Logistics stocks surge like rockets ….

On Friday, 17th November 2017, most logistics stocks surged like rockets.

Gati Ltd led from the front with a spectacular gain of 10%.

TCI Express and TCI were in hot pursuit with hefty gains of 7% each.

What caused the sudden surge in these stocks is not known. Presumably, the ratings upgrade announced by Moody’s may have played a part in the euphoria for logistics stocks.

…. Though Allcargo Logistics stayed subdued

However, the baffling aspect is that Allcargo Logistics stayed subdued and did not participate in the euphoria.

With great difficulty, the stock managed to notch up a petty gain and that too after much egging by the punters.

Even on a YoY basis, Allcargo Logistics is flat. In contrast, its arch rivals TCI and TCI Express have notched up hefty gains.

Appointment of Claudio Scandella of DHL will be game changer?

Claudio Scandella, the former CEO of DHL, has been appointed CEO of ECU Worldwide, one of Allcargo’s subsidiaries.

Scandella has rich experience of the logistics business given that he was a member of the DHL Global forwarding senior leadership team as the CEO of their Middle East, Africa & Turkey operations.

ECU Worldwide is one of the global leaders in shipping logistics and the biggest LCL (less than container load) consolidator in the world.

ECU contributes 80 per cent of Allcargo’s revenue today.

It is quite possible that Claudio Scandella may give Allcargo the catalyst for growth that it badly requires.

Allcargo will invest Rs. 1,000 crore & become a $2-billion global leader by 2020: Shashi Kiran Shetty

Shashi Kiran Shetty, the visionary Chairman of Allcargo Logistics, has stated that his focus is to turn Allcargo into a $2-billion global leader by 2020.

“We are in a large industry; we are in India and we are global. There is always an opportunity to grow organically in the markets where we operate. That’s clearly one focus,” he said.

He explained that the industry is very fragmented and that buying existing players is one of the quickest ways to grow.

“Warehousing and distribution require a large scale, and very few companies can do it because that needs lot of capital and management bandwidth. It is not simply loading and unloading trucks and storing goods in a godown. A lot more goes into it — there is inventory management and value addition; it’s a very scientific way of managing business that needs a lot of competencies and capabilities, which we have as an organisation,” he elaborated.

The Goods and Services Tax is expected to spur consolidation and transform the warehousing industry.

One of the game plans is to invest as much as Rs. 1,000 crore over the next five years to increase the capacity to over 10 million sqft, from about 2 million sq ft, spread across 15-20 cities.

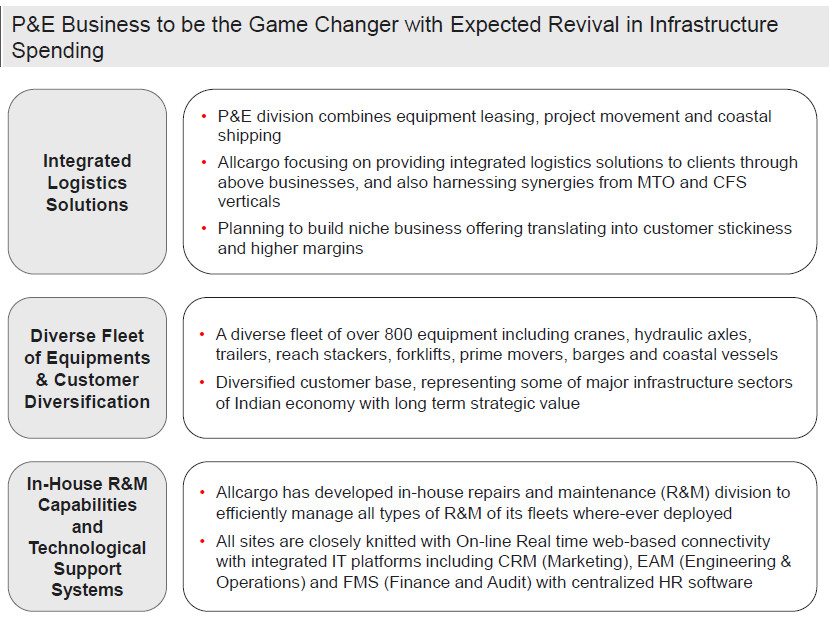

P&E Business to be the Game Changer with Expected Revival in Infrastructure Spending

According to the latest investors’ presentation, the Project and Engineering Solutions Business will be a “Game Changer” with expected revival in infrastructure spending.

The logic for this is explained in the following words:

P&E’s Strong Long Term Growth Opportunity

– Infrastructure led growth especially in sectors like power, oil & gas, cement and steel – expected to increase demand for specialized transport solutions

– Government focusing and incentivizing on shifting cargo carried by rail and road to coastal shipping and inland waterways

– Government plans to take wind energy generation to 60,000 MW in the next 5 years from around

20,000 MW currently.

Government also plans to have 100,000 MW of solar power capacity by 2022

– Government plans to set up 5 new Ultra Mega Power Projects, each of 4,000MW

– US$ 45 Billion is expected to be spent oil & gas sector in India in next few years

– India’s cement demand is expected to reach 550-600 Million Tonnes Per Annum (MTPA) by 2025. To meet this demand, cement companies are expected to add 56 MT capacity over the next three years

– India’s steel sector is expected to grow from 91 Mn tons in 2015 to 300 Mn tons by 2025

– Currently metro rails are fully operational in only 2 cities of the 53 Indian cities with a population of more than one Million. Almost all the state capitals are having plans to build metro railways

– Significant capex expected not only on Greenfield projects, but also on repairs & maintenance, and transmission & distribution

– Demand for world-class quality supply chains to handle project cargo – expected to increase significantly

Allcargo Logistics is a great buy: Sudip Bandopadhyay

Sudip Bandopadhyay of Inditrade Capital has recommended Allcargo Logistics as a “great buy”. His logic is as follows:

“I have been bullish on Allcargo Logistics for quite some time and I think it is a great buy – GST or no-GST, fresh trigger or no fresh trigger. Fundamentally, this company is doing very well. Globally they are one of the largest player in less than container load segments.

A whole lot of things they are doing right and I think with all the kind of economic activity picking up in the country, GST getting implemented, they are going to be the big beneficiary for domestic business as well. So both, domestic and global business for Allcargo looks excellent. For fundamental long term investor, even at current level, Allcargo is a great buy“.

Allcargo has strong position in the Industry and huge growth potential: Choice India

Choice India has also recommended a buy of Allcargo Logistics on the following logic:

“Indian logistics industry is moving towards a phase of major transformation Government’s plans to cut logistics costs from the current 14-15% of GDP to 9- 10%,through a modal shift towards water and railway and efficiency improvement, the sector is all set to experience a positive growth trajectory. Government also announced Sagarmala project for port modernization and augmentation, development of multimodal logistics parks, smart cities project and dedicated freight corridors. Successful and timely completion of these proposed projects will ensure cost effectiveness and operational efficiencies in the transport and logistics sector. With the effect of GST, instead of maintaining smaller warehouses in each and every state ACLL will be able to set up fewer and bigger warehouses. And follow hub and spoke model for freight movement from warehouses to manufacturing plants, distributors and retailers. Hence, a bigger opportunity awaits the company this help company to manage bigger routes and deliver accurately and efficiently. GST provides with ample opportunities to expand the contract logistics business in India. The Company’s Expansion plans of setting up rail linked park logistic park in jhajjar (Haryana) and new CFS set up in Kolkata which will be soon in operation will help to take the business to next level of growth With a strong order book, we are hoping for revival in private capex along with the already increasing public capex, driving business growth for the company. Strong cash flows generated in the years to come, will be used to bring down the existing debt on the balance sheet. At a CMP of Rs. 168.9 ACLL is trading at a TTM P/E multiple of 17.7x, which is at a discount to the peer average of 36.2x on the EV/EBITDA front too the Company is trading at a TTM of 9.9x which is at discount to the peer average of 16.6x. We expect the company to have a strong position in the Industry and it also has huge growth potential, thus we assign “Buy” rating on this stock.”

Stock is also recommended by Porinju Veliyath, DD Sharma and others

In my earlier piece, I have drawn attention to the fact that Allcargo has been recommended by a number of leading experts such as Porinju Veliyath, DD Sharma, Sandeep Jain, Motilal Oswal, Religare, PL and Maybank Kim.

Allcargo a multi-model logistics player; a stock worth watching: @porinju@nikunjdalmia @AyeshaFaridi1 @tanvirgill2 @SiddarthBhamre pic.twitter.com/N3F3CoYG3b

— ET NOW (@ETNOWlive) October 19, 2017

All experts are unanimous in their opinion that the subdued performance of Allcargo Logistics is a blessing in disguise because it gives investors the much needed opportunity to tuck into the stock at bargain basement levels.

However, whether the stock will be able to shed its lethargy and catch up with its illustrious peers like TCI and TCI Express requires to be seen!

Interesting that this scrip, which looks fundamentally good, is resisting all attempts of brokers and analysts, especially when anything featured on RJ site would go up 5-10% that day! Motilal Oswal recommended it last month, and now RJ site recommends it, shows big capital expenditure move of the company, big management change etc etc, but the scrip is stuck around 170! Rise in Other logistic companies is like rubbing salt on analyst/investor community’s wounds!

I was a holder of allcargo shares since 2 yrs. It still sticks with same levels . Finally I exited from it.

Sir, Mr.Porenjuji has tken 5.35% stake in ASHAPURA MINCHEM. Please make your comments.