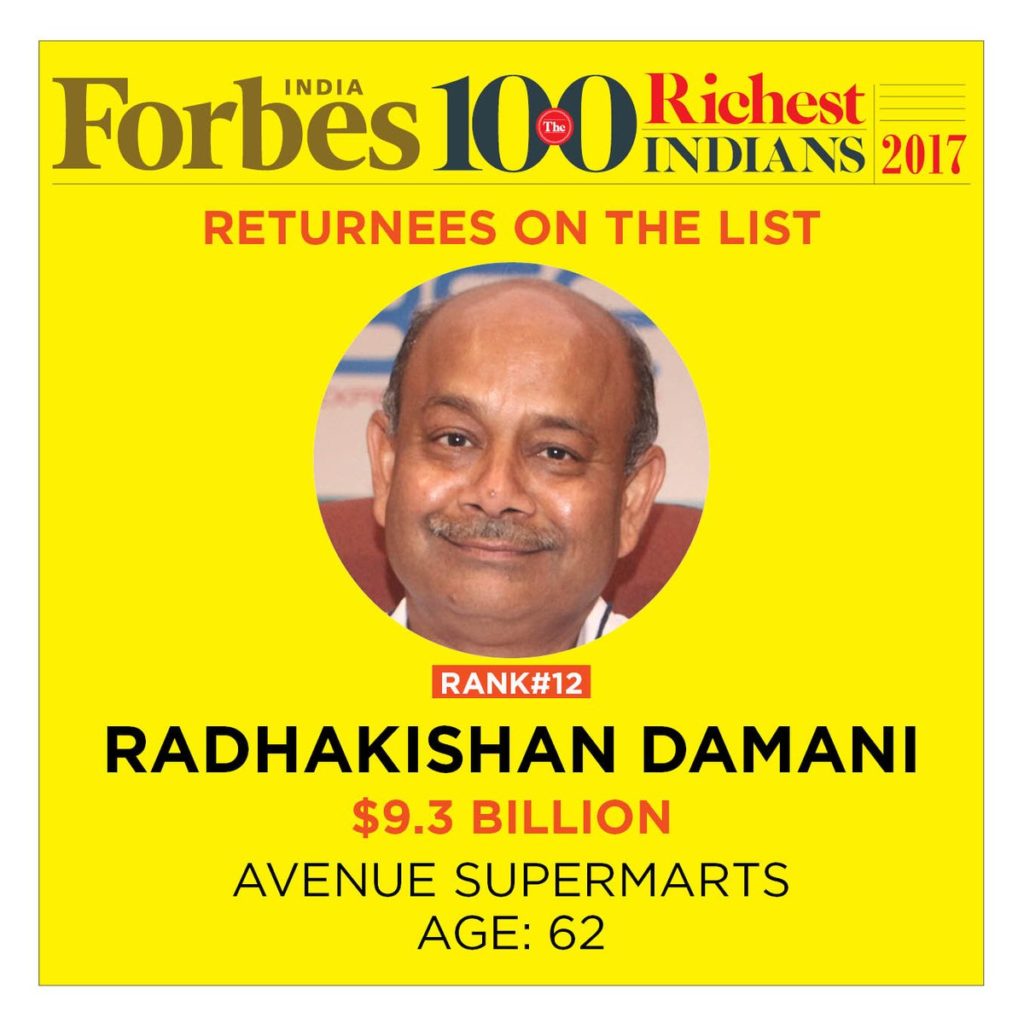

Radhakishan Damani, SSC pass, made Billions

It is no secret that Rakesh Jhunjhunwala reveres Radhakishan Damani as his ‘Guru’ and ‘Mentor’.

The Badshah revealed this during his joyous Birthday celebrations in 2014.

“Who do you count amongst your mentors in the market,” Udayan Mukherjee asked him point-blank.

The Badshah did not hesitate for even a second:

“Mentor is only one, Mr. Radhakishan Damani”, he declared emphatically.

“I learnt trading from him … He has wisdom, extreme patience and humility … The patience he has to hear the other person’s point of view is unbelievable .. He taught me life and shaped my nature. If he and my father had not been there to guide me, I would not have achieved such success”, the Badshah gushed, heaping rich praise upon the Billionaire investor-cum-retail-king.

In fact, the Badshah had expressed surprise at the fact that Radhakishan Damani’s net worth was less than that of his.

Later, when Radhakishan Damani’s net worth surged to an ATH of $9.3 Billion in the wake of D-Mart’s spectacular success, the Badshah was elated that the rustic stock picker had been given his rightful place in the Forbes Billionaires’ Club.

Naturally, in his latest interview, Rakesh Jhunjhunwala once again made copious reference to Radhakishan Damani with a view to inspire us to walk in his illustrious footsteps.

“Radhakishan Damaniji, he is SSC pass. How can he be India’s most successful and most profitable retailer? How did he compete with the Tatas, Reliance and Birlas,” the Badshah asked.

It is explicit from the Badshah’s statement that if a rustic, with little education and experience, could compete successfully against deep-pocketed and established Giants in the hyper-competitive retail space, achieving success in the stock market ought to be a cakewalk for us.

I came with no wealth and I could earn wealth

Rakesh Jhunjhunwala then cited his own example as to how enormous wealth can be created from the stock market.

“I came with no wealth and I could earn wealth,” he said in his typical brusque style of talking.

“Things in India are changing for the good and the development of the capital market is extremely important in this country not because you and I want profit but because that will bring entrepreneurship and create capital,” he added.

(Image credit: ETNow)

R 1 lakh became Rs. 1 crore. If it is now at Rs. 80 lakh, why do you cry?

Rakesh Jhunjhunwala is well aware of the tendency of novices of bemoaning their fate whenever there is even a minor correction in stock prices.

“Jiske pas share hai, uska ek lakh ka ek crore hai. Ab ek crore ka 80 lakh ho gaya” (Those who owned these shares, their money went from Rs 1 lakh to Rs 1 crore. Now it is reduced to Rs 80 lakh), the Badshah said, speaking in Mumbaiya Hindi, so as to be understandable to everyone.

“But if the company is performing well Kya farak padne wala hai?”, he asked implying that we should look at the Glass as half full and not as half empty.

“Nothing in life is linear”, he added in a philosophical tone.

Watch the earnings trajectory of the stocks, not the stock prices

It is common sense that stock prices are driven by earnings.

However, there are occasions when the stock prices languish, leading investors to suspect that the stock’s earnings may have plateaued.

The Badshah advised that if investors are lucky to get their hands on good quality companies, they should not get frustrated by the fact that the stock prices appear to be consolidating indefinitely.

“My advice to shareholders on good companies is that unless and until the earning trend is going to reverse or earnings growth is going to reverse, there are going to be periods where stocks are going to consolidate,” he said.

I made my entire fortune of $2 Billion in only 5 to 8 stocks

Normally, Rakesh Jhunjhunwala does not quote Warren Buffett or any of the other eminent investment Gurus.

However, given the obsession of novices towards Warren Buffett’s quotes, the Badshah also referred to it.

“What did Buffett say? You need only one good decision in life,” he said with a big smile on his lips.

“If I see my career, the trading wealth that I earned is very important but it is the 5-8 investment decisions which have made my wealth essentially,” he added.

There are no prizes for guessing the names of these stocks.

Even the rawest novice knows that Titan is the crown jewel in Rakesh Jhunjhunwala’s portfolio followed by multibagger stalwarts like Escorts, Lupin, DHFL, Delta Corp etc.

(The Badshah with charming ladies Sonia Shenoy and Sumaira Abidi)

Don’t worry about the outcome of the elections

Another aspect which has gripped investors is the worry relating to the outcome of the elections in 2019.

Some experts have predicted that a Mahagatbandhan led by RaGa, Mamta, Mayawati and other dreaded politicians will overthrow NAMO and wrest power.

This is feared to lead to an exodus of foreign investors and result in cataclysmic consequences for the stock market.

However, Rakesh Jhunjhunwala was dismissive about our fears.

“When the BJP lost in India Shining, the Sensex came to 4,500 and it was 25,000 within that four years. Then when Congress won 209 seats, the Nifty went up 40% in two days and after that it never went up,” the Badshah said, implying that the politicians in power have no effect on the stock market.

“India is greater than individuals,” he added in an emphatic tone.

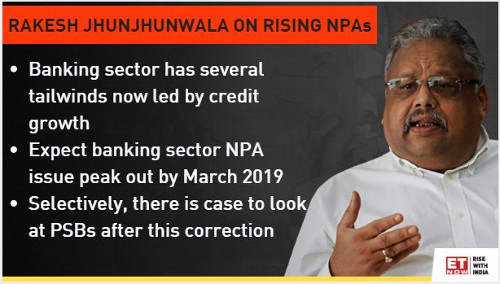

Huge tailwinds for Banks & NBFCs

Rakesh Jhunjhunwala sent the clear signal that we should aggressively tuck into high-quality private banks and NBFC stocks.

“There are very big tailwinds for banks. Tailwind in the sense that there is going to be credit growth. You cannot create these banks and this problem of bad assets will now peak by March 19,” the Badshah exclaimed.

The Badshah also gave a clean chit to PSU Banks.

“I was very bearish on these public sector banks but I think now even public sector banks can be considered now selectively,” he said.

“I surely feel it’s time to buy banks with a 5-year horizon,” he asserted.

It is notable that Rakesh Jhunjhunwala has been aggressively increasing his stake in Karur Vysya Bank, one of the crown jewels in his portfolio.

KARUR VYSYA BANK in focus

RAKESH JHUNJHUNWALA increases stake in co to 4.22% from 3.36% (qoq)

— Nigel D'Souza (@Nigel__DSouza) July 25, 2018

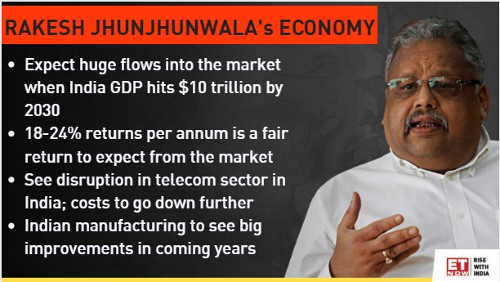

$300 billion of houselhold savings will be invested in stocks by 2030

Nobody can dispute that Rakesh Jhunjhunwala is a visionary.

He gave yet another example of this by pointing out that while India is presently a $10 trillion economy, its savings alone will be $3 trillion a year by 2030.

“If even a paltry 10% of those savings come to the stock market, we are talking of a mammoth $300 billion,” the Badshah exclaimed in an excited tone.

“Do not forget 32% of household in America today is in equity,” he added, implying that the estimate of 10% is highly conservative.

If a well known investor like me cannot get more than 30% return, why are you so greedy?

Rakesh Jhunjhunwala also tried to drill sense into us that we should pare our expectations and not be too greedy about the returns.

The Badshah knows that our temptation for snaring multibagger gains overnight leads us to invest in all sorts of dubious stocks, with disastrous results.

“If I get 18% to 24% return, I am extremely happy. The reality is you don’t get more return than that. I am a well known investor. Do I get 30%? I do not think so,” the Badshah said.

Conclusion

It is obvious that our obsession for multibagger gains has brought us a lot of grief. We have squandered away our meager savings by investing in all sorts of junkyard stocks. We have to now take a lesson from Radhakishan Damani and Rakesh Jhunjhunwala and invest only in high-quality stocks which will give us steady compounded gains for years to come!

Why can’t these successful experts give the name of stocks for us to invest?

he is the true buffet of indiain all sense

Would these experts just give us the names of the stock, the price to buy, the return on the stock in 2 years. That wud ne very helpful

well actually they did give us their fav stocks.

in his latest interview he did mention icici and tisco.

check youtube

sohail roshni

Readers will understand clearly that when we compare our indices to the global ones, only Sensex and Nifty are used. That is why, just to give another “India Shining” moment to everyone, the govt guided SEBI to ask MFs to sell Mid cap and small caps and buy only large caps. This resulted in further losses to small investors and gains to these maha-investors.

As if that was not enough, SEBI went a step ahead to curb SCs and MCs by adding them to ASM list.

We should actually use an index involving 500 stocks, not just top 30 or 50, when we compare India’s market performance with the world or other emerging markets.