Novice cloners strut around with 5-baggers in portfolios

One of the amusing aspects of the present stock market is that novice investors who know diddlysquat about investing are strutting around like millionaires with bulging bank balances. They openly flaunt their portfolios with five and ten bagger stocks in them.

For this, we have to thank Mohnish Pabrai and his famous theory of cloning.

Mohnish famously described himself as a “low life” “shameless cloner”. This removed the stigma that was hitherto attached to the practice of cloning and opened the floodgates for novices to peep into the portfolios of eminent stock wizards and piggyback on their broad shoulders.

One salutary effect of cloning is that the novices are spared of the perils of venturing out into the jungle on their own and falling prey to junkyard stocks.

(Trimurti of Rajiv Khanna (Dolly Khanna’s illustrious alter ego), Mohnish Pabrai & Porinju Veliyath taking a vow to eradicate poverty amongst novice investors)

Balaji Amines, a textbook stock to clone

Balaji Amines, a small cap (Rs. 1673 crore), is a textbook example of a stock which one can/could have cloned without even the slightest hesitation.

This is because the stock has the unique distinction of having won the confidence of four well known wizards.

Ashish Chugh recommended the stock in January 2011 in the following words:

“This is a Maharashtra based company. This company manufactures various kinds of amines and derivatives of specialty chemicals and natural products. This company has got three manufacturing plants; two are located close to Solapur and one plant located in Hyderabad. This company caters to a wide range of industries starting from pharmaceutical to agrochemicals. It also caters to the chemical industry and FMCG in a small way. Almost all pharmaceutical companies whether Indian or international, the major international companies, are the customers of Balaji Amines.If you take a look at the financials of the company, for FY10 company achieved a sales of about Rs 260 crore which was up by close to 4% compared to FY09 and profit after tax was up by about 35% to about Rs 20 crore. This company has got a small equity of about 6.5 crore. In the first half of the current financial year, sales are up by close to 35% to about Rs 170 crore. Profit after tax is up by 30% to about Rs 16 crore. Earnings per share (EPS) on an annualised basis is coming close to Rs 10, the stock is traded at about Rs 40, which means that the P/E in this case is about 4.”

It is unbelievable that Balaji Amines was then available at a throwaway price of only Rs. 40.

Porinju Veliyath picked up the gauntlet in March 2015.

“Smart stock pickers always have a great opportunity, irrespective of how high the Nifty is,” he said.

He lambasted novices for having unnecessary apprehensions about irrelevant issues. He was particularly irked by the fact that novices were avoiding buying stocks owing to sundry problems in Greece and other frivolous issues.

“I am seeing hundreds of stocks worth buying,” he said and recommended three stocks, one of which was Balaji Amines.

He explained that Balaji Amines has a monopoly in some products and that its’ valuations were irresistible.

Mohnish Pabrai, who is famous for his declaration that he only buys stocks with 5-bagger potential, scooped up a massive chunk of 607,204 shares of Balaji Amines in the Jan-March 2017 quarter.

It is interesting to note that Mohnish bought his quota over eleven occasions. He was keen not to attract attention of the novices to his interest in the stock.

| Date of purchases | Nos of shares |

| 17-06-2016 | 73450 |

| 24-06-2016 | 109543 |

| 08-07-2016 | 67889 |

| 15-07-2016 | 58961 |

| 22-07-2016 | 59778 |

| 29-07-2016 | 39556 |

| 05-08-2016 | 50283 |

| 12-08-2016 | 38754 |

| 19-08-2016 | 21738 |

| 26-08-2016 | 25472 |

| 02-09-2016 | 11825 |

| Total holding as of 30.09.2017 | 607204 |

Shyam Sekhar and his family members held 183,561 shares + 208,000 shares of Balaji Amines as of 31st March 2016. The present holding is not known.

Stock surges in wake of blockbuster Q2FY18 results

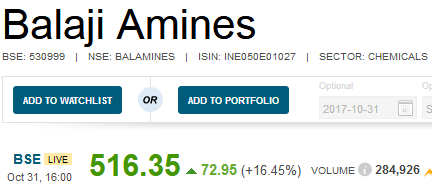

Today, Balaji Amines surged a magnificent 16% on the back of strong Q2FY18 results.

The sales increased 16.87% to Rs. 201.19 crore for the quarter ended 30th September 2017 as against Rs. 172.15 Crs. for the corresponding period last year.

The Profit Before Tax (PBT) increased 39.88% to Rs.46.47 crore as against Rs. 33.22 crore for the corresponding period last year.

The Profit After Tax (PAT) increased 39.81% to Rs. 29.16 crore as against Rs. 21.73 crore for the corresponding period last year.

The exports for the quarter ended 30tt September, 2017 increased 44.82% to Rs. 39.81 crore as against Rs. 27.49 crore for the corresponding period last year.

| BALAJI AMINES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2017 | SEP 2016 | % CHG |

| NET SALES | 201.19 | 172.15 | 16.87 |

| OTHER INCOME | 1.27 | 1.06 | 19.81 |

| TOTAL INCOME | 202.46 | 173.21 | 16.89 |

| TOTAL EXPENSES | 149.67 | 132.48 | 12.98 |

| OPERATING PROFIT | 52.79 | 40.72 | 29.64 |

| NET PROFIT | 29.16 | 21.73 | 34.19 |

| EQUITY CAPITAL | 6.48 | 6.48 | – |

(Source: Business Standard)

10-bagger since Ashish Chugh’s recommendation, 5-bagger since Porinju’s

It is unbelievable that the stock has given a gain of 1051% since Ashish Chugh’s recommendation of January 2011.

The stock has given a gain of 543% since Porinju Veliyath’s recommendation.

Balaji Amines up over 500%; reminded me of this short chat:https://t.co/nFzixol7D6

— Porinju Veliyath (@porinju) October 31, 2017

Even if we had bought the stock by following Mohnish Pabrai’s illustrious footsteps, we would be richer by about 37% in the seven months that have gone by.

Are more gains left in Balaji Amines?

D Ram Reddy, the boss man of Balaji Amines, confirmed that the strong growth and margins are sustainable at least in the short term.

#Q2WithBQ | Balaji Amines' D Ram Reddy speaks about the earnings and future outlook. https://t.co/aHqpPj8rVB pic.twitter.com/0GH7ginO95

— BloombergQuint (@BloombergQuint) October 31, 2017

It is also stated that Balaji Amines will invest Rs 66 crore in Balaji Specialty Chemicals Pvt Ltd.

All of this suggests that more bucks are waiting to be pocketed from Balaji Amines.

We must also remember that Shankar Sharma has confidently asserted that the specialty chemical sector is a “structural growth story” and that he is very bullish about the sector.

Also, Mohnish Pabrai’s declaration that he does not buy any stock which does not have 5-bagger potential implies that Balaji Amines has a long way to go before we can call it a day!

This report came on 31st Oct 2017 and Pabrai started selling stake from 3rd Nov 2017.

We should not coat tail period.