Don’t worry about stocks which surge or plunge. Just manage your portfolio allocation

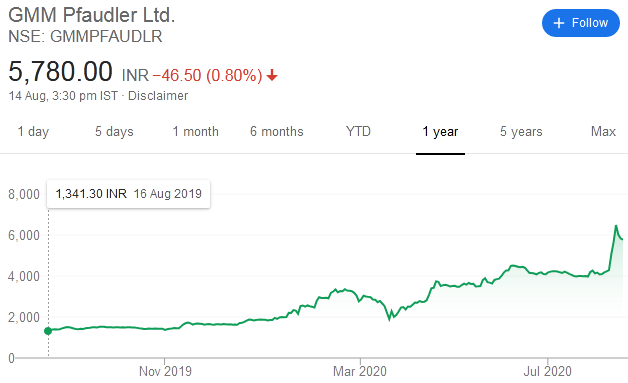

Saurabh Mukherjea had recommended GMM Pfaulder to us in March 2020 when it was quoting at the throwaway valuation of Rs. 2980 (See Saurabh Mukherjea Adds Blue-Chip MNC Stock (Market Leader, Debt-Free, High RoE) To Portfolio Of Multibaggers).

The stock is presently standing strong at Rs. 5780 and has given a return of nearly 100% in just a few months.

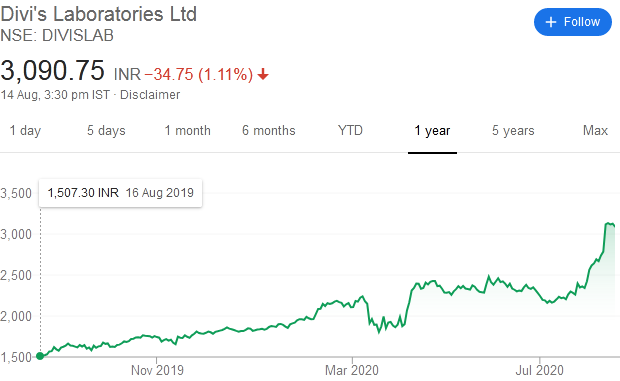

Similarly, Saurabh had recommended that we buy Divis Labs with the confident assurance that it will do well.

“Divi’s has higher return on capital, higher operating margins among Indian companies, which are selling their own medicines in the western world. I would say a CCP-type franchise with strong moat, strong compounding engine and, we reckon, it will potentially stand the test of time“, he had advised.

This recommendation has also played out well with Divi’s surging to new highs on the back of robust operating performance.

When stocks surge, sell them so as to stay within allocation

However, it is a fact that the result of the surge is that these stocks are now quoting at exorbitant valuations.

Saurabh advised that the best way to handle the situation is to sell some of the holdings so that the allocation of funds to the stock in the portfolio remains unchanged.

“If I let the stock rip from being 10% of the portfolio to becoming 50% of the portfolio, it doesn’t make any sense. We hive the position to bring it back to 10%,” he said.

When stocks plunge, buy more so as to stay within allocation

Conversely, if the stocks plunge, investors should buy more so as to maintain the allocation.

Saurabh cited the classic example of Bajaj Finance which recently lost a mammoth 70% of its valuation owing to baseless allegations from fear mongers that the stock would be crippled by NPAs.

“We didn’t let the position dribble down, we doubled our holding of Bajaj Finance,” Saurabh said.

The strategy of buying more of Bajaj Finance when it was languishing at the depths was brilliant because the stock has since surged and regained a lot of its past glory.

“The position size should be determined not by the prevailing share price but by the Fund Manager’s perception of the barriers to entry, etc,” Saurabh advised.

#InvestmentGuide | When is the right time to exit a stock? How do you decide what is the right time to sell? Saurabh Mukherjea answers @JaayShaan & @Mahesh26808212's query @Marcellusbot @MarcellusInvest @_anujsinghal @SurabhiUpadhyay pic.twitter.com/n6ZDKDzE1d

— CNBC-TV18 (@CNBCTV18News) August 12, 2020

Invest only in stocks that meet three parameters

Saurabh advised that as a rule we should invest only in companies that compound their earnings at a high rate.

He explained that earnings compound, not because of GDP growth, but because the company reinvests a large amount of capital and ploughs it back into the business.

He also advised that we should not be obsessed with valuations and the PE multiples but should focus on the return on capital and the allocation of capital.

He suggested that we should always keep three parameters in mind whilst investing, namely, Cleanliness of accounts and management, essentiality of the product and dominance in the market place.

Saurabh explained the entire theory in eloquent terms:

“Should I invest or not in a company –

firstly, you look for clean franchises, we want to invest with promoters who are clean, who are honest, and who are not stealing money.

Secondly, look for companies who are producing essential products and services…

Thirdly, look for dominant franchises, look for monopolies.”

“The higher the barrier to entry the greater should be the portfolio allocation,” he suggested.

#InvestmentGuide | What’s the thought process that goes into investing in smaller companies? @_anujsinghal & @SurabhiUpadhyay speak with Saurabh Mukherjea @Marcellusbot @MarcellusInvest pic.twitter.com/nr9zw9gksa

— CNBC-TV18 (@CNBCTV18News) August 12, 2020

Four of the best stocks to buy now

It is no secret that Saurabh is a big fan of large-cap Banks and NBFCs like HDFC Bank, Kotak Mahindra Bank and Bajaj Finance.

These stocks are a part of his famous ‘Kings of Capital’ and Coffee Can portfolios.

He has eloquently described these stocks as being “incredibly juicy and attractive“.

Saurabh Mukherjea says don's get caught up in the near term forecasts, focus on long term. Bajaj Finance, HDFC Bank, Kotak Bank look incredibly 'juicy', attractive at this level

Premium financials in NBFC space, auto look very attractive— avanne dubash (@avannedubash) May 11, 2020

Saurabh advised that we can fearlessly tuck into Kotak Mahindra Bank because it will effortlessly compound at a CAGR of 20 percent over the next decade and has very little volatility.

He also recommended Pidilite as an investment candidate.

He pointed out that the Company already has a stranglehold over the adhesives market and is building yet another monopoly product.

The Company’s philosophy regarding capital allocation is also flawless.

GMM Pfaudler is also (despite its nose-bleed valuations) a no-brainer because it has no competition in the glass-lined vessels industry.

The Company also scores well on the three parameters of cleanliness, essentiality and dominance.

“GMM Pfaudler makes an essential product in the form of glass-lined vessels that the pharmaceutical and the chemical industry cannot do without. It is an absolute essential,” he explained by way of investment rationale.

Alkyl Amines Chemicals was cherry-picked because it is a dominant player.

“Alkyl Amines is the class play in this, dominant player – clean, well-run compounding machine in the aliphatic amines industry,” Saurabh recommended.

#InvestmentGuide | What are Saurabh Mukherjea's top picks within the giant, mid, small and micro category? Listen in to @_anujsinghal & @SurabhiUpadhyay in conversation with Saurabh Mukherjea@Marcellusbot @MarcellusInvest @GautamC89 pic.twitter.com/jcEkLks8xd

— CNBC-TV18 (@CNBCTV18News) August 12, 2020

Multibagger stocks in the Little Champs portfolio

Saurabh has also, in an act of unmatched generosity, candidly revealed the names of all the small and mid-cap stocks in his ‘Little Champs’ portfolio.

He has also provided a succinct investment rationale for each stock, which is as follows:

| Little Champs portfolio composition and brief description | |

| Garware Technical Fibres | Starting out as a supplier of cordage products to domestic fishing and shipping industries, the Company successfully diversified into sports, aquaculture and other sectors across global markets backed by strong product innovations and customer connects. Value added products now account for >60% of total revenues. |

| GMM Pfaudler | Dominant supplier of glass lined equipments (GLE) to the domestic pharma and chemical industries backed by technology from parent Pfaudler (a global leader). Successful diversification into adjacent products helped by strong customer relationships in core GLE portfolio. Profitability and RoCE metrics significantly ahead of peers as the latter have been devoid of scale in India. |

| Alkyl Amines Chemicals | Leader in supply of aliphatic amines to pharma & agro-chemical industries. The company has been successful in expanding its product baskets in higher value-added products on the back of strong R&D strength and focus on the niche amines space. |

| Galaxy Surfactants | Leading olechemical based surfactants supplier to Home/personal care players in India (-60% mkt share) with strong global presence (2/3rd revenues outside India). Enjoys strong patronage of leading customers like Unilever, P&G etc backed by quality, consistency and innovation capabilities. |

| Ultramarine & Pigments | A global top-3 supplier of Ultramarine Blue pigment with strong inroads into export markets in recent years. The company is also a leading supplier of surfactant particularly to South India based FMCG players. |

| Amrutanjan Health Care | Second largest player in the head painbalm category (-65% of revenue). The Company commands high market share in certain states like Tamil Nadu (traditional market with >5096 market share), Kerala, Orissa and West Bengal. In the recent years, the company has also diversified into newer segments such as body pain balm, sanitary napkins (Comfy brand) and beverages (Fruitnik brand). |

| Mold-Tek Packaging Engineering | Leading supplier of injection moulded rigid plastic containers to paint and lubricants industries with a strong presence across all leading players like Asian Pain., Berger, Castro!, Shell etc. Competitive advantages surround innovation and backward integration (in-house moulds, label development) which places company in a strong position to capture market share particularly as In-Mold labelling shift takes place in Food & FMCG packaging. |

| Suprajit Engineering | A leading supplier of mechanical cables to domestic 2Ws, the Company has been able to make inroads into domestic and export PVs in recent years helped by its immense cost advantages over MNCs in both domestic & global markets. |

| PPAP Automotive | Leading supplier of weather strips to the domestic PV industry helped by a strong Japanese technical partner and backward integration (in-house tools etc). Looking to increase content per vehicle through diversification into automotive plastic parts. |

| Sterling Tools | Second large. Indian automotive fasteners supplier (largest in North India), company is now looking at penetrating the southern based OEMs through a new plant commissioned in Karnataka. The Company is also looking at enhancing product and process capabilities through tie-up with Meidoh, a leading fasteners player in Japan. |

| Lumax Industries | Largest automotive lighting supplier in India backed by strong technology partners (Stanley, a co-promoter in company and S L Corporation) and a diversified presence across vehicle categories & OEMs. |

| V-Mart Retail | A leading retailer of low-ticket apparels in North India particularly in Tier 2/3 locations. Strong financial performance (amongst the best RoCE generating retail company in India) backed by superb inventory management, calculated .ore expansions and investments into technology. |

| La Opala | A Leading supplier of opalware with >5096 market share. The company has been primarily responsible for creating/growing the category through investments into manufacturing automation and passing on the ensuing cost benefits to bring down the price gap vs large incumbent tableware categories like steel and plastic. |

| Music Broadcast | Second largest Radio FM player in India. Growing focus on tier 2/3 cities helped by strong parentage (owned by Jagran Prakashan, a leading newspaper publisher in Hindi Heartland) and conservative capital allocation has led to significant outperformance over peers. |

| DCB Bank | A SME/ MSME focused lender with strong asset quality track-record. Over 95% of the loan book is secured with high degree of granularity. Improved productivity of branches set up in recent years to aid earnings growth and RoE improvement. |

| MAS Financial | Gujarat headquartered NBFC lending to SME/MSME via two models – direct lending and lending to NBFCs which in turn lend to SME/MSMEs. Unique business model of lending to NBFCs on the asset side and building liability side by way of assignments, thereby enabling it to make large NIMs with NPAs of under 1%. |

No doubt, we can confidently clone these stock picks and rake in mega gains for ourselves!