After KRBL, narrow escape from Care Ratings

Nobody can dispute that Mohnish Pabrai has the luck of the Devil.

Some of his investment decisions have landed up in serious trouble.

However, Providence has always bailed him out.

KRBL is a classic example of this.

Mohnish bought a massive truckload of the stock in Feb 2018 (see Is Mohnish Pabrai’s Latest Stock Pick A “Screaming Buy” Multibagger Or An Overvalued Compounder?)

Now researching, what crying bargain has @MohnishPabrai seen in KRBL at Rs 600/share and 33 times earnings.

— Rajeev K (@rk_health) February 13, 2018

He was enticed by the business model of the Company, which entails converting raw rice into Basmati and selling it to customers under the brand name “India Gate” at massive premium.

Naturally, such a business model is expected to churn out mega multibagger gains for investors.

Unfortunately, KRBL got embroiled in nefarious activities such as the “Augusta Westland Helicopter Scam” and the stock price tanked like a ton of bricks.

To Mohnish’s good luck, the Enforcement Directorate ruled that his purchase of KRBL shares from the Balasharefs was null and void.

This spared Mohnish a crippling loss of Rs. 150 crore (and counting) and he and his fans heaved a sigh of relief (see Mohnish Pabrai Escapes Loss Of Rs. 150 Crore As Fav Stock Tanks In Bribery Scam).

CARE Ratings is yet another example where Mohnish escaped in the nick of time and was spared massive losses.

Mohnish’s theory was that credit rating agencies are great investment candidates because they have a “bullet-proof” business model, which is unaffected by vagaries of the economy.

He cited the example of Moody’s, a renowned credit agency, which continues to thrive despite admission of bungling during the great sub-prime crisis of 2008.

He described Moodys as the “prime culprit” of the sub-prime crises because it issued ‘AAA’ ratings to even Junk Bonds and fooled investors.

“There is no business on the planet which has a deeper and a wider moat than rating agencies … they almost have a license to print money …. its a phenomenal business,” Mohnish gushed in admiration in his famous drawl.

Here is the full interview I had with @Nigel__DSouza of @CNBCTV18News last week:

Part 1: https://t.co/c1XOnfwcOo

Part 2: https://t.co/Kkm9LjXOX8@FiatChrysler_NA @maruti_corp @PoloniusHamlet @MoodysInvSvc @spglobal @CARE_Ratings @rain_carbon @SunteckR @koltepatilltd

Enjoy!— Mohnish Pabrai (@MohnishPabrai) October 31, 2018

#JustIn | CARE Ratings: Pabrai Investment raises stake pic.twitter.com/W4xzIz3xPx

— CNBC-TV18 (@CNBCTV18Live) September 28, 2018

However, Mohnish soon realized that the fact that Credit Rating Agencies are able to hoodwink regulators in the USA did not mean that they would be able to do so in India as well.

Mohnish was right because SEBI and SFIO are tough as steel and are able to see through BS and call the bluff.

CARE got hauled up by the SFIO for the role they played in the ILFS scam.

Also, its top brass, a worthy named Rajesh Mokashi, was given marching orders by SEBI.

#Exclusive | @NayantaraRai learns from her sources that the Serious Fraud Investigation Office (SFIO) is probing ICRA & Care Ratings for the role they played in #ILFS Group's fall to disgrace. Watch this exclusive report here:#ILFScrisis #ILFSmess pic.twitter.com/CySEz6ftST

— ET NOW (@ETNOWlive) November 2, 2018

CARE Ratings: Send MD Rajesh Mokashi On Leave With Immediate Effect

TN Arun Kumar Appointed As Interim CEO

Decision To Send MD On Leave Post Anonymous Compliant Received By @SEBI_India pic.twitter.com/rfdw6oUX8L

— BTVI Live (@BTVI) July 18, 2019

Naturally, the stock price plunged to levels never seen before.

Stock in Action: Due to poor financial performance and bleak outlook on the rating business Care Ratings cracked again today by 20 percent. Yesterday too, it was down by 20 percent.

To know more about this stock visit: https://t.co/WwFLHKr0MC pic.twitter.com/oNy11j2UNJ

— Marketsmojo (@Marketsmojo) August 2, 2019

However, Mohnish had a wry smile on his face because he had already made good his escape from the junkyard stock.

And Mohnish Pabrai himself downgrades CARE RATINGS as he sold off 4 lac shares @985 purchased @1250 in the month of September'2018#WTF LONG TERM INVESTING MANTRA GOING 2 THE DOGS??? https://t.co/reF3kniaRA

— SURYA N BANERJEE (@banerjeesurya) December 20, 2018

Mohnish suffered a loss in the fiasco. However, it is always better to admit a mistake and book a loss rather than to be defiant and be saddled forever with a junkyard stock in the portfolio.

BSE Ltd – Latest stock pick of Mohnish Pabrai

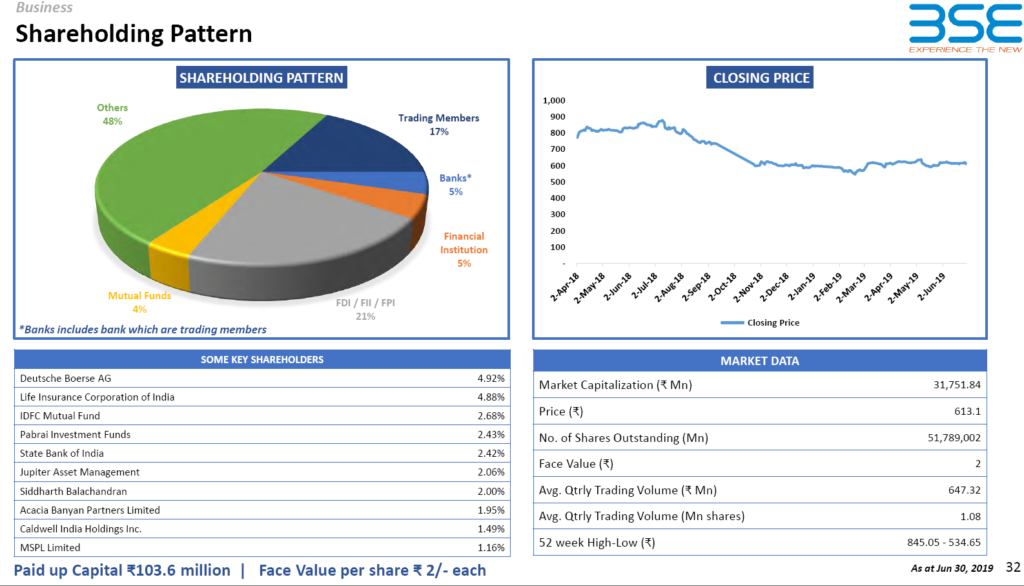

Mohnish’s latest stock pick is BSE Ltd.

He and his assorted PMS Funds hold 2.43% of the equity capital of BSE Ltd.

This information is revealed by the latest investors’ presentation.

| BSE LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 2,401 | |

| EPS – TTM | (Rs) | [*S] | 34.57 |

| P/E RATIO | (X) | [*S] | 13.41 |

| FACE VALUE | (Rs) | 2 | |

| LATEST DIVIDEND | (%) | 1250.00 | |

| LATEST DIVIDEND DATE | 27 JUN 2019 | ||

| DIVIDEND YIELD | (%) | 6.47 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 507.10 |

| P/B RATIO | (Rs) | [*S] | 0.91 |

[*C] Consolidated [*S] Standalone

| BSE LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2019 | JUN 2018 | % CHG |

| NET SALES | 161.19 | 153.8 | 4.8 |

| OTHER INCOME | 11.8 | 16.21 | -27.21 |

| TOTAL INCOME | 172.99 | 170.01 | 1.75 |

| TOTAL EXPENSES | 110.41 | 99.82 | 10.61 |

| OPERATING PROFIT | 62.58 | 70.19 | -10.84 |

| NET PROFIT | 41.32 | 51.5 | -19.77 |

| EQUITY CAPITAL | 10.36 | 10.38 | – |

(Source: Business Standard)

Stock exchanges & brokerages – textbook examples of operating leverage

Prima facie, Mohnish’s decision to invest in the stock exchange cannot be faulted.

This is because stock exchanges (and broking companies) are textbook examples of the benefits of ‘operating leverage‘.

They are able to service large volumes of business with no increase in operating and fixed costs.

This means that the additional margins from the increased business flows directly into the P&L account.

This is the reason why Rakesh Jhunjhunwala and Radhakishan Damani invested in MCX Ltd (the commodities exchange).

(Mohnish Pabrai with Billionaire Charlie Munger)

BSE Ltd is a value buy: HDFC Sec

HDFC Sec has conducted an indepth study of the affairs of BSE Ltd and recommended a buy.

It is emphasized that “Value is emerging with net cash of Rs 20bn (~80% of MCap) and a dividend yield of ~7%“.

It is also pointed out that BSE has been constantly innovating and investing in technology and is building future platforms for growth.

It is emphasized that BSE has huge net cash of Rs 20bn (~Rs 440/sh, ~79% of MCap) which is excluding SGF, earmarked funds, and the buyback amount.

The current dividend yield of ~7% is attractive.

The stock currently trades at 11.1/9.7x FY20/21E EPS (steep discount to MCX valuations).

HDFC Sec has opined that BSE should be valued on SOTP basis by assigning a TP of Rs 320 to CDSL and 25x to BSE’s core earnings (ex-CDSL) and adding back net-cash of Rs 15.8bn (excluding buyback amount and for buyback tax).

The Target Price is Rs 655 (36% upside from CMP), which includes the core BSE value at Rs 169/sh, Net Cash of Rs 351/sh and CDSL stake value of Rs 134/sh.

Yeh Share Kyun Nahi Chalta?

BSE Ltd is notorious for disappointing its investors owing to its sluggish performance on the Bourses.

Anil Singhvi and his colleagues at Zee Business conducted a forensic inquiry into why “Yeh Share Kyun Nahi Chalta – एक अच्छी कंपनी होने के बावजूद जानिए क्यों नहीं चलता BSE Ltd का शेयर“.

The report provides valuable insights into the matter.

What about the NSE IPO?

Some punters at MMB pointed out that BSE Ltd is likely to suffer in the short run because of the overhang arising from the impending IPO of NSE Ltd.

NSE Ltd is the arch rival of BSE Ltd and is generally more preferred by investors and speculators when trading because its volumes are higher.

It may be recalled that NSE is presently in the dog house because it has been banned by SEBI from accessing the capital markets for its alleged role in the ‘co-location’ scam.

However, Vikram Limaye, the boss man of NSE Ltd, opined that SEBI will give clearance for the IPO after the 6-month ban period gets over.

NSE files IPO papers with Sebi, looks to raise Rs 10,000 crorehttps://t.co/NWPmJyC20j pic.twitter.com/YoB7WUOiEZ

— Business Standard (@bsindia) December 29, 2016

Prima facie, NSE’s IPO will adversely affect investors’ sentiments towards BSE Ltd though this ought to have no bearing for long-term value investors like Mohnish Pabrai!

“Prima facie, NSE’s IPO will adversely affect investors’ sentiments towards BSE Ltd”.

This is wrong analysis. NSE IPO will create interest in BSE and the stock will rise.

Generally it happens as you have said. Also, NSE in corruption then why people will weigh that higher?

Mohnish meets all these companies top management like CARE, REPCO and KRBL.etc. I am sure he is able to distinguish between a quality management and a mediocre management. Being an admirer of Charlie and Warren i think he believes good business run by idiots will make money. But he is clearly not thinking what happens to good business run by crooks!There is a difference between crooks and idiots which i think he is not able to distinguish! This is a changing India under Namo! If crooks survived and thrived in US does not mean they will India!

Lol! Good luck AshishKumar Chauhan going by what happened to CARE , REPCO and KRBL:) By the Rain is sure to go back to 35 levels now! People who believed in Vada Pav story are only left with Vada Pav after investing in it !

Very well said Rohit! Mohnish if your reading this next time you meet Charlie and Warren tell them unlike Wells Fargo where they sent 5300 scapegoat employees home in India we have sent the CEO home first who has the primarily responsibility for setting the culture right. If took Wells Fargo a few years to do that!

I would wait Mr Contrarian of evening to comment on this PICK of BSE! He commented on REPCO and KRBL and we all know what happened. This time fundo prof did his magic on CARE too. Lets see wait to her from these stalwarts

Bse ka stock ko bhi ab panauti lag gaya

What about Rain industries that has collapsed to 85 now? So many suckers listened to their idols like Porinju and Mohnish and invested. All are in the drains now.

NSE with massive volumes is moving on jet speed with latest technology and BSE should always catch up often investing substantial investment to be at par with NSE. Its significant advantage for NSE and BSE would find it difficult to invest that kind of capital for every upgrade. To be honest, BSE is home to most of the dubious stocks and given the low volumes of large caps on BSE, most of the large players like MFs and FIIs would go through NSE only. I feel again Mohnish entered in to wrong stock at a time many of the equity investors including SIPers are struggling to generate decent returns and with further threat of equity meltdown of US markets and its affect on Indian markets. I am not really sure whether stock BSE might turn into Multibagger but don’t see threat on ECG wise as like in mid/small cap space that he got into with other stocks.

abhi yeh log naya stock fira rahele hai

People with integrity have created more wealth in stock market than people with Integrity and that is what the new govt is moving towards !