Housing finance is a large market, but there aren’t many real players

“Housing finance is a large market, but there aren’t many real players,” Ajay Piramal told Nisha Poddar, the charming M&A specialist of CNBC TV18.

When Nisha looked at him quizzically, the Billionaire explained that though there are more than 80 housing finance companies operating in the Country, there are only ten with an AUM of more than Rs. 15,000 crore and 16 with an AUM of more than Rs. 5,000 crore.

He added that even in this AUM, it is not just pure housing finance loans but it also includes construction finance and loan against property.

“We have just started the housing finance company. In the 20-odd days that we’ve got the licence, we have got Rs 200 crore worth of loan book, and expect it to touch Rs 15,000 crore by 2020,” he said.

“So it tells us how big an opportunity it is,” he emphasized with a big smile on his face.

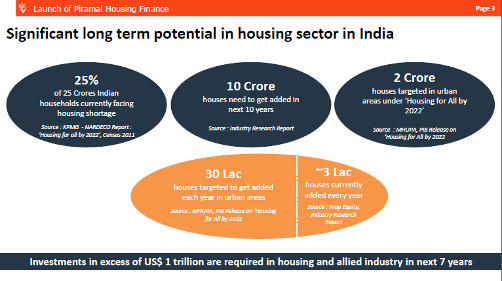

Significant long term potential in housing sector in India

Ajay Piramal also furnished an investors’ presentation of Piramal Housing Finance, a subsidiary of Piramal Enterprises, which provides valuable data about the housing sector.

The data is as follows and is quite mind-boggling:

(i) 25% of 25 Crores Indian households currently facing housing shortage;

(ii) 10 Crore houses need to get added in next 10 years;

(iii) 2 Crore houses targeted in urban areas under ‘Housing for All by 2022’;

(iv) 30 Lac houses targeted to get added each year in urban areas;

(v) ~3 Lac houses currently added every year.

The presentation emphasizes that investments in excess of US$ 1 trillion are required in housing and allied industry in the next 7 years.

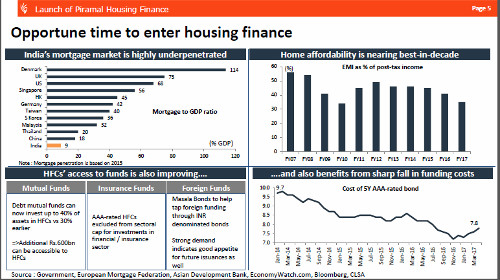

Opportune time to enter housing finance

The presentation by Piramal Housing Finance also makes out a compelling case on why the present is the opportune time to enter housing finance.

It is also pointed out that there are very few players in HFCs dominating the market and that there is massive opportunity for the incumbents and newcomers to grab market share.

It is also stated that the strong government focus on housing sector augers well for the HFCs.

The housing finance sector is a “lakh crore ki kahani”

Basant Maheshwari is credited with being the first discoverer of the potential of housing finance stocks.

He has been repeatedly egging us to buy these stocks on the basis that he is “super, super bullish” about them and that they are “blind buys”.

Basant has confidently predicted that such will be the growth of the HFC stocks that one of them will trade in “five digits” in the foreseeable future.

Vijay Kedia has endorsed this stance by proclaiming that the housing finance could be the next market leader.

In my view, 'Housing Finance' sector could be the next market leader.

— Vijay Kedia (@VijayKedia1) January 30, 2017

The same theory was reiterated by Raamdeo Agrawal at the Sohn India Conference 2017.

He excitedly described the entire sector as a “lakh crore ki kahani” implying that we will be able to rake in unimaginable wealth from the HFC stocks.

Needle in a Haystack found by @Raamdeo Agarwal, PNB Housing Finance Limited Stock. What a Narrative! @varinder_bansal @CNBCTV18Live #Nifty pic.twitter.com/X1l7i2Oznf

— Rattan Joneja (@rattanjoneja) June 7, 2017

The housing sector is at a tipping point and will be the economy’s next big growth driver: CLSA

The theory with regard to the potential for the housing finance sector is not just one of intuition but is backed by solid data.

CLSA has opined that the housing sector is at a tipping point and will be the economy’s next big growth driver.

It has also stated that the catalyst is the government’s big push for an ambitious affordable housing programme and that this “will unleash a trillion-dollar-plus housing market opportunity over the next seven years”.

Housing Fin broad based rally yesterday got me digging. Found this brilliant note from CLSA: pic.twitter.com/CI2IrFwLQx

— Ajaya Sharma (@Ajaya_buddy) May 3, 2017

Best housing finance stocks to buy

Now, we have to turn to the challenging but enjoyable task of identifying the best housing finance stocks to invest in.

Piramal Enterprises

Piramal Enterprises is one obvious choice. It is a diversified basket of high growth businesses which includes Piramal Housing Finance.

Mohnish Pabrai has described Ajay Piramal as the ‘Warren Buffett of India’ and Piramal Enterprises as the ‘Berkshire Hathaway of India’, implying that we are assured of safety of capital coupled with high growth.

PNB Housing Finance

PNB Housing Finance is another obvious choice given that it has been recommended by Basant Maheshwari and Raamdeo Agrawal.

The Company is growing at a scorching pace. Basant has assured that it will do “phenomenally well“.

Canfin Homes

Canfin Homes is also a fail-safe option. The stock has doubled every year for the past four years straight and there is no reason to believe that the growth will slow down given the size of the opportunity.

Can Fin Homes – on average the stock has doubled every year for the past 4 years straight. Next 4 years could be better!

— Rajat Sharma (@SanaSecurities) July 27, 2016

As mentioned, this has doubled yet again for the year. So double now will be 6000!! https://t.co/hz51AVm2VA

— Rajat Sharma (@SanaSecurities) May 2, 2017

DHFL

DHFL is one of the crown jewels in Rakesh Jhunjhunwala’s portfolio and so it qualifies as a non-brainer investment for us.

Varinder Bansal has done a lot of number crunching and opined that DHFL is the cheapest in comparison to its’ peers.

This implies that there is sufficient margin of safety should things go awry.

DHFL is clearly the cheapest in terms of valuations in housing finance sector. pic.twitter.com/vWe7UQHtF2

— Varinder Bansal (@varinder_bansal) April 20, 2017

Kapil Wadhawan, CMD, DHFL, assured that the AUM would touch nearly 2 lakh crore and that the return on equity would be over 20 percent by 2020.

He also explained that the only reason for the stock trading at cheap valuations is because of the so-called “perception” about low levels of corporate governance.

“This entire thing about perception makes me laugh because on one hand you have a formidable business that we are running on the ground, you have close to 100,000 crore of AUM, which has been built from 2009. We have done a few acquisitions in the market, we deal with more than 25 banks and financial institutions, we have a AAA (triple A) rating from the rating agencies,” he said with a chuckle.

It is explicit that if the “perception” improves and DHFL is seen to be a reliable company, it will be re-rated and its valuations will surge to catch up with its peers.

DHFL

▪️Healthy asset quality

▪️NIM crosssed 3% (3.05%)

▪️Sale of non core business ➡️Significant value unlocked

▪️⬆️in profitibality➡️C/I ⬆️— Amit Gadre (@midcap_mantra) September 28, 2017

Other HFC stocks

There is a wide array of other stocks such as Repco Home Finance, LIC Housing Finance, Indiabulls Housing, Gruh Finance etc that we can choose from depending on our own preferences and convictions.

Pnbhfl is a no brainer keep accumulating on every dip

You are ignoring a new listing REL HOME FINANCE. RHFL with a attractive valuations.

Management had given a wonderful guidance, best outperformer in this segment considering 2-3 year period.

Yes agree. Recently listed. Only negative is it is owned by anil ambani.

Regards

Ranga

All top HFC stocks are good, buy and hold

DHL, Lic housing, Gic housing, Rel Home Finance, Pnb housing, L&t financial holding etc looks good.

I don’t see anybody uttering the name of HDFC. I think it’s a combination of all financials….hfc, insurance, banking, MF…..

Accumulate it for the next few years and pass it on to your child!

Mannappuram finance too got into housing finance, where Dolly Khanna is heavily invested. To give a thrust to their housing portfolio, they have brought on board corporate professional who is an expert in the sector. They seem to be moving in the right direction, this was stated in last con call by MD. Management is excited about the opportunity in the space and ready to take advantage.

Look at Muthoot Capital. It will be bigger than Mannapuram Finance.