Santa Clause rally was AWOL. However, Bear market ended

I pointed out earlier that some leading experts were of the view that a mega Santa Claus rally was about to take Wall Street and Dalal Street by storm and send stocks surging.

This prognosis was based inter alia on the fact that the S&P 500 had formed a rare “cyclical market bottom” of the type that happened only in 1974, 1982, 1987, 2002 and 2009.

Unfortunately, the rally was nowhere to be seen.

Instead, stocks crashed like a ton of bricks.

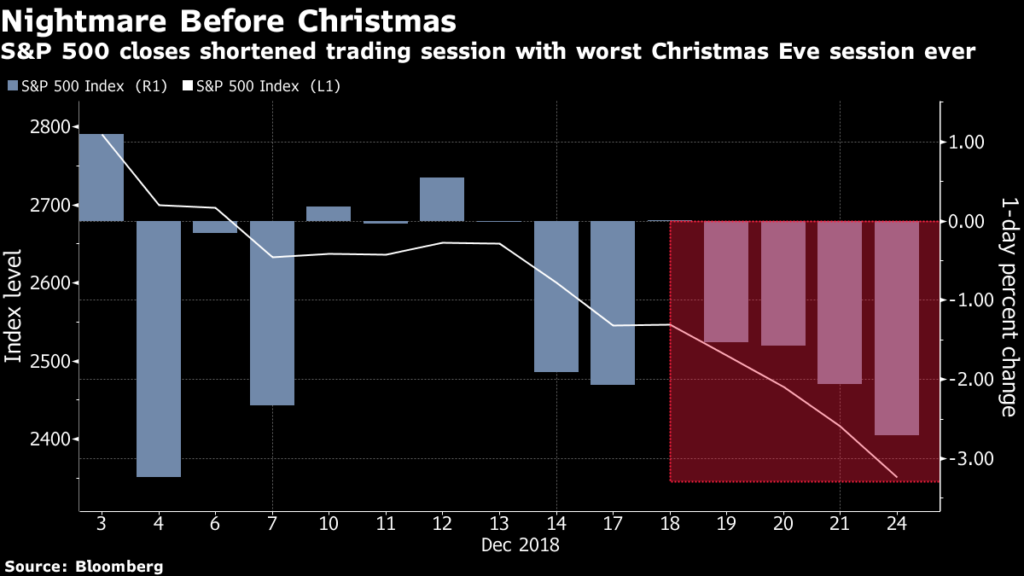

The Dow sank 2.9% while the S&P 500 lost 2.7%.

The Asian Indices, including the Sensex & Nifty, followed suit.

This is said to be the “biggest Christmas Eve declines ever“.

US stocks suffer worst Christmas Eve declines ever https://t.co/JgPQxvwrq3 pic.twitter.com/nvfOnZ0D3m

— WISN 12 NEWS (@WISN12News) December 24, 2018

Worst Christmas Eve performance for stocks ever. S&P officially closes in bear market

— Sara Eisen (@SaraEisen) December 24, 2018

“The market is getting pummelled from every direction,” an expert lamented, tears streaming down his face.

The tailspin was caused by a tweet from President Trump that “the only problem our economy has is the Fed,” stoking fears he may fire Jerome Powell, the Chairman of the Federal Reserve.

The only problem our economy has is the Fed. They don’t have a feel for the Market, they don’t understand necessary Trade Wars or Strong Dollars or even Democrat Shutdowns over Borders. The Fed is like a powerful golfer who can’t score because he has no touch – he can’t putt!

— Donald J. Trump (@realDonaldTrump) December 24, 2018

How to deal with Bear markets: 10 Tips by Jim Cramer

Jim Cramer is an authority on the stock markets, according to the intellectuals of Wall Street.

He has recommended 10 tips for novices to deal with Bear markets.

No doubt, there is a lot of sensible wisdom embedded in the 10 tips and we should follow them obediently.

Bulls make money, bears make money…with a lesson or 10. Check out what you missed during @JimCramer's full monthly Action Alerts Plus members-call here: https://t.co/yZdvrM4zEt pic.twitter.com/9QMYtV9ftD

— TheStreet (@TheStreet) January 19, 2019

Bear market ended on Christmas Eve

Now, Jim Cramer has opined that the Bear market has ended.

“We came through a bear market … people are still oblivious that the bear market ended on that horrible half-day,” the expert stated, confidence oozing out of his voice.

“I think people are still oblivious that the bear market ended on that horrible half-day” Dec. 24 session, @MadMoneyOnCNBC's Jim Cramer says. https://t.co/X4UdURPSDN

— CNBC (@CNBC) January 14, 2019

Prima facie, there is merit in this theory because the S&P 500 has surged a mammoth 13% since Christmas Eve, implying that a Bull market has resumed.

“It’s a grind higher, but I think that’s classic. The market takes the stairs up and elevator down. The elevator was a horror show in December. The market is just grinding its way back,” Art Hogan, chief market strategist at National Securities, said.

“It has happened in a rational fashion, and I think that’s good,” he added.

Experts opined that the recovery signals that the December sell off was an overreaction to fears about a global slowdown, rising rates and trade tensions.

“December was out of line with fundamentals,” Richard Bernstein, another expert, opined.

“Too dangerous” not to buy stocks now

Novices on Wall Street and Dalal Street are still cowering in fear and hiding in their bunkers.

They are too scared to venture out and buy stocks.

To cajole the novices and inspire them to be brave, Jim Cramer has advised that there is “incredible value” in the stock market right now.

“When you see this kind of positive action, you need to recognize what’s driving it. In the fourth quarter, stocks got way too cheap, and that overreaction to the downside has created incredible values that give investors a sense of certainty — they know they won’t be blown out if they buy something because there’s only so much much downside from these levels,” he patiently explained in a soothing tone.

“When you have that sense of certainty, it’s very easy to pull the trigger and buy,” he added with a big smile on his lips.

In a way, "it feels dangerous *not* to buy stocks," says @JimCramer https://t.co/fvXwgWs2WO

— Mad Money On CNBC (@MadMoneyOnCNBC) January 18, 2019

“Rok Sako To Rok Lo“: Basant Maheshwari & Porinju Veliyath

Jim Cramer’s advice that there is “incredible value” in stocks and that investors should rush in to buy is in line with that offered by Basant Maheshwari and Porinju Veliyath.

“Expect market highs led by financials. Rok sako toh rok lo!,” Basant declared.

“Market has bottomed out, getting ready for a bull run; Expect consumer stocks & financials to lead the bull run,” he added.

#OnCNBCTV18 | Basant Maheshwari, @BMTheEquityDesk says #market has bottomed out, getting ready for a bull run; Expect consumer stocks & financials to lead the bull run@_soniashenoy @Reematendulkar pic.twitter.com/XGFmF38gTg

— CNBC-TV18 News (@CNBCTV18News) December 14, 2018

With @DasShaktikanta as @RBI Gov expect interest rate cuts; liquidity & move from a headmaster type attitude + assembly elections show that though Modi didn’t get the seat share the vote share is intact for 2019 elections.Expect market highs led by financials.Rok sako toh rok lo!

— Basant Maheshwari (@BMTheEquityDesk) December 12, 2018

Porinju Veliyath has also come out with all guns blazing.

“Look at the 52-week highs and today’s price, unbelievable? Wait for next Dec and check the 52-week lows and prevailing prices, trust me it would be equally unbelievable,” he said.

Look at the 52-week highs and today's price, unbelievable? Wait for next Dec and check the 52-week lows and prevailing prices, trust me it would be equally unbelievable.

Applies only to non-index, sound stocks?

— Porinju Veliyath (@porinju) December 13, 2018

2018 was a year of correction & pain for investors. Now is a great time for stock-picking if you are yet to invest. India is on track – getting cleaner, whiter, organized and patriotic. Long way to go. Explore the pockets of opportunities in #ChangingIndia

— Porinju Veliyath (@porinju) December 2, 2018

General elections in 2004, 2009 & 2014 all witnessed beginning of equity bull cycles. This time won't be different. The fear of event is already behind us. Elections, whoever wins, vindicates Democracy!

PS: I know who will win in 2019 ?

— Porinju Veliyath (@porinju) December 12, 2018

Vijay Kedia recommends four multibagger stocks

Vijay Kedia is well aware of the fact that we need acute hand-holding.

We cannot be trusted to do anything on our own. We will invariably buy junkyard stocks and ruin ourselves.

So, he has cherry-picked four high-quality and fail-safe stocks with multibagger potential (see Vijay Kedia recommends 4 multibagger stocks for 2019)

He has also homed in on a stock that he “cannot takes eyes off” and given 10 reasons why the stock will delight investors.

The stock has been a mind-boggling 56-bagger in the past and enjoys the confidence of eminent luminaries like Ashish Kacholia, Malabar Fund, Nalanda Capital etc.

Conclusion

It would be foolish for us to ignore the collective advice of Jim Cramer, Basant Maheshwari, Porinju Veliyath and Vijay Kedia. We need to put our money to good use and buy stocks when the bargains last!

Not sure whether US market would bounce back so early and so fast as given in the post. US has more serious problems which include Fed tightening and its impact on interest rate and economy’s growth, Euro Zone issues including Brexit, China slow down and Japan growth rate and therefore expecting a hockey stick / J kind of serious turnaround in the global markets/US market does not seem a probability.

In fact, India is the only country with sweetest spot as of now. The only problem with India as of now is the general election round the corner and incumbent government’s profligate measures derailing fiscal discipline.

Simply misleading, big investors are trying to divest their portfolios as we know that it’s highly overpriced on PE, world market, cyclical.

Prepping novice investors to the slaughterhouse.