Our fate is sealed

Sonia Shenoy is normally very protective of novice investors.

She sugar-coats bad news and shields us from shock.

However, she appears to have now decided that it is better if we grow up fast and learn to accept the bad news.

“Sensex down 600 points,” she said in a matter-of-fact tone even though novices were trembling with fear.

Market alert: Sensex down 600 points

— Sonia Shenoy (@_soniashenoy) October 4, 2018

The other TV anchors are also making no attempt to mollycoddle and comfort novices.

“Put on your seatbelts Bulls .. for a wobbly trading day,” Anisha Jain, Sonia’s colleague, said in a somewhat brusque tone.

Put on your seatbelts Bulls.. for a wobbly trading day:#RupeeAt73 at record lows #DollarIndex above 96#Crude hovering at $86/ bbl

US 10 Year Yield rushing to 3.2%

Strong US economy – not necessarily a great news for EM-FII exodus ?

SGX #nifty50 down below 200 DMA ;around 10730— Anisha Jain (@_anishaj) October 4, 2018

However, NAMO & Jaitley delivered the ultimate blow upon us.

The duo directed that the Oil Marketing Companies (OMCs) like HPCL, BPCL and IOC should bear a part of the burden arising from a reduction in the prices of petrol and other products.

Citi On OMCs

Govt Finally Buckled

Re-imposition Of Price Controls Unequivocal -ve

Lower FY20-21 EBITDA By 32-35% For BPCL, 39-42% For HPCL & 25-27% For IOC

Cut Target By 42-57% & Downgrade All 3 OMCs From Buy To Sell @CNBCTV18News @latha_venkatesh @_soniashenoy @_anujsinghal— Nimesh Shah (@nimeshscnbc) October 5, 2018

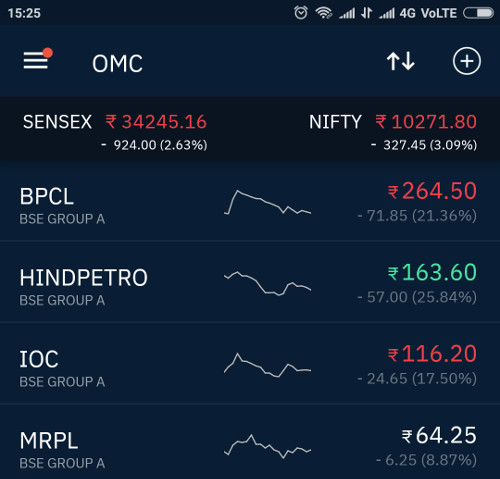

Naturally, this move sent all OMC stocks tumbling down like nine pins.

Massive sell-off in OMC stocks.

BPCL -19%

IOC – 18%

HPCL – 22%#Sensex down 806 pts at 35169#Nifty down 249 pts at 10599#markets https://t.co/6YBjQXhHiy— Rutam Vora (@RutamV) October 4, 2018

It was claimed that this move is warranted because India is facing an “economic crisis” due to the surge in crude oil prices and depreciation in the rupee.

India facing ‘economic crisis’ due to huge oil imports: Nitin Gadkari – Livemint https://t.co/KpeZ5aUNqJ

— Subramanian Swamy (@Swamy39) October 4, 2018

It's heartening to see at least one Union Minister of the Modi Govt admit the truth about the economy. https://t.co/0ApW7N6kW1

— Congress (@INCIndia) October 5, 2018

Rs. 64,500 crore lost in OMC stocks

According to Sonal Bhutra, a CA, the three OMC companies have lost a colossal market capitalisation of Rs. 64,500 crore over the past two days.

She also opined that the confidence of investors that the OMC sector would be decontrolled is severely dented.

Apart from profitability, this move could have possibly hit investor confidence.

~38,600cr MCap lost yesterday

~25,900cr MCap lost today till now(For all 3 OMCs) https://t.co/CjblK9wg11

— Sonal Bhutra (@sonalbhutra) October 5, 2018

. @sonalbhutra tells you what the brokerages have to say about the OMCs that are taking a sharp knock on back of #ExciseDutyCut #FuelPriceRelief pic.twitter.com/8QegfLZADc

— CNBC-TV18 News (@CNBCTV18News) October 5, 2018

LTCG fiasco had earlier crippled sentiments of investors

Arun Jaitley and Hasmukh Adhia had earlier torpedoed sentiments of investors by levying tax on long-term capital gains.

At that time, the move had been severely condemned by several distinguished experts.

In fact, Samir Arora and Shankar Sharma had issued the dire warning that the LTCG tax would “Kill Equity Cult in India”.

However, Hasmukh was adamant that the tax is justified because “capital gains don’t accrue from any effort”.

Capital gains don’t accrue from any effort, Finance secretary Hasmukh Adhia says – Times of India https://t.co/wVUB04lO1s

— Suhas Govilkar (@suhasgovil) February 4, 2018

It is now obvious that Hasmukh is living in a fools’ paradise.

LTCG is most idiotic Proposal in this year's Budget by Modi Govt

Killed Market Sentiments

Screw up Fund Raising Plans of PSU & Pvt companies

Govt wont get any Tax during Fy 2018-19

Killed MF mobilisation & asset diversification

22 lakh cr Market Cap loss from the top— Rishi Bagree ?? (@rishibagree) March 23, 2018

LTCG is a latest B-School case study on how to screw a blooming market by idiotic Tax proposals by @FinMinIndia pic.twitter.com/96k4HLsYyO

— Rishi Bagree ?? (@rishibagree) September 24, 2018

"Capital gains don't accrue from any effort" – Hasmukh Adhia !! Now you don't have to pay any taxes either 🙂 Na rahega Gain aur na rahega Tax !!

— Pankaj Baid (@pankajbaid17) October 4, 2018

Sensex loses Rs. 9 lakh crore in just three days

The shock waves created by the OMC stocks also shook all other stocks.

In just the last three days, the Sensex lost 2149 points, which translates into a mammoth Rs. 9 lakh crore market capitalisation.

Nifty

– Largest One Day fall since Aug 2015

– Ended in the Green on Mon, Shut on Tue

– Lost 692 Points in 3 Days. Biggest 3 Day fall since Jan 2018

– Lost 614 Points This Week (Biggest Ever Fall in Absolute Terms)Sensex in last 3 Days

– Lost 2149 Pts; Lost 9 Lk Cr in MCap— Mangalam Maloo (@blitzkreigm) October 5, 2018

Porinju seethes with anger

Porinju is known to be a die-hard supporter of NAMO.

Even during the LTCG tax controversy, Porinju had gone against the tide and defied public opinion to support NAMO.

10% LTCG is fine; existing grey areas about it, discretionary/harassing powers given Tax Officials is hurting many investors/honest payers!

— Porinju Veliyath (@porinju) February 29, 2016

However, Porinju knows that there is a limit beyond which one cannot support the indefensible.

He slammed the Government for being “penny-wise pound-foolish” and “unethical“.

PSU oil companies lost Rs.1,390,000,000,000 (1.39 lac cr.) in 35 minutes of trading (in 2 days) for subsidizing fuel by Rs.1 per litre – the value erosion from recent high is Rs.3.12 lac cr. Is it ethical to disinvest such PSUs to investors? #PennyWisePoundFoolish ?

— Porinju Veliyath (@porinju) October 5, 2018

He suggested that the Government ought to have borne the entire price cut burden of Rs. 7,000 crore and simply recovered the deficit from the OMCs by way of extra dividend.

This way, the carnage of Rs. 1.32 lakh crore of investors’ wealth could have been avoided.

A prudent thing would have been to keep OMCs away from subsidizing – instead raise 7000 Cr as an extra dividend from OMCs and bear full Rs.2.5 per litre cut. This could have saved Rs.1.32 lac cr. investor wealth, most of which is govt's own! @narendramodi

— Porinju Veliyath (@porinju) October 5, 2018

Sunil Jain, a distinguished editor, echoed the same view. He called the fiasco a “classic definition of being penny wise and pound foolish“:

Oil PSUs took a post-tax hit of Rs 4,500cr due to Rs 1 per litre subsidy on petrol/diesel but @arunjaitley @narendramodi took a Rs 14,031 crore hit in the value of their shares in these PSUs!!! Classic definition of being penny wise and pound foolish ? pic.twitter.com/PD2OM4HoWz

— Sunil Jain (@thesuniljain) October 4, 2018

Actual hit to govt is Rs 13,000cr as it will also get Rs 2,500cr less Corp Tax from PSUs

— Sunil Jain (@thesuniljain) October 4, 2018

The last time the govt started forcing PSU oilcos to sell petrol/diesel at subsidised rates @dpradhanbjp @arunjaitley @PMOIndia the private sector retail industry had to shut shop. You're doing it again. How much damage will be inflicted before elections?

— Sunil Jain (@thesuniljain) October 5, 2018

After govt lost Rs 14,031 crore of market cap in the oil PSUs yesterday — after it decided to get the PSUs to cut petrol/diesel prices by Rs 1 per liter — it lost another Rs 25,403 crore today @dpradhanbjp @arunjaitley @PMOIndia @narendramodi That's Rs 39,000cr already

— Sunil Jain (@thesuniljain) October 5, 2018

Samir Arora also made his contempt for the Government clear:

Is there a competition for self goals going on that we don't know about?

— Samir Arora (@Iamsamirarora) October 5, 2018

talktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalk

talktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalk

talktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalktalk— Samir Arora (@Iamsamirarora) October 5, 2018

OMCs can still create huge wealth

However, Porinju remains an incorrigible optimist.

He complimented NAMO for the significant decline in corruption and mismanagement of OMCs since 2014 and assured that the OMC stocks can still “create huge wealth for investors”.

Oil PSUs: corruption & mismanagement declined significantly since 2014. Beyond this, if professionally managed, these 4 PSUs can create huge wealth for investors and the Nation.

— Porinju Veliyath (@porinju) October 5, 2018

In fact, Porinju had first recommended HPCL in 2014 when it was languishing at the throwaway market capitalisation of Rs. 10,000 crore.

HPCL@320 – MktCap 10,000 Cr. Revenue 200k Cr. Stock to quote in 4 digits If the next govt. behave rationally. just sharing my thoughts

— Porinju Veliyath (@porinju) April 30, 2014

By January 2018, the market capitalisation had surged 7x to Rs. 70,000 crore.

Rs.37,000 Cr for 51%, HPCL created 7x wealth in 4 yrs under the new govt – over 100 mid-caps became large caps. 101 mid-caps will transform to large-caps in next 5 years! Bullish on #ChangingIndia https://t.co/qU4n0Akolb

— Porinju Veliyath (@porinju) January 22, 2018

Presently, the market capitalisation is Rs. 25,000 crore, up 2.5x from Porinju’s first recommendation.

Time is ripe to buy beaten down OMC stocks?

Some experts claimed that they had foreseen the crash in OMC stocks and had warned against investing into them.

Contra call from us on OMC stocks, which were a popular buy trade in the market. We've been underweight for a year now… https://t.co/mk0K5D85z7

— Amar Ambani (@AmarAmbani) October 5, 2018

I have been warning against investing in Oil OMC PSUs with the view that at some stage Govt will blink & make them take a hit

It happened today. Margins cut by Rs 1 per litre by Diktat.@nikunjdalmia @AyeshaFaridi1— sandip sabharwal (@sandipsabharwal) October 4, 2018

The Bureaucrats never learn, they just don't. They think they are over-smart @arunjaitley @FinMinIndia @PMOIndia

Market Cap of PSU Oil OMC's fell by a full Rs 55000 Crores today. Just to save Rs 7000 extra going into the fiscal deficit by passing on Rs 1 per litre hit to OMCs

— sandip sabharwal (@sandipsabharwal) October 4, 2018

Even Raamdeo Agrawal, who is known to be an “OMC Bull”, is now diffident about investing in OMC stocks.

“Oil is clouding all guesses …. promising sectors appear to be auto, private banks, NBFCs, consumer companies, white goods companies … However, current valuations are high and factors influencing these sectors are oil, inflation and RBI interest rates …. At these high valuations, I can’t risk a guess, hence I would be cautious till the oil price stabilizes,” he said in a somewhat shaky voice.

In the circumstances, it is better if we also stay aloof till crude oil prices stabilize and cool down instead of rushing in where angels fear to tread!

At last Andh Bhakts are opening their eyes even if it is after carnage in market due to continuous Economic Misgoverness. Otherwise Andh Bhakts never cared even after introduction of LTCG TAX,Which was clearly starting point of destruction in market.

Totally agree… The blind followers of NaMo creates more problems than anyone else 🙁

Yes, NaMo and Amit Shah duo are “dirty-tricks pure politicians” and not even fraction of a true patriot or a wise statesman or even prudent diplomats !!!

Both duo believes in 100% selfish, autocratic & dictatorial styles of managing national political affairs — they are least worried about either hindus or poors or any citizens of India – just interested in grabbing & retaining POWERS at ALL COST !!!

UNFORTUNATELY there are large numbers of BLIND FOLLOWERS – with totally dead brain & senses – only GOD can help !!!

India will soon (over next 2/3 year’s time) become BANANA REPUBLIC with ECONOMICALLY BLIND TEAM-NAMO !!!

BEWARE for the NEXT ELECTION, WHOM YOU SHOULD VOTE FOR!

AB

Kharbji,

please don’t forget money we made when senses roared from 13k to 37k in just 4 years .

By the way market corrections are part of game and market will find out reason to correct . You are a long timer hope you have seen many bear markets from 2000 .

Market hardly corrected 10% … and we have seen worst than this .. so keep calm, invest and enjoy long term story of India …

We have a seen economist PM who created NPA mess, policy paralysis, OIL Bonds (paid by Present government).. so keep cool and let a clean government work for development of the country .

Thanks,

Guys dont you think its time to do cherrypicking…some small midcaps r on sale……mega shopper sale in markets…enjoy while it lasts…

There is no Oil Bonds being paid by this Government. This is a big folly and clear lie created by this Government including the Ministers of this Government. Out of total Oil Bonds issued by UPA Government of Rs. 1.40 lakh crores, only Rs. 3,500 crores worth of Oil Bonds were due for redemption during the current year and of course, were redeemed by the present Government. Rest all Oil Bonds amounting to Rs. 1,36,500 crores are due for repayment/redemption only 2021 and beyond. Don’t be under this big lie created by this Government.

Please provide the source based on which you are saying present govt not paid oil bonds?

Illiterate minister lied about the repayment of oil bonds. No such payment happened, only interest of a few thousand crores was repaid:

https://www.quora.com/Did-the-Modi-government-really-repay-the-loans-taken-on-oil-bonds-by-the-previous-government

Very well articulated.

Everything is a false propaganda. Economics PM kept the economy rolling on a strong path even during 2008 recession. When the crude was above 100 dollers he kept petrol at 70 and diesal at 40. Now the NDA is all at sea to deal with even at the rate of $ 80 per barrel.

Market didnt went up on sny results. Markt went on hope

If agsin oil goes to the level it was at time of Manmohan ji times just see the levrl of market

From 13k to 37k in just 4 years….What are you smoking dude??

Kharb ji, we remember the sensex crossing 25,000 when the current Govt came to power 4 years back. Now the sensex is at 34,500. That’s an approximate 40% rise in 4 years. Where did you get your figures from?

AJ, please do not think others are fools and only you are smart. In fact it is the other way round. Please calculate CAGR of NaMo period. 25,000 to 34,700 in 4 years comes to 9%. Compare that with Congress Government. In 1992, Sensex was 500. In 2014 it was 29,000. CAGR comes to 17%. Please write applying your mind. Not pure bhakti towards modi.

Prashant ji, we remember the Sensex crossing 25,000 when the current Govt came to power 4 years back. Now the Sensex is 34,700. The rise is approximately 39% in 4 years. Where did you get your calculation from?

This Government wasted its initial four years in just chest beating and rhetoric like “Congress-mukt Bharat”, etc. doing actually nothing on the ground. All these things are now being reflected in the way Economy is being managed.

There are series of blunderous mistakes by this Government, starting from Demonetization, hasty introduction of GST, introduction of LTCG while still maintaining and levying STT and now wrong handling of crude oil/petroleum product pricing. Still six months remain, who knows what will be the next blunder?

Kamalji,

record breaking GTS revenue collection , 24% increase in IT returns filed, 64k thousand crores voluntary disclosed black money .. do you still think that GST is not implemented properly ? Every Indian state agreed and sent suggestion on GST, most of them are agreed and accepted .

So on what basis you think GST is not implemented properly ?

GST implementation removed the biggest taxation inefficiency and its going to yield long term benefits for India. Its due to clean governance, GST implementation , infrastructure development world bank sees atleast a decade of 10% growth in INDIA .

Thanks

“24% increase in IT returns filed, ”

Is this really important?

The government should declare the incremental AMOUNT collected from these 24% increased returns. Theoretically, if these were hoarders of black money, the average amount collected per person should be above median, as collected in the past.

The truth is: this is not so. If this was so, the data being published would be totally different. Stop misusing data.

Ltcg is fine .. but where is gain?

Instead of getting into blame games, see it as a good opportunity to buy some great companies at huge discount.

where is the money left, already everything evaporated….. need to print currency to buy quality stocks.

At each decline someone saying great level to buy.

Piase kahan hai be c$#$ ye? Roz kya per pe paise lagte hai ki tor lao?

Huge stock like IOC falling 40% in 2 days is normal?

Had anyone witnessed this before? I am asking about a fortune 500 company and not a micro cso

What had happened to the andhbhakts when they were giving higher target?

Finally bhakts are realizing ki bhaktigiri se paith nahi bartha hai. Namo namo karke indirect taxes increase Kia.. fir demonetization, fir gst , ltcg , you let banks run lose with scams.. now this dumb headedness … This is what happens when u have an educated cabinet of ministers and a PM.

He doesnt win he will start selling pakodas…before he was selling chai.nothing will change for him.hes just enjoying his time now when its over he will go to mount kailash or dharamshala for enlightment.simple…

Earlier when ever there was panic in market, LIC use to come for buying at lower levels to stabilise the market and it also ends up making money. But now in Modi Raj, Lic is busy in helping NPA hit IDBI BANK and defaulter IL&FS. Modi Govt want to Suck blood of investors by LTCG tax but has no time to calm the market. Govt should not have asked oil companies to reduce 1 Rs from their pocket, rather Govt could have reduced this 1 rupee from its pocket and has asked more dividend from these Oil Companies.By this way market cap of these companies could have been protected. Never ever buy any PSU as these are just play ground of politicians and may be used for political gains at the cost of investors.

They will continue to suck our blood…as many as 80 percent have decided to vote for namo.so another 1500cr of our taxes on namos chartered flights…imagine 3000cr in 8 years…

Well mate, are you sure no other PM prior to Modi ever took a flight?

Out of 4 years he was out for 270days..close to a year…1500crores net of janata money..that is ur hardearned money. Plus failure of all schemes…first demon,second gst,third ltcg…the failure continues to deepen by the day.all foolish laws…….

Buddy,

I challenge you provide numbers for so many failures your are counting .

Which schemes failed , do you atleast few numbers handy ?

India is power surplus in just 4 years .

Record break GST collection .

Huge investment on infra development .

Record tax collection .

27% jump in ITR filing .

Record break renewable energy production .

Historic investment in renewable energy .

Biggest investment in country’s defense needs

Where do you see failure ? Probably in your dreams .

And stock market moved from 13k to 37k .. did you forgot ?

Thanks

Dear Kharbji,

I am astonished that seasoned investor like you realized that PSUs are playground of the politicians, so late . It was always the case, thats why PSU always comes with huge discounts to private peers . Every government uses PSUs for populist policies … thats the tradition we have in India .

Thanks,

I believe in INDIAN GROWTH STORY..

I believe in INDIAN GROWTH STORY..

I believe in INDIAN GROWTH STORY..

PORINJU VELIYAH….till last year

MOST FOOLISH DECISION CAUSING A SCAM OF MORE THAN ENTIRE UPACAUSED DURING THEIR TENURE. FROM WHOM FM WILL COLLECT 10% LTCG. ON THURSDAY HIS MATERS VOICE DESYROYED THE CREDITABILTY OF ENTIRE PSUS AND AS A COUNTRY . WHY SHOULD FIIS INVEST IN INDIA?

This government has been very bad at managing Finance. They came with a huge advantage of low oil prices but still kept taxing the middle class and hiking petrol prices. Now that we see oil has jumped again we see a hike for consumers.Where did the surplus they earned during low oil prices go or where did the multiple taxes levied go? On schemes which sound only good in name but fail in execution. Wondering whom will they blame now for ILFS fiasco.Whatever be the good intentions PM Modi had, his unwillingness to pick the right man for the FM post will cost him his next election. Many of us still dont want to vote for the other party but the decision to pick BJP is becoming harder and harder to make with these policies.

Next few years of jaitley regime will bring india on par to somalia..

Since when was it a jaitley regime? Its an out and out modi regime. The reason the economy is in the pits is because of one and only one person modi. Stop making a sacrificial lamb out of jaitley. Nothing moves in this govt without express permission of modi and he should himself be held responsible.

More rats are jumping the sinking ship. With the equity cult in tatters, the last remaining edifice of this lousy government led by one of the worst PM India has ever seen is crumbling. Time to kick him out.

For all the Cry Babies,just read what Deepak Shenoy says;

https://capitalmind.in/2018/10/the-markets-are-we-going-to-hell-in-a-hand-basket/?utm_source=wysija&utm_medium=email&utm_campaign=Daily+Digest+Email

NAMO seem to have worst economic advisors.

Demon – Worst Failure

LTCG Tax – Horrible Tax

Fuel Prices – Life Time high

Black Money Recovery – Zero

INR – Depreciation by 20%

Equity Markets – Zero gain for LT investors and even destroyed wealth

Air India – Nothing Done

LIC – It is close to getting crippled

and many more

Guess time has come to say good bye.

OMCs – Wealth Destroyed

Since when has he listened to any advisors? He has some hare brained ideas which he probably reads in the whatsapp groups and the next morning he implements them.

Namo is like GOD. God is always invisible and visible in photos or movies. same is our Namo, he is visible in videos doing yoga challenge or in pictures with different dresses everyday. So only real god can protect india from Namo.

Lol. You’re right!

This data is available in public domain. One can visit Finance Ministry and RBI site to seek and verify details.

Porinju was praising Namo as his Portfolio went up. Now it has gone down he is criticizing. He himself bought all the Crap stocks Namo never told him to do so!

The mess that congress created in 70+ years, modi created more of it in just 4 years. Not to forget our economy size is 2+ trillions since independence under congress.

Arrogants like modi, jaitley, adhia, porinju who are pro ltcg, took the matter easily thinking investors will make a bee line for investing here. They are not the market makers, it is the smart fii’s who run the show. .

Modi thought with his jumla policies, phekugiri, he can manage it by artificially coating the number. He has no other work than just harp 24/7 about black money, which he was not able to recover, could not prove 2g. It all means at the end of the day he is just another jumlabaaz politician for votes can hob nob with corrupt politicians, deliver freebies, promise reservations, he is showing his true colors.

Dear Economist,

instead of blabbering do you have any numbers to prove mess created that you could see ?

Thanks

We need politicians who are skilled and experienced in managing the economy, if you give it to unskilled modi and jaitley, mess is sure to happen. Don’t go by what they say, go by what they do. They have done nothing in 4 years other than harassing tax payers in the name of transparency.

How much transparent modi is in his affairs ? They don’t reply to rti’s, their guest list is secret, he doesn’t pay taxes on his party funds, why ? citizens should understand why he isn’t transparent when he keeps preaching it. It’s getting difficult to trust gujratis,most of them are involved in scams.

Er, chap, I think you got your individuals mixed up.

If namo along with his goodas are out in 2019 expect sensex to touch 50k or else get ready to crumble.

Namo is a big Dramo(a). One of the f__i is Adhia in this govt administration.. God bless indian stock market..

God already blessed Indian stock market and thats why it moved 300 % in just 4 years without any major correction/crash .

Thanks,

Do you mean 100% in 6 years? Bec that’s what Sensex returned in the last 6 years. Please use actual data, not NAMODATA.

Sincere Apologies for wrong data .

I will take for sure going forward . I did not realized am pputting wrong figures , it wont happen again .

Thanks

prashantji going forward hopefully namojaitleyand iraniji too apologize for the losses caused to aam Janata. thankyou

Sensex was approximately at 23000 when this government came to power. Now it is at 34000. By no means this looks like 300% movement. I learned Maths at high school 20 years back and ow I teach my daughter. How on earth is 34000 300% of 23000?

That is by Namoshaley mathematics formula. New generation maths of Namo+sha+jaitley. Fooling people around and acting as sleeping.

Prashant sir studied with namo and smriti Irani,same school…

Snake charmer will die of snake bite. Like wise those live with share market will always be ready for loss.It is quite natural in share market that what ever goes up has to come down. Porinju should learn the basic of share market. Be ready Porinju for the market to come down by another 15 to 20 percent. Make a list of people so that you can blame them for collapse.

Learn to earn in share market. If you loose you are not learnt.

How much dumb act can Govt do. For gaining 7500 Cr, it lost 40,000 Cr and made the investors bleed more than 100,000 Crore. Worse, he killed all the private petrol stations wiping out all franchise investors.

All that transparency NAMO talked about in the initial years go muted for Rafael deal.

If NDA-2 comes to power in 2019, NIFTY /SENSEX will be back to 3000/9000.

CORRECT

Next PM of India= H’onble CM chandrababu naidu, Finance minister=Raghuram Rajan,,,,,India will world no1

Dont know abt ur choice of PM but Raghuram Rajan welcome

And pls welcome Manmohsn Singh.. as now it is clear that Arun Jaitley studied finance from same place where Modi or Smriti Irani did his graduation

If any PMS has taken huge blow, it must have been Porinju’s PMS. His bets on Infra, Small Caps, trying to catch falling knife in stocks with CG issues, OMC bets (HPCL) and with recent floods in Kerala must have wrecked havoc. The pain in OMCs is not yet over and if crude touches 90-100, we might see below 100 in HPCL/BPCL stocks. I am guessing his PMS business could be on the verge of bankruptcy.

LOSS OF CAPITAL GAIN TAX WITH THE RECENT FALLOUT MAY BE MET FROM STT AND SECURITY RELATED TRANSACTION. SINCE THERE IS NO HOPE VISIBLE FOR ANY LTCG IN FY 2018-2019 EXCEPT SCATTERED INSTANCES.

It’s ironical that few months Porinju was asking his followers to blindly buy kachra stocks. Now when the kachra has gone into the dustbin he is blaming Modi.