MMB punters fret over slump in KRBL

“Mar Dala KRBL Ne logo ko indiagate brand fail,” Jigneshbhai said with disgust in his tone.

He vented his anger by forcefully spitting his mouthful of Gutka into a pit which had been freshly dug up by the BMC.

Mukeshbhai also had a mournful look on his face.

“This scrip is worse than SBI!,” he muttered under his breath.

Shyambhai, the wizened proprietor of Shyam’s Tea Stall, sympathized with the duo.

He handed over a sachet of Kamala Pasand to Jigneshbhai.

“Kamala Pasand khao. Sab theek ho jayega,” he assured Jigneshbhai in a soothing tone.

Shyambhai himself does not do any punting.

However, because Shyam Tea Stall is the nerve center of Dalal Street, he keeps tabs on who is buying which stock.

When the news flashed that Mohnish Pabrai had bought a massive truckload of KRBL, all punters had rushed in to stake their claim to the stock.

The excitement of the punters is understandable because Mohnish’s last stock pick, Rain Industries, has blossomed into a magnificent 10-bagger.

In such circumstances, one must buy first and think later, according to the credo of Dalal Street.

(Dalal Street Punters)

Notional loss Rs. 100 crore

Unfortunately, the game for the punters has not gone as per plan.

KRBL has been sinking like a stone since Mohnish’s purchase.

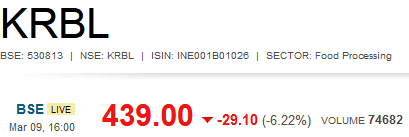

Mohnish bought his consignment of 64,18,491 shares on 12th February 2018 at Rs. 594 per share. Thereafter, the stock surged to a high of Rs. 638 on 14th February 2018.

At the CMP of Rs. 439, the stock is down a whopping 32% from the peak price of Rs. 638.

From Mohnish’s price point of Rs. 594, the stock is down 26%.

This means that there is a notional loss of Rs. 155 per share which works out to a mammoth sum of nearly Rs. 100 crore on the investment made by Mohnish in KRBL.

Other basmati stocks are surging

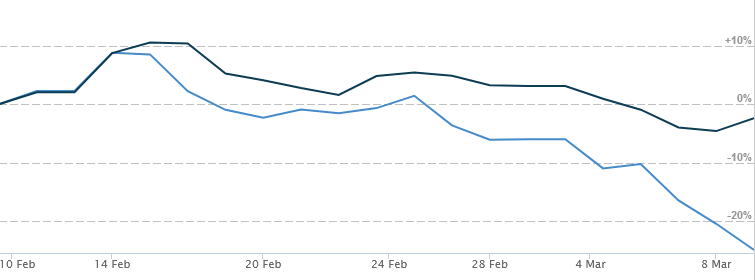

The baffling aspect is that KRBL’s arch rivals such as LT Foods (Daawat), Chaman Lal Setia Exports, Kohinoor Foods, Gujarat Ambuja Exports and others are surging like rockets.

This is because the prices of basmati rice are rising owing to a surge in demand and a fall in supply.

“Rice prices rose in top exporter India this week on healthy demand amid lower supplies,” Arpan Varghese of Reuters reported.

He pointed out that the prices of 5 percent broken parboiled rice have risen by $3 per tonne to $422-$426 in the wake of heavy demand from African and Asian countries.

Even Bangladesh, which is otherwise an exporter of basmati rice, is importing the product because the recent floods have played havoc with the crop.

Arpan Varghese opined that the demand from Bangladesh would remain strong for the next few months because basmati rice is a staple diet amongst the locals there.

This news was corroborated by Sonam Mehta and Deepali Rana of CNBC Awaaz, both of whom keep their ears to the ground and are prompt in reporting.

KOHINOOR FOODS/ KRBL/ LT FOODS/ GUJARAT AMBUJA EXPORTS / CHAMANLAL SETIA

India rice rates up on steady demand; stronger baht props up Thai rates https://t.co/0I9ZX3ourI— SONAM MEHTA (@sonamcnbcawaaz) March 9, 2018

In Focus: Kohinoor Foods, LT Foods, KRBL, Guj AMbuja Exports

Rice prices rose in top exporter India this week on healthy demand amid lower supplies, while gains in the local currency and prospects of a deal with the Philippines pushed up rates for the staple grain in Thailand.— Deepali Rana (@deepaliranaa) March 9, 2018

(KRBL (light blue) vs. LT Foods (dark blue))

Who is dumping KRBL?

MMB Punters are famed for their sleuthing abilities.

One punter speculated that the Balsharaf’s may be the culprits.

Prima facie, there is merit in this theory.

The Balsharaf Group, a business house in Saudi Arabia, holds a massive chunk of stock in KRBL.

The stock was bought in November 2003 at the throwaway price of Rs. 90 per share.

As of 31st December 2017, Omar Ali Obeid Balsharaf and Abdullah Ali Obeid Balsharaf collectively hold a massive oil-tanker load of 150,00,000 shares of KRBL.

The duo sold off a chunk of 65,00,000 shares on 12th February 2018, all of which was bought by Mohnish Pabrai.

It is possible that the Balsharafs are frequenting Dalal Street looking for someone to buy the rest of their holding in KRBL.

This may explain the weakness in the stock.

Anil Kumar Goel is yet another possible culprit to whom the needle of suspicion is pointing, according to the MMB punters.

As of 31st December 2017, Anil Kumar Goel and his PAC Seema Goel collectively hold 118,87,000 shares of KRBL.

We have seen earlier that Anil Kumar Goel has a penchant for periodically tinkering with his portfolio.

He sells small bits and pieces of his crown jewel stocks if a more compelling investment opportunity comes by and funds are required to be raised.

Further, given the size of stake that the Balsharafs and Anil Kumar Goel hold in KRBL, it is not known at what stage they will be satiated with the selling, another punter pointed out.

Varinder Bansal gives novices a rap on the knuckles

The incessant fretting by Mukeshbahi, Jigneshbhai and the other punters, bemoaning their fate, irked Varinder Bansal, the former anchor with CNBC TV18 and now a honcho with Pantomath Asset Management, a PMS Fund.

“If you cannot suffer pain in the equity market, don’t expect any gains,” he yelled in a stern tone.

“Patience & conviction are the biggest virtues for wealth creation. Always buy a part of the business and not a stock,” he added with a fiery look in his eyes.

Varinder knows that when novices are hysterical, they must be dealt with sternly with a firm rap to the knuckles. It is futile to reason with them.

If you cannot suffer pain in the equity market, don’t expect any gains. Patience & conviction are the biggest virtues for wealth creation. Always buy a part of the business and not a stock.

— Varinder Bansal (@varinder_bansal) March 9, 2018

“Buy only if u know what u r buying as a BUSINESS having +ve cash flows,” he quipped, echoing the timeless wisdom of Warren Buffett.

BIG lessons from NEW INDIA CONCALVE

Fall is painful

No-one knows the bottom

Buy only if u know what u r buying as a BUSINESS having +ve cash flows

Be nimble footed as an investor

Think long term as an equity investor

Don’t leverage & buy at all

Don’t be adventurous in day trading— Varinder Bansal (@varinder_bansal) March 9, 2018

You buy real estate, pay interest & wait for 2-3-4-5 years for project to get completed and no tax benefit & no liquidity & no clue of appreciation. But u don’t want to wait for even a year in equity markets. Why? Only because of emotions & daily noise. Buy business & not stock.

— Varinder Bansal (@varinder_bansal) March 9, 2018

Golden opportunity to buy the stock?

In my earlier piece, I have drawn attention to the opinion of leading experts like Manish Bhandari of Vallum Capital, Ambit Capital and HDFC Securities, all of whom have opined that basmati stocks in general and KRBL in particular is an excellent buy.

This is confirmed by Karvy in its latest research report.

The buy recommendation is issued in clear-cut terms:

“Growth Story Continues…

KRBL Limited posted consolidated revenue of Rs. 7835 mn in Q3FY18 which is down by 1.8% as against Q3FY17 on YoY basis, but 9MFY18 revenue of Rs. 23705 mn is up by 6.1% against corresponding period of FY17 on YoY basis.

The shift in preference for branded rice, increased restaurant cultures and rise in personal income contributed in domestic sales’ growth, while export growth remains subdued amidst volatile international price.

However, basmati exports could rise in FY18-19E due to steady global demand and strengthening of economies in Gulf region following rise in crude oil price.

We believe that global and domestic conditions are supportive for basmati rice. Hence, we rate “BUY” on the stock with TP of Rs. 635 which gives a potential upside of 21%.

Segmental Performance:

India agri business in Q3FY18 at Rs. 5036 had flattish growth on YoY basis. However, 9MFY18 India agri business moderated to -3% on YoY basis.

India agri business contributed 67% while rest of the world contributed 33% in total agri business in Q3FY18 on YoY basis, whereas 9MFY18 India agri business stood at 56% while rest of the world stood at 44%.

Thus, the company witnessed to good pick up in the domestic demand, while export demand did not pick up proportionately mainly because of volatile international price.

Energy business is purely a domestic play which came at Rs. 503 mn in Q3FY18 registering 74.7% growth on YoY basis. 9MFY18 energy business stood at Rs. 1538 mn, registering growth of 33.9% on YoY basis. Further, government’s thrust on power is expected to stimulate demand for energy. The company has long term contract with state governments for Solar and Wind power.

Outlook & Risks

With growing demand amidst lower harvest, value added products, extensive distribution channel and sound financials, likely export order from Iran and improving gulf economies – the key basmati rice consuming region price realization for the company will further improve.

The stock is currently trading at P/E 19.9x which is at discount to industry P/E of 35.

Seeing business potential, we value the stock at 1 Yr Forward P/E 24x of FY20E EPS which gives TP of Rs. 635 with potential upside of 21% and rate “BUY” on stock for next 9-12 months.

However, already high basmati rice price may prove to be deterrent to the overall demand.”

Conclusion

Prima facie, this is a golden opportunity for us to outsmart Mohnish Pabrai by buying KRBL at a price which is lesser than what he paid for it. However, the only doubt is whether the Balsharafs and/ or Anil Kumar Goel are still going to dump the stock or not. We can buy in bits and pieces and buy more if the price dips further. This way, we will enjoy the best of both Worlds!

Many stocks and sector comes to limelight in every bull run from Nowhere. It seems with end of Mid Cap rally, rice stocks should also trade at fair value and when stocks will approach down their fair value, investers will be more than surprised. Rice stocks are not FMCG, it is pure commodity and sooner investers will learn, better it will be.

Yes that is why if you track the retail prices of daawat you will notice a 20% rise if im not mistaken in price.

Kharb you need to ask the people who cook biryani .Which basmati rice do they use and are the willing to switch brands. You will get ur idea on what quality and brand is. It’s like saying parachute is commodity . Sometimes brand and quality matter specifically what u consume. The taste matters.

I may agree but only partially. But look at numbers of customers you are talking. Look at FMCG companies customers profile, from super rich to poorest use HUL, ITC, Dabur, colgate, Godrej consumer, Britania etc . But only rich will use Rice as brand and there too every Second Baba will come with his packaged Rice to compete along with hundreds of Rice brands already competing, may be few will have more share. In my view margins may become wafer thin in future. Just a personal view as a Rice Customer. I am not talking about any stock performance, as I have seen even closed companies share trading at several thousand per share , Mazda Industry stock price during Harshad Mehta time may be for example only. More over I fear PSU Scam may come to Haunt many Bonless Creatures of Stock market who are showing performance on PSU Bank Loans, just my guess, not specific to any stock.

In Terms of market Basamati rice has a huge market as it can be exported to any rice consuming country and basmati rice has a huge shelf life unlike .FMCG is confined only to Indian consumers. . Also on your point on competition you can check the quality of India Gate Classic and test its quality against any other competing product . You will say Biryani made out of India Gate Classic is the best.On the price point because its a rich food one would pay premium for better quality basmati rice as its not a daily consumption food. These are my thoughts based on my research with consumers.

KRBL is a great stock but overvalued. What is the lesson to be learnt ? Never buy stocks at crazy valuations. KRBL at 300 would be a great buy at 400 would be a good buy and at 500 a risky buy. Though after time correction, it would cross even 600.

Mohnish usually does not enter a stock unless he sees 10x upside. As per his interview all his buys have dipped after he buys but he keeps the conviction, He has a concentrated bets portfolio strategy and if you look at his bets they are hardly 6 unlike dolly khanna and Proinju who have 40-45 stocks.

Rain industries, Balaji amines, Sunteck realty, Kolte patil and Oberoi reality ( not sure) apart from KRBL…

Obviously he sees something in KRBL which is not very obvious based on financial parameters… Saudi investors existing the stock could be a good opportunity to get this stock at attractive valuations.

I think its time o sell KRBL, its dominance as one and only high quality rice provider is coming to end. More and more players have now entered the play field. 360 is max risk one should take on it, if price goes below 360, its better to exit and look for better investment opportunity.

New shareholding pattern released doesn’t mentions Monish Pabrai’s name.

Can anyone explain he bought large chunck of shares amounting to 2.71 % of total shares.

His holding shown in ICCL column he increased his holding by purchased more than 76000 shares more Bcoz he is Forign base investor Indian clearing corpn take time to settle his holding in his ac it will be shown in his name in next qtr if he hold

Hi Dheeraj,

can you please share the link where ur seeing that his holding is increased by 76,000 shares.

I was checking “http://www.icclindia.com/” website but couldn’t find it.