Novices oblivious, Pros alert, to money making opportunities

One can straightway see the difference between a novice investor and an accomplished investor from the way they react to events.

While I listened intently to the radical reforms unleashed by NAMO and Arun Jaitley with regard to the slashing of GST rates on food stuffs, hotel tariffs etc, it never occurred to me to consider the impact that this would have on the stocks from the hotel sector.

"We are extremely thankful to the government for making these much required changes in the GST regime. This will help restaurants across India rationalise tariffs," FHRAI President Garish Oberoi said in a statement. https://t.co/mIjz1Lh9ph

— moneycontrol (@moneycontrolcom) November 11, 2017

Instead, I was chuckling with amusement at the buffoonery statements of some opposition leaders who claimed that GST will “break the backbone” of the Country.

The aim of #GST is to break the backbone of India: Rahul Gandhihttps://t.co/WaEFYKuzvx pic.twitter.com/p72BcUXjKv

— Business Standard (@bsindia) November 11, 2017

Height of ignorance.!! I think Papu economics teacher is Chidambaram ???

— कार्तिक K (@karthiktvm1990) November 11, 2017

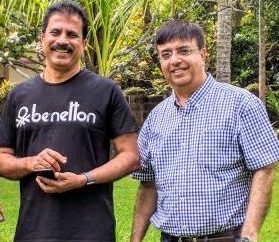

However, Porinju Veliyath and Ashish Chugh were in no mood for jokes. Instead, they were listening to NAMO with rapt attention and calculating what the impact would be on the stocks from the hotel sector.

When Porinju and Ashish Chugh talk in sync, we have to be on red alert

In the past, we have seen Porinju and Chugh work as a team and effortlessly mop up mega bucks for themselves.

In fact, it would not be an exaggeration to say that the duo is a formidable money-making team.

One incident that comes readily to mind is that of Arvind Infrastructure where the duo teamed up to scoop up the stock that was being mindlessly dumped by big-ticket investors who were not happy with being allotted shares in the micro-cap infra company upon the demerger from Arvind Ltd.

Within just four months, when the selling abated, the duo was basking in unimaginable gains of 250%.

Stock Ideas can from anywhere! This demerged stock (idea) is up over 250% in 4 months!https://t.co/Q3qrLylizg

— Porinju Veliyath (@porinju) January 12, 2016

Another incident is that of Balkrishna Papers (Niharika Papers) where something similar happened.

Yet another example is that of Balaji Amines where the duo teamed up with Mohnish Pabrai and Shyam Sekhar to rake in mind-boggling gains of upto 1000% (10-bagger).

From this, it is obvious that we have to always monitor the conversations of the duo, read between the lines and act with alacrity.

Hotel stocks are in a “sweet spot” and must be bought aggressively

Porinju fired the first salvo by pointing that the GST reforms have put hotels in a “sweet spot” and that the hotel stocks “look attractive”.

3&4 Star hotel operators are in a sweet spot. F&B at 5% GST. Room rates are mostly below Rs.7500 (18% GST). Margins to go up. Advantage at the expense of 5 Stars. Few listed companies in the space look attractive. Am I missing something?

— Porinju Veliyath (@porinju) November 10, 2017

He added that the lower GST rates are a “tailwind” which will propel hotel stocks into a higher trajectory after languishing for a decade.

The industry is turning around after a decade, despite disruptive @Airbnb etc. High cost and crack down on black money could moderate supply going forward. Lower GST is tailwind for 3&4 Stars @safiranand @hiddengemsindia

— Porinju Veliyath (@porinju) November 11, 2017

Porinju’s analysis is corroborated by Ashish Chugh. He opined that years of stagnation have lead to “leaner cost structure” and “cost rationalization” and that “operating leverage” will now kick in with increased occupancy contributing to the bottom line.

Industry has seen a down cycle followed by multi year consolidation – leading to a a leaner structure & cost rationalisation. Case of operating leverage with higher occupancy. https://t.co/4pjbmrkSOW

— Ashish Chugh (@hiddengemsindia) November 11, 2017

He also gave a glimpse of his visionary outlook by counseling novices to have an “open mind” whilst investing and not to assume that what has not happened in the past cannot happen in the future.

It is imp.to have open mind in Investing.Invstrs shunned airline stocks 4 yrs-only Argumt-Warren Buffett doesn't like them&they never delvrd in past-w/o realising what was happening to single biggest cost in sector.Worst assumptn-what's not happened in past can't happen in future https://t.co/KPq25RnKcn

— Ashish Chugh (@hiddengemsindia) November 12, 2017

From the above exchange between the two stalwarts, it should be obvious even to dim-witted novice investors that the duo is recommending an aggressive buy of hotel stocks.

Is Royal Orchid Hotels the best stock to buy?

On the million dollar question as to which is the best hotel stock to buy, there is no need for us to beat around the bush because Porinju has already recommended Royal Orchid Hotels as the best stock to buy.

His precise words are as follows:

“There could be companies like the Royal Orchid. It is in a very good expansion mode and a very clean company. It is mostly into management of the hotels, Oriental Hotels. That segment is to be looked at. The sentiment has been bad on the industry for last many years, so these companies are available at a very attractive valuations. That is why I would like to talk about these. And after many years in spite of the fact that too many hotels have come up, too many properties are happening, still there is like shortage of hotel rooms in the five star and four star segments, mostly during seasonal time. So, that is very positive for the profit margins for these companies can go up.”

In fact, Porinju bought (in the name of Sunny) 150,000 shares of Royal Orchid on 31st December 2015 at Rs. 66.25 per share though the present holding is not known.

Royal Orchid Hotels reported “stellar” Q2FY18 results and is a “Strong Buy”: S&M

I have earlier pointed out (when Ashish Kacholia held 3.94% of the equity) that Stewart & Mackertich have recommended a buy of Royal Orchid Hotels on 18th August 2017 on the premise that it is on the “cusp of graduation”.

The recommendation has worked out well so far because the stock surged from Rs. 109 to Rs. 148 within just a few weeks. Even at the CMP of Rs. 133, hefty gains of 22% are on the table.

In the latest report, Aditya Jaiswal of Stewart & Mackertich has pointed out that Royal Orchid Hotels has reported “stellar standalone results” in Q2 FY18 which proves that it is on the path of recovery.

The analysis of the results is as follows:

“Royal Orchid Hotel Limited (ROHL) is the flagship company of the Royal Orchid Group of Hotels. The hotel chain has been in the business since the past 30 years, it comprises 5 and 4 star properties for business and leisure travellers and has an inventory of 3,159 rooms spread across 47 operational properties pan India.

Q2 FY2018: ROHL reports stellar results!

– Royal Orchid reported stellar standalone results in Q2 FY18. Its revenues from operations grew 27% YoY to INR24.72 crores, on the back of increase in occupancy levels (75%) in Q2 FY18.

– Its employee benefit expenses increased 20% YoY on the back of implementation of minimum wage rules.

– Its EBITDA grew 75% YoY to INR4.06 crore, while the EBITDA margin expanded by 447 bps YoY to 16.42%.

– Its interest cost declined 10.60% YoY to INR1.35 crore on the back of re-negotiated interest rates.

– Its PAT increased 66% YoY to INR3.14 crore, while its PAT margin expanded 296 bps YoY to 12.70%.

– The Company declared a strategic partnership with Bespoke Hotels Ltd. Bespoke Hotels manages over 200 properties worldwide, with over 50 represented hotels in India, and stands as the UK’s Largest Independent Hotel Group. This partnership will enable ROHL the ability to offer its guests hundreds of hotel options across multiple global markets.”

At the end, Aditya Jaiswal has reiterated the “strong buy” recommendation. He has projected a target price of Rs. 188, which if achieved, will put hefty gains of 32% into our pockets.

Other virtues of Royal Orchid Hotels

In my earlier piece, I have already elaborated on the other virtues of Royal Orchid, such as its “asset light business model” and “high promoter holding” (70.80%).

I have also drawn attention to the investors’ presentation which sets out in precise terms the game plan for the future.

There is also an analysis by Rajesh Naidu of ET where he has opined that Royal Orchid is quoting at “attractive valuations” in comparison to its arch rivals.

Conclusion

It is obvious that we have no option but to immediately tuck into one or more high-quality hotel stocks like Royal Orchid, Taj GVK, Indian Hotels, Sinclairs Hotels etc. Otherwise, if the stocks surge like rockets, we will cut a sorry face for not having acted despite being forewarned by Porinju Veliyath and Ashish Chugh!

http://blog.dhavalparikh.co.in/2017/11/royal-orchid-hotels-a-five-star-check-in/

Another good research report which has recently been published a week back. Worth reading !!

for the ignorant people criticizing Rahul must remember that Congress brought the concept of gst and it was vehemently opposed by Modi

CRITICIZING RAHUL IS DIFFERENT FROM CRITICIZING THEN PM,FM. Rahul held no post at that time 🙂

Rahul or MMS it is true that the idea came from Congress Government and the ehn BJP State governments were aggressively opposing to get political mileage. Anyhow GST was implemented without taking enough homework and it is biting the economy now. Hope this negative impact will be turned positive soon.

https://economictimes.indiatimes.com/markets/stocks/news/ashish-kacholia-sells-3-stake-in-royal-orchid-hotels-shares-drop-over-5/articleshow/60762274.cms

Another biggie sold 3%.

Reasearch & then invest.

And still Bigger Biggie bought that Biggie who sold 3% 🙂 Do deep research and then invest !! Not only that even at CMP other FIIs also bought 🙂

http://www.moneycontrol.com/news/business/stocks-business/royal-bank-of-scotland-buys-9-28-lakh-shares-of-royal-orchid-2392253.html

In my view GST is good for organised players in all sectors. There will be migration of business from unorganised to organised sectors . Benefits will be more in sectors where unorganised players were more. But it may have neutral impact in some highly organised sectors like Auto where there were no unorganised players. For stock market it is hugely positive as listed players are organised sector. In large cap universe of Nifty and Sensex, HUL may be good post GST bet for 15% CAGR for next few years.

Royal Orchid , Oriental hotels, Tajgvk, kamat hotels, viceroy hotels will benefit from the structural upturn in hotel industry after 10 years of slowdown. Occupancy of all hotels has been increasing, cost of capital has come down. high entry barriers for new entrants plus tailwinds of gst making it attractive play with high margin of safetly… Some with broken balance sheets like Leela hotels may see buyouts… A must defensive play in your portfolio