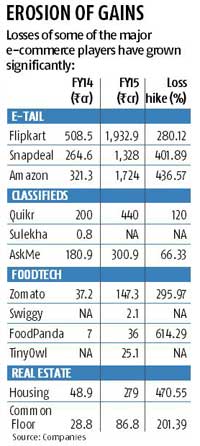

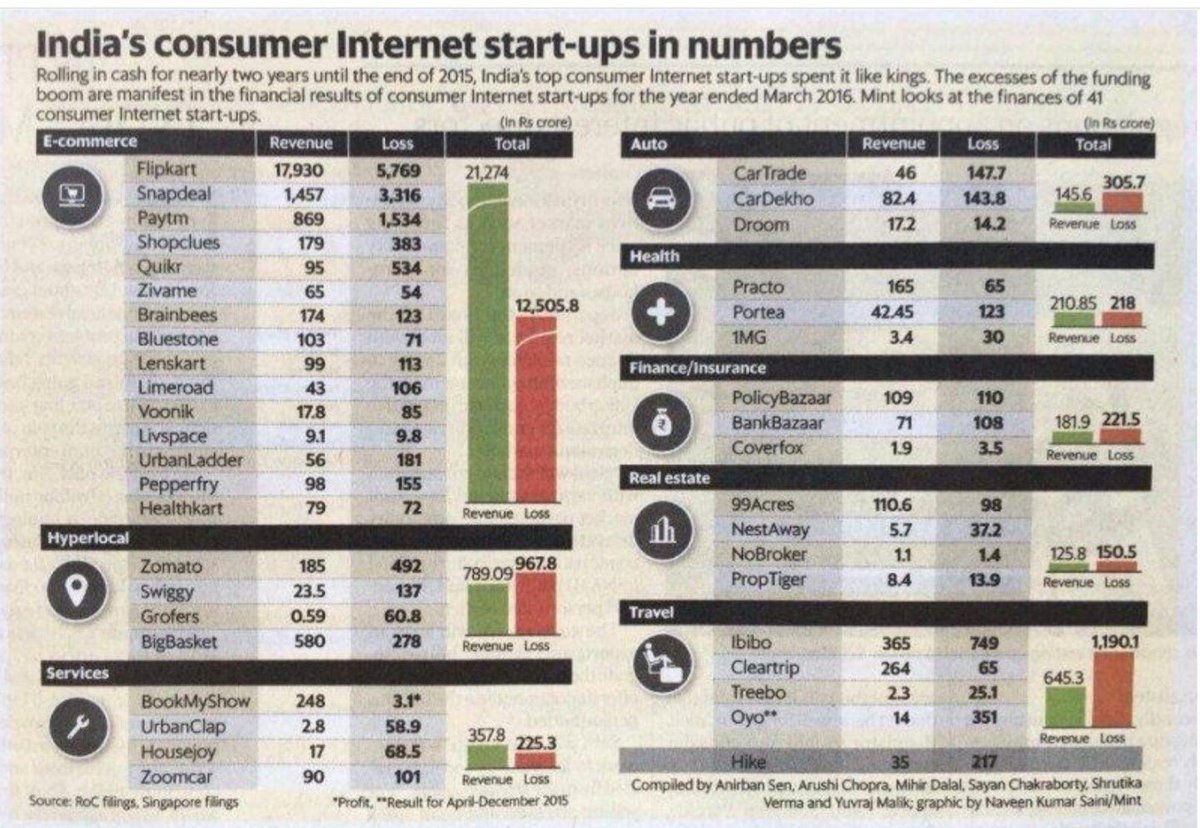

Colossal losses suffered by all e-com companies

The losses suffered by e-com companies make for frightening reading.

Flipkart leads the list with a loss of Rs. 5,769 crore. It is followed by other worthies such as Snapdeal, PayTM, Quickr etc.

This is the actual pathetic state of our ecommerce companies. Barring the odd Bookmyshow,everything else on the verge of Bankruptcy. pic.twitter.com/bvps7RQGwU

— Arun Mukherjee (@Arunstockguru) February 12, 2017

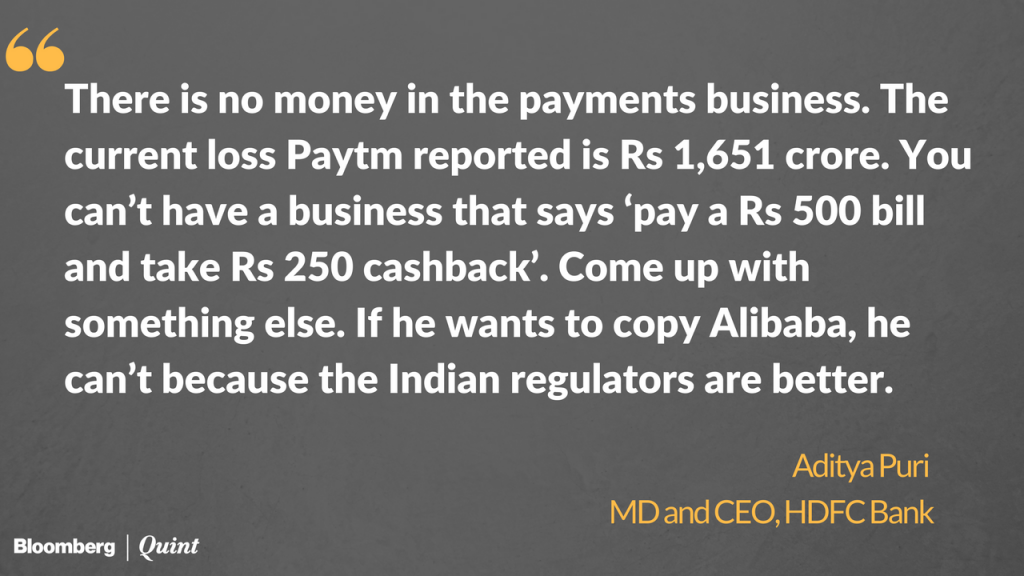

Business model of PayTM and other wallet companies is not sustainable: Aditya Puri

Aditya Puri, the CEO of HDFC Bank, is the quintessential staid banker. His financial acumen cannot be taken lightly given the growth and dominance of HDFC Bank during his tenure.

Puri has bluntly described PayTM’s business model as unsustainable.

“I think wallets have no future. There is not enough margin in the payment business for the wallets to have a future … Wallets as a valid economic proposition is doubtful. There is no money in the payments business. The current loss reported by market leader Paytm is Rs1,651 crore. You cannot have a business that says pay a Rs500 bill and take Rs250 cash-back,” Puri said.

“When I talk to consumers they say only till he (e-wallet companies) gives us the cash back, we’ll go there ….. Is this wallet any better than mine, other than a cash- back? I don’t have a Rs1,651 crore loss. You eliminate the loss, then we will talk,” he added in a contemptuous tone.

Vijay Shekhar unfazed by doomsday talk?

Vijay Shekhar, the Billionaire founder of PayTM, appeared to unfazed by Aditya Puri’s concerns.

He tweeted a link to Aditya Puri’s rant and called it “#superb insights” tongue in cheek.

#superb insights https://t.co/YkWqh7zjfC

— Vijay Shekhar (@vijayshekhar) February 17, 2017

Vijay Shekhar also found support from influential quarters:

Time to short @HDFC_Bank stock. Their MD is clueless abt tech 🙂 https://t.co/ci1OukvrKF

— Mahesh Murthy (@maheshmurthy) February 17, 2017

Paytm nearing No of Sbi accounts now .A pigeon closes eyes on seeing a cat, thinkin she doesnt exist https://t.co/5ckyy81bkH

— Haresh Nagpal (@nagpalharesh) February 18, 2017

Flipkart has “Bad DNA” & will not make it: Mohnish Pabrai

Mohnish Pabrai, the visionary stock picker, has condemned Flipkart for having “Bad DNA”. It is “not gonna make it” he declared confidently in a grim tone.

I don't short, but if I did, l'd short Flipkart. Not gonna make it. Bad DNA. https://t.co/sWYlbfJSXv

— Mohnish Pabrai (@MohnishPabrai) February 10, 2017

@MohnishPabrai two rules of doing business 1) never bet against @JeffBezos 2) don't forget rule no. 1

— Dhruva Pandey (@Dhruvapandey) February 10, 2017

So @Flipkart 'dumped' 24,000cr foreign capital here to kill @indiaplaza etc But wants govt to stop @amazonIN 'dumping' 15,000cr against it:)

— Mahesh Murthy (@maheshmurthy) February 10, 2017

So @Flipkart wants level playing field with @amazonIN ? Start by cutting top exec salaries by 80%. Overpaid underperforming crybabies. pic.twitter.com/xhZltL4Vop

— Mahesh Murthy (@maheshmurthy) February 10, 2017

First, show me Flipkart’s business model before talking about valuations: Rakesh Jhunjhunwala

Rakesh Jhunjhunwala, the Badshah of Dalal Street, was the first to recognize the unsustainable business model of e-com companies.

When the Badshah was asked whether the valuations of the e-com companies are “irrational”, he roared with contempt:

“Irrationality of valuations? Forget that, forget the valuation, where is the completed business model? I want to know Flipkart’s business model. I want to know how you will be profitable? Second is if you look at any company in the world, the real companies who have given returns to investors had been built by the cash flows of those businesses, not by investors’ money. When are these cash flows going to come?”

I Am Confident Internet/ E-Com Stocks Will Crash: Prem Watsa

Prem Watsa, the self-made Billionaire who is fondly referred to as “the Warren Buffett of Canada” for his brilliant investing acumen, said he is “always amazed” at the “continuing speculation reflected in the stock prices of public high tech companies”.

“We’re confident that most of this will end as other speculations have – very badly!” is the bone-chilling prediction of Prem Watsa.

E-Com Investors Are Guaranteed To Lose Big Money: Samir Arora & Mark Cuban

Samir Arora & Mark Cuban, both whiz-kid investors in their own right, have sounded the red alert that investors in e-com ventures should bail out while they can.

Samir Arora mocked e-com investors in his typical style:

“What do you call valuations of Indian internet companies? Kehte hai isko hawa hawaii, hawa hawai, hawa hawaiiiiiii.”

What do you call valuations of Indian internet companies?

Kehte hai isko hawa hawaii, hawa hawai, hawa hawaiiiiiii.— Samir Arora (@Iamsamirarora) March 5, 2015

Mark Cuban, an internet entrepreneur who made millions from his website, was more somber in his warning:

“If we thought it was stupid to invest in public internet websites that had no chance of succeeding back then, it’s worse today … I have absolutely not doubt in my mind that most of these individual Angels and crowd funders are currently under water in their investments. Absolutely none. I say most. The percentage could be higher” he said.

Losses of Flipkart, Amazon & Snapdeal would have allowed ISRO to go to Mars 24 times

Chhavi Tyagi & Anu Thomas of ET have conducted a detailed study to understand the reasons for the losses suffered by three of the major e-com companies, Flipkart, Amazon & Snapdeal.

The duo points out that the losses of the big three presently stands at Rs 11,754 crore and that it is “mounting at an alarming pace” and has “more than doubled in the fiscal year 2015-16”.

“While keeping up the fight is bleeding all the players and with coexistence not an option, it is time for the Big Three to change track before mounting losses bury them all,” is the grim warning issued by the duo.

Is Snapchat IPO worth Rs. 1,43,000 crore?

The astonishing aspect is that despite the sincere warnings and well-meaning advice of the old-school investment legends, the appetite amongst the new age investors for e-commerce ventures shows no signs of waning.

Snapchat, an app for teenyboppers, is coming out with an IPO in the next few days. The IPO is valued at $22 Billion which is equivalent to an eye-popping Rs. 1,43,000 crore.

Snapchat suffered a net loss of $515 million in 2016, on revenue of $404 million.

Snapchat’s top brass has made a detailed presentation on the revenue model of the Company and why the IPO is a compelling investment opportunity.

Snapchat is over priced, 20-25 billion!!!! That's nuts, its 60 multiple valuations.$snap pic.twitter.com/rfWXNW00bC

— Rami Alnajjar ♞ (@veryFatcat) January 20, 2017

If Snapchat can ask for 22 billion for losing data, MongoDB should be worth 22 trillion. Also: I hate Silicon Valley's screwed up valuations

— Michael DeHaan (@laserllama) February 17, 2017

Conclusion

Prima facie, it appears that the old-school investors know what they are talking about when they insist on cash flows and valuations before making an investment. The new age investors would do well to pay heed to this advice and bail out of the mess when they still can!

All models will survive but very thin margins,as in long term it is only innovative product that can command premium.These are no more tham logistics companies and will have margins just to survive but will never make huge profits.

What did these old investors think abt Facebook 5-7 years ago?

Mahesh Murthy, “Overpaid underperforming crybabies”. Sir yes sir, I agree. I also never thought e-wallet businesses are any good, in fact I always feel they are just over glorified.

Next I don’t usually appreciate people but this is quite unbiased and extremely well written.

There is a story that Mahesh Murthy himself wanted to buy stake in Flipkart but was turned down by Bansals. So he started speaking against them. Then when Flipkart raised huge money, he said he was wrong and Flipkart will do well. Now again Flipkart seems to be in trouble to Murthy says its a bad business model. Fact is he knows jack$hit. Just got lucky so he can give any gyaan. I have 100 times more respect for the founders of these companies who are at least doing something. What value do people like Murthy add?

I agree with you. It will be interesting however to see who will,be wrong or,right in the long run. On a pure business model, nobody in their right mind would invest in a loss making business. On a hype and marketing mirror style model, when will the demand and lure in people’s mind fade. Basically it nobody ever accepts the truth, then flip kart and others will keep astronomical valuations. If people accept the truth that the company is losing money, then it will collapse. But so is that saying sheep follow in droves. Becuase flip kart cleverly boasts that they have a huge customer base and following, then nobody will accept the truth that it means nothing without profit. Where there is a huge crowd, people always thinks,it must be a popular entity with huge potential.

when a sheep jumps in to a river other sheep will follow–let us hope people will not do the same

Will IPO of snapchap pave way for all other e-commerce companies? This will surely give clarity in opinion of these investors.

PayTM has grown very fast which is commendable. Unfortunately, it is not responsive to complaints from customers. There are scores of PayTM complaints which go unanswered.