Three recent stock picks which have already yielded multibagger gains

First, we have to compliment Porinju for his three latest multibagger stock recommendations.

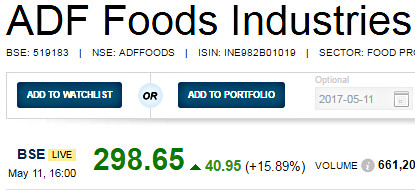

ADF Foods – 239% YoY gain

The first is ADF Foods, which is flying like a rocket.

In hindsight, ADF Foods was a no-brainer given that Dolly Khanna was aggressively increasing her stake in the Company.

In addition to Porinju Veliyath, Dolly was in the exalted company of Lashit Sanghavi, Ashwin Kedia and Nirmal Arora, all of whom are masters at finding multibagger stocks.

The Company had also announced a buy back at the throwaway price of Rs. 125 which sent that the clear signal that the management regarded the stock as being deeply undervalued.

Is LT Foods Next?

The reference to ADF Foods reminds me that Dolly Khanna and Porinju Veliyath are also feasting together in LT Foods, the leading manufacturer of Basmati rice under the brand name “Daawat”. Whether LT Foods will walk on the same illustrious path as ADF Foods or not has to be keenly watched.

PPAP Automotive – 122% YoY gain

While we are on the topic of Dolly Khanna, we must also pay tribute to her for PPAP Automotive which is also flying like a rocket on the back of stellar operational performance.

Dolly Khanna is hunting together with Anil Kumar Goel and Vallabh Bhanshali in PPAP. It is customary for the trio to bring home magnificent riches.

Mirza International – 310% gain

Mirza International is the second stock for which Porinju deserves to be complimented. He recommended a buy of the stock on 10th June 2014 when it was languishing at Rs. 33.

Mirza Intl.@33 – the 'Red Tape' shoe company | 700 Cr Revenue looks attractively priced. Valuable brands, big exporter – I hold some shares

— Porinju Veliyath (@porinju) June 11, 2014

It is unbelievable that Mirza International is today standing tall at Rs. 132 after having posted mega gains of 310%.

Nothing changed in Mirza, but stock price?

Keep investing simple, it's all about common sense! https://t.co/T4fFsJR46v— Porinju Veliyath (@porinju) May 10, 2017

KNR Construction – 978% gain

Porinju recommended KNR Construction on 28th April 2014 when it was languishing at Rs. 21 (adjusted for split). KNR has a clean Balance Sheet, good business, and is a good stock given the scope for Infra in the changing environment, he said.

KNR Construction @ 97 – MktCap 270Cr. Clean BS, good business, good if you want to bet on Infra in the changing environment.

— Porinju Veliyath (@porinju) April 29, 2014

KNR Construction is today commanding a price of Rs. 205 after notching up massive gains of 1000% (10x).

10x in 3 yrs! Many more KNRs in making

Trillion Dollar opportunity in Housing & Infra coming up, Grab it! https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) May 9, 2017

Forget stocks which are already multibaggers, hunt for new ones

Porinju knows that novice investors like you and me have the bad habit of waking up late and then chasing stocks which are already mega multibaggers, without any regard to the fact that the valuations may be exorbitant.

To rein us in and curb our tendencies, Porinju has sent the timely warning that we should focus our attention and energies on spotting potential multibaggers instead of wasting time with the spent ones.

Beginners Beware: Need not chase stocks after moving 2x, 3x in a yr – there is another set of stocks ready to do that, waiting ur attention!

— Porinju Veliyath (@porinju) May 8, 2017

Forget Bookish knowledge and number crunching; use common sense to find winning stocks

It is well known that Porinju has an allergy towards investors who believe that academic theories will help them snare multibaggers.

“The bookish people in the market tend to sell penny stocks, In India, this is the season to look at such companies,” Porinju said in the context of Mirza International which was written off as a junkyard stock by the academicians though it had immense multibagger potential.

“Use your common sense, understand what the company is doing, what is the relevance of the company’s production services going forward in this country in a changing environment, in a changing global environment,” Porinju advised.

“Common sense and wisdom is the most important requirements for picking stocks,” he added with a smile.

@porinju Common sense is not common for all ?

— Aarti (@AartiDubey2008) May 10, 2017

Porinju also came down heavily on the tendency of some investors to obsess over “number crunching”.

“People number crunch too much and go into too many details. They do not make big money in the market. They miss on the big picture for which you do not need a lot of number crunching,” he said.

Instead, investors must develop insights into the future of the company, the industry, environment, the economic environment and blend all factors before deciding whether a stock is investment worthy or not, he added.

Investors who cannot make 10x gain in five years are foolish

Porinju has put all novice investors on notice that our probation period is over and that we are now expected to earn our keep.

“It is a historic thing happening in this country and if equity investors cannot make 10 times the money in the next five years, they are foolish,” he said in a blunt tone.

Porinju gave solid logic to explain why the expectation of 10x gain over the next five years is not an unrealistic pipedream.

He explained that people are underestimating what is happening in this country.

Though major historic structural changes are happening in the economy with relevance to equity investments, people are missing out on the big picture and are focusing on petty gains over the short period instead of playing the theme for the next 10 years.

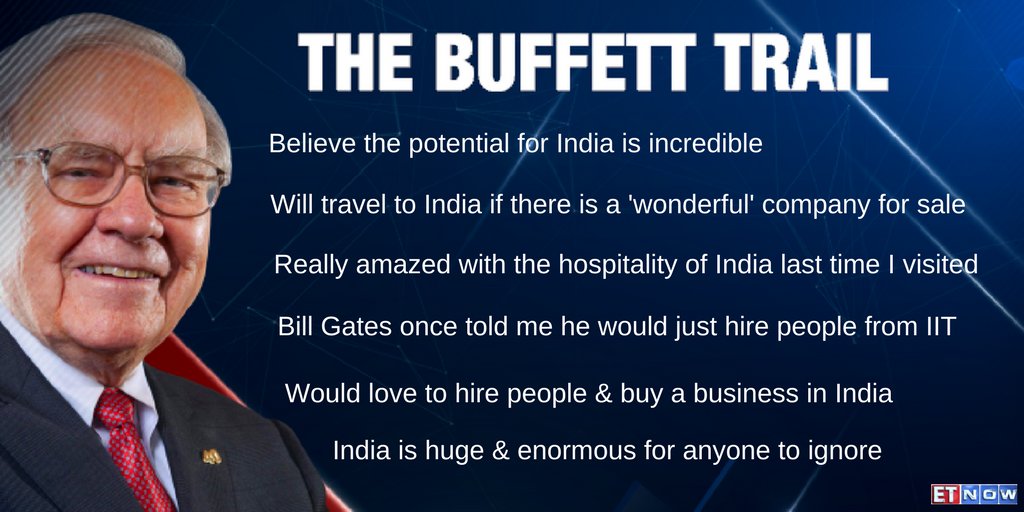

Porinju’s advice makes sense when we view it in the context of what Warren Buffett said a few days ago.

“India Is An Incredible Investing Opportunity,” Warren Buffett declared, indicating that he is also attracted to the charms of Dalal Street and will soon land up there with a shopping basket in his hands.

“The Nifty is at the bottom today,” Porinju exclaimed, underlining the fact that novice investors who fret that the Nifty is at the peak are making a big mistake because they are not looking at the long-term scenario.

“India is a huge emerging market, transforming from a $2 trillion to a $5 trillion economy in the next 3-6 years. You should think twice before making a sell recommendation on a stock in this kind of an economy,” he added.

Two potential multibagger stocks to buy now

Porinju knows that novice investors cannot be allowed to venture into Dalal Street unescorted. They will invariably buy junk stocks and burn their fingers.

@porinju We r idiots sir, give some names sir

— VIKAS GUPTA (@vicky1982gupta) May 9, 2017

So, to aid the thinking process, he has drawn attention to two top-quality stocks, namely, Everest Industries and Ramco Industries.

Both stocks are powerhouses with top-quality managements, though they are presently not in fancy amongst investors.

He opined that both stocks will do well given the huge boost that the housing and infra sector is going to get in the foreseeable future.

| EVEREST INDUSTRIES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 429 | |

| EPS – TTM | (Rs) | [*S] | 1.60 |

| P/E RATIO | (X) | [*S] | 173.75 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 50.00 | |

| LATEST DIVIDEND DATE | 21 JUN 2016 | ||

| DIVIDEND YIELD | (%) | 0.39 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 225.94 |

| P/B RATIO | (Rs) | [*S] | 1.23 |

[*C] Consolidated [*S] Standalone

(Source: Business Standard)

With reference to Ramco Industries, Porinju emphasized that is a holding company with a market cap of only Rs 2000 crore even though its holding in Madras Cements makes it worth more than Rs 4000 crore. This provides the much needed margin of safety, he said.

| RAMCO INDUSTRIES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 2,145 | |

| EPS – TTM | (Rs) | [*S] | 7.73 |

| P/E RATIO | (X) | [*S] | 32.00 |

| FACE VALUE | (Rs) | 1 | |

| LATEST DIVIDEND | (%) | 50.00 | |

| LATEST DIVIDEND DATE | 18 MAR 2016 | ||

| DIVIDEND YIELD | (%) | 0.22 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 65.59 |

| P/B RATIO | (Rs) | [*S] | 3.77 |

[*C] Consolidated [*S] Standalone

(Source: Business Standard)

Conclusion

Porinju’s advice that we should look at the big picture and not obsess over petty gains and losses in the short-term makes sense. We have to tuck into the best top-quality stocks ASAP and sit tight!

Now Porinju Bro is talking like me. I always believed commonsensical investment is the only way to riches

intuition coupled with commonsensical is the main ingredient for success. This accountant types will only look at others for making money for their record keeping.

Future and options must be banned for retail punters traders investors. Moment govt ban this most of ignorants will be forced out and big punters won’t be able to bite small retail guys. Then it will be game of equals. Within few days they will kill each other. Retail small investors will be better off in cash markets

Porinju is the only known face in the INDIAN stock markets using his innate intelligence along with common sense and wisdom so effectively sitting far away from Mumbai.

Being from Mumbai does not give you any advantage. Shows that People in Kerala like Porinju are much more common sensical than people in Mumbai. You know only one porinju but porinju takes tips from some other people in Kerala

Porinju is like sewag.. May not be technically correct like sanjay manjrekar but always gives you fours and sixes… While there are many Manjrekars who are like “operation successful patient dead” what matters is sewag style to make money. Nothing suceeds like success…

Multibagger investments during this high point??? Not sure… !

Listen doesn’t care about Index levels. Please listen to the interview once more.

Everest Industries is awesome recommendation

Everest is best.Its Ac sheets , panels, boards & steel sheets biz will do well due to housing push but more growth will come from Peb biz becoz of growth in e commerce , make in India ,smart city needs of parking lot , metro stations etc . They r no 3 in this biz with clients like godrej , brittania, cadbury , walmart to