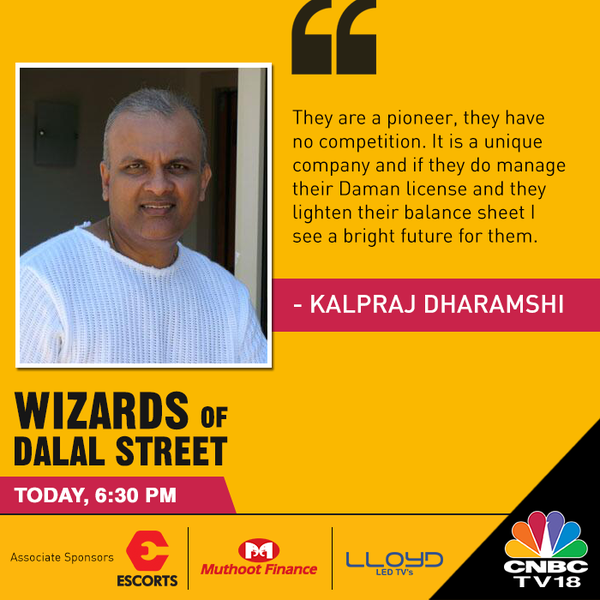

“Delta Corp is an example of a stock which has not worked out” Kalraj Dharamshi said, his brow creased with worry lines and his voice quivering even as Ramesh Damani looked at him sympathetically.

Kalpraj’s statement was in reply to a question by Ramesh Damani on the worst investment decisions that the former had made during his illustrious career as a stock wizard.

The veteran value investor had good reason to be concerned because he and his family members collectively hold a treasure trove of nearly 30,00,000 shares of Delta Corp worth (presently) in excess of Rs. 50 crore.

In my interview Delta Corp is an example of an investment which has not worked out for me. But I remain optimistic on the company ?

— Kalpraj Dharamshi (@KalprajD) September 11, 2015

“However, I remain optimistic about the Company”, the veteran added and proceeded to provide a masterful analysis as to why Delta Corp had good potential but had failed to deliver.

“They are a pioneer. They have no competition. It is a unique company and if they do manage their Daman license and they lighten up their balance sheet, I see a bright future for them” Kalpraj explained on being prompted by Ramesh Damani.

| DELTA CORP LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 3,868 | |

| EPS – TTM | (Rs) | [*C] | 2.21 |

| P/E RATIO | (X) | [*C] | 75.79 |

| FACE VALUE | (Rs) | 1 | |

| LATEST DIVIDEND | (%) | 20.00 | |

| LATEST DIVIDEND DATE | 14 SEP 2016 | ||

| DIVIDEND YIELD | (%) | 0.12 | |

| BOOK VALUE / SHARE | (Rs) | [*C] | 34.79 |

| P/B RATIO | (Rs) | [*C] | 4.81 |

[*C] Consolidated [*S] Standalone

| DELTA CORP LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2016 | JUN 2015 | % CHG |

| NET SALES | 108.66 | 80.73 | 34.6 |

| OTHER INCOME | 5.44 | 1.2 | 353.33 |

| TOTAL INCOME | 114.1 | 81.93 | 39.27 |

| TOTAL EXPENSES | 67.11 | 58.36 | 14.99 |

| OPERATING PROFIT | 46.99 | 23.57 | 99.36 |

| NET PROFIT | 20.65 | -0.41 | 5136.59 |

| EQUITY CAPITAL | 23.07 | 23.07 | – |

(Source: Business Standard)

Cloning Of Rakesh Jhunjhunwala’s investment style

Kalpraj candidly admitted that Rakesh Jhunjhunwala, the Badshah of Dalal Street, had a “tremendous influence” on him and that watching him analyze stocks was a “tremendous learning experience”.

Look for companies which are addressing large opportunities and have low competition

Rakesh Jhunjhunwala made billions from the stock market by betting on companies which are addressing large opportunities and have low competition.

Stocks like Titan, Praj Industries, Lupin, etc readily come to mind as textbook examples of stocks which fulfill the criteria at the time that Rakesh Jhunjhunwala bought them.

Kalpraj disclosed that he has cloned this philosophy and insists that the Companies that he buys are addressing large opportunities and have low competition.

Some other stocks that Kalpraj Dharamshi holds which fulfill this criterion include SQS BFSI (which was recommended by Daljeet Kohli and turned into a magnificent multibagger), Ricoh India (which was also a multibagger but is presently in the doldrums owing to fraud).

“Very Excited” about Delta Corp’s prospects: Rakesh Jhunjhunwala

Predictably, Rakesh Jhunjhunwala was the first to spot the opportunity that Delta Corp has.

“I am very excited about the prospects of Delta Corp” Rakesh Jhunjhunwala proclaimed, his face breaking into a wide smile.

The Badshah explained that Delta Corp would be the “next Las Vegas” owing to its dominance in the gaming and the hospitality space.

As of 30th June 2016, Rakesh Jhunjhunwala holds a massive treasure trove of 2,25,00,000 shares of Delta Corp (along with Rekha Jhunjhunwala) which is worth Rs. 377 crore.

All expectations have come true and Delta Corp is now a multibagger

Today, barely a year after Kalpraj Dharamshi lamented that Delta Corp had “not worked out” for him, the stock has surged from Rs. 77 to Rs. 167, leading to enormous gains of 117%.

The reason for the euphoria is because Delta Corp is well on the way to deliver the lofty expectations placed on it by savvy investors.

The Company reported blockbuster Q1FY17 results. The total income surged 35% to Rs 109 crore against Rs 81 crore in Q1Fy16. This was due to better targeted marketing and getting on board “high roller” customers.

Further, Goa, where the bulk of Delta Corp’s operations lie, has become a year round destination rather than seasonal. This has boosted revenues and positively impacted profitability.

Delta Corp assured that the income streams are steady and are bound to translate into greater revenue and growth in the months to come.

It added that its floatel (floating hotel), Casino Deltin Caravella, which is operational in Goa, is expected to add to revenues and profitability.

Casino in Sikkim

Delta Corp has announced that it has obtained a provisional license from the Government of Sikkim to operate a casino. It will operate a live gaming casino offering approximately 150 gaming positions.

The company will be a dominant and formidable player in the Indian gaming and entertainment space owing to its three offshore and two onshore casinos in Goa and Sikkim.

Purchase of poker and rummy website ace2three.com

Nayantara Rai, the ace investigative journalist with ET, has revealed that Delta Corp is talks to buy a rummy and poker site called ace2three.com.

My story: Delta Corp may buy rummy website ace2three for $80-100m. Stock hits 52week high https://t.co/vV6hIBSXeP @ETNOWlive @EconomicTimes

— Nayantara Rai (@NayantaraRai) September 28, 2016

Adda52.com already acquired

Delta Corp acquired Gauss Network, which owns Adda52.com, India’s leading poker site, in a part cash, part equity deal, for a consideration of over Rs 150 crore.

Adda52.com is churning out big money. The consolidated revenue of Gauss Network in FY16 was Rs 47 crore and EBITDA (earnings before interest, taxes, depreciation, and amortisation) margins were in the 30-35 per cent range. The company is debt-free and is cash generating.

Stranglehold in online and offline gambling

Delta Corp is following the clear strategy of becoming the leader in the offline and the online gaming sector. The online segment complements the offline gaming business and does not cannibalize the existing business. The market is big enough to accommodate both the segments. Globally, the two coexist.

The online segment will provide great business and growth synergies as well as financial strength and flexibility. It will help expand the customer base and market penetration.

Research report by Motilal Oswal

Motilal Oswal has conducted an expert analysis of Delta Corp’s future prospects. It points out that the investment phase is behind and the launch of the Daman casino will trigger significant cash generation as well as RoCE / RoE improvement, beginning FY16. It is also emphasized that given the significant growth potential for India’s gaming industry, Delta’s dominant position, and strong earnings outlook for its gaming business, the company is well placed to deliver mega gains to its shareholders.

Classic application of Howard Marks’ theory of difference between “fundamental risk” and “investment risk”

At this stage, we have to pay tribute to Howard Marks, the billionaire investment-philosopher, for advising us to buy top-quality companies when they are in the doldrums and are available at throwaway valuations.

Howard Marks explained that investors have to always bear in mind the difference between stocks carrying a “fundamental risk” and those carrying an “investment risk”.

“Even a quality stock quoting at exorbitant valuations carries a high “investment risk” even though the fundamental risk is low” Howard Marks said with his characteristic clarity of thinking.

“Finding a stock quoting at a low valuation in relation to its intrinsic value is the way to find multibagger stocks”, the Billionaire added.

In hindsight, Delta Corp was the ideal investment at the time that Kalpraj Dharamshi talked about it because both risks, at the fundamental level as well as the investment level, were low.

The best part of such stocks is that even if the investment hypothesis fails, the risk of a loss is low because there are no expectations built into the stock price.

Other “failed” stocks which are ripe for a buy applying Howard Marks’ theory

Novice investors like you and me have to strive towards practical examples that meet the test of theory.

Majesco

A few days ago, I conducted a meticulous analysis of Majesco, a stock which has fallen out of favour amongst the hoi polloi owing to the slowdown in the technology sector and the soft quarterly results. However, leading experts have opined that the time is ripe to aggressively buy the stock owing to its fundamentals and limitless opportunities.

Jain Irrigation

I have also put the spotlight on Jain Irrigation, a top-quality stock which has fallen from grace because of a change in the business model. Experts are urging that given the Company’s dominance in micro-irrigation systems and the Government’s thrust on ushering in reforms for the agriculture sector, the stock is destined to sparkle and shower multibagger gains in the near future.

Conclusion

There is much to be learnt from listing to the wisdom of eminent stock wizards like Ramesh Damani and Kalpraj Dharamshi. The all-important lesson is that one should not be discouraged by temporary periods of under-performance of a stock but should instead take the opportunity to aggressively buy the stock. That is the secret to making multibagger gains!

RIL fits as example and has under performed market,so among mega large cap ,I expect it to double in less than three years .

There a dime a dozen good quality companies which will multiply 5 times in three years. Investors who expect a scrip to double in three years are fools.

Dear Venky-Can you name your dozen companies which will multiply five time in three years for the benefit of fools.

Star Paper Mills, CMP 115, target 400 to 500 in next two to three years, Emmbi Industries CMP 125, target 300 to 350 in two years. There are plenty more. Do some hard work, and dont rely on Reliance. The stock will take you for a royal ride

Thanks dear Venky, but please be generous by naming the rest 10 of your dozen he wells so that people can avoid royal ride of RIL

Agree Venky. And would you be kind enough to explain the uasage of the phrase “Dime a dozen” so that nobody ends up waiting for the another 10 (dozen minus two named) scripa

Rel Capital is also in the same category ,and now its time has come to perform.DCB bank and IDFC bank are other good stocks which are expected to show good show in medium to long term.

Wat about Tourism Finance.wat is ur opinion in idfc bank in next 10 years.

If IDFC bank becomes 7 x in ten years, I will not be surprised.

how many “X” in ten years for HDFC Bank and RIL?

and what happened to Ricoh India? on down circuit and he has a large position.

But for now its the chemical sector run….

Thanks for article

Jain Irr has already been a multibagger for this year –