Promotion to Head of Equities

First, we have to congratulate Vinit Sambre because he has been promoted to the prestigious post of Head of Equities in the DSP Mutual Fund.

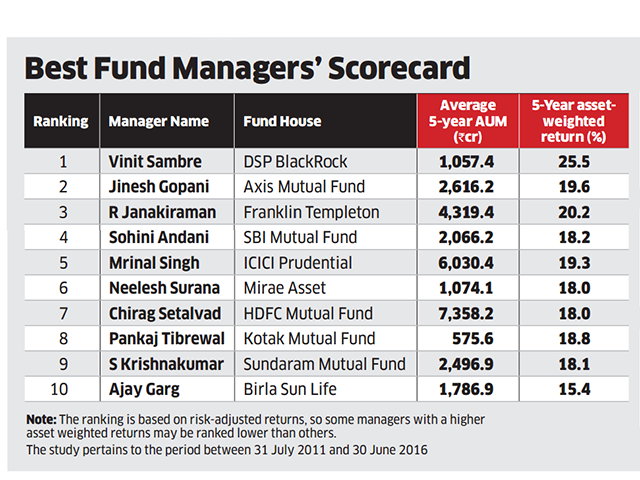

No doubt, this promotion is because Vinit proved his mettle by rising to the top of ET Wealth’s ‘Best Fund Managers’ Scorecard’.

His Mutual Fund scheme, named the ‘Micro-cap Fund’ alias

‘Small-cap Fund’, churned out an impressive 5-year weighted return of 25.5% and thrilled investors.

He has also won the confidence of novice investors with his calm and down-to-earth attitude.

What about his salary?

One issue that is of great interest to us is the salary that Vinit Sambre receives in his post of Head-Equities.

On an earlier occasion, I have pointed out that mutual fund managers receive massive salaries that rival those received by corporate titans like Mukesh Ambani, etc.

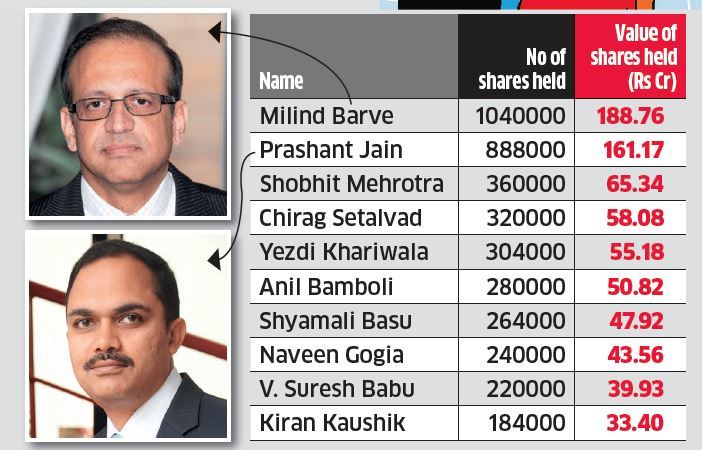

Celebrity fund managers like Prashant Jain, Sunil Singhania, Milind Barve, Sundeep Sikka, Nimesh Shah pocket as much as Rs. 20 crore in annual salary + perks.

In fact, Prashant Jain, Milind Barve, and the other honchos of HDFC Mutual Fund, have set new standards by raking in an eye-popping fortune of Rs. 188 crore from the ESOPs of the AMC.

From this, we can confidently speculate that Vinit Sambre’s salary will be no less than Rs. 20 crore + perks per annum.

Reopening of DSP Small-Cap Fund signals that coast is clear

In 2016, the DSP Small-Cap Fund had slammed its doors shut and turned away investors who were eager to invest large sums of money in the fund.

This was an unprecedented move because no mutual fund is known to refuse to take money.

However, the move showed the sagacity of the mandarins of the Mutual Fund because in the savage correction that followed, several novice investors lost the shirts off their backs.

One can gauge the severity of the correction from the fact that even Porinju Veliyath’s PMS, which earlier effortlessly churned out a CAGR return of 45%, slumped to the bottom of the rankings (see My PMS Fund Earlier Gave 45% CAGR Return. Now It Is The Worst Performer: Porinju Veliyath Explains What Went Wrong).

@dspmf DSP Small Cap Fund is managed by Vineet Sambre, a competent analyst with reasonable portfolio management experience under his belt. He has managed this fund since June 2010. Morningstar believes that it is an excellent investment choice in the small-cap fund space.

— L (@larissafernand) September 5, 2018

Anyway, now the good news is that the DSP Mutual Fund has once again opened its doors, albeit in a limited manner.

This sensational news was revealed by Surabhi Upadhyay.

All you folks looking at #smallcaps here's some news- Vinit Sambre the big boss at @DSPMF just confirmed that they will soon reopen their #smallcap fund for subscriptions. (I hear it may happen next month)

Last 5 yrs

DSP SMALL CAP 35%

NIFTY SMALL CAP 27%#MutualFunds— Surabhi Upadhyay (@SurabhiUpadhyay) August 23, 2018

Investors are only permitted to invest in a SIP basis. Lump sum investments are still prohibited.

In his latest interview, Vinit Sambre explained that the reason for the liberalization in the policies is because the savage correction has cleaned the “froth” and brought many stocks to bargain basement valuation levels.

“The froth is not fully cleaned. I would say it is cleaned somewhat but it is a good starting point for all of us because as an investor one is never able to always identify the lowest price point” he said.

He also revealed that the volatility caused by the macroeconomic headwinds will provide opportunities to grab companies which are attractive in terms of the business.

How to find multibaggers?

Vinit Sambre gave a quick 101 tutorial on how we can spot potential multibagger stocks.

He explained that we have to focus on the quality of management and the quality of earnings before deciding to entrust a stock with our money.

“Top quality management is the most important factor, beyond which comes the business, the outlook for the business and the other valuation parameters,” he explained.

These are the most important pillars investors should focus on, he said.

He also pointed out that every company has a value and we should focus on it to understand what is the value of that business, what is the value of the franchise which the management is building and the valuations at which the stock is trading.

Take advantage of price plunges to aggressively buy stocks

Vinit Sambre frowned at the tendency of novices of getting their knickers in a twist when the stock markets correct and prices plunge.

“During volatile times, whenever we see price correction taking place, for us the value does not get impacted as much as the price. Hence, we take these corrections as an opportune time,” he emphasized.

At the same time, when euphoria grips the market and stock prices surge beyond reason, we should take advantage of the situation to dump the junkyard stocks in our portfolio upon our less-fortunate brethren.

Best stocks to buy now

Now, this is where we have to be on red alert because the names of potential multibaggers are likely to be revealed.

First, we have to peep into the top ten holdings of the DSP Small Cap Fund and also peruse the sectoral allocation.

Top 10 Holdings As on Jul 31, 2018

| Company | Sector | Value | % Assets |

|

Atul |

Chemicals | 203.95 | 3.81 |

|

Ipca Labs |

Pharmaceuticals | 178.28 | 3.55 |

|

Aarti Ind |

Chemicals | 189.89 | 3.46 |

|

SRF |

Manufacturing | 175.92 | 3.33 |

|

Finolex Cables |

Telecom | 185.38 | 3.29 |

|

APL Apollo |

Metals & Mining | 156.97 | 2.93 |

|

DCB Bank |

Banking/Finance | 153.46 | 2.87 |

|

KPR Mill |

Manufacturing | 147.78 | 2.76 |

|

Nilkamal |

Manufacturing | 135.27 | 2.62 |

|

Siyaram Silk |

Manufacturing | 140.44 | 2.53 |

Sector Allocation (%) As on Jul 31, 2018

| Sector | % |

|

Manufacturing |

20.83 |

|

Chemicals |

17.45 |

|

Engineering |

8.24 |

|

Banking/Finance |

7.69 |

|

Metals & Mining |

7.14 |

|

Pharmaceuticals |

6.73 |

Big opportunity is brewing in specialty chemical stocks

As one can see, a massive chunk of 17% of the AUM is allocated to specialty chemical stocks.

Vinit Sambre explained that he is foreseeing that a “big opportunity is brewing up” on account of the clamp down by China on polluting companies.

Indian companies are gearing up to take advantage of the situation and are aggressively increasing capacities.

“The outlook for that set of companies is going to be much better than what they are today. The growth will be much better than what they are today given the kind of capex which they have done,” he said.

According to some knowledgeable investors, Deepak Nitrite is likely to be a beneficiary of the bonanza because it has commissioned a new plant to manufacture ‘phenol’, the prices of which are surging in the international market owing to unabated demand.

Phenol prices have seen strong uptick recently, to add fuel to the fire we have weak INR also leading to high import prices.

Interesting to see Deepak Nitrite as a company – they have recent commissioned a large capacity for Phenol-Acetone in Dahej (large import substitution)

— Yatin Mota (@YatinMota) September 14, 2018

When Deepak Nitrite announced its new plant, consumption in India was around 2.5 lac MT which has now increased to 3.50 lac MT. Demand is further expected to grow by 10-12 percent every year.#DeepakNitrite

— MIHIR (@mihirm123) September 16, 2018

Meghmani Organics is yet another specialty chemical company that we can consider.

According to Sonal Bhutra, a young CA with a razor-sharp mind, Meghmani Organics has reported robust results.

Meghmani Organics

Good show continues

Rev growth limited due to weak rev in Pigment and Agrochemical biz

Overall strong EBIT growth

Agrochem biz strong

Co had told us last qtr that chlorine prices have turned positive

Revenue up 13%

EBITDA up 36%

OPM at 26% vs 21.6%

PAT up 78%— Sonal Bhutra (@sonalbhutra) August 8, 2018

Actually, we don’t have to look beyond Dolly Khanna’s portfolio to find multibagger specialty chemical stocks.

Dolly has teamed up with Ashish Kacholia, Anil Kumar Goel and other eminent veterans and has a strangle-hold on several high-quality specialty chemical stocks such as NOCIL, IG Petro, Thirumalai Chemicals etc.

62% upside from Dolly Khanna + Anil Kumar Goel Portfolio Stock. Leader in Specialty chemicals. Large Entry Barriers. Higher revenue & profitability growth due to brown field expansion & higher capacity utilization Attractive valuations + Re-rating expected https://t.co/AsTCbeFVJp pic.twitter.com/TqaEJUBJR5

— RJ Stocks (@RakJhun) March 14, 2018

Vinati Organics is yet another powerhouse which has a monopoly/ dominant position in several specialty chemical products.

Vinati Organics to @CNBCTV18Live

– Had about 45% market share in ATBS, it has increased to 65% due to exit of Lubrizol

– ATBS sales saw a growth of 50% in this quarter

– Working at full capacity in ATBS segment, margins have increased in this product https://t.co/AH0qAZIokg— Sonal Bhutra (@sonalbhutra) August 7, 2018

We can confidently buy one or more of these stocks and wait for the gains to gush into our portfolios.

Excited at long-term trends and opportunity size of NBFC stocks

NBFC stocks are slightly under the weather now because the interest rate cycle is seen to be inching up.

However, this weakness is the ideal opportunity for us to dive into these stocks, Vinit Sambre opined.

“We get excited looking at the long-term trends and given the opportunity size, we have backed them up,” he said with a sparkle in his eyes.

“The opportunity is still very wide and the interest rate cycle will keep having its own cycles. It is sometimes high and sometimes low, but these NBFCs have displayed strength during the last 10 years and have also maintained their asset quality quite well,” he added.

As to the best NBFC stocks, we can stick to our all-time favourite stocks like L&T Finance Holdings, DHFL, PNB Housing Finance, Manappuram Finace, Muthoot Capital etc.

These stocks are powerhouses which can effortlessly smother the competition.

In fact, Dolly Khanna has rewarded two of these stocks with a place in her portfolio.

Sandip Sabharwal also recently recommended L&T Finance Holdings (and two other mid-cap stocks) to us with the confident assurance that we will not go wrong.

It is worth recalling that Mohnish Pabrai has also given the NBFC sector a clean chit and described HFC stocks as “no-brainers” owing to the mammoth scale of opportunity.

He has two fail-safe finance stocks, namely, Repco Home Finance and CARE Ratings, in his portfolio.

#ChaiWithPabrai | Repco Home has no competition in the demographic they're serving; Expect Repco's lending discipline to continue in the future, says @MohnishPabrai in an #Exclusive chat with @nikunjdalmia @tanvirgill2 pic.twitter.com/4Jr8w0HhpL

— ET NOW (@ETNOWlive) June 1, 2018

Branded textiles & home textile stocks are must buy

Vinit Sambre opined that domestic branded stocks will benefit immensely from the aggressive consumption behaviour of India’s middle class.

He also singled out home textile export-oriented companies as ideal investment opportunities.

He explained that Indian companies are gaining competitive advantage over China because of cost competitiveness as cotton is available in India.

In fact, India is one of the largest cotton growers of the world and the companies have top-notch managements.

Some companies are leaders in their own space and will continue to grow and take advantage of the huge opportunity size, he explained.

Here, the stocks that come to mind are KPR Mills, Siyaram Silk, Arvind Ltd, Trident Ltd, Welspun etc.

Conclusion

Prima facie, Vinit Sambre’s opinion that no one can perfectly time the bottom of the market is quite sensible. It is advisable if we also leave the shelter of our bunkers and resume buying high-quality mid-cap stocks in a staggered manner!

Recommendation list is all OK, but, what if market corrects severeally from here because of global concerns like elevated crude, building tariff barrier due to Trump and China factor and of course reversed interest rate cycle not only in India but globally also.

If market will correct further, most of the stocks will correct. For small cap companies it is wiser to go through mutual funds. But correction will also be Golden Chance to accumulate blue chips like HDFC Bank, Kotak Bank, RIL, Asian Paints, HUL, ITC, L&t etc. So you as small investors enjoy your shopping at lower prices of blue chips, sold by Goras (FIIs). If you can average down your buying in Indian Blue chips by slow and scattered buying and can hold your nerves for one to two year, You will get chance of dumping the same blue chips at very high prices to same FIIs in future. No recommendation but my ready plan for execution if FIIs throw the towel.

Indian markets are highly screwed up. Nothing blue chip. One negative news screws up everything. Like real life scenario, it is easy to stab but takes lot of time for recovery. The way Yes Bank and other NBFCs hammered today which could happen to any other stock. One more ILFS kind of news, markets are doomed.

Better to stay out of market till Dec. Savage correction is coming

Interesting he as the Equity Head recommended DHFL among others, and his Debt side (of DSP) sold CPs of DHFL and spooked the market with a 50%+ fall in just 3 days hence!

Now, see the timing!!