Will DHFL’s “Delay” turn into “Default”?

Presently, there is a morose atmosphere in Dalal Street.

This is because news has come in which indicates that DHFL will miss the deadline for payment of Rs. 1150 crore.

Shireen Bhan and Sumaira Abidi explained the grim situation with their typical professionalism.

DHFL likely to miss payment deadline for Rs 1,150 cr due on NCDs but may complete the payment within the 7-day grace period to avoid default. @SumairaAbidi reports pic.twitter.com/9Ivu3uSOhO

— CNBC-TV18 News (@CNBCTV18News) June 4, 2019

Ira Dugal, the expert on complex macro-economic issues, warned that the “delay” could turn into “default“.

This will set the cat amongst the pigeons and lead to mayhem in Dalal Street.

DHFL: Delay or default?

It appears the seven day grace period is to declare “event of default”, which can trigger cross defaults. The default on this security has happened due to delayed payment of interest.

Details below:https://t.co/juMboXxNYG

— Ira Dugal (@dugalira) June 4, 2019

Hapless investors in mutual funds will take the blow on their chin because there will be a 75% haircut of the NAV.

Mutual Funds have an exposure of Rs. 5,000 crore to DHFL.

BIG BREAKING – NAVs of all funds with #DHFL exposure to take a hit of 75% on total exposure today. Additionally I hear that a rating downgrade will follow. Lets see what tomorrow brings #mutualfunds #MutualFund @CNBCTV18Live

— Sumaira Abidi (@SumairaAbidi) June 4, 2019

#DHFL misses to make the interest payment of Rs 960 crore by due date. Says doesn't constitute default yet, to make payment in 7-days grace period. At April-end, #mutualfunds had more than Rs 5,000 crore of debt exposure to DHFL https://t.co/h3NeHoe13c

— Jash Kriplani (@jashkriplani) June 5, 2019

DHFL impact on NAV. pic.twitter.com/G0Ay1frZRE

— Amit Kumar Gupta (@amitgupta0310) June 5, 2019

How much is the MAXIMUM a debt fund (and I repeat DEBT FUND) NAV fall in a SINGLE day?

Option 1: 4% (~ 6 mths interest)

Option 2: 8% (~ 1 yrs interest)

Option 3: 25% (~3 yrs interest)

Option 4: 50% (~ 5 yrs interest)Here's the fall in debt fund NAVs yesterday of some funds pic.twitter.com/UZhETPGlbu

— Nagpal Manoj (@NagpalManoj) June 5, 2019

Crisis in NBFC sector Is Imminent. It Is Perfect Recipe For Disaster: Corporate Affairs Secretary

In hindsight, the writing was on the wall.

Injeti Srinivas, the Corporate Affairs Secretary, did not mince any words while condemning the NBFC sector.

“There is an imminent crisis in the NBFC sector. There is a credit squeeze, over-leveraging, excessive concentration, massive mismatch between assets and liabilities, coupled with some misadventures by some very large entities, which is a perfect recipe for disaster,” the top Babu said.

Obviously, we should not have ignored the warning given that it has come from a high-level functionary in the Government.

Saurabh Mukherjea warned of crisis in June 2018

At this stage, we have to compliment Saurabh Mukherjea because he had foreseen the present crisis as far back as in June 2018.

“I cannot but help feel that a major correction in financials is overdue. I am talking about the wholesale market dependent financial companies who borrow money in the wholesale market and lend to the retail customers.

The wholesale market rates have tightened by 125-130 bps in the last six months. There is further tightening in rates coming in the wholesale market and I cannot feel that a major correction in NBFCs and HFCs is also around the corner,” he said, displaying amazing prescience.

He reiterated the warning in April 2019.

“We are half-way through the blow up … My reckoning is the rest of the blow up in the sector will happen in the six, seven months following the elections,” he said.

“Those problems will exacerbate over the next six months and we are only half way through what will be a brutal shake out in the HFC and the NBFC sector ….

There will be a few champions who will be left standing but I think of the top of my head I cannot see more than three credible NBFCs surviving this brutal shake out over the next two years,” he added.

Varinder Bansal produced data which shows that NBFCs are due to repay a colossal sum of Rs 1.3 lakh crore in Q1FY20.

This is scary for me.

Nearly Rs 1.3 lakh crore of NBFC borrowing from MFs coming up for repayment in Q1. NBFCs under stress will face serious issue for repayment. pic.twitter.com/Id9w6lxy2N— Varinder Bansal ?? (@varinder_bansal) April 26, 2019

Private Banks will be beneficiaries of NBFC meltdown

It is elementary that if the NBFC sector is in trouble and runs out of money, borrowers will have no option but to make a beeline for Banks to seek funds.

“Big private banks will make tons of money going forward,” Saurabh exclaimed with a big smile on his face.

“Two pockets in the Nifty which I think will run over the next 12 months… the first pocket is the top 4 private sector banks… the big four private sector banks with good balance sheets, good CASA franchises will make tons of money in the next couple of years. The other space is FMCG,” he added.

Which are the four private banks which will make “tons of money”?

Saurabh did not name the four private banks.

However, finding the “big four private sector banks with good balance sheets, good CASA franchises” is child’s play for sleuths of our caliber.

These are HDFC Bank, Kotak Bank, ICICI Bank and Axis Bank.

Saurabh has given these stocks pride of place in his famous “Coffee Can Portfolio” of multibaggers.

“HDFC Bank, Kotak Mahindra Bank, Asian Banks and Nestle are high-quality companies, with a stellar long-term track record and that is why people wanted to buy these stocks,” he explained.

“We are buying companies with clean financial statements, high-quality governance, stellar franchises, and long track records of cash generations. Where I am perplexed is where you don’t have these sort of track records and that is almost 90 percent of the Indian market and still people want to buy these companies with less than ideal fundamentals at giddy valuations,” he added.

“If you want to put money work in India in stellar franchises, structurally compounders such as HDFC Bank, Asian Paints are good and it is a good time to buy …. If one wants to play rung beneath that a play, for example, Maruti Suzuki or HUL, this is not the time to be speculating on second line stocks,” he elaborated.

Why not just invest in Bank Bees?

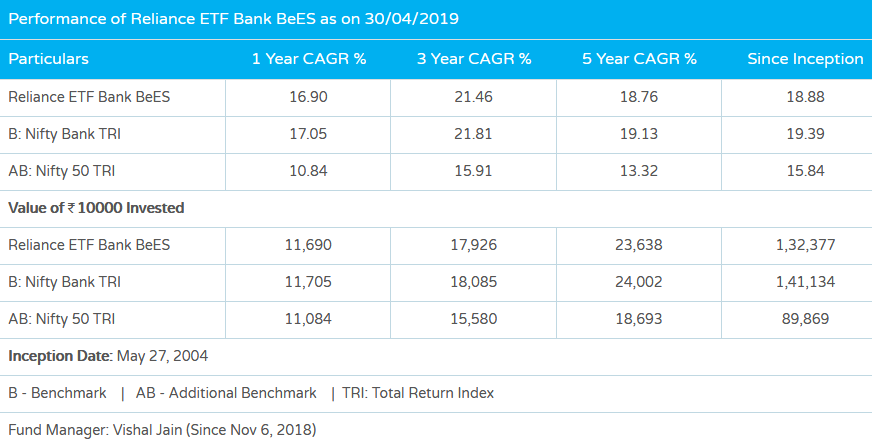

A sensible way of implementing Saurabh’s advice to buy the four top private banks is to buy the famous ‘Reliance ETF Bank BeES‘.

This ETF gives us a combo of the best private sector banks like HDFC Bank, ICICI Bank, etc together with the best PSU Banks like SBI, PNB etc.

The latest portfolio of the ‘Reliance ETF Bank BeES’ is as follows:

| Name of the Instrument | % to NAV |

| HDFC Bank Limited | 33.26% |

| ICICI Bank Limited | 18.13% |

| Kotak Mahindra Bank Limited | 12.78% |

| Axis Bank Limited | 11.69% |

| State Bank of India | 9.06% |

| IndusInd Bank Limited | 6.42% |

| Yes Bank Limited | 2.43% |

| RBL Bank Limited | 2.19% |

| The Federal Bank Limited | 1.44% |

| Bank of Baroda | 1.09% |

| IDFC First Bank Limited | 0.73% |

| Punjab National Bank | 0.70% |

| Subtotal | 99.92% |

Here are 5 easy ways to find great #stocks. Use a simple screener to use this approaches. pic.twitter.com/4zBJCjWCwh

— Trading Blog – JK (@BlogJulianKomar) June 15, 2018

Ironical that risk averse investors who put money in debt funds have to suffer haircut due to DHFL default

True. Rules to be rewritten in this modern age. High Risk equity becomes low risk and Low risk debt becomes high risk. Don’t know where is SEBI, Rating Agencies and Other Watch dogs. Each of the DHFL PRAM Debt Funds have got more than 40% exposure to own ground of companies. Markets have become full of scams and frauds looting innocent investor funds.

very good points. the DHFL saga is a complete failure of all regulatory agencies. SEBI, RBI, Ratings agencies. Everybody has been silent.

he is highly reliable an analyst