KRBL plunges 20%

According to the SOP of the RJ Fan Club, stocks owned by famous celebrity investors are kept under 24×7 surveillance.

Every tiny bit of news relating to the stocks is tracked and analyzed by a crack team of experts.

Mukeshbhai, Jigneshbhai and me, the three trusted lieutenants of the Fan Club, take turns at monitoring the stocks.

Today, at 0915 hrs IST, Mukeshbhai was manning the radars and sensors when the first indication came that something was terribly wrong with KRBL.

The stock was sliding as if it was gripped by strong Bear hands.

“Mohnishbhai ke fav stock pe Bear attack ho raha hai,” Mukeshbhai yelled in a tone of panic and urgency.

However, it was too late for us to save the stock. It plunged a mammoth Rs. 94 and tripped the lower circuit of 20%.

KRBL is embroiled in AgustaWestland helicopter scam

The reason for the panic selling in KRBL was an explosive revelation by Atir Khan of Sunday Guardian that a person named Gautam Khaitan, an independent director of KRBL, had allegedly laundered the bribe money in the notorious AgustaWestland helicopter scam case.

Worse, a wholly owned subsidiary of KRBL named Rawasi Al Khaleej General Trading (RAKGT) allegedly played a role in the entire money laundering exercise. It received a massive sum of Rs. 110 crore from various other companies which was meant to be paid as a bribe.

“The ED document accessed by this newspaper says that RAKGT was incorporated in 2007 by KRBL DMCC, Dubai, which itself was incorporated in 2006 as a 100% subsidiary of KRBL Ltd, India. In 2009, the entire stake of KRBL DMCC held in RAKGT was transferred to Potdar, the nephew of the promoters of KRBL Ltd, according to the ED,” Atir Khan has stated in a grim tone.

There is also a report by NewsX which makes the dramatic claim that “KRBL’s role in money laundering case been exposed by NewsX investigation“.

Ayesha Faridi & Tanvir Gill grill top brass of KRBL

Ayesha Faridi & Tanvir Gill are known for their formidable interrogating abilities.

They gave yet another masterful example of their skill by relentlessly grilling Anoop Kumar Gupta, the top brass of KRBL.

Anoop Kumar Gupta downplayed the bribery incident.

He stated that Gautam Khaitan had long resigned from the Company.

He also claimed that KRBL had nothing with the alleged bribery despite the fact that RAKGT, a WOS of KRBL, allegedly played an instrumental part in the transaction.

Anoop Kumar Gupta, KRBL to ET Now

Gautam Khaitan was an independent director from 2007-13, no longer a director with KRBL

I have been questioned by ED as well; KRBL has nothing to do with Agusta deal

Balsharaf wanted to sell shares in KRBL & ED has halted the transaction— Ayesha Faridi (@AyeshaFaridi1) June 25, 2018

#EXCLUSIVE | Anoop Kumar Gupta of KRBL clarifies that KRBL has nothing to do with Agusta deal. Gautam Khaitan was an independent director from 2007-2013. He also mentioned that Balsharaf wanted to sell shares in KRBL & ED has halted the transaction @AyeshaFaridi1 @tanvirgill2 pic.twitter.com/iDbo4CIcYS

— ET NOW (@ETNOWlive) June 25, 2018

Mubina Kapasi and Mangalam Maloo of CNBC TV18 also conducted top-notch investigation into the matter.

Anoop Gupta, KRBL TO @ETNOWlive

Gautam Khaitan an independent director from 2007-2013

'I have been questioned by ED as well'

KRBL has nothing to do with Agusta deal/scam

'ED questioned me on our relation with Gautam Khaitan and Balsharaf'

'I have been questioned by ED 7-8 times'— Mubina Kapasi (@MubinaKapasi) June 25, 2018

KRBL Tells CNBC-TV18

Gautam Khaitan Was Independent Director In KRBL Between 2007-2013

Gautam Khaitan Has Been Arrested & Being Questioned

Co Has No Financial Dealings With Gautam Khaitan

Co Will See No Impact Of The Investigation https://t.co/60r8mCJYZO— Mangalam Maloo (@blitzkreigm) June 25, 2018

Mohnish Pabrai escapes loss of Rs. 150 crore in the KRBL carnage

However, one sensational aspect relating to Mohnish Pabrai’s purchase of KRBL stock emerged from the questioning by Ayesha Faridi and Tanvir Gill.

It may be recalled that Mohnish Pabrai had bought a massive chunk of 64,18,491 shares of KRBL on 12th February 2018 at Rs. 594 each.

The amount invested in the stock was Rs. 381 crore.

The stock was purchased from Abdullah Ali Balsharaf and Omar Ali Obaid Balsaraf.

Unfortunately, Mohnish had purchased the stock at an inauspicious time. It has been relentlessly on a downtrend since then (see Slump In Mohnish Pabrai’s Latest Stock Pick Baffles Punters)

Tanvir Gill point blank asked Anoop Gupta about the fate of this transaction.

“Because of the ED, Pabrai took his money back and the shares have gone back to Balsharaf,” Anoop Kumar Gupta replied.

This is joyous news for Mohnish Pabrai and his fans because it effectively means that Mohnish has been spared a crippling loss of nearly Rs. 150 crore.

This also explains why Mohnish maintained a studied silence about KRBL in his latest interview even though he talked extensively about his other favourite stocks being Rain Industries and Repco Home Finance.

Balsharafs have challenged the ED’s directives

Anoop Kumar Gupta also revealed that the dispute between the Balsharafs and the ED is sub judice at present.

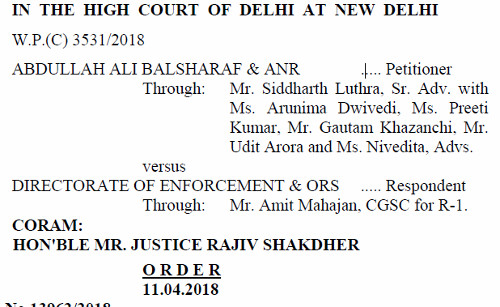

I conducted an investigation into the matter and discovered that the Balsharafs have indeed filed a Writ Petition in the Delhi High Court bearing No. 3531 of 2018.

The case is posted for hearing on 30th July 2018.

Whether Mohnish Pabrai is a party to the Writ Petition is not known.

Also, the consequences of the Balsharafs succeeding in the Petition are not known.

Hopefully, it will have no impact on Mohnish walking away from the transaction!

How many so-called legends have recommended this stock in last few yrs?

I am least surprised by such issues in third class stocks as such stocks historically use to trade between Rs 2 to 20,suddenly were manipulated to higher levels. I had always doubted poor quality stocks and even raised Red Flag when such stocks were discussed here. But it seems every manipulation is fair in a Bull market. Still there is time to get rid of third class manipulated stocks even at loss before it is too late. I am invested in Pvt banking, pvt insurance, good nbfc including HFC, retail, FMCG, paints, and stocks like RIL and L&t, auto, logistics etc.In my view now Indian Stock market is play on 1.3 Billion Consumers which can be very well played with financial and consumption, Stick with top names in these for a long ride.

I hold a little different opinion. Earlier low price should not be the criteria to judge the quality . According to your assertion , Rain is low quality stock as it was available at around in 30s a few years back. By the same same logic of yours,it also means that we get multibagger returns from only low quality stocks as in my view low price does help in getting multibagger returns. In my opinion, efforts should made to find good quality undiscovered stock at low price ,which is quite difficult and patience testing task.Well known large caps are good for Index returns. I also conceed that I could be wrong in my thinking as you are more knowledgeable and experienced.

You could not read between lines , I am talking here about many of these Chawal (Rice)traders and dodhiyays (dairy) .More over exceptions are always there and few among them can do well like Nestle ,is big daddy of doodhiyas has done very well world over .More over I feel that ITC is already betting big on these agri and food including milk products , all such small players will be wiped out.

Investing is a game of skill and luck.Otherwise,how could an astute investor like Mohnish Pabrai,whome I keep in high esteem,be wrong in selecting a company like KRBL although he has always emphasised the significance of quality of the management.

I am a small invester but I feel Quality of stocks of Mohnish Pobrai are questionable and can only perform in bull market , I will be surprised if these can sustain in uncertain markets like now but I reserve my right to be wrong.My view is even worse about a well known third grade stock picker.Just my personal view with due respect to all big stock Gururs , no recommendations to buy or sell.

Kharb can you list out your picks so that we can do some research on those

I think we should follow the sane advice given by kharb.

Kharb, as requested by Shyam, can you list your picks.

Thanks