Vijay Kedia’s sixth sense alerts him that Budget would confer bonanza for HFCs

It is long believed that ace stock pickers have a sixth sense that alerts them to buy stocks when they are on the verge of a tipping point.

We can see a live example of this in the case of Vijay Kedia.

On 30th January, Vijay Kedia suddenly surfaced from the blue to declare that the housing finance sector would be “the next market leader”.

In my view, 'Housing Finance' sector could be the next market leader.

— Vijay Kedia (@VijayKedia1) January 30, 2017

Just two days later, Arun Jaitley, the Finance Minister, declared in the Budget that affordable housing would be conferred the exalted status of “infrastructure” which entitles it to receive several incentives and concessions.

Understandably, real estate stocks and housing finance stocks have taken off like rockets since then and conferred heavy gains on their shareholders.

Vijay Kedia’a fans are obviously thrilled at the fantastic state of affairs.

@VijayKedia1 Sir, you have definitely attained some spiritual powers. Otherwise, how could you tell this even before budget was presented. ?

— Mihir A. Kulkarni (@MihirCoolcarney) February 1, 2017

@VijayKedia1 u were the 1st to tweet that Hsg.Fin. cos.will be d new leader. Now everyone is saying so.Dont mind,was the budget leaked to u?

— adi kumar (@adik0910) February 2, 2017

@adik0910 @VijayKedia1 To make serious money you need to spot the winner before others. Dr. Kedia has uncanny ability to regularly do that.

— Manoj Kaushik (@DillikiBiili) February 2, 2017

Kedia was characteristically modest and humorous about his predictive abilities.

Don't' ask this secret on twitter bro. Someone with initials 'AJ' told me.

No no.. not that AJ.

(Angelina Jolie) https://t.co/Q7uQIgJdie— Vijay Kedia (@VijayKedia1) February 2, 2017

“I love LIC Housing Finance”: Vijay Kedia

“I have loved LIC for long,” Vijay Kedia candidly admitted when Nikunj Dalmia grilled him about his favourite stocks.

“I am very bullish on the housing sector …. among housing finance companies, LIC is cheaper than its peers …. It may not be a multi bagger but I think that it should give me a 20-25 per cent return every year,” he added with his characteristic wide smile.

Dolly Khanna’ makes Manappuram Finance her No. 1 stock pick

It is not a coincidence that Dolly Khanna has also chosen to break her long-standing rule of not investing in NBFCs. I reported earlier that not only has she invested in Manappuram Finance but the stock has overnight become the number one stock in her portfolio with the largest capital allocation.

In fact, Dolly’s choice of Manappuram as an investment candidate in the NBFC sector is impeccable. Manappuram has a finger in almost all the pies. Apart from loans against gold, which is its mainstay, Manappuram also has its finger in micro-finance, SME loans and housing finance.

“Home finance segment provided a good business diversification opportunity,” V. P. Nandakumar, the promoter cum CEO of Manappuram Finance, revealed.

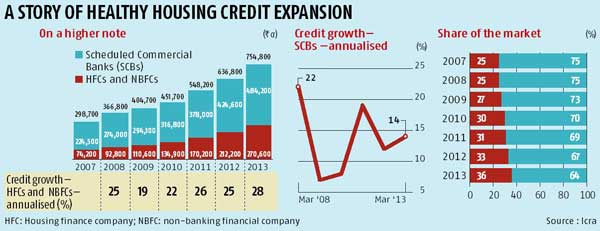

(Image Credit: Business Standard)

Housing finance stocks are a “Blind Buy”: Basant Maheshwari

Basant Maheshwari is famous for his unflinching bullishness for housing finance stocks.

His theory is that the unending demand for housing by the ever-burgeoning population of the Country augers well for these stocks. He has also pointed out that housing finance enjoy high repayments and low NPAs because borrowers are loath to default and lose the roof over their heads.

“A blind buy in this situation would be non-banking finance companies – NBFCs specifically relating to the housing finance sector. You can buy them, buy them 5 percent lower, 5 percent up from here, keep them for 5-10 years. The two which I own, are from western India and southern India,” Basant said.

Basant recommended Repco Home Finance as his “best buy for 2014”. The stock has done well and delivered gains of nearly 125% since then.

“Super Bullish” as Note-Bandi will benefit housing finance companies

Basant gave a detailed explanation in support of his theory that demonetization and the crack down on black money will benefit organized players in the housing finance sector.

“I am super bullish on housing finance …. they are growing at more than 30 percent. When home prices go down, what happens is you defer your purchase. You say maybe you will get it cheaper later on, so, you defer your purchase. So, to that extent, for a quarter or two quarters, there will be postponement of purchases …. So, all of that demand is going to come back in a lumpy nature.

Once the black component goes out, the ability of these guys to fund more would increase because you need more white money. Thirdly, as the unorganised lending and borrowing finishes, the organised financers would have bigger pie to run on. So, for example, if I am buying a house, I will say give me Rs 5 lakh and I will pay you interest every month and I take cash from you and do it; all that business is going to stop, nobody is going to give cash, nobody is going to take cash. So, I think the entire activity would increase. However, the screen discounts all of that. I am not giving you something which is out of the extraordinary. This is very fair knowledge to everybody and screen discounts all that.

Lower home prices increases affordability and lower home prices encourages people to go and buy it. So, I think that is going to come back with a bang. It might take a couple of quarters but afterwards it is all going to come back. So, out of the NBFC which I own and like, nothing has changed. I still own all of them — the NBFC space, the sector that I am talking about, housing finance is top on the list.

….

Housing finance companies are growing at more than 30 percent. I think anybody can go and just do the math. Not the 18-20 percent, not the 25 percent, the ones which are growing at more than 30 percent, I think they should do very well.”

Housing finance sector will see “immense growth” due to Budget 2017: Expert

D K Aggarwal of SMC Investments has conducted a detailed study of the impact of grant of “infrastructure” status to affordable housing in Budget 2017.

He has opined that the macro environment is extremely favourable for housing finance companies. The Modi government’s incentives in terms of allocation related to Pradhan Mantri Awas Yojana (PMAY) of Rs 23,000 crore would provide the much-needed momentum to the sector, he says.

He adds that the reduction in the holding period for capital gains tax in case of immovable properties from three to two years also augers well for the sector.

“In the days to come, supported by growth drivers such as rising disposable income, personal income-tax benefits, increasing urbanisation and economic growth of tier II and tier-II cities, the sector is likely to see immense growth,” D K Aggarwal opines.

A similar opinion has been expressed by other leading experts interviewed by ET.

One expert pointed out that affordable housing projects would now be able to attract investments from institutional, pension and insurance funds and external commercial borrowings at attractive rates. The borrowing cost of developer for construction of affordable homes would come down to below 10 per cent from 14-15 per cent in any other normal project, he added.

Stocks of small housing finance companies stand to benefit as lending rates fall.https://t.co/AtY7IF461z pic.twitter.com/I27hlWl90u

— BloombergQuint (@BloombergQuint) January 2, 2017

Real Estate, Housing Finance Stocks Gain After PM Modi Announces New Schemeshttps://t.co/McxXJgcfEl

— NDTV Profit (@NDTVProfit) January 2, 2017

Best housing finance stocks to buy

Now, let’s turn our attention to the best housing finance stocks to buy.

Buy IndiaBulls Housing Finance – Target price Rs. 1,010

Ventura Securities recommended IndiaBulls Housing Finance on 27th December 2016 on the logic that the Company is:

– focusing on the affordable housing segment,

– growing its loan book using better technology,

– leveraging its financial strength and improving its ratings to increase competitiveness

– and diversifying its funding mix to reduce funding costs.

The stock has surged from Rs. 628 to the CMP of Rs. 795, putting gains of 25% on the table. The target price of Rs. 1,010 implies that more gains are due from the stock.

Motilal Oswal have also recommended IndiaBulls Housing on the logic that “IHFL is among the lowest-levered HFCs (4.6 times) to support growth. Asset quality trend is likely to remain stable, while its improved borrowing profile, better credit rating, and liquidity buffer should help maintain healthy spreads”.

Buy LIC Housing Finance – Target price Rs. 645

LIC Housing Finance, which is Vijay Kedia’s favourite stock, has been recommended by PL on the logic that:

“LICHF net earnings of Rs4.99bn were in‐line with our estimates with strong NII growth of 22.6% YoY at Rs9.15bn (PLe: Rs8.82bn) but was offset by lower fee income (down 45% QoQ). Overall loan book grew at 15.3% YoY, but growth was mainly led by strong growth in developer book (45% YoY) and LAP book (87% YoY). Core retail book growth continues to be slow at 9.4% YoY. Competitive landscape continues to be tough with all asset financiers getting into faster interest rate cuts, while cost repricing has been gradual which will keep spreads steady. We retain ‘Accumulate’ with revised PT of Rs645 (from Rs630), based on 2.3x as we rollover to Sep‐18E ABV.”

UBS and JP Morgan also recommend LIC Housing Finance

Buy Dewan Housing Finance – Target price Rs. 374

Dewan Housing Finance is Rakesh Jhunjhunwala’s all-time favourite stock. He bought the stock when it was languishing at throwaway prices and has pocketed hefty multibagger gains since then.

Edelweiss has recommended a buy of DHFL on sound logic:

“DHFL is bound to be key beneficiary of government’s initiative to promote affordable housing, given its presence in tier II/III cities and lower ticket size. However, in view of rising proportion of developer loans, we are building in higher NPLs going forward. The company has the potential to deliver 20% earnings CAGR over FY16-19E with RoE of 16%. Juxtaposing this with inexpensive valuation (1.3x FY19E P/ABV) renders favourable risk-reward. We maintain ‘BUY/SO’ with a target price of INR 374.”

Buy PNB Housing Finance

PNB Housing Finance has come under the radar of several astute investors.

PNB Housing is best compounding story- Fastest growing HFC https://t.co/BdnsGUb1XS

— Rakesh Laroia (@r_laroia) February 3, 2017

Porinju Veliyath recommends buy of GIC Housing Finance with prediction of 30-40% YOY gains

Porinju Veliyath has recommended that investors should stick to old and trusted stocks which have not posted hefty gains in the past. He has recommended an investment in GIC Housing Finance with the confident assurance that the stock would deliver hefty gains of 30% to 40% on a YoY basis.

What about affordable housing real estate stocks?

At this stage, we have to also pay attention to stocks such as Ashiana Housing and Poddar Developers, both of whom have a stranglehold over the affordable housing sector.

Daljeet Kohli recommended Ashiana Housing as part of his Budget 2017 stock recommendations. The stock has rocketed from Rs. 143 to Rs. 174, leading to impressive gains of 22% in just a few days.

It is worth noting that Ashiana Housing and Poddar Developers are backed by eminent luminaries like Ashish Kacholia, Brahmal Vasudevan’s Creador/ Latinia, Prof. Sanjay Bakshi etc. So, it is only a question of time before these stocks show their true mettle and shower hefty gains on investors.

Billionaire Narayana Murthy loses 55% in ill-timed panic sale of Can Fin Homes

I have earlier reported the shocking news that Billionaire Narayana Murthy’s Catamaran Investments sold off a massive truckload of 153,041 shares of Can Fin Homes at Rs. 1290 on 15th November 2016.

Prima facie, it appears that the Billionaire was panic-stricken by the LAP (loan against property) exposure of Can Fin Homes and feared that demonetization and the crusade against black money would spell doom for all real estate and housing finance stocks.

The sale was most ill-timed. All worries of demonetization etc are now a distant memory. Can Fin Homes has bounced back to Rs. 2000, showering hefty gains of 55% since the knee-jerk sale.

Conclusion

The bottom line is that we need to wake up from our slumber, take a cue from the illustrious troika of Dolly Khanna, Vijay Kedia and Basant Maheshwari and tuck into real estate and housing finance stocks without further delay!

DHFl , LIC and GIC housing are good bets in this sector along with L & T finance and Rel Capital.Pvt banking are also good bets who will make money from housing sector.

I dont know whether to believe these guys or not. If big guys buy NBFCs/HFCs they may just mean to put topi on the ordinary investor’s head, which is make the retail investors buy such companies and these guys sell quietly and vanish. Look at Prima Plastics. It is backed by well known investors whom I dont wish to name, they are very well known. What a dismal performance it came out in Q3 of this FY. Even the 9 month performance is poor. Im sure the shareprice will be artificially spiked and the hyped investors will quietly exit, and share price will plummet. Please do your own research before buying, and do not buy any stock just because some biggie bought it.

The two which I own, are from western India and southern India,” Basant said. Any idea Which are the two cos Basant is refering to? I know probably one that he likes/owns is Can Fin homes.

Basant & vijay both the maestro will take HFCs to new highs for sure!!!!

My bet is on Manapuram

my super bets are DHFL & GIC

Which is the Housing Finance company Basant is referring to which he owns and is growing at more than 30 percent ???

@Jose In a recent interview with ET Now, Basant disclosed that his PMS owns PNB housing finance and Can Fin homes. He also said he does not recommend to buy these stocks nd he may sell it trow itself.

Thanks Rish … I thought Can Fin Homes & Ujjivan