Secret formula for finding multibagger stocks revealed

The secret as to how one can find mega multi-bagger stocks was first revealed by Ian Cassel, an authority on the subject.

Ian Cassel has written a detailed guide in which he has explained the common characteristics that wannabe mega bagger stocks exhibit. He has also given real-life examples of stocks that meet the criteria to help us home in on such stocks.

Jatin Khemani, the founder of Stalwart Advisors, a stock advisory servcie, has mastered the technique. He has revealed his own adaptation of the formula by pointing out that a contribution of six factors leads to a multibagger being snared.

These six factors are leadership in the marketplace, growing niche, unknown credentials with zero institutional holding, ethical and competent management and reasonable valuations.

Market Leader + Growing Niche + Unknown + Zero Institutional Holding + Ethical & Competent Mgt + Reasonable Val. = Multi-Bagger#TastyBite

— Stalwart Advisors (@Stalwartsadvise) February 9, 2017

Tasty Bite Eatables – 725% gain in less than 2 years

Jatin Khemani recommended Tasty Bite Eatables, then a micro-cap, as an investment candidate in April 2015 when it was languishing at the throwaway price of Rs. 640.

His logic was flawless. He explained that the aggressive acquisition by Kagome, the Japanese behemoth, of a majority stake in Tasty Bite, meant that it was imminent that the latter would soar into orbit.

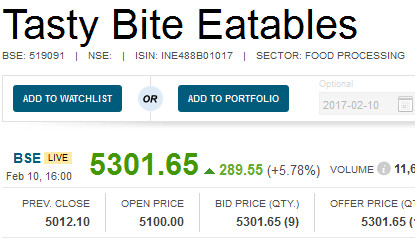

This has come true and Tasty Bite is today standing tall at Rs. 5,302, giving eye-popping gains of 725% to the lucky shareholders in less than 24 months.

Tasty Bite’s success shows appetite for ready-made food packets

Ramesh Damani, one of the most astute investing minds on Dalal Street, was obviously intrigued at the spectacular success of Tasty Bite and asked Jatin Khemani to explain the rationale.

Jatin explained that Tasty Bite’s USP is the fact that it is exporting Indian food to NRIs in foreign countries. The NRIs are obviously deep-pocketed and have a craving for Indian food. They are willing to pay a fortune for desi food and this enables Tasty Bite to make a fortune.

“We found an owner operated business, creating a niche out of nowhere following a blue ocean strategy with lot of skin in the game and it was still only Rs 150 crore topline and we saw huge size of the market opportunity and that is when we thought it could be a great opportunity,” Jatin said with a big smile even as Ramesh Damani looked on with admiration writ large on his face.

Radhakishan Damani lost his nerve at the steep surge in Tasty Bite?

Radhakishan Damani’s investment arm, Damani Estate and Finance Private Limited, held 13,900 shares of Tasty Bite Eatables as of 1st April 2015. Unfortunately, he dumped his entire holding sometime in the financial year 2015-16.

It is not known what caused Radhakishan Damani to lose confidence in Tasty Bite. However, he was not alone. Several other well known investors like K. Swapna, Sushama Ratnakar Samat, Vora Yogesh Dhirajlal and Ajay Kumar Kayan offloaded a chunk of their holdings in Tasty Bite Eatables.

Prima facie, it appears that these illustrious investors may have got jittery at the steep ascent of the stock price and thought it prudent to cash out.

In hindsight, we can say that the decision was most imprudent.

Other stocks recommended by Stalwart Advisors

Now, we have to turn to the pleasurable activity of probing the other stocks recommended by Jatin Khemani. There is a good chance that these stocks may also effortlessly become multibaggers.

Wonderla Holidays – favourite of ace stock pickers

Wonderla Holidays has the unique distinction of being the favourite stock of eminent investors like Billionaire Narayana Murthy, Prof Sanjay Bakshi and Porinju Veliyath.

Narayana Murthy’s Catamaran Investment bought a chunk of 437,539 shares of Wonderla Holidays at Rs. 386.50 per share. The present holding is not known.

Prof Sanjay Bakshi’s ValueQuest India Moat Fund, holds a treasure trove of 11,30,186 shares of Wonderla as of 31st December 2016.

Porinju Veliyath has been one of the earliest backers of Wonderla. He recommended the stock when it was languishing at Rs. 159 and called it a “safe investment” with a “Futuristic business, class management, clean BS & attractive price”.

Wonderla Holidays, IPO@700 Cr valuation is good for long term investing. Futuristic business, class management, clean BS & attractive price

— Porinju Veliyath (@porinju) April 17, 2014

Wonderla@159 – mktCap900Cr. I feel it is a safe investment with reasonable return.

Disclaimer: close with promoter family.— Porinju Veliyath (@porinju) May 9, 2014

Jatin Khemani has issued a detailed research report in which he has said that “Wonderla Holidays could be an amazing opportunity not just for next 3-4 years but for next decade or even longer”.

Relaxo Footwears and Amrutanjan Healthcare

Jatin Khemani is also known to have recommended Relaxo Footwears and Amrutanjan as potential multibagger stocks.

What about other packaged food stocks?

At this stage, we have to ask the pertinent question that if Tasty Bite became so successful as a result of the appetite of the NRI public for packaged foods, what about the other stocks which are engaged in the same business?

In particular, we have to keep an eye of ADF Foods which is backed by a panel of eminent investors like Dolly Khanna, Porinju Veliyath, Lashit Sanghavi, Nirmal Arora etc. ADF Foods manufactures packaged foods under the brand names ‘Ashoka’, ‘Soul’ etc.

We also have to keep a close eye of the Basmati stocks. In an earlier piece, I pointed out that how Shyam Sekhar, Porinju Veliyath and Ekansh Mittal of Katalyst Wealth have minted a fortune by buying basmati stocks like KRBL, LT Foods, Chaman Lal Sethi etc.

Daawat 100% more delicious in 6 mths? https://t.co/zz3dTekMrn

— Porinju Veliyath (@porinju) February 8, 2017

Prima facie, it appears that the insatiable appetite of well-heeled NRIs for desi food will send all of these stocks into an upward trajectory and give us enormous multibagger gains to feast on!

Bulls are on rampage for last couple of years; hence, so we have seen so many multi-baggers.