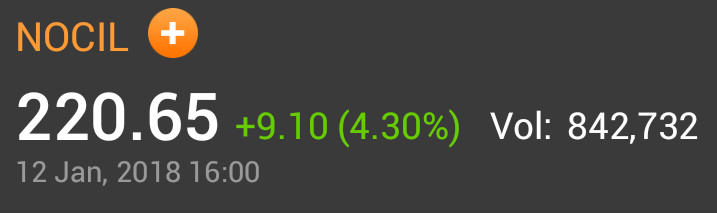

160% gains gush out of NOCIL after Dolly Khanna and Ashish Kacholia grab stake

While Dolly Khanna and Ashish Kacholia are formidable stock pickers in their own right, they are an unbeatable hunting pair when they team up.

We saw a real life example of this in the case of NOCIL.

In March 2017, Dolly came rushing to Dalal Street to grab a massive chunk of NOCIL at the throwaway price of Rs. 80.

Ashish Kacholia came right behind her in hot pursuit and grabbed a massive chunk for himself at Rs. 97.

Thereafter, the two stalwarts have been adding more of the stock to their respective portfolios whenever the stock corrected.

In hindsight, the stock was a no-brainer at that time because of its debt-free status, high RoE, low valuations and the massive tailwinds for the specialty chemicals sector.

Today, barely a few months later, NOCIL is standing tall at Rs. 220 and has brought big smiles to the faces of Dolly Khanna and Ashish Kacholia.

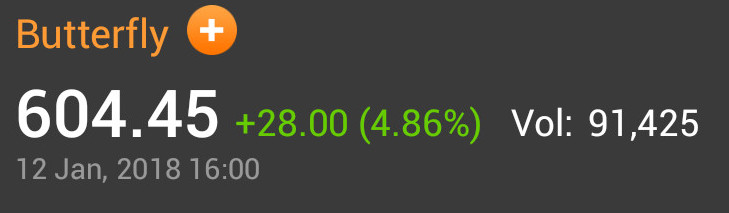

Latest stock pick: Butterfly Gandhimathi Appliances Ltd

Butterfly Gandhimathi Appliances Ltd, a little-known small-cap (Rs. 1000 crore market cap), is the latest stock to have won the confidence of Dolly Khanna and Ashish Kacholia.

We were alerted to Ashish Kacholia’s interest in the stock when he launched a raid on 19th December 2017 and scooped up a chunk of 200,000 shares at Rs. 525 by way of a bulk deal.

BULK DEAL ALERT:

KACHOLIA ASHISH bought 2,00,000 shares of Butterfly Gandhimathi Appliances Ltd at Rs. 525.00Seller:

RELIANCE ALTERNATIVE INVST FUND PVT EQ SCHEME I . – 2,00,000 shares at Rs. 525.00— Rohan Gala (@RohanG90) December 19, 2017

Thereafter, he has bought a further 50,000 shares and taken his holding to 2,50,000 shares as of 31st December 2017.

Unlike Ashish Kacholia and other peers, Dolly prefers to keep a low profile by buying the stock in a covert manner.

The first indication of her interest in Butterfly Gandhimathi came when her name popped up in the list of major shareholders as of 31st December 2017 with a holding of 2,25,928 shares.

When Dolly started buying the stock and what price she paid for it are State secrets that are unknown as yet.

However, given that the stock is up a magnificent 225% on a YoY basis, we can confidently assume that Dolly must have pocketed a bulk of the gains

| BUTTERFLY GANDHIMATHI APPLIANCES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 1,081 | |

| EPS – TTM | (Rs) | [*S] | – |

| P/E RATIO | (X) | [*S] | – |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 12.50 | |

| LATEST DIVIDEND DATE | 28 JUL 2016 | ||

| DIVIDEND YIELD | (%) | 0.00 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 101.27 |

| P/B RATIO | (Rs) | [*S] | 5.97 |

[*C] Consolidated [*S] Standalone

| BUTTERFLY GANDHIMATHI APPLIANCES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2017 | SEP 2016 | % CHG |

| NET SALES | 200.95 | 155.1 | 29.56 |

| OTHER INCOME | 1.05 | 0.79 | 32.91 |

| TOTAL INCOME | 202 | 155.89 | 29.58 |

| TOTAL EXPENSES | 184.1 | 146.01 | 26.09 |

| OPERATING PROFIT | 17.9 | 9.88 | 81.17 |

| NET PROFIT | 11.5 | 0.55 | 1990.91 |

| EQUITY CAPITAL | 17.88 | 17.88 | – |

(Source: Business Standard)

Ashish Kacholia, IDFC Mutual Fund and Standard Chartered Mutual Fund buy more

Today, Ashish Kacholia again turned up at Dalal Street. This time, he was in the distinguished company of the mandarins of IDFC Mutual Fund and Standard Chartered Mutual Fund.

While Ashish Kacholia helped himself to 152,404 shares of Butterfly Gandhimathi, IDFC Mutual Fund bought 100,000 shares. Standard Chartered Mutual Fund bought 300,000 shares.

The trio paid about Rs. 580 each for their purchase.

The aggressive buying sent the stock price rocketing to Rs. 605.

Bulk deals on 12th January 2018

| INVESTOR | BUY/ SELL | NOS OF SHARES | RATE (Rs) |

| IDFC MUTUAL FUND | BUY | 100000 | 580 |

| KACHOLIA ASHISH | BUY | 152404 | 580 |

| RELIANCE ALTERNATIVE INVST FUND PVT EQ SCHEME I . | SELL | 850000 | 580.67 |

| STANDARD CHARTERED MUTUAL FUND | BUY | 300000 | 579.99 |

Strong Turnaround is on the cards for Butterfly Gandhimathi: ICICI Direct

ICICI Direct appears to be the only research house tracking Butterfly Gandhimathi’s fortunes.

In a brilliant report dated November 2017, ICICI Direct recommended a buy on the basis that there is a “strong Turnaround on the cards”.

The prediction has turned out to be prophetic and the rationale is worth reading:

“Strong Turnaround on the cards…

– Butterfly Gandhimathi Appliances (BGAL) reported strong set of Q2FY18 results. Revenues for the quarter grew by 29.6% YoY to Rs 201.0 crore. The growth was supported by healthy traction in cooker/cookware and appliances segment.

– EBITDA margins for the quarter expanded by 250 bps YoY to 8.4%. The margin expansion was driven by improvement in gross margins (up 136 bps YoY) and positive operating leverage owing to strong topline growth (employee expenses down 139 bps YoY). Subsequently, EBITDA came in at Rs 16.9 crore vs. Rs 9.1 crore in Q2FY17.

– Strong operational performance coupled with decline in interest expense (down 45.7%) resulted in PAT of Rs 11.5 crore vs. Rs 0.6 crore in Q2FY17.

Worst over, revenue growth rebounds…

Q2 has been a seasonally strong quarter for BGAL as various dealers replenish their inventory a month prior to the start of the new festive season. With normalisation settling in post GST disruption, various traders and Multi brand outlets (MBO’s) are witnessing restocking at a gradual pace. This resulted in revenue recovery for BGAL in the retail space, clocking in revenue growth of 15% YoY. Strong traction in PMUY scheme and low base effect of Q2FY17 led to 45% YoY growth for the institutional sales. Segment per se, cooker/cookware and kitchen appliances grew 38% and 13% to Rs 30.2 crore and Rs 163.3, respectively. We expect strong revenue trajectory to sustain in H2FY18 owing to improvement in consumer sentiment and low base effect (H2FY17 was adversely impacted owing to demonetisation blues). We have introduced FY20 estimates and expect revenues to grow at a CAGR of 20% in FY17- 20E.

Revenue growth & margin improvement to sustain;

Recommend BUY!!

FY17 was a challenging year for the company on account of: a) absence of government orders, b) demonetisation impacting consumer sentiments, c) drought conditions and Vardah cyclones denting sentiments in southern areas. In addition, given the fixed cost nature of the business, low capacity utilisation rates resulted in negative operating leverage leading to losses at the EBITDA level for BGAL in FY17. We believe worst is behind and BGAL is in for better growth rates ahead. The key revenue growth drivers are a) Uptick in consumer sentiments owing to active monsoon in the southern state, b) Foraying into LFS and online distribution channel to provide additional impetus, c) new LPG connections to be released by the government under PMUY scheme and d) favourable base. Subsequently, we expect revenues to grow at a CAGR of 20% over FY17-20E. With strong revenue growth trajectory, we expect operating leverage benefit to kick in. We expect margins to recover from FY18E and touch 7.0% in by FY20E. In addition, management expects to break-even in non-south markets by FY19E. On the balance sheet front, a higher focus on recovery from debtors has led to a significant decline in debtor days from 104 days in FY16 to 74 days in FY17. Efforts to improve the liquidity of the balance sheet has resulted in a reduction in debt to the tune of 35% to Rs 125 crore as on FY17. The stock price has run up nearly 2x since our last update, however we feel there is more headroom given the strong earnings trajectory and attractive valuation (1.1x and 0.9x Mcap/sales for FY19E and FY20E). Hence we assign a BUY rating with a revised target price of Rs 405 (based on 1.0x FY20E market cap/sales).”

The stock has surged like a rocket from Rs. 360 to the CMP of Rs. 600, turning the target price of Rs. 405 projected by ICICI Direct into a distant memory.

Stellar set of numbers from Butterfly Gandhimathi Appliances:

Net profits at Rs 11.5 crore vs Rs 0.5 crore

Finance cost halves— nickey (@OnlyNickey) November 7, 2017

Is Butterfly Gandhimathi the “Next Hawkins Cooker, CERA etc”?

Old timers will recollect that Hawkins Cookers was once the crown jewel of Dolly Khanna’s portfolio.

She has raked in incalculable gains from the stock.

However, when Hawkins Cookers started to flounder and began to lose its leadership position to upstarts, Dolly dumped the stock like a hot potato and went seeking greener pastures (see Dolly Khanna Escapes Hawkins Cookers’ Carnage Even As Punters Rue Their Luck)

We saw the same thing happen in Cera Sanitaryware, which was also one of Dolly Khanna’s high conviction picks.

When the valuations got too hot for comfort and the stock started underperforming, Dolly bid adieu to the stock but not before pocketing multibagger gains from it (see Dolly Khanna Does It Again. Escapes Carnage In Cera Sanitaryware).

Prima facie, Butterfly Gandhimathi appears to be in the same position that Hawkins Cooker and CERA were before they started their upward journey.

If so, we can confidently predict that Dolly Khanna and Ashish Kacholia will rake in multibagger gains from Butterfly Gandhimathi as well in due course of time!

Is it proxy play to housing for all???

Can you please share you insights on what tail winds are present for the speciality chemicals sector?

Shyam sekhar has entered Manugraph India