Novice investors fret & fume while ace investors spot money-making opportunities

The difference between novice investors and ace investors becomes apparent from the way they react to crisis situations.

While novice investors are getting their knickers in a twist and worrying about all sorts of permutations and combinations about the impact of demonetisation, the ace investors are displaying ice-cool temperament.

“Don’t worry about things that don’t worry about you,” Vijay Kedia, one of the finest investment minds, said in reply to a worried rant from one of his followers.

Dear, my knowledge about all these things is limited therefore I believe ' Don't Worry about things that don't worry about you'. https://t.co/jtzzebNkly

— Vijay Kedia (@VijayKedia1) December 7, 2016

Kedia’s statement sounds flippant but it actually encompasses deep philosophy. Instead of worrying about issues over which we have no control, stay cool and focus energies on issues over which we do have control is his precious advice.

It is this unique ability to stay calm in crisis situations and to think straight that has enabled Vijay Kedia to effortlessly amass a huge fortune from the stock market even while his peers are still languishing in poverty.

Proactive stance of thinking ahead and grabbing the bull by the horns

Porinju Veliyath’s proactive stance provides us with a textbook example of how one should always think ahead of the present and visualize what the future is likely to look like.

Much before the demonetisation and the digital payments revolution, Porinju visualized that a cashless regime would soon become a reality in the life of every Indian.

He advised his followers to buy select stocks which would profit immensely from the cashless regime.

We have a dozen e-governance stocks listed. Looks like an inflection point for this futuristic biz. I have been buying few of them.

— Porinju Veliyath (@porinju) September 30, 2016

That was a timely Idea on E-Governance stocks – up 40 to 100% in 2 weeks! @_nirajshah @nikunjdalmia pic.twitter.com/hhcIMjAYHF

— Porinju Veliyath (@porinju) December 5, 2016

Needless to say, all stocks from the cashless/ e-governance sector are surging like rockets due to massive demand from investors.

It is worth noting that some companies like TVS Electronics have notched up mind-boggling gains of 92% in just the last month.

| Stock | CMP (Rs) | 1-Month Gain (%) | YoY Gains (%) |

| ABM Knowledgeware | 171 | 32 | 36 |

| Aurinpro Solutions | 150 | 33 | (26) |

| Bartronics | 20 | 41 | 68 |

| Cosyn | 199 | 42 | 540 |

| Datamatics | 96 | 28 | 62 |

| HCL Info | 61 | 36 | 10 |

| Intellect Design Arena | 172 | 18 | (32) |

| RS Software | 118 | 79 | (6) |

| Nucleus Software | 292 | 47 | 13 |

| Quick Heal | 275 | 16 | 10 |

| TVS Electronics | 201 | 92 | 53 |

| Vedavaag | 61 | 59 | 59 |

| Vakranjee | 282 | 13 | 70 |

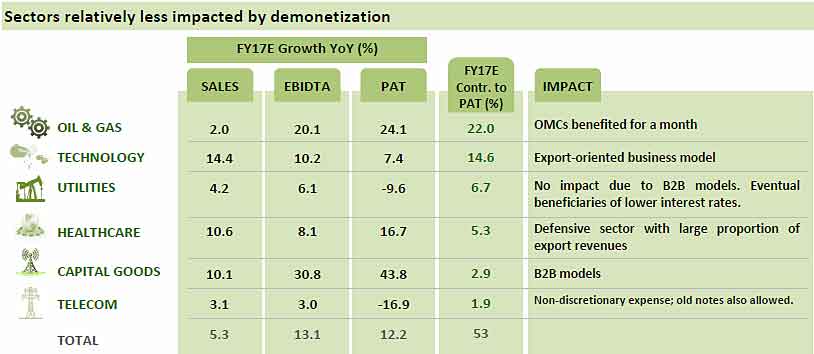

Systematic analysis by Motilal Oswal

The wizards at Motilal Oswal have conducted a systematic study into the impact of demonetisation on various sectors and stocks.

It is notable that there are several sectors which are immune to the adverse effects of demonetisation. However, these stocks have also taken a beating along with the rest of the market.

It goes without saying that tucking into these stocks (the ones that are not impacted by demonetisation) is a very sensible strategy indeed.

Best note-bandi stocks to buy now

The young Turks at CNBC TV-18 comprising of Anuj Singhal, Varinder Bansal and Sonia Shenoy deserve to be complimented because instead of being mere reporters, they are adopting a proactive stance and identifying opportunities for investments.

The trio has done path-breaking research into the stocks that will benefit from the demonetisation move.

It is notable that the stocks have been evaluated from the parameters of:

(i) EBITDA Margins – Quick Heal is on top with a whopping EBITDA margin of 30.5%. TVS Electronics comes a distinct second with a margin of only 8.9%;

(ii) EV/EBITDA – Quick Heal is the cheapest stock with an EV/EBITDA of 13.2x as compared to 37.3x for RS Software and 22x for Nucleus Software;

(ii) Debt and cash on books – Quick Heal scores again with a debt-free status and huge cash of Rs. 380 crore on its books.

Profile of the companies

Varinder Bansal also provided a succinct analysis of the companies referred to in his report:

(i) Quick Heal Technologies – A play on anti-virus software for mobile phones, laptops

(ii) RS Software – A play on electronics software. VISA was one of their big clients in the past

(iii) TVS Electronics – A play on electronic payment products. Makes swipe cards and billing machines

(iv) HCL Infosystems – A play on Aadhaar Data. It also -maintains central database of nearly 100 crore individuals.

(v) Nucleus Software – Developed world’s first offline payment solution software.

Quick Heal, favourite stock of Ramesh Damani

Ramesh Damani was way ahead of everyone else in predicting the future of the digital revolution stocks.

In May 2016, Ramesh Damani recommended a buy of “technology product companies that focus on Indian consumers with a more diversified revenue stream”. He pointed out that there are Indian companies that are focusing on technology related to banking, insurance, antivirus software etc which will be hot favourites in the future.

He referred in particular to Quick Heal as “a company that recently listed that deals in antivirus security software”.

Ramesh Damani repeated this in another interview in October 2016 (much before demonetisation) where he advised that “Cyber Security is a big theme for Samwat 2073 and next few years”.

“There are only two kinds of companies in this world – companies that have been hacked and companies that will be hacked. And increasingly, there will be only one kind of company that has been hacked once and will be hacked again. So I am leaning towards cyber security as a big outlook for the next few years,” Ramesh Damani said in a prophetic tone.

Hacking of celebrity twitter accounts proves Ramesh Damani’s prophecy

The recent spate of incidents whereby the accounts of twitter celebrities like Rahul Gandhi, Vijay Mallya, Barkha Dutt, Ravish Kumar etc have been hacked has created a fear psychosis amongst citizens.

Email and twitter accounts are getting hacked all over the place and the government wants us to go digital with our money too

— Veena Venugopal (@veenavenugopal) December 10, 2016

Hacker groups like #Legion hacking verified @twitter account at will and Mr Maggi @narendramodi here wants us to use e-wallets like @Paytm ?

— BAN Modi… (@VAvinash) December 10, 2016

If such high profile Twitter accounts is prone to hacking, is our money really safe with online payment apps like @Paytm

— Z Plus Baba (@zplusbaba) December 1, 2016

After seeing high-profile Twitter accounts hacked, debit cards scammed, Aadhaar misused, unsafe wallets, I should really rethink cashless.

— Anupam Gupta (@b50) December 9, 2016

Account hacking was introduced only after demonetization. Before that, online transaction and online surfing was safe.

— Khaleesi (@HappyHigh01) December 11, 2016

Fear psychosis augers well for internet security stocks

It is obvious that the fear psychosis amongst the citizens about the cashless regime augers well for companies like Quick Heal and Bartronics which provide anti-virus and security solutions.

In fact, the global antivirus industry, which thrives on fear psychosis, is growing at 11% CAGR and will be worth an eye-popping 202.36 Billion USD by 2021.

The DDOS (Distributed Denial of Service) sector is also a big beneficiary of the insecurities of the users.

Global companies like Kaspersky, Norton, Cloudflare etc are raking in money hand over fist by offering so-called security solutions.

Bartronics – a big beneficiary

According to a report in DSIJ, Bartronics India provides information technology (IT) services and business solutions. The company provides Automatic Identification and Data Capture (AIDC) solutions. It manufactures Smart Cards and Radio Frequency Identification (RFID) equipments, and caters to financial inclusion projects and services. Its services include application development, application management, enterprise solutions, IT infrastructure management and strategic sourcing.

DSIJ has also explained that the provision of AIDC solutions is the big trigger to Bartronics as the economy has gone cashless, catalysing the cashless transaction and the use of debit and credit cards, thereby enhancing the company’s business. The shares of the company since demonetisation have rallied over 41 per cent. In the last six months, the shares have surged by 131 per cent.

Savvy investors value PayTM at Rs. 32,500 crore ($5B)

It is difficult to believe that Vijay Shekhar Sharma, the founder of PayTM, was, till some time ago, a penniless pauper like us.

Today, he enjoys the exalted stature of a Forbes Billionaire thanks to his visionary approach.

According to Money Control, immediately after demonetisation, Paytm’s transactions touched five million in a day regularly and even hit a peak of seven million. In value terms, transaction totals hit Rs 24,000 crore a day. The company registered 700 percent increase in overall traffic and 1,000 percent growth in the amount of money added to PayTM wallets. The number of transactions per user increased from 3 per week to 18.

#DigitalPayments have increased significantly after 8th November 2016, which shows how fast India is embracing digital payments.

— Ravi Shankar Prasad (@rsprasad) December 9, 2016

Savvy investors are literally begging Vijay Sharma for a stake in PayTM. He sold a one percent stake to an unnamed shareholder for a sum of Rs. 325 crore, valuing the Company at a mind-boggling Rs. 32,500 crore.

Aggressive stance of the Government to promote cashless regime

Few are aware that in August 2016, the Government set up a committee to suggest ways to promote electronic transactions through incentives.

The Committee’s mandate is to study introduction of single window system of payment gateway to accept all types of cards/digital payments of government receipts and enable settlements via NPCI (National Payments Corporation of India) or other agencies within specified timelines.

Lottery/ Lucky Draws of Rs. 125 crore to encourage digital transactions

The latest news is that NITI Aayog has directed National Payments Corporation of India (NPCI) to formulate an award scheme to incentivise people using digital mode for making payments through weekly and quarterly lucky draws.

This will undoubtedly promote electronic transactions amongst the masses.

The annual budget for this new scheme is reportedly Rs 125 crore.

#CashlessEconomy | Government to announce two lucky draw award schemes for those who have made digital transactions since November 8

— NDTV (@ndtv) December 10, 2016

Quantum jump in POS Machines & digital transactions: Nandan Nilekani

Nandan Nilekani, the visionary co-founder of Infosys, and also the creator of Aadhaar, the world’s largest biometric database, exuded confidence that demonetization would create a quantum jump in digital transactions and the sale of POS (point of sale) machines.

He explained that while the growth in POS machines in the past 30 – 40 years was about 1.5 million, this would double or treble in the next three to six months.

A similar surge would be seen in the sale of micro-ATMs, Nilekani said.

“Any short-term contraction in economic growth will be compensated for very quickly with digitization,” he added in a soothing tone.

Intellect Design Arena – favourite stock of Rakesh Jhunjhunwala & Ramesh Damani

In another interview, Ramesh Damani spoke in glowing terms about Intellect Design Arena as “a nice looking product company”.

Rakesh Jhunjhunwala and Mukul Agarwal of Param Capital are major shareholders in Intellect Design Arena.

The confidence the stalwarts is not misplaced because the stock has been surging to new highs.

Arun Jain, the CMD, revealed that Intellect Design Arena has invested over Rs 500 crore in five years on digital products. It provides digital solutions called “Digital Face” to SMEs. It has 50 clients so far. It also has a payment wallet called “Pay123”.

Other companies which will benefit from the cashless regime

Aurionpro Solutions claims to be a beneficiary of digitisation and said that digital and payment branches form 30% of the total revenues. It was also stated that the revenues would grow 40-45% annually.

Conclusion

It is obvious that there is a gold mine waiting to be excavated in the cashless sector. We need to shed our inhibition and grab a few of the top-quality stocks from the sector. Then, we can also ride to glory as the stocks ascend to the skies and fill our portfolios with mega gains!

Confused … which one to invest in 🙂

Missed out on Mobile telecommunications..India’s biggest plant for POS machines

Due to recent demonetisation, few s/w related companies have came into investor’s focus. Companies such as Intellect Design Arena which is active in s/w for BFSI sector, Majesco which is involved in making s/w for insurance sector, Quick heal which is antivirus company can be a big beneficiary of overall digital push. So investors can look to buy any of these stock with 2-3 year view and add on any good declines.

Why is Majesco not named here in the article????

How about RS software who is in payment solutions and TVS electronics in POS machines