400% gain in 15 months. Rs. 2 crore earned from margin money of Rs. 50 lakh

Ashwani Gujral has earlier revealed that in FY 2017-18, he earned an income of Rs. 2.49 crore from trading in Bank Nifty Futures.

This was done with margin money of Rs. 50 lakhs.

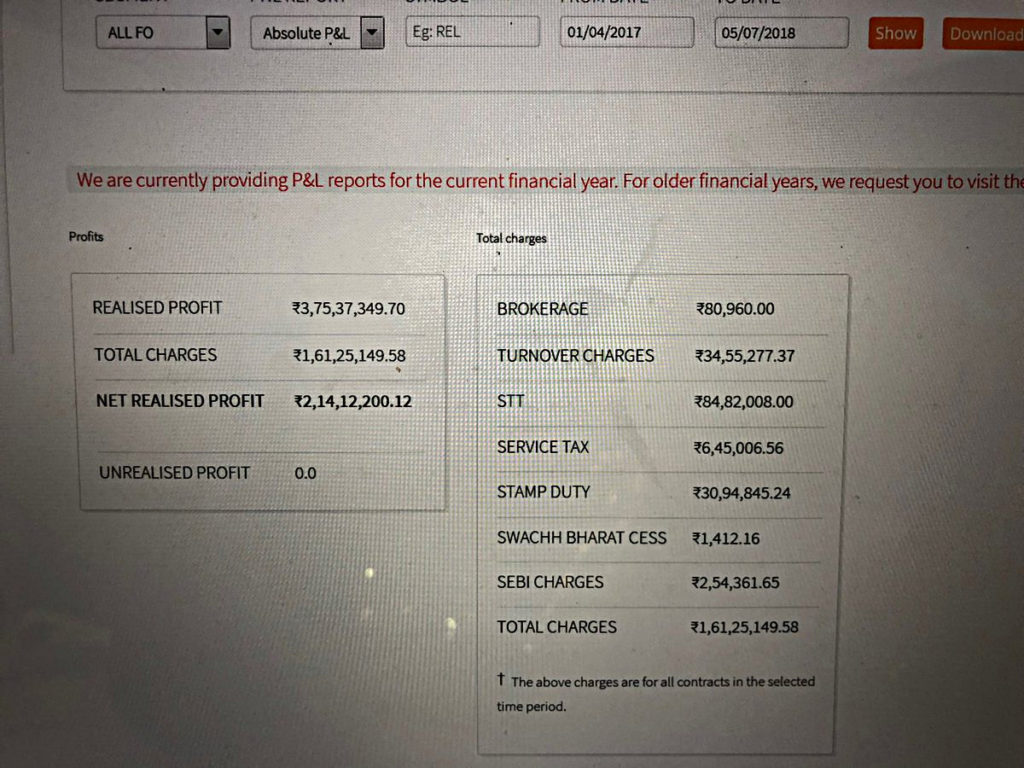

In continuation of that disclosure, he has now revealed that his earnings for the 15 month period from 1st April 2017 to 5th July 2018 has totaled Rs. 2.14 crore.

15 months, 400 pc return, 50 lk starting capital!!! It’s possible pic.twitter.com/tdWrMUdxSd

— Ashwani gujral (@GujralAshwani) July 5, 2018

A minute study of the screenshot reveals that the total profit was Rs. 3.75 crore of which charges of Rs. 1.61 crore was incurred. The net realized profit is Rs. 2.14 crore.

Of the charges, STT is the biggest component at Rs. 84.82 lakh. Turnover charges comes second at Rs. 34.55 lakh followed by stamp duty at Rs. 30.94 lakh.

There are several other sundry levies towards service-tax, SEBI charges and also Swacch Bharat Cess which also eat up a large part of the gains.

The broker (presumably Zerodha) had to stay content with a measly fee of Rs. 80,960.

The reason for the low brokerage is because the charges are levied at 0.01% or Rs. 20 per executed order, whichever is lower.

So, even if the order size is Rs. 100 crore, the maximum brokerage payable is Rs. 20.

This makes it an irresistible win-win situation for traders.

Rs. 65 Lakh earned in Q1FY19

Ashwani Gujral also revealed that in the period from 1st April 2018 to 4th July 2018, he has raked in a profit of Rs. 64.74 lakh.

Here also, the total earnings were Rs. 1.15 crore and various assorted charges gobbled up Rs. 51.21 lakh, leaving only Rs. 64.72 lakh as take-home income.

Extrapolating these earnings to the rest of the year, we can expect Ashwani Gujral to report an income of Rs. 2.50 to 3 crore for FY 2018-19, which is quite a hefty figure.

However, he still described the Q1FY19 earnings as “lukewarm”, implying that there is scope for substantial enhancement in the income.

Lukewarm 1st quarter, 2018, still up 65 pc in da quarter on a capital of 1 cr, inspite of losing some in developing new products. Traders make money in up and down mkts pic.twitter.com/KLrXHGB56i

— Ashwani gujral (@GujralAshwani) July 4, 2018

While stats posted by me are good, I will be dead the day they stop improving. Trading like life and gym, the more you push, the better your stats. I think they will get much better in the months to come. I am looking to make profits larger and losses smaller, not win rate!!!

— Ashwani gujral (@GujralAshwani) July 7, 2018

Traders respect risk and escape with small losses; investors do not and suffer huge losses

It is no secret that investors in Dalal Street are presently in a highly pitiable state.

The stocks that we bought with “multibagger” aspirations have turned into “multibeggars” and left us in a poverty stricken state.

In sharp contrast to the sorry state of the investors, traders are raking in big bucks owing to the extreme volatility.

Ashwani Gujral opined that this is because traders “respect risk” and bail out in a hurry if the trade is not going as expected.

Investors, on the other hand, hold on to stocks despite poor earnings in the forlorn hope that someday the tide will turn.

The midcap plunge has lead portfolios to bleed 40-50 PC. Meanwhile traders have made money in this volatility. This is da difference between traders and investors. Traders respect risk!!! To make back 40 PC, you now need to make 65 pc. RIP small/midcap/multibagger/crap investing

— Ashwani gujral (@GujralAshwani) May 30, 2018

Don’t buy crap shit stocks. Buy ETFs and established brand stocks

Ashwani Gujral advised that the sensible strategy that novices should follow is to invest 50% of the portfolio in mid-cap Exchange Traded Funds (ETFs) and the balance in stocks of companies with established brands which are looking strong even in weak markets.

He recommended an investment in Reliance ETF Junior BeES.

Prima facie, the recommendation of Reliance ETF Junior BeES is quite sound.

The top 10 holdings of the ETF are as follows:

| Company | Sector | Value | %Assets |

|---|---|---|---|

| Britannia | Food & Beverage | 19.09 | 5.05 |

| JSW Steel | Metals & Mining | 19.29 | 5.00 |

| Godrej Consumer | Cons NonDurable | 15.89 | 4.16 |

| Motherson Sumi | Automotive | 13.73 | 3.60 |

| Dabur India | Cons NonDurable | 11.35 | 3.13 |

| Ashok Leyland | Automotive | 11.75 | 3.08 |

| Shriram Trans | Banking/Finance | 11.69 | 3.06 |

| Piramal Enter | Pharmaceuticals | 11.95 | 2.97 |

| Shree Cements | Cement | 11.36 | 2.97 |

| United Spirits | Food & Beverage | 10.48 | 2.75 |

No doubt, each of the ten stocks is a high-quality fail-proof multibagger powerhouse.

The ETF has also notched up hefty gains with a five year CAGR return of 19.40%, which is quite impressive.

| Performance of Reliance ETF Junior BeES as on 31/05/2018 | |||||||

|---|---|---|---|---|---|---|---|

| Particulars | 1 Year CAGR % |

3 Year CAGR % |

5 Year CAGR % |

Since Inception |

|||

| Reliance ETF Junior BeES | 13.14 | 14.40 | 19.40 | 22.30 | |||

| B: Nifty Next 50 (TRI) | 13.62 | 15.41 | 20.53 | 23.70 | |||

| AB: Nifty 50 Index (TRI) | 13.30 | 9.79 | 13.78 | 17.96 | |||

| Value of Rs 10000 Invested | |||||||

| Reliance ETF Junior BeES | 11,314 | 14,989 | 24,276 | 216,785 | |||

| B: Nifty Next 50 (TRI) | 11,362 | 15,392 | 25,451 | 257,941 | |||

| AB: Nifty 50 Index (TRI) | 11,330 | 13,246 | 19,072 | 124,814 | |||

| Inception Date: Feb 21, 2003 | |||||||

| B – Benchmark | AB – Additional Benchmark | TRI: Total Return Index | |||||||

| Fund Manager: Payal Wadhwa Kaipunjal (Since May 2008) | |||||||

The best part is that ETFs operate in a low-cost environment which means that we will not have to sponsor the hefty salaries that mutual fund managers take home for buying the same stocks as in the ETF (see Warren Buffett’s Warning Falls On Deaf Ears As Mutual Fund Managers Take Home More Salary Than Mukesh Ambani & Other Corporate Hot Shots Despite Poor Performance).

A lot of people in pain buying midcap multibaggers. Now what? Find companies with estd brands. If after this sort of carnage, if a stock is at new highs then it means smart players are buying. Examples Avenue supermart, bajaj twins, Titan..etc This technique is powerful.

— Ashwani gujral (@GujralAshwani) June 3, 2018

The problem people have with their portfolios is that they have all pinch hitters. Reduce risk by putting 50 pc in midcap ETF. And rest should be gud quality , decent size, trading at new highs. Out of 10 multibaggers, the hit rate is often 1/10!!! Respect risk or risk do u!!!

— Ashwani gujral (@GujralAshwani) June 28, 2018

And then every month, cut losers and add that money to winners, just keep doin that for da rest of your life. And maybe u will get a few multibaggers, that is how u get multibaggers. Not by buying unknown crap shit stocks

— Ashwani gujral (@GujralAshwani) June 28, 2018

reliance junioe bees

— Ashwani gujral (@GujralAshwani) June 28, 2018

Here are 5 easy ways to find great #stocks. Use a simple screener to use this approaches. pic.twitter.com/4zBJCjWCwh

— Trading Blog – JK (@BlogJulianKomar) June 15, 2018

Latest book – How to Make Money in Intraday Trading

Ashwani Gujral has released a new book titled “How to Make Money in Intraday Trading: A Master Class By One of India’s Most Famous Traders”.

According to one reviewer, the book is a “practitioner’s guide for stock markets” and “covers all the basics very well”.

Yet another claimed that “This is not just a book. This is a intraday course for every novice trader with a minimal fees. Strongly recommended for all novice trader.”

Other readers have also heaped rich praise on the book for dealing with the basics of intraday trading in a “crisp, clear and concise manner”.

Conclusion

Trading in Nifty and Bank Futures does not appear to be our cup of tea given our lack of mental sharpness. However, the advice to respect risk by investing only in high-quality stocks is a sound one which we can and should follow diligently!

I love it when closes his eyes on TV and speaks to Latha. I did not know he was making so much money.

Yes Sonia, Ashiwni is really cute as a teddy bear:) He has good sense of humor too the way he answers trick questions. He seems to be a great expert in Bank Nifty.I have been tracking his calls for some time.Still trying to build my conviction though.

He is fooling around you , me and all, better do your own (repeat) own research and study if you are investing in SHARE MARKET.

His advice of investing in ETF and top quality nifty/BSE stocks is the only thing I have got good from him till now.

Guys/Girls, Never ever ever try to get quick rich formula of FUTURES/OPTIONS.

And for GOD’S sake never ever act on tips/advices on FUTURES/OPTIONS or INTRADAY trades of these people.

NEVER BUY TIPS/ADVICES FROM THEM AND ALSO NEVER FOLLOW THEIR FREE ADVICES.

They make money from us in two ways:

1. By selling their subscription of tips/advices.

2. By putting trades on the same advices they give to us.

On one hand they will tell you to buy and on the other they will themselves be selling the same stock.

Through these means they make money.

While they are giving tips on TV to buy/sell a stock and their agents are ready to give sell/buy respectively in no time.

In one or two minutes they make huge money, and non suspecting people like you and me keep waiting for prices to come up to our desired level which never happens.

friends

it is a marketing gimmick.

Dont fall prey to excel mesmarics.

Ashwini is a great strategist .People are making false videos of him.He is a champ in Bank Nifty.

For whatever the reasons, he had built up sizable corpus (profit in the market) in the initial years and he can afford to lose that corpus in trading. His principal is not stake. His case is like, if he wins, it is big show and where as if he loses, nothing to worry. Novices and Ordinary investors have not got such luxury. No wonder, he keeps making money. Remember, all our trading losses are his profit.

Aswins strategy 75/present ok.but who are watch full Time tv.not more.so some time get opportunity to make money

Not every time.all in all THANK YOU.ASWIN SIR.