Porinju’s visit to Dalal Street goes unnoticed

Normally, Porinju’s visits to Dalal Street are accompanied with much pomp and show.

Novices from across the city turn up in large numbers to see what stock he is buying.

There is generally a festive atmosphere with the novices talking animatedly with each other at the discovery of a potential multibagger.

However, on Friday, 16th March 2018, Porinju and his entourage walked past the gates of Dalal Street unnoticed by anyone.

Prima facie, it appears that the incessant bombardment by the Bears which lead to the colossal fall of 594 points in the Sensex had spooked everyone.

Everyone was hiding in the bunkers. Dalal Street was deserted except for a few blood-thirsty Bears who were fearlessly roaming around, looking for victims to slaughter.

Nickey and Deepali Rana, the two charming lady reporters with Bloomberg and CNBC Awaaz respectively, were not intimidated by the savage Bear attack.

They stayed put at their posts and diligently monitored the happenings at Dalal Street.

They spotted Porinju and sounded the red alert early Monday morning.

Stocks To Keep An Eye Out On:

Porinju Veliyath buys 0.35% stake or 1,91,200 shares in VA Tech Wabag

Allcargo Logistics to meet several fund houses including Param Capital (Mukul Agrawal), GS on March 19— nickey (@OnlyNickey) March 19, 2018

In Focus: Va Tech Wabag

Porinju Veliyath Equity Intelligence bought 0.35 percent stake or about 1.9 lakh shares in VA Tech Wabag.— Deepali Rana (@deepaliranaa) March 19, 2018

Porinju has amassed a treasure trove of Va Tech Wabag stock

I am also well known for my diligent attitude.

Immediately on receiving the tip-off from Nickey and Deepali Rane, I rushed to BSE to check the official records.

I was astonished to find that while Porinju’s Equity Intelligence PMS bought only 1,91,200 shares on Friday, it collectively holds a massive treasure trove of 27,35,711 shares of Va Tech Wabag comprising of 5.01% of its equity.

How and when Porinju bought the rest of the holding is a mystery that deserves to be probed.

The investment is worth Rs. 132 crore at the CMP of Rs. 482.

Porinju’s PMS is now one of largest shareholders of Va Tech Wabag.

He towers over other heavyweight investors like Sumitomo Corp (the Japanese behemoth), Parvest Equity India, Goldman Sachs, TATA AIA etc.

Only SBI Magnum and IDFC Mutual Fund have a holding that is larger than that of Porinju’s PMS.

In fact, given that the Equity Intelligence PMS has an AUM of about Rs. 1,500 crore, Va Tech Wabag is one of the crown jewels of the portfolio.

| VA TECH WABAG LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 2,639 | |

| EPS – TTM | (Rs) | [*S] | 21.82 |

| P/E RATIO | (X) | [*S] | 22.13 |

| FACE VALUE | (Rs) | 2 | |

| LATEST DIVIDEND | (%) | 200.00 | |

| LATEST DIVIDEND DATE | 13 JUL 2017 | ||

| DIVIDEND YIELD | (%) | 0.82 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 155.11 |

| P/B RATIO | (Rs) | [*S] | 3.11 |

[*C] Consolidated [*S] Standalone

| VA TECH WABAG LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2017 | DEC 2016 | % CHG |

| NET SALES | 460.89 | 718.32 | -35.84 |

| OTHER INCOME | 18.52 | 3.49 | 430.66 |

| TOTAL INCOME | 479.41 | 721.81 | -33.58 |

| TOTAL EXPENSES | 409.33 | 699.34 | -41.47 |

| OPERATING PROFIT | 70.08 | 22.47 | 211.88 |

| NET PROFIT | 41.14 | -0.37 | 11218.92 |

| EQUITY CAPITAL | 10.93 | 10.91 | – |

(Source: Business Standard)

Is Va Tech Wabag a potential 5x/ 10x multibagger?

Porinju has never missed an opportunity to propagate his pet theory that infra stocks have great potential for success in our economy and will reward investors with 5x/ 10x multibagger gains.

“In infrastructure, everybody will agree India has a long way to go. Lakhs of crores of infrastructure spending is coming up … I am talking about trillions of dollars. Then only we will become a reasonably good level of accumulating 1.3 billion people. So we need to, it is compulsive kind of forces because of the political mismanagement of last 70 years,” Porinju said in his usual earnest manner.

“There are at least 20 companies in infrastructure in the currently listed companies whose market cap can go beyond 10,000 crore,” he added with a sparkle in his eyes.

Over a dozen Infra cos at inflection point – stronger balance sheet, better visibility & exciting operating environment; potential 5x & 10x

— Porinju Veliyath (@porinju) July 26, 2017

At least 5 Infra companies with mktCap <10,000 Cr currently, heading for >30,000 Cr mktCap in 5 years in a favorable operating environment.

— Porinju Veliyath (@porinju) August 13, 2017

I see 25 listed 10x ( in next 5 Yrs) stocks in this picture! pic.twitter.com/T2y9Ng1nbQ

— Porinju Veliyath (@porinju) October 28, 2017

For obvious reasons, we cannot take Porinju’s advice lightly. He appears to know infra stocks like the back of his hand.

KNR Construction, an infra stock recommended by him in April 2014, blossomed into a mind-boggling 10-bagger in just three years.

KNR Construction @ 97 – MktCap 270Cr. Clean BS, good business, good if you want to bet on Infra in the changing environment.

— Porinju Veliyath (@porinju) April 29, 2014

KNR up 450% while most in Infra fell:

Huge EPC opportunities emerging, explore few Infra mid-caps with healthy B/S!https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) August 14, 2015

10x in 3 yrs! Many more KNRs in making

Trillion Dollar opportunity in Housing & Infra coming up, Grab it! https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) May 9, 2017

Wastewater Treatment is a low hanging fruit: KR Choksey

KR Choksey has conducted an in-depth study of the state of the wastewater treatment industry in general and of Va Tech Wabag in particular.

It is claimed that there will be incalculable demand for water due to growing population and industrialization and that there will be no option but to treat wastewater and make it usable again.

It is also stated that the market for desalination (converting sea water into potable water) is growing by leaps and bounds and that Va Tech Wabag is ideally positioned to take advantage of this situation.

The recommendation to buy Va Tech Wabag is expressed in the following words:

“Given VATW’s dominant position in the desalination market (among top 10 players globally for desalination) and the company has successfully executed desalination projects in the past, the probability of winning more contracts in the future remains strong. Moreover, if the company is successful in receiving orders, it could receive O&M orders as well for the maintenance of these plants resulting in margin expansion as O&M division enjoys higher margins.”

“Valuation & Recommendation

VA Tech is considered as one of the most prominent player in the waste water treatment industry with a market share of ~14%. The company’s R&D centres located in Europe have helped it to have more than 100 patents, which in turn assisted company to garner strong order flows in the past. In terms of the technology offerings, it provides solutions ranging from zero liquid discharge to desalination unlike its peers and hence, we believe this could offer the company an upper hand in terms of future order activities. In terms of domestic market, government has announced stringent norms for sewerage treatment plants recently, which we believe could augur well for the industrial order flows and VATW being the strongest player is poised to receive large orders in the coming period.

For municipal orders intake, we expect increase in the budget outlay for ‘Namami Gange’ could see some uptick in short term. Further, BMC (Brihanmumbai Municipal Corporation) also plans to come up with STP orders estimated at approximately INR 45bn. VATW being a leader in STP can garner large orders going ahead.

The company already has the L1 status in more than INR 15bn worth of contracts, of which management expects a majority to get finalized in Q4FY18. Any positive development could improve revenue visibility for FY19 & FY20. Apart from domestic market, VATW has also entered into Latin America and some other parts of Africa last year, which we believe are key growth markets for waste water treatment in medium to long run.

VATW is a renowned name in the international market and thus, possibility of winning large orders cannot be overlooked. Taking all this into consideration, we expect the company to get more than INR90bn of orders over the next 2 years, which could improve revenue visibility of the company going ahead.

The revenue is expected to grow at ~12% CAGR over FY17-20. In terms of operational performance, we believe majority of Wabag India orders are in execution phase and the revenue share for Wabag India is likely to increase over the next 2 years. Further, Wabag India has higher margins as compared to Wabag Overseas, which could potential improve group OPM. We expect OPM to expand by ~139bps over FY17-20E. PAT is expected to increase at 17% CAGR over the same period.

In terms of peer comparison, we believe Suez is a close competitor of the company given its presence in nearly all technologies offered by VATW. Hence, we have considered Suez for comparison.

In terms of financial performance, revenue for Suez grew at mere 0.4% over CY12-16, while VATW reported a growth of 19% over FY13-17. EBITDA & PAT grew at a CAGR of 20% & 17% respectively, for VATW as against mere 1.5% & 8.8% for Suez.

Further, return ratios are also favorable for VATW with average ROE & ROCE at 11.8% & 20.6% as against 7.8% & 12.3% for Suez. This places VATW among the leaders in the waste water treatment industry.

In terms of valuations, we have valued the company on P/E basis. At CMP of INR 550, the stock is trading at 14.2x on FY19E and 11.4x on FY20E of our earnings estimates. The stock has been historically trading at medium multiple of ~17x on 1 yr fwd and ~12x 2yr fwd P/E band. However, valuations improved at the time of NDA victory on the expectations of uptick in the order activity.

We expect more wastewater treatment order to be announced before next election and hence, players like VATW are expected to benefit from this process. This, in turn, could improve valuations of the company and hence, valuing the company at 15x on FY20E earnings of INR 48.1, we have arrived a target price of INR 722, potential upside of 31% from CMP of INR 550. We have ‘BUY’ rating on the stock.”

‘Namami Gange’ Project will shower mega orders upon Va Tech Wabag

Experts are unanimous that NAMO’s ambitious ‘Namami Gange’ Project for which incalculable sums of money will be spent to clean the Ganga and other holy rivers will spell a bonanza for Va Tech Wabag.

ICICI-Direct referred to this as an “upside risk” to the stock:

“Positive outlook, orders win from Namami Gange pose upside risks

The company may see large order inflows from ‘Namami Gange’, the tendering process for which has already started.

The management pegged this opportunity to Rs 4000-5000 crore in the next two to three years. Large order wins from this segment pose upside risk to our target price.

Wabag has also planned fund raising up to Rs 400 crore for meeting equity contribution criteria in any such large project.

All such projects are likely to be centrally funded to tune of 40%. The rest 60% is to be funded via debt & equity. Of the 60%, 26% equity to be held by the key technology partner with a three year lock-in and 15 years O&M contract.

Apart from this opportunity, Wabag is likely to participate in large upcoming orders from Maharashtra (~Rs 8000 crore) for mega sewage treatment plants, Tamil Nadu (~Rs 5000 crore) for desalination plants, Delhi (~Rs 2500 crore) & Karnataka (~Rs 2500 crore) for water treatment.”

This sentiment is echoed by Axis Direct in the following words:

“Strong order pipeline:

Management talked about strong order pipeline for the company both in the domestic as well as international market, driven by expansion and greenfield projects in oil & gas industry.

Domestic order pipeline highlighted earlier:

(a) desalination plants in Chennai (Rs 17-22 bn),

(b) 7 sewage treatment plants in Mumbai worth ~Rs 50 bn, and

(c) Namami Gange projects opportunity worth Rs 200-250 bn over next 2-3 years.”

Kotak Securities is also gung ho about the prospects for the water and sewage treatment sector on account of long term drivers like urbanization, smart cities, water reclamation, industrial effluent treatment and Namami Gange.

Latest investors’ presentation reveals details of order book etc

The latest investors’ presentation has important information relating to the performance in the 9 months of FY17-18.

The information is as follows:

Highlights for the 9 months ended:

– Consolidated Revenue up by 17%

– Standalone Revenue up by 21%

– Consolidated EBITDA up by 21%

– Consolidated PAT at INR 736 Mio

• Continued improvement in top line aided by execution progress in our large projects

• Good contribution to EBITDA from our overseas subsidiaries and IIUs

• TCO under control driven by reduction in Europe

• Healthy growth in revenue driven by project execution progress

• Repatriation from profitable project execution in MEA resulting in Dividend income

• Increase in finance cost mainly due to higher bank charges associated with execution and new projects

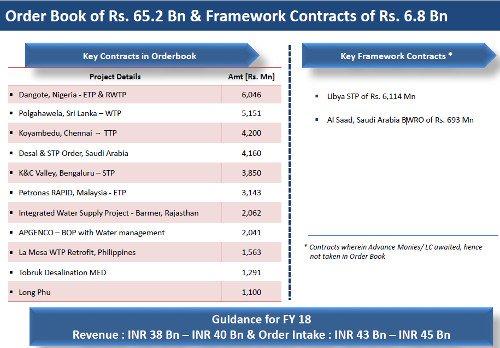

It is also stated that the Order Book is Rs. 65.2 Bn & the Framework Contracts are of Rs. 6.8 Bn.

The guidance for FY 18 is said to be Revenue: INR 38 Bn –INR 40 Bn & Order Intake: INR 43 Bn –INR 45 Bn

Is Porinju emulating the strategy of Billionaires Carl Icahn & Bill Ackman?

Prima facie, it appears that Porinju is following a conscious strategy of cornering large chunks of stock.

We saw this play out in Kaya, LEEL (where Dolly Khanna and SP Tulsian also have a stake) and GVK Power.

These stakes are large enough for Porinju to look the management eye to eye and demand that they attentively listen to him.

He can also perhaps demand a seat on the Board of Directors and play a formal role in shaping the destiny of the Company.

Porinju has already given a hint of his ambitions in the context of Sarda Plywood where he said:

“If I manage this company, I will make it into a Rs 2,000-3,000 crore company in the next five years time.”

It is worth noting that Billionaires Carl Icahn and Bill Ackman have honed this strategy to an art.

They are known as “activist investors”.

They barge into badly managed companies quoting at steep discounts and force the managements to do the right things which will enhance shareholder value.

The managements generally have no option but to obediently follow the instructions of the activist investors.

This leads to mega multibagger gains for all the stakeholders.

In fact, Carl Icahn has the reputation of being the “CEO’s worst nightmare” because he shakes things up and makes life difficult for the management.

He is also known as a “corporate raider”.

Whether Porinju will choose to walk in the footsteps of the Billionaires or whether he will choose to be a passive investors requires to be watched carefully!

one red flag : promoter holding is ONLY 24%, Like Taleb says in his new book, SKIN IN THE GAME: does the company have skin in the game? Company with good track record, though.

Low promoter holding could be the reason due to which Porinju may have got the stated idea.This may lead to more similar activities in the market by other big investors.

I don’t know about this stock, but Porinju was ADVOCATING LTCG tax and has told correction after budget as temporary and buying opportunity. I had maintained that SOMETHING BIG HAS CHANGED WITH LTCG TAX and many who deal in Chor and Weak fundamental companies must have been hit hard and more pain waits them, I assume . I would be curious to know HOW MUCH HIT PORINJU AND HIS FOLLOWERS HAS TAKEN AFTER LTCG TAX IN BUDGET , IT MAY BE BIG AND WORK STILL IN PROGRESS I ASSUME.

The basic rule which I follow during this panic environment is, not to understand notional loss as permanent loss ,since most of my investments are longterm oriented. Rational ,not emotional, thinking should be the guiding force to make money in equity market.

My interpretation of Buffett’s two famous rules of not losing money is- never to convert notional loss into permanent loss until more attractive opportunity is being offered by the market at better/lower price. Winning strategy suggests to move forward some times one has withdraw some step steps backward.

cash flow statements does not give me the confidence. its negative for last 3/4 years… a lot of cash burning is required as against the cash generation..

I think little risk is fluctuating profit margins. More net sales were reported this year but Net Profit was less than last year. If risk managed properly I can agree with Porinju’s decision.

Vijay Kedias story is really inspiring. starting with only 35K and becoming a respectable name in stock market is an achievement, so is Porinju. But let us not forget that there innumberable people who have lost everything in stock market. It is good if you can write a story about them also. In my personal life I know one Mr Dandapani who left his job in bank to deal in shares (during harshad mehta time) when demat was not there and share transfer was big head ache due to signature not matching. He intially made some good progress and forced his wife to resign from RBI and dedicated full time to stocks. After Harshad Mehtha scam he lost everything and had to sell his flat and disappeared. Another guy was one Mr. Patel working in IT department of IOC. Those days one can pay money upfront through agent and get assured allotment of IPOs, but no receipt will be given for that. He put lot of money in one IPO, if I remember correctly Air command India (to manufacture portable a/cs) and lost all money and committed suicide. I am forced to write these stories because one should not think reading about above guys that stock market is an assured success