Big Bulls converge on Dalal Street

Yesterday was a historical and red-letter day for Dalal Street. A large number of eminent Billionaires and illustrious stock pickers traversed the gold paved streets of Dalal Street and made a beeline for the listing ceremony of Radhakishan Damani’s Avenues Supermarts aka D-Mart.

(L-R: Madhusudan Kela, Ramesh Damani, Radhakishan Damani, Rakesh Jhunjhunwala, Dharmesh Shah (Axis) and Rashesh Shah)

Among the luminaries in attendance were Rakesh Jhunjhunwala (the Badshah of Dalal Street), Ramesh Damani, Vallabh Bhanshali, Nimesh Shah, Madhusudan Kela, Rashesh Shah etc.

Who is Radhakishan Damani? Here's all you need to know about him and D-Marthttps://t.co/Fwpc4IxlwW pic.twitter.com/EOjtcs9uGJ

— BloombergQuint (@BloombergQuint) March 22, 2017

While the dignitaries were celebrating their incredible success and partying away to glory, Porinju Veliyath was keeping an eagle eye on the proceedings. He was not as interested in the festivities as he was in finding the opportune moment to grab the D-Mart stock.

When the opportunity did arise, albeit for a second, Porinju moved like a flash and grabbed a massive truckload of 10,000 shares before anyone could realize what was happening.

.@porinju: Bought 10,000 shares in D-Mart today.

— ET NOW (@ETNOWlive) March 21, 2017

Assuming Porinju paid the closing price of Rs. 641 for D-Mart, his investment is about Rs. 64 lakhs in the stock.

Why the sudden change in stance by Porinju?

The surprising aspect is that when Porinju was grilled by the sleuths of Bloomberg and CNBC TV18 about the investment-worthiness of D-Mart, he had unequivocally expressed the opinion that though D-Mart has multibagger potential, it was overpriced in the IPO and that investor should await a correction in the price.

His precise words were as follows:

“D-Mart is a wonderful company and is going to grow much more. It can be a 5x company in the next 10 years. That’s the kind of potential that the company has. It is a well-managed company. But don’t compromise too much on the valuations. That’s the key because if you buy shares at the wrong price, it may take away you 2-3 years of your time and time is also money. But with some reasonable premium, I would recommend D-Mart if it corrects after listing at a higher price.”

He was further quoted as saying:

“In the CNBC-TV18 interview, he also talked about the upcoming D’Mart IPO, and said that the stock may be overvalued at the indicative price and said he would prefer Future Retail to it.”

So, it is a mystery as to why if Porinju thought that the IPO was overpriced, he went ahead and bought the stock at 100% premium on its listing.

Prima facie, the august presence of the eminent Billionaires like Rakesh Jhunjhunwala and Radhakishan Damani may have swayed Porinju’s thinking.

He opined that the opportunity for D-Mart to grow is “immense“.

.@porinju: Opportunity for D-Mart to grow further is immense in current market conditions.

— ET NOW (@ETNOWlive) March 21, 2017

He added that D-Mart may have a market cap of Rs. 1 lakh crore in the next few years which means that we are talking of 300-400% gains from the CMP.

.@porinju: Possible for D-Mart to have a market cap of around Rs 1 lk cr in 3-4 years.

— ET NOW (@ETNOWlive) March 21, 2017

'D-Mart a long-term play,' says Helios Capital's Samir Arora https://t.co/eajaLlNJoP pic.twitter.com/hvmdYE1Ze4

— BloombergQuint (@BloombergQuint) March 12, 2017

Profits, existing markets to remain D-Mart’s focus, says CEO Neville Noronha.@sharleendsouza reportshttps://t.co/9HTtfx4DW0 pic.twitter.com/i3hUFri6z3

— BloombergQuint (@BloombergQuint) March 22, 2017

Has “irrational exuberance” taken the stock price of D-Mart too far?

Pallavi Pengonda of Mint opined that the 115% appreciation in the stock price of D-Mart on listing day is “taking things too far”. She explained that D-Mart is now quoting at 77x estimated earnings for fiscal year 2016-17 and 55 times one-year forward earnings.

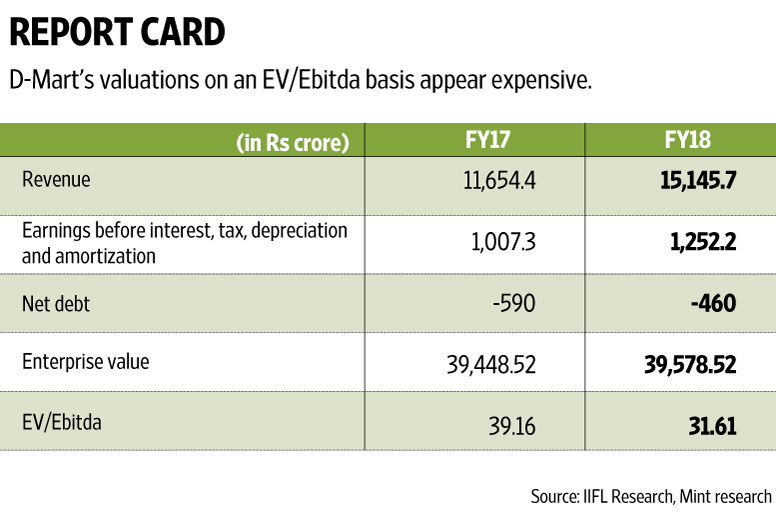

She added that even on an EV (enterprise value) to Ebitda basis, the valuations are sky-high at around 31.6 times.

She also compared D-Mart with its arch rival Future Retail and explained that while D-Mart’s return on capital employed (ROCE) for 9MFY17 was 22.9%, higher than Future Retail’s estimated return of 12.8% for FY17, that still did not justify a valuation of 31.6x EBITDA.

She also warned that D-Mart’s YoY revenue growth of 33% and 37%, respectively for FY16 and FY15 was lower than the annual revenue growth seen in the preceding two years.

“With valuations so high, there is hardly any room for error on any of these counts,” she said in a chilling tone.

(Image Credit: Mint)

Business Standard interviewed a number of stalwarts like Ambareesh Baliga and AK Prabhakar, who advised that it would be sensible to book profits and decide on a re-entry when the stock price cools down.

A similar view has been expressed by experts interviewed by ET, namely that DMart “looks ripe for profit booking, wait it out to buy”.

Why D-mart richly valued at 80 PE ??

Friend : It gives 6% disc so everyone buysMe – I get 15 % discount from Metro Cash & carry in Kolkata

— Rishi Bagree (@rishibagree) March 22, 2017

My cook wants to sell her whole portfolio & buy #DMart. Told her that all the Market wizards are also doing the same. I get Kheer for lunch.

— Shyam Sekhar (@shyamsek) March 22, 2017

What is Vijay Kedia’s stance on D-Mart’s valuations?

Vijay Kedia has maintained a conspicious silence over the investment-worthiness of D-Mart at the current valuations. Instead, he shared an image of himself with Billionaire Radhakishan Damani with the cryptic caption “Doyen Mart”.

Doyen Mart. pic.twitter.com/qUuswW2WWx

— Vijay Kedia (@VijayKedia1) March 21, 2017

Vijay Kedia’s followers were quick to point out that Radhakishan Damani was not in his trademark white-and-white dress, implying that the picture is rare one and that the occasion must have been extra-special.

@VijayKedia1 Damaniji not in white and white, rare picture

— Prashant Mahesh (@PrashantmET) March 22, 2017

@VijayKedia1

Both are believers of simple living and high thinking

Hats off to both— Balvant (@Balvant32546101) March 21, 2017

I think Porinju has invested for the short term play in mind.. It might go to 700-800 and fall to 500.. He mostly uses his own name to play and not to invest for long term.. People wrongly think those are his investment decisions.. Look at his many new microcraps he bought and people got so angry because they judged them as good companies.

I see lot of gamblers and addicts. I don’t get tempted by them. While many can go bankrupt, some can afford to lose for kick and fun. Small, normal and ordinary investors should not blindly follow the celebrity investors.

Yes it is good that listed with more than 100%premium from the issue price. Valuation really look very expensive.However company may be having serious growth potential.

There are other listed player with relatively cheap valuation and having good growth potential.

Nifty on top ……….. Dmart on high PE…. really confusion to Buy or not?