Agriculture stocks have ‘input’ and ‘output’ sides

Shyam Sekhar, the noted value investor, is very bullish about agriculture stocks. Like Kenneth Andrade, he believes that the vision of the Government to increase farm productivity and usher in reforms towards subsidy augers well for the sector and that several stocks, which are presently languishing, can effortlessly turn into multibaggers.

Shyam Sekhar meticulously explained that there are some agriculture stocks which thrive on “input”, such as seeds, fertilizers, pesticides, irrigation etc and others that thrive on “output”, such as basmati rice, milk, cheese etc.

While Kenneth Andrade has a preference towards “input” stocks (Coromandel International), Shyam Sekhar has a preference towards “output” stocks (KRBL).

The logic for the preference towards basmati stocks is that the raw material (rice) is bought at throwaway prices from the farmers and sold at exorbitant prices to the end-consumers in the form of FMCG products under brand names like Daawat, India Gate, Kohinoor, Lal Qila, Jagat, Amira, Heritage, Maharani, Fortune etc.

The basmati companies are able to rake in super-normal profits this way, Shyam Sekhar explained.

Dolly Khanna bought the “input” side through GNFC

We saw a few days ago that Dolly Khanna has made her debut into the agriculture sector by buying a big chunk of GNFC, a company engaged in the manufacture of agro-chemicals and fertilizers.

According to experts, GNFC cannot be evaluated on traditional parameters because it has a monopoly product in TDI. The Government has decided to impose anti-dumping duty on TDI and this will give GNFC a strangle-hold in the market place and freedom to charge premium pricing for its product without worrying about cut-throat competition from China and Korea.

Now, Dolly Khanna has bought the “output” side in the form of LT Foods

LT Foods is a small-cap company (Rs. 1700 crore) engaged in the production of basmati rice which is sold under the brand name “Daawat”.

As of 31st March 2017, Dolly Khanna holds 29,57,280 shares of LT Foods. The investment is worth Rs. 19.22 crore at the CMP of Rs. 65.

Fundamentals of LT Foods

Let’s cast a quick glance at the fundamentals of LT Foods:

| L T FOODS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 1,726 | |

| EPS – TTM | (Rs) | [*S] | 1.10 |

| P/E RATIO | (X) | [*S] | 58.86 |

| FACE VALUE | (Rs) | 1 | |

| LATEST DIVIDEND | (%) | 15.00 | |

| LATEST DIVIDEND DATE | 09 SEP 2016 | ||

| DIVIDEND YIELD | (%) | 0.23 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 13.00 |

| P/B RATIO | (Rs) | [*S] | 4.98 |

[*C] Consolidated [*S] Standalone

| L T FOODS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2016 | DEC 2015 | % CHG |

| NET SALES | 799.44 | 726.79 | 10 |

| OTHER INCOME | 0.2 | 0.33 | -39.39 |

| TOTAL INCOME | 799.65 | 727.12 | 9.97 |

| TOTAL EXPENSES | 698.51 | 650.41 | 7.4 |

| OPERATING PROFIT | 101.13 | 76.71 | 31.83 |

| NET PROFIT | 32.39 | 18.52 | 74.89 |

| EQUITY CAPITAL | 26.66 | 26.45 | – |

(Source: Business Standard)

LT Foods is Porinju Veliyath’s multibagger stock recommendation

Porinju’s Equity Intelligence PMS bought 438,011 shares of LT Foods on 11th July 2016 at Rs. 28.27 per share (adjusted for split).

Thereafter, he made a public disclosure of this fact and sent out a subtle buy recommendation.

Daawat at historic high today; had shifted from 'IndiaGate'; found it more delicious 🙂 https://t.co/kc1xetkowt

— Porinju Veliyath (@porinju) July 20, 2016

Porinju’s timing was flawless. The stock took off like a rocket and posted 100% gains in no time.

Daawat 100% more delicious in 6 mths? https://t.co/zz3dTekMrn

— Porinju Veliyath (@porinju) February 8, 2017

At the CMP of Rs. 65, Porinju has gains of 131% from his purchase of LT Foods in less than a year’s time.

Manish Bhandari of Vallum Capital is also bullish about basmati stocks (KRBL)

Manish Bhandari of Vallum Capital is one of the early buyers of KRBL, the market leader in basmati stocks (India Gate).

He has written a detailed article in Outlook Business where he has set out the business prospects for basmati producers in the Indian and overseas markets.

He has reiterated the bullishness for the basmati sector in general and for KRBL in particular in his latest newsletter where he observes:

“The company has improved its brand positioning, retained market leadership, and launched a new high protein diet product for health conscious customers …

We strongly believe the best is yet to come for this business and this represents one of the significant undervalued FMCG opportunity in your portfolio”.

The logic formulated by Manish Bhandari obviously applies to other basmati stocks as well.

Packaged foods industry is at an inflection point and basmati stocks are the big beneficiaries: Ekansh Mittal of Katalyst Wealth

Ekansh Mittal of Katalyst Wealth has opined that the packaged foods industry is at an inflection point in India and that basmati rice will be a big beneficiary of the conversion from loose sales to packaged sales.

He has emphasized that basmati is gaining acceptance all over the world, including countries such as the US, UK, Australia, New Zealand, besides the traditional export market of West Asia.

He has also pointed out that basmati exports have shown an astounding CAGR of 27% from Rs. 2,800 crore in FY05 to Rs. 27,600 crore in FY15.

Even China has developed an appetite for Indian basmati rice and is turning out to be a major importer.

While Ekansh Mittal has recommended a buy of Chaman Lal Setia Exports, his investment rationale applies to all basmati stocks, including LT Foods.

Basmati stocks have a “moat” which dissuades competitors: HDFC Securities

Atul Karwa of HDFC Securities has conducted a systematic and thorough study of all the three stocks in the basmati sector, namely, KRBL, LT Foods and Chaman Lal Setia.

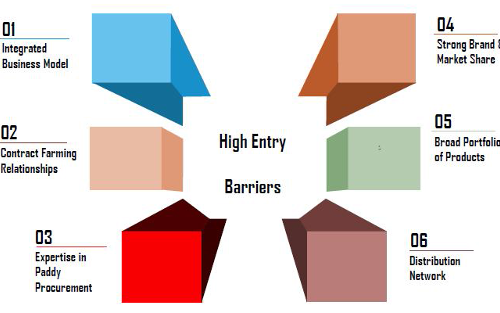

He has opined that the basmati business has a “moat” in the form of “Huge entry barriers for new entrants”.

This is because:

“The Basmati players in India have built a robust profile which is difficult to replicate by any new entrant in the short term. Most players in the organized sector have an integrated business model and have forged strong relationships with farmers including contract farming which takes care of raw material requirements. They have built expertise in paddy procurement and state of the art manufacturing facilities. A wide number of brands have been launched with a wide distribution network. Expenses on advertisement and brand promotion have ensured huge brand recall resulting in huge base of loyal customers. The high level of working capital requirement dissuades new entrants.”

The investment rationale is summed up as follows:

– Huge entry barriers for new entrants

– Strong demand in the Middle East

– Iran may resume purchases of Basmati rice

– Opening up of Chinese markets for basmati

– Rising disposable income leading to shift towards premiumisation

Basmati rice exports may grow to Rs 22,000-22,500 crore in FY18: ICRA

ICRA has issued a detailed research report in which it has conducted a SWOT analysis of the basmati industry.

It has opined that FY 2018-19 is expected to witness better revenue growth supported by a rise in average realisations, as paddy prices firm up during the current procurement season.

It is also stated that the resumption of imports by Iran will drive industry growth in the upward trajectory.

In the period from April to December 2016, the basmati companies have posted an impressive growth with an average 44% year-on-year growth in net profit. The aggregate net profit of these companies increased to Rs 419 crore in FY17 from Rs 291 crore in FY16.

| Price in Rs | Net proft/loss (Rs cr) | ||||

| Company | 31/03/2016 | Latest | % chg | 9MFY16 | 9MFY17 |

|

L T Foods |

22.59 | 67.50 | 198.8 | 66.6 | 83.7 |

|

Kohinoor Foods |

42.80 | 87.00 | 103.3 | -5.6 | 15.6 |

|

KRBL |

222.60 | 432.00 | 94.1 | 199.8 | 289.6 |

|

Chamanlal Setia |

55.55 | 103.90 | 87.0 | 30.7 | 30.1 |

(Source: Business Standard)

LT Foods will grow at 15-20% and be a Rs. 6,000 crore company

Ashwani Kumar Arora, the CEO of LT Foods, has revealed that the company has ambitious plans to grow by 15-20 percent year-on-year through organic and inorganic routes. He also assured that over the next five years, LT Foods will be a Rs 6000 crore company.

Will LT Foods be a success story similar to ADF Foods?

It is worth recalling that Dolly Khanna and Porinju Veliyath have also teamed up in ADF Foods. ADF Foods is also a leader in the packaged foods segment. The duo is basking in YoY gain of 147% and 2 year gain of 236%.

Conclusion

Dolly Khanna’s endorsement of the prospects of the basmati stocks is the ultimate green signal for us. There is no need for us to sit on the sidelines any more. We can pick our favourite basmati stock and dive in without any inhibitions!

Will add some more. Thanks for detailed analysis.

But all these rice stocks have run-up a lot..

I BUY 12 STOCKS for fy17-18

IVC = HOLDIN COMPANY WITH GOOD PORTFOLIO AND DIVIDEND

NOIDATOLL = GOOD DIVIDEND AND 100 % FALL IN LAST YEAR

IDFC BANK , CORPORATION BANK & SOUTH IND BANK = PRIVATE BANK ,UPSIDE

FUTURE CONSUMER = TRACK THIS FROM 7,NOW 34 AND LOSS TO PROFIT IN RESULT

NHPC & SJVN = GOOD DIVIDEND POWER SECTOR PSU

MTNL = ITI GOES 25 TO 100, MTNL ,BSNL MERGE NEWS ALL OVER,

IFCI = NE CDSL IPO AND MANY YEARS NOT PERFORM

SUNIL HITECH = I THINK THAT IS A GOOD BUY

SUZLON = AFTER FUTURE TRADE ENTRY, I THINK GOOD BUY

SUGGEST SOMETHING

SIR I CAN INVEST IN THE LIST MENTION

& FOR WHAT PERIOD SHALL I HOLD, PL GUIDE

Honestly most of these stocks are already at peak levels.