Practice what you preach – Buy when valuations are rock bottom

One of Mohnish Pabrai’s famous 10 commandments is that investors should rush in to grab stocks when they are quoting at rock-bottom valuations.

“When I was going through the financial crisis, what was exciting was just the sheer number of investment opportunities. While your portfolio is burning and crashing, you are seeing mouth-watering investment ideas .. I sold cheap stocks to buy cheaper stocks,” he said, reminiscing the glorious days of 2008 when Blue Chip stocks were available at the throw-away valuations of penny stocks (see My Networth Plunged But I Still Kept My Head: Mohnish Pabrai Reveals Top 10 Commandments For Success In Stock Market).

A similar golden opportunity came our way in September 2018 when high-quality NBFC stocks sank like stones over the ILFS liquidity crisis.

All housing finance companies crack!

DHFL now down 25%

Indiabulls Housing down 10%

Repco down 5%

Can Fin down 5%— Mubina Kapasi (@MubinaKapasi) September 21, 2018

NBFCs thrashed

— Darshan Mehta (@darshanvmehta1) September 21, 2018

Chola Fin, Dewn Hsg, Indiabulls Hsg, Shriram Transport – all these stocks down and how !!

— Yatin Mota (@YatinMota) September 21, 2018

DOWN 20% NOW… whats going on here ? https://t.co/qYnpefY4Dl

— Yatin Mota (@YatinMota) September 21, 2018

As many as 60 stocks 4m NBFC space fell up to 50% so far in Sep. including names like DHFL(down 57%),Rel Cap (down 34%), Baj Fin (down 22%) et al on d back of debt mkt liquidity concerns. Near term risks and NIM compression seem to have already been factored into stock prices.

— Jagdesh (@cjrsaaketa) September 25, 2018

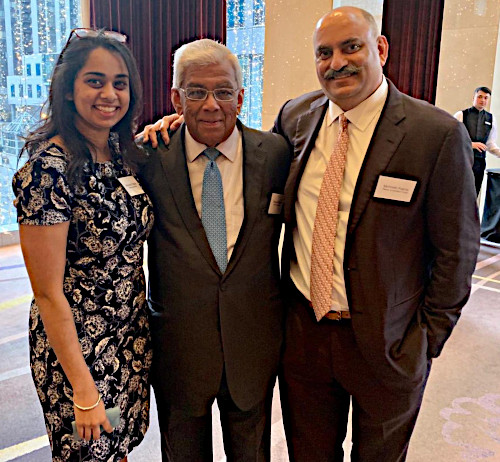

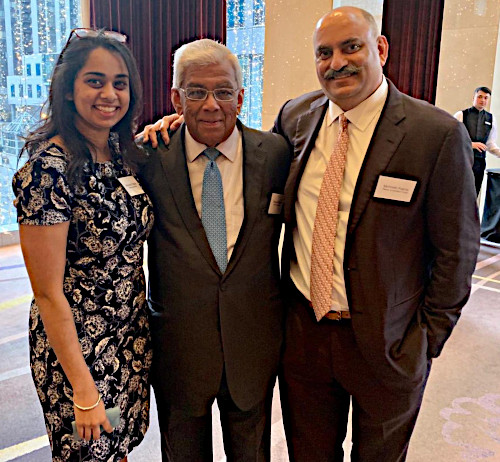

(Mohnish Pabrai with Billionaire Prem Watsa, the “Warren Buffett of Canada“, and charming lady)

Three Billionaires advised that we should grab NBFC stocks

Billionaires normally stay aloof from novice investors and do not offer stock picking advice.

However, in September 2018, three eminent self-made Billionaires, namely Ajay Piramal, Nirmal Jain and Rashesh Shah, could see what novices could not, namely, that the mouthwatering levels at which high-quality NBFC stocks were then available was a god sent opportunity.

They spoke in one voice and advised investors to grab the stocks with both hands.

“Things have started to settle down in the NBFC space with capital flowing much easier than few days back,” Ajay Piramal said in a soothing tone.

“NBFC sector fears are exaggerated,” Nirmal Jain declared in a firm tone.

He blamed “rumour mongering and panic” for the crash in stock prices.

Rashesh Shah made it as plain as one could. He reminded us of the timeless wisdom of Warren Buffett – Be greedy when others are fearful.

These are the times to revisit Buffet…. Be fearful when others are greedy and greedy when others are fearful https://t.co/1Jux9Yj9bL

— Rashesh Shah (@rasheshshah) October 25, 2018

#EXCLUSIVE | Things have started to settle down in the NBFC space w/ capital flowing much easier than few days back. Ajay Piramal of @PiramalGroup says NBFCs are critical for the growth of the country as they lend to MSMEs which are the backbone of the country. @Ajaya_buddy pic.twitter.com/YvPwR6r7ne

— ET NOW (@ETNOWlive) October 9, 2018

I think NBFC sector fears are exaggerated. Sector has robust regulatory framework, is growing well helping financial inclusion-nation’s growth by delivering credit to underserved! Excessive panic can cause heart attack in a healthy body. Equity sentiment alwys moves in a pendulum

— Nirmal Jain (@JainNirmal) September 26, 2018

My views on NBFCs- as published in ET- NBFCs role in nation’s growth notwithstanding the current crisis

Don’t throw the NBFC baby out with the bathwater https://t.co/ulFwBqd7u7 via @economictimes

— Nirmal Jain (@JainNirmal) November 6, 2018

No NBFC, other than IL&FS has actually defaulted or shown any sign of distress or liquidity issue till now. Yet so much of rumour mongering and panic. In fact mutual fund, CP squeeze Sept rollover have been acid test for the sector. We must listen at data, facts and not hearsay

— Nirmal Jain (@JainNirmal) October 9, 2018

Keki Mistry, the boss man of HDFC, also contributed by confidently asserting that the “crisis has been resolved” and “confidence has returned to the NBFC industry“.

Very imp takeaways from interview with Keki Mistry ,HDFC

– Confidence returned to the NBFC industry

– Commercial papers have been rolled over or redeemed

– no need for liquidity window by RBI since crisis has been resolved

– IL&FS was a stray case, dont expect a repeat— Sonia Shenoy (@_soniashenoy) November 16, 2018

Needless to say, today, a few months later, the so-called ILFS crisis is a forgotten memory now.

All Bank and NBFC stocks are now surging to new highs.

#CNBCTV18Market | Nifty Bank hits record high, crosses earlier level of 30,269 pic.twitter.com/xxYEaYdBOe

— CNBC-TV18 (@CNBCTV18Live) March 28, 2019

What a class show from this company.. The #NBFC crisis was supposed to separate the men from the boys, and its happening now. 40% AUM growth with improving margins. Mgmt confident of sustaining the momentum. #stocks #earnings #Bajajfinance https://t.co/HKEqxzoS32

— Surabhi Upadhyay (@SurabhiUpadhyay) January 29, 2019

(Mohnish Pabrai with Billionaire Nirmal Jain)

Mohnish Pabrai buys Edelweiss Financial Services

Mohnish was amongst the few scouting for high-quality NBFC stocks during the great crisis.

He found what he was looking for in Edelweiss Financial Services, the NBFC founded by Billionaire Rashesh Shah.

As of 31st March 2019, his ‘The Pabrai Investment Fund Iv, Lp’ holds 1,07,52,000 shares, comprising 1.15% of the equity capital.

The investment is worth Rs. 194 crore at the CMP of Rs. 180.

Rakesh Jhunjhunwala, the Badshah of Dalal Street, is one of the oldest shareholders of Edelweiss.

In fact, it is believed in Dalal Street that it is Rakesh Jhunjhunwala’s support and encouragement that helped Rashesh Shah overcome his hurdles and difficult days and become the spectacular success that he now has.

Rakesh Jhunjhunwala holds 1,00,00,000 shares of Edelweiss as of 31st March 2019.

[Watch] @rasheshshah, Chairman& CEO, @EdelweissFin, opens up about his early life, how he bet his house to start the company, and how he emerged from the toughest times, only at Moneycontrol Townhall at Club – The A.https://t.co/oFzJYTHCF4

Experience partner: @theaupdates pic.twitter.com/x1RNVWNzyL— moneycontrol (@moneycontrolcom) April 16, 2019

“You can’t exactly say how the river will flow, at what pace it will flow, But the river will flow.” Mr. @rasheshshah Chairman & CEO, Edelweiss Group sees more opportunities than challenges in the Indian economy. Read the full article here: https://t.co/zHioON130d

— Edelweiss Group (@EdelweissFin) April 8, 2019

Edelweiss #9MFY19 results – PAT up by 22% YoY at 763 cr, total revenue up by 25% YoY at 7,944 cr, RoE excluding Insurance at 18.1%. PAT CAGR 34% over FY12. Read more: https://t.co/btAbfpEzmD pic.twitter.com/hqcV4pyuOz

— Edelweiss Group (@EdelweissFin) January 24, 2019

(Mohnish Pabrai with Deepak Parekh, the “Bhishma Pitamah” of the NBFC Sector)

Mgts call him 'Bhishma Pitamah' of #housingfinancesector

Some call him 'The Living Legend' of fin services sector

One of the most humble person I have met; he came out to drop a person to lift#Inspirational to many

Mr. Deepak Parekh: Chairman of .@HomeLoansByHDFC#fanmoment pic.twitter.com/fwiStRkRWj— Abhishek Kothari (@kothariabhishek) March 14, 2019

| EDELWEISS FINANCIAL SERVICES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 16,706 | |

| EPS – TTM | (Rs) | [*S] | 1.52 |

| P/E RATIO | (X) | [*S] | 117.83 |

| FACE VALUE | (Rs) | 1 | |

| LATEST DIVIDEND | (%) | 110.00 | |

| LATEST DIVIDEND DATE | 04 FEB 2019 | ||

| DIVIDEND YIELD | (%) | 0.74 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 36.57 |

| P/B RATIO | (Rs) | [*S] | 4.90 |

[*C] Consolidated [*S] Standalone

| EDELWEISS FINANCIAL SERVICES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (CR) | DEC 2018 | DEC 2017 | % CHG |

| NET SALES | 2775.68 | 2205.46 | 25.85 |

| OTHER INCOME | 15.2 | 18.77 | -19.02 |

| TOTAL INCOME | 2790.88 | 2224.23 | 25.48 |

| TOTAL EXPENSES | 1087.24 | 860.53 | 26.35 |

| OPERATING PROFIT | 1703.64 | 1363.7 | 24.93 |

| NET PROFIT | 258.35 | 218.64 | 18.16 |

| EQUITY CAPITAL | 91.14 | 91.14 | – |

Conclusion

It is obvious that after the green signal from Mohnish, there is now no excuse for us to shy away from Bank and NBFC stocks. We should grab one or more of these stocks and add them to our own portfolios when the valuations are still reasonable!

are pabrai and ‘badshah’ adding to their losing position in Edelweiss now? please update.