Porinju Veliyath & Ashish Chugh launch synchronized buying action on BCL Industries

In an earlier piece, I pointed out that Porinju Veliyath and Ashish Chugh often work in tandem when it comes to buying micro-cap stocks.

Stocks like Arvind Infrastructure, Nirvikara Paper, Kaya, Balaji Amines bear testimony to this fact.

BCL Industries is yet another example of this theory.

On Monday, 20th November 2017, the duo landed up at Dalal Street and made a beeline for the counter of the micro-cap.

Porinju bought 200,000 shares in his own name and 450,000 shares in the name of the EQ India Fund PMS.

Ashish Chugh bought 75,000 shares in the name of Om Prakash Chugh.

The duo paid a throwaway price of Rs. 109.90 for the stock.

Sonam Mehta of CNBC Awaaz, who is famed for her eagle-sharp eye, reported the transaction.

BCL Industries and Infrastructures – FUND ACTION

PORINJUV VELIYATH BUYS 2 lk shares @ Rs 109.9/-

EQ INDIA FUND buys 4.50 lk shares @ rs 109.9/-

OM PRAKASH CHUGH buys 75000 shares @ rs 109.9/-

SARVA PRIYA EXPORTS PRIVATE LIMITED sells 11 lk shares @ rs 109.9/-— SONAM MEHTA (@sonamcnbcawaaz) November 21, 2017

Nikhil Vora and Kanchan Sunil Singhania also storm into the stock

A few days later, Nikhil Vora and Kanchan Sunil Singhania also landed up unannounced at the counter of BCL Industries.

While Nikhil Vora helped himself to 250,000 shares, Kanchan stayed content with 100,000 shares.

Though the duo paid a higher price of Rs. 137.20 per share for the stock than that paid by Porinju and Ashish Chugh, they did not exhibit any signs of discontent.

Instead, they looked quite pleased at the outcome.

This transaction was reported by Rohan Gala, an investor. He appears to be quite vigilant about reporting bulk deals by illustrious investors.

BULK DEAL ALERT:

BCL Industries & Infrastructures Ltd

Deal price: 137.2Buyer:

NIKHIL VORA- 250,000

KANCHAN SUNIL SINGHANIA- 100,000

SAWARMAL HUF- 100,000

PNEUMATIC LEASING SERVICES PVT LTD- 136,000

ANOOP JAIN- 350,000

SIDDHARTH BALACHANDRAN- 500,000

DIVYAM TIE UP LLP – 194,104— Rohan Gala (@RohanG90) December 15, 2017

| BCL INDUSTRIES & INFRASTRUCTURES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 194 | |

| EPS – TTM | (Rs) | [*S] | 9.70 |

| P/E RATIO | (X) | [*S] | 14.14 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 10.00 | |

| LATEST DIVIDEND DATE | 14 SEP 2017 | ||

| DIVIDEND YIELD | (%) | 0.73 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 74.89 |

| P/B RATIO | (Rs) | [*S] | 1.83 |

[*C] Consolidated [*S] Standalone

| BCL INDUSTRIES & INFRASTRUCTURES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2017 | SEP 2016 | % CHG |

| NET SALES | 215.36 | 131.27 | 64.06 |

| OTHER INCOME | 0.94 | 1.06 | -11.32 |

| TOTAL INCOME | 216.3 | 132.33 | 63.45 |

| TOTAL EXPENSES | 200.84 | 119.77 | 67.69 |

| OPERATING PROFIT | 15.46 | 12.56 | 23.09 |

| NET PROFIT | 4.36 | 2.62 | 66.41 |

| EQUITY CAPITAL | 14.15 | 14.15 | – |

(Source: Business Standard)

BCL Industries’ three business verticals make it alluring to ace investors?

To understand what is so alluring about BCL Industries which has made it irresistible to the noted investors, I had to dive down deep into the records of the Company.

My research shows that the unique aspect about BCL Industries is the fact that it has three business verticals. These are:

(i) Edible Oil & Vanaspati

(ii) Distillery and

(iii) Real Estate

As regards the first vertical, BCL Industries is a powerhouse in the field of edible oil and vanaspati for which there is insatiable demand from the masses of the Country.

It has an integrated edible oil complex which is one of the largest integrated units in North India. The units have a capacity of processing 1,000 MT per day.

It is said to be one of the most modern and vertically integrated edible oil and rice complexes in North India with a loyal customer base and a 300-dealer network spread across Northern India.

The refined oils are sold under well known brand names such as “Homecook”, “Do Khajoor” and “Murli”.

The “Homecook” brand is the flagship brand. There are a wide range of refined oils including soybean oil, sunflower, cottonseed oil and rice bran oil, sold under this brand and others.

As regards the Distillery business, BCL Industries is the 7th largest producer of Extra Neutral Alcohol (ENA) in the Country.

It has well known Country Liquor brands like “Asli Santra”, Ranjha Saufi”, “Punjab Special Whisky” etc.

It also has IMFL brands called “Mc Choice Premium Whisky”, “Summer Chef Vodka” etc.

As regards the real estate vertical, BCL Industries has affordable housing and commercial office projects in the city of Bhatinda, Punjab.

While the affordable housing project is named ‘Ganapati Enclave’, the commercial office project is named ‘DD Mittal Towers’.

Bathinda is the next growth centre of Punjab. It has a population exceeding 4 lakhs and is the hub of economic activity. The city is a leading cotton belt and has become a medical, engineering and business hub and on its way to become ultra-modern industrial, business and educational city of Punjab.

It is evident that there will be no dearth in demand for affordable housing and commercial office space in a growing city like Bhatinda.

Prima facie, it appears that BCL Industries is, despite its diminutive size, already a diversified conglomerate.

Novices cannot barge into the stock because BSE mandarins have played spoilsport and frozen the stock

BCL Industries has the misfortune of being listed only on the BSE.

This has given the mandarins of BSE the freedom to impose arbitrary price controls and play havoc with the stock.

It may be recalled that Porinju had earlier given a piece of his mind to the mandarins for the “total chaos” created by them.

What's going on with @bseindia ? PCA, GSM, over a dozen groups & total chaos; looks like investors getting scared and avoiding BSE stocks!

— Porinju Veliyath (@porinju) June 29, 2017

However, the mandarins are a law onto themselves and are unlikely to pay attention to anyone.

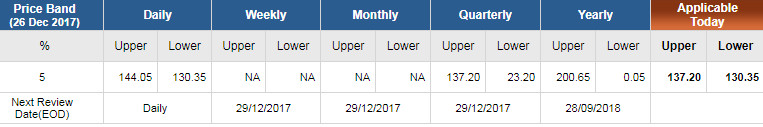

Anyway, the bottom line is that BCL Industries is subject to an upper circuit limit of Rs. 137.20 which will be released only on 29th December 2017.

This means that we cannot barge into the stock now.

Instead, we will have queue up outside BSE early morning on 29th December 2017 and launch a no-holds-barred buying action to grab the stock.

Hopefully, we will be able to grab our quota before the BSE mandarins impose yet another price freeze!

i am too a resident of bathinda, we as resident of bathinda do not see BCL as some company. their work ethics are very basic, they do not work like some microcap company. yes their liquor business is good but their resident project like Ganpati enclave where most of their asset are sold out but still prices in ganpati are going downwards due to over supply of homes.

they were unable to provide flats in dd mittal towers on time even after 2 years..people have to reach court in some cases.

their another real estate projects like Sushant city I and Sushant City II are almost 90 % vacant.

As far their refined oil business is concerned they cater to low income customer, very few people in bathinda city uses their product.

for additional information their MD was jailed few years back for some court cases and his father was also involved in criminal case of mixing animal fat in to vegetable refined oil. rest all these investor knows more….

Kapil,

good info from someone who has first hand experience. Thanks

https://www.hindustantimes.com/punjab/31-years-on-cbi-court-convicts-leading-industrialist-of-selling-beef-fat-as-vegetable-ghee/story-OGT7TROtr0PMpdDVqDFJ7I.html

Seems like this is a very old case which started in 1983 and which was closed very recently.

Hope promoters have learnt their lesson and don’t repeat the same in their current business, which looks to be growing well.