Tanvir Gill, the young-faced editor of ET Now, is one of the most pleasant faces on television. Her stylish mannerisms and charming smile mesmerizes the audience and they stay glued to the show, resulting in super-high TRPs for the channel.

However, Tanvir’s USP is not only her effervescent personality and charming smile but that she has also a deep knowledge of stocks and a razor-sharp mind. She is also a master of psychology and knows how to get her guests to reveal secrets that the audience wants to hear.

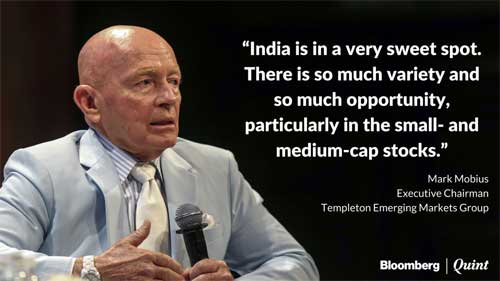

One can see this play out in Tanvir’s latest interview of Mark Mobius, the legendary fund manager with Templeton, the trillion-dollar global Mutual Fund.

When Mark Mobius started straying from the topic and began dilating on academic global macro-economic issues, Tanvir rightly sensed that the audience would soon lose interest. She tactfully and skilfully brought Mark Mobius back on track and got him to reveal information on specific stocks and strategies.

“I know you are not going to talk stocks though I would want you to talk stocks”, Tanvir started off in a firm tone, laying down the terms of engagement.

She then coaxed him to give three ground rules that have never failed while picking up a multibagger idea within the small cap universe.

Three-fold strategy to finding multibagger small-cap stocks

Mark Mobius cautioned that small-cap and midcap stocks represent risky businesses with unpredictable business cycles. He warned that the companies are owned by the promoter-families and that there are doubts about the integrity of the management.

However, he assured that if investors follow his three-fold strategy, they could avoid the deadly stocks and at the same time home in on winning stocks that can become multibaggers:

(i) Ensure that the Company has very good management. The management must be people with integrity. They must also be people with good management know-how and with a deep understanding of the market. They must also know how to relate to investors. The corporate governance of the Company must be impeccable.

Mobius emphasized that quality of management is “very, very important”. He added that his fund does a lot of intensive research into the people behind the companies before investing any funds in it.

(ii) Ensure that the management has a “vision for growth”. The management must have a clear-cut road-map on what they will be doing for the next five years and where they expect the company to be in that time;

(iii) Three, the management must be aware of the legal framework of the Country where they are working. Mobius emphasized that the rules and regulations in India are very complicated in India and one can unwittingly get into serious trouble if he puts a wrong step. The awareness of how to work within the legal framework is very important, Mobius added.

Simple but highly effective strategy

Mark Mobius’ three-fold strategy sounds quite elementary but it actually reflects deep thinking. The management is the nerve center of the business. If the investors choose the management well, most of the problems will be taken care of. A visionary management with a deep understanding of the market will ensure that the Company vanquishes all adversities and prospers. This prosperity will itself effortlessly turn the Company into a mega multibagger.

India is a “small cap treasure house” owing to the superlative performance of Indian stocks

Mark Mobius acknowledged that Templeton’s small cap fund has given a CARG return of 47% over the last five years. This is an outstanding performance by any standards and heavily outperforms the benchmark.

He also accepted that the result of this standout performance is that the allocation to India in the small-cap fund of emerging markets has been doubled. India is a “small cap treasure house” and is a “very exciting” place to be in, he added.

We are very upbeat on India & #Modi’s reform movement, and see growth likely accelerating going forward @business #bmarkets2016

— Mark Mobius (@MarkMobius) September 30, 2016

Diwali Gift from Mark Mobius

Novice investors like you and me will never be able to muster the courage to ask an investment legend like Mark Mobius for a stock tip as a Diwali gift. However, Tanvir Gill charmingly asked him for one knowing that she was doing it on our behalf and for a noble cause.

“If I were to ask you what is the one segment or stock perhaps because it is Diwali time in India so you could help our viewers perhaps the Diwali gift and a stock idea or stock investment that has worked for you very well or segment that you very bullish on within the small cap universe that would be great?” she said in her soft and sweet voice, choosing her words carefully so as not to spook Möbius.

Mobius carefully pondered over the situation for a few seconds. He knew that if he recommended a specific stock, he would receive a terse memo from the dour-faced legal team in Hong-Kong.

At the same time who can refuse to oblige a beautiful young lady asking for a stock tip, he thought.

“To hell with the legal team”, he decided.

India’s banking system is the best in the World and Federal Bank is the best Bank stock

“One area that deserves mention is banking because you have a growing country which reflects on bank’s earnings. You have a central bank who have been very astute and very disciplined in making sure that banks account for their non-performing loans so that combination is very, very positive and if you compare it to other countries it is usually not present in many other countries so I would say the banking sector and you mentioned Federal Bank but I am now recommending it because at any point in time we have been….” Mobius said in his clipped British accent, his face breaking into a wide smile.

Federal Bank is the fav of Billionaires Rakesh Jhunjhunwala and MA Yusuffali

We have to compliment Mark Mobius for his stellar stock recommendation because Federal Bank is also the favourite stock of Billionaires Rakesh Jhunjhunwala and MA Yusuffali.

In my piece of 7th May 2016, I pointed out that both Billionaires had aggressively hiked their stake in Federal Bank.

“Billionaire stock investors are supposed to have an instinct for sniffing out undervalued stocks with the potential for hefty gains” I rightly said.

54% gains in just five months

It is worth noting that in just the five months that have elapsed from the date I wrote my piece on Federal Bank being a favourite of Rakesh Jhunjhunwala and MA Yussuffali, the stock is up an amazing 54%.

Stock recommended by Akash Prakash of Amansa Capital

At this stage, we have to also compliment Akash Prakash, the whiz-kid fund manager of Amansa Capital.

He broke his long-standing rule of not making stock recommendations by making an exception for Federal Bank on the occasion of the Sohn India conference.

He pointed out that the severe problems being faced by the PSU Banks in terms of the surging NPAs, which has crippled their ability to lend further, provides a golden opportunity to well-capitalized private Banks like Federal Bank. He also explained that the Bank has now got its act in order and made adequate provisions for its own NPAs. Also, the Bank has a clear-cut road map for aggressive growth, he added.

Blockbuster Q2FY17 results by Federal Bank

Federal Bank reported blockbuster Q2FY17 results. The net interest income surged 19% to Rs.726.19 crore as compared to Rs.610.68 crore in the same quarter of last year. The total deposits surged 17% to Rs.8,630 crore, while the total advances surged 27.17% to Rs.5,087 crore.

Federal Bank delivers finally after so many quarters of waiting, will he stock break-out of its range now???

— Ajaya Sharma (@Ajaya_buddy) October 25, 2016

| FEDERAL BANK LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2016 | SEP 2015 | % CHG |

| NET SALES | 2066.25 | 1904.6 | 8.49 |

| OTHER INCOME | 261.54 | 179.93 | 45.36 |

| TOTAL INCOME | 2327.79 | 2084.53 | 11.67 |

| TOTAL EXPENSES | 681.2 | 541.32 | 25.84 |

| OPERATING PROFIT | 1646.59 | 1543.21 | 6.7 |

| NET PROFIT | 201.24 | 161.28 | 24.78 |

| EQUITY CAPITAL | 344.1 | 343.49 | – |

Is City Union Bank next?

The blockbuster results posted by Federal Bank is a clear indicator that the financial sector is doing well. Now, the question is whether City Union Bank will follow the illustrious path and also delight investors by posting excellent returns.

It is worth recalling that City Union Bank has won the confidence of Brahmal Vasudevan’s Creador/ Latinia. The Bank has the same pedigree and credentials as that of Federal Bank.

Conclusion

In addition to being interviewed by Tanvir Gill, Mark Mobius also gave sound bytes to Bloomberg and other eminent publications. Mobius was clear in his thinking that small-cap stocks is the place to be invested in at present. He assured that the falling interest regime augers well for the Indian economy and that small-cap stocks will continue to put up a spirited performance. So, we have to take a cue from him and not only stay invested but load up on top-quality small-cap and mid-cap stocks on every correction!

That got my attention on Federal Bank, I’ll surely spend little time researching before I decide to buy.

Very Good article and Tanvir Gill is one of top journalist and Arjun has perfectly described her. Indian private sector is very good sector to invest. Many banks are good bets and RBI control ensures good governess. To invest in private banks like basket make good sence. I am heavily invested in. Yes bank, indusind, kotak, hdfc bank, icici, axis, Dcb, idfc bank, federal bank, eco and city union bank.

Read eco as RBL

Really an asset of Indian banking – Federal Bank.