What Is A Blue Chip Share?

A blue chip share is a nationally recognized, well-established and financially sound company. These companies are old companies with reputed managements and well known for high standards of disclosure and corporate governance. They have a regular track record of profits and dividends.

Advantages of investing in Blue Chip Stocks:

The biggest advantage is that because these companies are well managed, they are able to weather the downturns in the economy and also take advantage of opportunities that come up. Also, the investor is well assured that his investment in the stocks of such companies is safe and that the promoter will not disappear overnight.

Another advantage is that these companies are generous in their dividend policy as also in issuing rights and bonus shares.

The third advantage is that the prices of blue chip stocks do not tend to be volatile.

Can A Blue Chip Become a Multibagger:

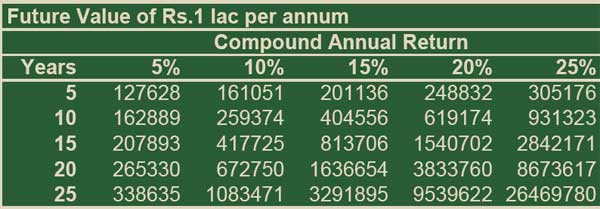

The common misconception amongst investors is that only unknown companies can become multibaggers because you can buy their share at low valuations as compared to the shares of well know companies which are always quoting at a premium. However, this is wrong. If a well known and established blue chip company is growing at 25% per year and the stock price keeps pace, a one-time investment grows 86 times. If you were to invest the same sum of one in annual intervals, your money would grow 429 times in 20 years!

Let’s take two practical examples to prove the point:

(i) An investment in one share of Nestle India on 1.1.2000 at the then CMP of Rs. 435 is worth Rs. 4500 today, giving a return of 895% (dividends extra);

(ii) An investment in one share of Asian Paints on 1.1.2000 at the then CMP of Rs. 158 is worth Rs. 3,700 today, giving a return of 2138% (dividends extra).

You can see how blue chips can turn into multibaggers by sheer passage of time.

How to create a portfolio of blue chip stocks:

There are two aspects to be noted. Firstly, because, blue chip stocks are highly priced in relation to their earnings, it does not make sense to invest all funds in one go. It makes sense to accumulate these stocks by adopting a “Systematic Investment Plan” (SIP). Also, to avoid risk, the investor should buy a basket of 5 or 10 blue chip stocks.

Secondly, merely because a stock has the label of a “blue chip” does not automatically make it worthy of investment. An example is Bharati Airtel which may have reached the peak of its performance owing to intense competition in the market place. Another example is Infosys which appears to have little room to grow. As opposed to this, there are “evergreen” blue chips like Nestle which has a vast portfolio of products that it can release in India. HDFC is another example which enjoys near monopoly power in the mortgage finance market.

Which are the Blue Chip Stocks In India:

While a complete portfolio listing is not possible, the consensus is that the following stocks fall in the category of “blue chip stocks”

| Equity | Sector |

| ICICI Bank | Banking & Financial Services |

| Bharti Airtel | Telecommunication |

| Infosys | Information Technology |

| HDFC Bank | Banking & Financial Services |

| Grasim | Conglomerates |

| Reliance | Oil & Gas |

| ONGC | Oil & Gas |

| Kotak Mahindra | Banking & Financial Services |

| Dr Reddys Labs | Pharmaceuticals |

| IndusInd Bank | Banking & Financial Services |

| Axis Bank | Banking & Financial Services |

| Power Grid Corp | Utilities |

| Cadila Health | Pharmaceuticals |

| Bajaj Auto | Automotive |

| Coal India | Metals & Mining |

| NTPC | Utilities |

| Cummins | Engineering & Capital Goods |

| Cipla | Pharmaceuticals |

| GlaxoSmith Con | Food & Beverages |

| Hindalco | Metals & Mining |

| Mah and Mah | Automotive |

| GAIL | Oil & Gas |

| IOC | Oil & Gas |

| Idea Cellular | Telecommunication |

| Bharat Elec | Manufacturing |

| Yes Bank | Banking & Financial Services |

| Crompton Greave | Engineering & Capital Goods |

| Larsen | Engineering & Capital Goods |

| Oracle Financ | Information Technology |

| Dabur India | Consumer Non-durables |

| NHPC | Utilities |

| GlaxoSmithKline | Pharmaceuticals |

| Asian Paints | Chemicals |

| NMDC | Metals & Mining |

| SAIL | Metals & Mining |

| Union Bank | Banking & Financial Services |

| India Cements | Cement & Construction |

| Wipro | Information Technology |

| Torrent Power | Utilities |

| Nestle | Food & Beverages |

| Titan Ind | Miscellaneous |

Average Returns from Blue Chip Stocks

According to a study commissioned by Raamdeo Agarwal “Motilal Oswal 16th Wealth Creation Study on Blue Chips“, blue chips have given a sensational CAGR over the years:

| Blue chip Stock | CAGR return (%) |

| ABB | 29 |

| Asian Paints | 28 |

| Bajaj Auto | 21 |

| Crisil | 28 |

| Dabur India | 20 |

| Dewan Housing | 25 |

| Federal Bank | 37 |

| GAIL India | 27 |

| HDFC | 31 |

| Hero MotoCorp | 23 |

| Infosys | 11 |

| IOC | 19 |

| ITC | 21 |

| L&T | 33 |

| M & M | 22 |

| RIL | 22 |

| SBI | 28 |

| Tata Steel | 24 |

Are there Mutual Funds that invest only in blue chip stocks?

A safe way of investment is to go through the SIP route offered by Mutual Funds. Several Mutual Funds have schemes dedicated to blue chip stocks. Among the popular ones are:

SBI Blue Chip Fund

Principal Emerging Bluechip Fund

Franklin India Bluechip Fund

Mirae Asset Emerging Bluechip Fund

Indiabulls Blue Chip Fund

ICICI Prudential Focused Bluechip Equity Fund

ICICI Prudential US Bluechip Equity Fund

ICICI Prudential Focused Bluechip Equity

Motilal Oswal 16th Wealth Creation Study on Blue Chips

[download id=”256″]

very nice article..shows the power of compounding and having patience..!but it is difficult for asian paints or nestle to deliver same kind of returns in the future.so how can one identify such stocks which will have the capacity to deliver similar kind of returns if one has a time horizon of 10-15 years?thank you.

Nice article. I wish to obtain Share Market Investing techniques n

suggestions from her time to time.

pl give me som e scripts to construct gud portfolio.

very much confused about choosing bluechip stocks, suggest atleast 5 stocks in which i can do investment regularly for 15 years horizon?? i have in my portfolio ril,tcs,asian paints,jspl,gspl,petronet lng…

for 15 year timeframe which r the best bluechip stocks to invest in regularly?