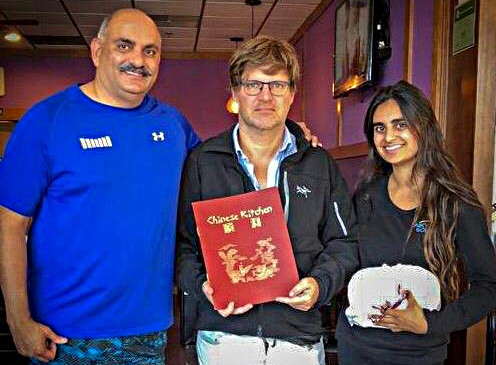

Vada Pav Diplomacy: Tanvir Gill Impresses Mohnish Pabrai & Guy Spier With Vada Pav & Kadak Adrak Chai

Yesterday, at 1600 hours IST, all novices of Dalal Street gathered at the RJ Fan Club for a special screening of Tanvir Gill’s interview of Mohnish Pabrai and Guy Spier.

Because the novices had come after a tiring day of punting, arrangements for endless supply of Pakodas and Adrak Chai from Shyam’s Tea Stall had been made by the mandarins of the Fan Club.

“Mohnishbhai aur Guybhai multibagger stocks ke barre mein discuss karenge aur investing tips bhi denge. Sab log dhyan se suno,” Jigneshbhai, the Master of Ceremonies, told the audience.

“Koi doubt ho to hum ko pooch lena,” Mukeshbhai chipped in.

Of course, Tanvir deserves to be complimented for her brilliant and out-of-the-box thinking.

Her game plan of offering the humble Vada Pav and Adrak Chai to distinguished and high-flying fund managers like Mohnish and Guy worked because it took them by surprise and relaxed them completely.

The duo freely talked about multibagger stocks and revealed their top investment strategies.

However, if the truth be told, most novices (including me) were mesmerized by Tanvir Gill’s stylish mannerisms. We could not pay much attention to what Mohnish and Guy were saying.

Bank & NBFC stocks are ‘high octane’ – I lost $120 Million by investing in them

On an earlier occasion, Mohnish had drawn a masterful distinction between simple businesses which “idiots can run” and complex businesses which even “genius can ruin” (see Invest In ‘No Brainer Stocks’ For Multibagger Gains Says Mohnish Pabrai While Buying Stock With ‘Unique Business Model’).

Companies like Coca-Cola, Nestle etc fall in the former category while Banks and NBFCs fall in the latter category, Mohnish said.

“Banks have to lend out 7x to 10x of the capital to make 1% return on assets …. The margin of error is very small and one big NPA can wipe out the entire capital”, he emphasized.

In the present exposition, Mohnish again attacked Bank and NBFC stocks.

“Levered financial institutions are high octane and they can be combustible and one should be careful,” he exclaimed with a flourish.

“The number one place where I have lost most money has been on the levered financial institutions. Probably more than $120 million went to zero on levered financial institutions,” he added.

“I have the scars from that. I remember that really well,” he said, while the novices shuddered in fright.

I am not dismayed by Rain Industries’ plunge from Rs. 475 to Rs. 150

It is well known that most investors who cloned Mohnish and Dolly Khanna are despondent at the manner in which Rain Industries is behaving at the Bourses.

After surging like a rocket from Rs. 40 to the ATH of Rs. 475, the stock went into a deep dive and has plunged to Rs. 150.

In fact, in hindsight, BNP’s abrupt dumping of Rain Industries in May 2018 at Rs. 277 (which was then severely criticized by the Pundits as a short-sighted move) now appears to be a very prudent move.

Biggest pappu of stock market is bnp first he buy fortis at 155 and sell at 123 in panic and now he is selling rain industries always in a panic mode god help her

— Narendra (@nwadhwani711981) May 11, 2018

Tanvir pinned Mohnish down and asked him “How do you react to the fall in your portfolio value due to market volatility?”

Mohnish was defiant.

“Rain Industries went up quite dramatically and then from the high 400s it went down to Rs 150. But none of that is very relevant. It has impacts on how the portfolios are valued but for me what matters is what is the value of the business? Where is the business going long term?” On those two fronts, news is generally good. We own about 10% of Rain. We used to own 10% of Rain three months ago and six months ago and nine months ago as well and that is the way it is,” he said.

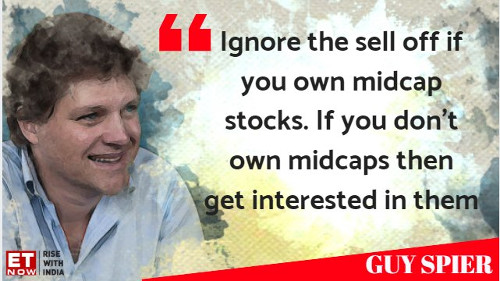

Don’t put yourself in Mohnish’s position if you do not have his wiring: Guy Spier

Guy Spier was not much impressed with Mohnish’s dare-devil attitude.

He cautioned novices not to walk in Mohnish’s footsteps if they do not have his “wiring”.

“Mohnish has very particular wiring. Enormous swings in his portfolio does not affect him … I don’t have the wiring and so I do not put myself in a situation where it is going to affect me as much. I have a reduced concentration,” he said.

It is obvious that Guy Spier is counseling us to have a diversified portfolio and not a concentrated portfolio.

This advice is in line with that given to us by Billionaires Jon Yarbrough and Kevin O’Leary (see I Hold Multibagger Stocks For 30+ Years).

“The best investment advice I’ve received is to be diversified. Being diversified is the best risk mitigator,” Jon Yarbrough said.

“Diversification is the only free lunch in investing,” Kevin O’Leary said.

Will Repco Home Finance also blossom into a mega multibagger

Tanvir Gill rightly sensed that the audience was getting restive at the theoretical discussion.

She cleverly steered Mohnish and Guy into discussing the future prospects of Repco Home Finance.

It may be recalled that Mohnish has described the entire housing finance sector as a “no-brainer” (see Housing Finance Stocks Are “No Brainers” Says Mohnish Pabrai & Approves “Lakh Crore Ki Kahani” Theory).

“As India rises, it is a no-brainer that people will want good housing and it is a no-brainer that they will have to finance it because there is no way that they can just buy it with their income levels …..

…. The housing finance sector will grow at 3 or 4 times GDP growth. So, if India is growing at 7%, the housing companies may be growing at 20 to 30%”, Mohnish had then said.

He has also bought a big chunk of 32,31,728 shares of Repco Home Finance comprising 5.16% of its equity capital and described it as having “no competition” and “lending discipline”.

#ChaiWithPabrai | Repco Home has no competition in the demographic they're serving; Expect Repco's lending discipline to continue in the future, says @MohnishPabrai in an #Exclusive chat with @nikunjdalmia @tanvirgill2 pic.twitter.com/4Jr8w0HhpL

— ET NOW (@ETNOWlive) June 1, 2018

Unfortunately, Repco Home Finance is one of the victims of the savage Bear attack on the entire NBFC sector.

Its stock price has been on a steep dive and has lost 37% on a YoY basis.

In the present interaction, Mohnish was somewhat diffident about Repco.

“Out of $800 million odd, Repco is may be 4% of the pie. So frankly, whether Repco doubles or triples in price or gets cut in half is not going to drive where we are five years or 10 years from now in Pabrai Funds,” he said, implying that Repco is a low conviction bet for him.

“One of the big lessons I have learnt in the past from the levered institutions is stay away from them and time will tell whether a Repco will work out or not. I do not have any reason to think it would not work out but I did not have any reason to think the previous batch would not work out either! Levered financial institutions are high octane and they can be combustible and one should be careful,” he added, implying that he is having second thoughts about Repco’s prospects.

I will never buy Repco Home Finance: Guy Spier

At this stage, we have to compliment Tanvir Gill for her razor sharp mind and ability to seize the initiative.

“You think you would never buy Repco Home Finance?” she asked Guy in an unexpected manner and leaving him with no option to avoid the question.

“No” Guy answered point blank.

“I will never be able to evaluate the people managing it and I would tell you that the probability of what happens to those companies over time is that inevitably, the vast majority gets tripped in one way or another at some point because they suddenly have a refunding crisis for one reason or another,” he elaborated.

Follow Rakesh Jhunjhunwala’s footsteps

On an earlier occasion, I pointed out that Mohnish had rapped the intellectuals of Dalal Street for studiously ignoring the achievements of Rakesh Jhunjhuwala, the Badshah of Dalal Street (see Learn How To Invest From Rakesh Jhunjhunwala: Mohnish Pabrai).

While the intellectuals refer to Warren Buffett and Charlie Munger in hushed tones, they make no reference to Rakesh Jhunjhunwala and Radhakishan Damani even though the achievement of the duo of raking in Billions from stocks is praise-worthy.

Guy Spier grabbed the opportunity to pay his due respects to Rakesh Jhunjhunwala.

“Mohnish talks about cloning. He started off cloning Warren and Charlie, I continue to clone Warren and Charlie. But there is not just Mohnish. At the time that I owned Crisil, Rakesh Jhunjhunwala was invested in Crisil and that guy is still invested in Crisil and I am not,” he pointed out.

“To pay attention to him and a number of other super smart people and the people who specifically sit and hold things for a long time is a great guidance for me,” Guy added with commendable humility.

So, what is the catch?

Buy Rain Industries, Reoco Home Finance and Crisis?

The catch is no catch, earlier they were saying it’s no brainer in housing finance. Now all are cautious , one thing is very clear, one must not copy them at all.

For example

Mehraboon Iran’s Asian Granito, Man infra …सबने पैसा डुबाया है

Pnb housing .. and others , there are many stories ..

You summed it up right. In fact if a share is hyped by all best to avoid.

One may note the unexplained direct correlation between the good-to-excellent results by all those companies during boom times and the bad-to-poor results once the boom ended! And not just limited to the Vakrangees or Manpasands, Repco or Rain, usually the favourites of fund managers. Yet companies from well known houses or companies with robust business and balance sheets most likely did not participate.

Something fishy.

he sold repco shares