Dalal Street tense after Rain Industries crashes like ton of bricks

MMB has turned into a virtual battlefield amongst Rain Industries’ supporters and detractors.

The detractors have been emboldened by the savage crash in the stock price to take potshots at the supporters.

“This is horrible stock with no business. It should be 200 soon,” a punter from the detractors’ camp yelled in a belligerent tone.

This enraged the supporters.

“You doomsayer keep your mouth shut, the more it falls the more I would buy. Keep your non-sensical advices with your herd followers. We know the strength of Rain Ind and its future prospects which day traders like you cannot fathom,” a punter in the supporters’ camp yelled back.

“Who is this joker ranting something without an iota of common sense??” a third asked.

It was not clear whether the third punter was supporting the supporters or the detractors.

The same situation has been playing out at Dalal Street as well.

Mukeshbhai, Jigneshbhai and the other local punters had bought Rain Industries when Mohnish Pabrai had opined that it has 4-bagger potential.

“I put 20 million of Pabrai Funds into the Company (Rain Industries). It is now worth north of 50 million. I think we will probably get 100 million or even 200 million out of it,” Mohnish had then said (see Mohnish Pabrai Foresees 4x Multibagger Gain From His & Dolly Khanna’s Fav Stock).

True to Mohnish’s word, the stock surged like a rocket from Rs. 120 on 14th August 2017 to Rs. 475 on 8th January 2018, showering massive gains of nearly 300% upon its delirious investors.

However, since then the stock has been on a free-fall.

At the CMP of Rs. 223, the stock is down a colossal 53% from the peak.

Gains of 80% are still on the table though they appear measly in the context of what they could have been if one had sold at the peak.

No drama in Rain at all. I bought more

Tanvir Gill and Nikunj Dalmia are both seasoned interrogators. They know what questions to ask of their illustrious guests and how to ask them.

They also have the salutary habit of coming straight to the point and of not beating around the bush.

“Have you sold Rain Industries?” Tanvir Gill asked Mohnish point-blank, flashing her charming smile.

Mohnish is equally seasoned. He does not baulk from answering tough questions.

“We have a higher position in Rain today than we had three months ago,” he replied with a bigger smile than that of Tanvir’s.

“I wish I could buy more but there is a limit of 10%,” he added.

Tanvir and Nikunj gaped at Mohnish open-mouthed.

As of 31st March 2018, Mohnish held a treasure trove of 290,12,715 shares comprising 8.62% of the equity capital.

If Mohnish has taken his stake upto 10%, it means that he has bought a further 46,44,726 shares or thereabouts.

His total investment in Rain Industries now stands at 336 lakh shares or thereabouts, worth a colossal Rs. 750 crore.

#ChaiWithPabrai | Have a higher position in Rain Industries today than 3 months ago; Wish I could buy more in Rain Industries but close to breaching limits, says @MohnishPabrai in an #Exclusive chat with @nikunjdalmia @tanvirgill2 pic.twitter.com/hHHccYi2s5

— ET NOW (@ETNOWlive) June 1, 2018

#MarketView | Ace Investor @MohnishPabrai on Rain Industries!#ChaiWithPabrai @WarrenBuffett @tanvirgill2 @nikunjdalmia pic.twitter.com/DsiCLZMmSV

— ET NOW (@ETNOWlive) June 1, 2018

Look at the business prospects, not the stock price

Mohnish grabbed the opportunity to tutor us about the fundamental laws of investing as laid down by Benjamin Graham in his treatise ‘The Intelligent Investor’.

“It is in the nature of equity markets that we are going to have swings in stock prices … the market is there to serve us. It is not there to instruct us,” he said in his famous drawl.

“We are not going to look at the stock price and figure out what is going on. The correct way to approach it is to have an internal reference of what the business is worth and buy from, or sell to, Mr. Market,” he added.

What about the business risks to Rain Industries

Some astute punters at MMB pointed out that the business environment for Rain Industries may not be as sanguine as it has been in the past.

According to the latest investors’ presentation, competitors like Rusal, Norsk Hydro ASA and some Chinese companies will shortly be increasing production of the products manufactured by Rain.

This is disclosed as follows in the presentation.

“Geopolitical Updates:

• In March 2018, US imposed 10% tariff aluminium imports with exemption for Canada & Mexico.

• In January 2018, India implemented the increase of import duty from 2.575% (incl. 3% cess) to 11% (incl. 10% surcharge) on petroleum coke with immediate effect.

• US sanctions on Rusal, a 6% supplier of global aluminium. US Treasury Department extended the deadline for unwinding business with Rusal from June to October and pointed out a path of sanction relief. Rusal may restructure its assets in near future to overcome the implications.

• Under judicial orders after allegations of a toxic leak, 50% capacity shutdown made by Alunorte refinery, the world’s largest refinery in northern

Brazil owned by Norway’s Norsk Hydro ASA. Alunorte refinery may return to full production over next six months.

• Amidst curtailments on environmental protection lines, production increased in China by 13% during CY17.

• As a part of ongoing efforts to move smelting capacity to more remote areas to reduce environmental impact on large population, the China’s Shanxi Province offered incentives for smelters willing to transfer smelting capacity to the north-eastern province. Availing this, a smelter has commenced construction of 500,000 tons p.a. smelting capacity in CY17”

These issues were also subject to discussion in the investors’ conference held by the Company.

Another issue worthy of note is that the Government is mulling a nationwide ban on the use of pet coke by various industries.

This is pursuant to a judgement of the Supreme Court in a pollution control manner.

To curb pollution, govt considering nationwide ban on use of pet cokehttps://t.co/qUFIMmTAvc pic.twitter.com/RN2nYTuMgZ

— Hindustan Times (@htTweets) April 10, 2018

Whether there is any connection between these developments and the weakness in the stock price of Rain Industries is not known.

(Chai with Pabrai: Mohnish with the ETNow anchors. Click for larger image)

BSE, NSE condemn Rain Industries to dreaded ‘ASM’ list

Yet another jolt to Rain Industries arises from the fact that the mandarins of BSE and NSE have subjected it to the dreaded Additional Surveillance Measures (ASM).

Stocks that are subject to the ASM are required to meet stringent margin money requirements so as to curb excessive speculation.

Surabhi Upadhyay of CNBC TV18 rightly pointed out that these stocks are “feeling the heat”.

Stocks in ASM (Additional Surveillance Measures) list feeling the heat. (Margin at 100% & circuit filter gets cut to 5% for ASM stocks)

On Circuit

– Goa Carbon

– Graphite

– HEG

– Himadari Chem

– Venky

– Tinplate

Close to Circuit

– Radico

– India Glycol#Nifty #market #Midcaps— Surabhi Upadhyay (@SurabhiUpadhyay) June 1, 2018

However, the moot question is whether this weakness is a blessing in disguise for genuine investors who want to buy the stock.

Is Dolly Khanna the Joker In The Pack?

Rain Industries’ stock price movements also hinge on whether Dolly Khanna is buying or selling the stock.

As of 31st March 2018, Dolly held 89,47,515 shares, comprising 2.66% of the equity.

The stock is a crown jewel in her portfolio with a very high allocation.

No doubt, her aggressive buying propelled the stock on its upward trajectory.

From past experience in Hawkins Cookers, Cera Sanitaryware, Avanti Feeds etc, we know that Dolly likes to escape just before the stock price begins to crumble.

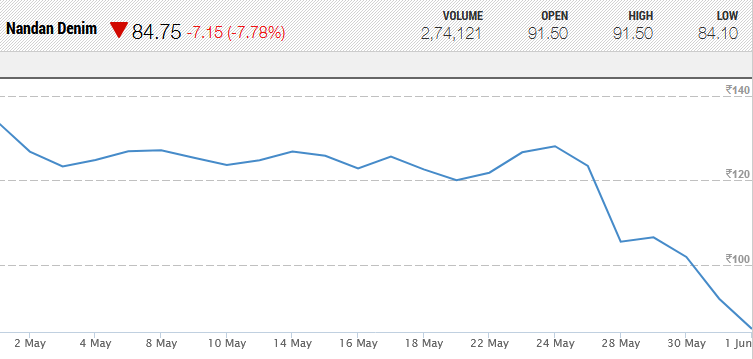

The latest example is that of Nandan Denim. Dolly has dumped her holding of 5,15,247 shares and bolted from the stock.

The escape was timely because Nandan Denim reported so-so Q4FY18 results and is in a free-fall.

The stock has lost 40% of its value in just the last month and is presently at its 52-week low.

Perhaps Tanvir Gill and Nikunj Dalmia can contact Dolly Khanna and persuade her to reveal whether she still holds Rain Industries or has dumped it.

If Dolly is still holding the stock, we can rest assured that all is well. However, if Dolly has dumped the stock, we have to head towards the exit door ASAP no matter what Mohnish may say!

You only come to know of the so called ace investors dumping and bolting off only after they have exited the stock. And then, there is nothing else than to repent on the investment decision based upon the so called ace investors advice/actions.

You only come to know after the end of the quarter when the shareholding pattern in available on the public platforms.

You said it bro, these online media is making these guys heroes, but like bank loans becoming NPA it is not always their personal money, but that of portfolio investors. The way these guys are covering rain industries is as if there is not other stock in the stock market like it.

Solution ,as it appears to me, is cloning with proper study and own conviction.Cloning should be taken as guidance,it is not just copying .

After going through the text, the ambiguity deepens further. No definitive guidance for retail investors whether to continue with the stock or sell at the distressed valuations. Can anyone guide ?

Businesses are never in steady state. Even in good business , the short term performance may fluctuate. It happens most of the time Hence to make money, outlook ought to be long term.More importantly,investment should be made on one’s own conviction,not on borrowed conviction of any Guru.In fact, I keep Mohnish Pabrai in high esteem as a thoughtful investor.

The trick is to follow people like Mohnish, RJ .etc whom you can find out the cost price most of the time. If you like an Idea then wait for it to buy below their price as you dont need to buy in bulk you will get that opportunity. Dont buy people like Porinju, Anil, Dolly or Shyam Shekar as these guys buy slowly and accumulate over a period of time. Hence you will never know their cost price. You know they bought the stock only when it goes over 1% in shareholding. Hence dont clone these guys.

Till recently, Indian investment gurus were going gaga over ban on chinese chemical industry for environmental issues, and were feasting with Indian chemical companies. Now it appears the Indian govt is playing the villain against some of these polluting industries.

Can RJ analyst team come out with a list of Indian companies that are likely to be affected by this proposal to ban Pet Coke? Which companies produce alternative products to that? How will steel, aluminium companies cope if they cannot use Pet coke? Is it really feasible to ban Pet coke completely across the country?

“However, if Dolly has dumped the stock, we have to head towards the exit door ASAP no matter what Mohnish may say!”

this is very judgmental and irrelevantly dismissing the experience of mohnish prabhai

Upside in Rain happened because Quarterly earnings in it increased from Quarter of March 2017 to September 2017, later rain failed to show any significant quarterly earnings due to which I am not optimistic on it.

I don’t think rain is going to recover from this decline.